Summary:

- Meta Platforms reported Q3 revenues of $34.15 billion, beating estimates by $700 million and showing 23% growth.

- The company has focused on efficiency, reducing expenses by 7% and doubling its operating margin to 40%.

- Meta’s 2024 expense forecast was lower than expected, indicating potential for solid growth and upside in the stock.

RyanJLane

After the bell on Wednesday, we received third quarter results from Meta Platforms (NASDAQ:META). The social media giant has seen its shares surge, a result of the company’s “Year Of Efficiency”, where management has worked to get its overall cost base in check. While I previously worried a bit about the company’s situation heading into 2024, the company’s Q3 report alleviated some of those concerns.

For the third quarter, Meta reported total revenues of $34.15 billion. This was more than 23% growth over the prior year period, and it handily beat street estimates by roughly $700 million. After missing estimates on the top line in three of four periods starting in Q3 of 2021, the company has now delivered five straight revenue beats. The latest beat comes despite meaningfully increased expectations. Meta delivered a revenue figure that was more than $3 billion above where the street was at for Q3 going into the Q2 report back in July when it gave strong guidance.

This year for Meta was about becoming more efficient, and the company has certainly done that. In Q3, total expenses were down 7% over the prior year period, a tremendous success when your revenues are surging more than 23%. As a result, the company’s operating margin doubled to 40%. When you factor in some other income gains as well as a lower tax rate, net income soared by 164%, and the buyback added a little more when it came to EPS. The company came in with EPS of $4.39, beating street estimates by more than 75 cents per share.

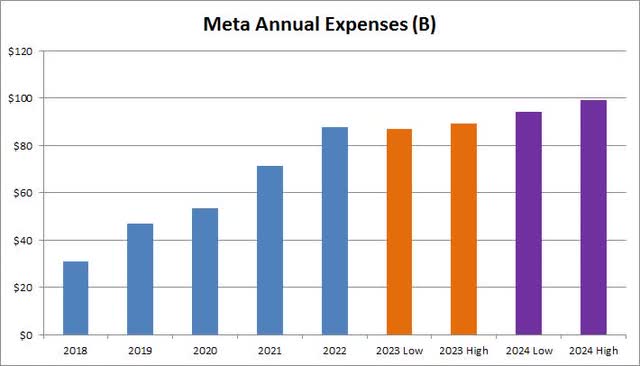

I mentioned in my previous article that the biggest issue for the company continues to be its operating expenses. This was the main reason why shares tanked in 2022, as the company spent like a drunken sailor and earnings collapsed. Full-year 2023 total expenses are now expected to be in the range of $87-89 billion, lowered from the prior range of $88-91 billion, and well down from Meta’s original range of $96 billion to $101 billion. In the chart below, you can see how this stacks up against prior years, and we also got our first look at 2024 on Wednesday.

Meta Annual Expenses (Company Filings)

Meta is guiding to a range of $94 billion to $99 billion in total expenses for next year. This is certainly an increase from 2023, and it is due to three main factors – higher depreciation expenses from increased investments in recent years, growth in payroll to support priority areas, and increased operating losses in Reality Labs. At the midpoint, you are looking at a low double digit increase here, but with analysts looking for revenues to rise around 12.5% currently, there could be some room for further margin improvement. Analysts had talked about the $100 billion number being the potential line in the sand for next year’s expenses, so this original guidance looks pretty good.

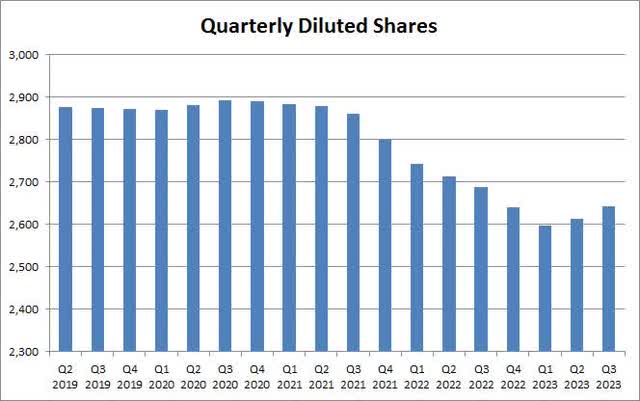

Like many tech giants, Meta continues to be a cash flow generation monster. The company delivered over $13.6 billion in free cash flow during Q3 alone, with more than $31.5 billion delivered in the first nine months of this year. Over $3.5 billion was spent to repurchase shares in the third quarter, although the impact of the buyback has certainly decreased a bit with the stock surging in 2023. This has resulted in the diluted share count used for EPS purposes starting to rise again, as seen below, with stock-based compensation being quite lofty.

Meta Diluted Shares (Company Earnings Releases)

The company finished the third quarter with over $60 billion in cash and marketable securities on the balance sheet, while having around $18 billion in debt. The buyback will need to pick up its pace quite a bit with the stock at these levels for it to become an earnings tailwind again in 2024. This isn’t a major problem for the company, but it is something to keep in mind when trying to project EPS figures moving forward.

With Meta announcing a double beat and giving fairly decent guidance for 2024, I am reiterating my buy rating on the name. The company’s forecast, assuming revenue growth comes in as expected, should result in at least $17 in earnings per share next year. At a 20 times multiple that is currently a little higher than what Google parent Alphabet (GOOG) (GOOGL) goes for, that results in a price target of $340. That would be about $50 of upside from where Meta shares finished in the after-hours session. Alphabet shares lost more than 9.5% on Wednesday which cut its P/E down a couple of points from the low 20s area.

Meta shares initially popped after the earnings report, recovering the day’s losses and then some. However, shares pulled back and then turned a bit lower after the conference call referenced some softness in Q4 ad spending so far. However, I don’t think things can be too bad, because for the quarter, management guided to total revenue of $36.5 billion to $40 billion. The midpoint of that range may have been slightly below what the street was expecting, but Meta has come in at the upper end of its guidance or slightly above it for the first three quarters of this year.

In the end, Meta announced another solid double beat on Wednesday, although the stock pulled back during the conference call. Revenues came in about $700 million ahead of estimates that had risen quite a bit recently, and showed strong 23% growth over the prior year period. The company really controlled its operating expenses in the period, leading to net income soaring and earnings per share crushing street expectations. With the company’s 2024 expense forecast being a bit lower than most were looking for, solid growth should continue next year, so this stock could have some nice upside ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.