Summary:

- Mark Zuckerberg mentioned that annualized revenue rate of Reels has jumped to $10 billion from $3 billion last fall.

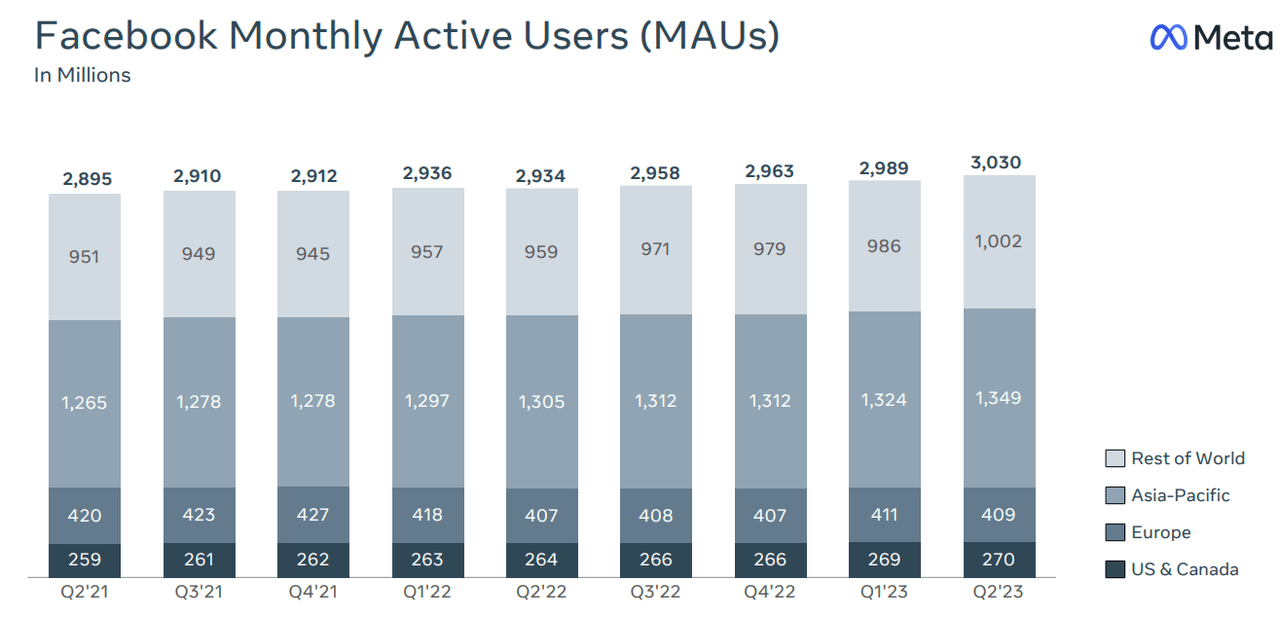

- This is reflected in the earnings report as the ad impressions have increased by a staggering 34% YoY and price per ad decreased by 16% YoY.

- It is easier to increase price per ad compared to engagement rate of users, and we should see a good improvement in price per ad in next few quarters.

- TikTok ban or significant restriction is highly likely in U.S. and other western markets by the next summer as the Presidential race heats up.

- Success of Meta in Reels will have long-term impact on key metrics and should improve the bullish sentiment towards the stock, giving it better valuation multiple.

Kira-Yan

Meta’s (NASDAQ:META) recent earnings report has shown a very promising trend for the company. Mark Zuckerberg reported that the annualized revenue rate of Reels has jumped to $10 billion from $3 billion last fall. Many analysts doubted Meta’s ability to enter this market and gain a good engagement rate due to the strong presence of TikTok. However, the management has not only increased the engagement rate rapidly but has also been able to monetize the platform. Meta’s ad impressions in the recent quarter have jumped 34% YoY and price per ad decreased by 16% YoY which is likely due to the growth of Reels. Even during the pandemic in Q2 2021 when Meta reported 56% YoY revenue growth, the ad impressions increased by a modest 6%. This shows the massive impact of Reels on all key metrics. In the previous article, it was mentioned that the company could show 20% annual EPS growth making it a long-term bet.

It is relatively easier to increase price per ad when the demand for ad placement increases. But it is more difficult to increase engagement rate and ad impressions due to maturity of the social media ecosystem. Reels is likely taking away market share from TikTok rapidly. In a recent CNBC interview, another presidential candidate announced that he will ban TikTok if elected. As the presidential race heats up, we could see more calls for a ban. Despite the massive lobbying by TikTok, it is unlikely that it could prevent a ban or massive restrictions in U.S. and other Western markets in the near term. Another important factor for the regulators is the rapid growth of Reels which gives customers an alternative platform making it easier for them to take more restrictive actions against TikTok.

Meta’s growth in Reels shows that there is still strong growth potential for the company. Reduction in competition from TikTok should push up the engagement rate for Meta and also help in improving the price per ad on Reels. It is likely that the company can deliver double-digit growth over the longer term with good EPS growth. At a forward pe ratio of 21, Meta stock is still reasonably priced and should deliver good returns over the long term.

Success in Reels will Change Everything

In 2022, Wall Street started viewing Meta as a company with stagnant revenue and low growth potential. This has changed in the last few months and a big reason is the growth of Reels. The management mentioned that annualized revenue of Reels has touched $10 billion from $3 billion last fall. Meta’s overall revenue has increased by $3 billion from the year-ago quarter. Hence, most of the growth has been due to Reels as users spend more time on this platform. This is also reflected in the ad impression growth. Meta has reported 34% YoY increase in ad impressions which is the highest rate in the last few quarters. Almost all of this increase would be due to higher ad delivery on Reels.

Company Filings

Figure 1: Ad impression and price per ad metric in the recent quarter.

An increase in ad placement on Reels has led to a drop in the price per ad. The main reason is that the monetization of Reels is lower than News Feed, Stories, and other features. The 16% YoY decrease in price per ad is quite big but we could see improvement in this metric as Meta pushes for better ad rates on Reels.

Company Filings

Figure 2: Meta’s Q2 2021 earnings call numbers on price per ad.

In Q2 2021 earnings call, Meta’s then CFO Dave Wehner mentioned that the ad impressions increased by 6% YoY while the price per ad went up by 47% YoY. Meta reported 56% YoY revenue in that quarter which helped the stock reach the previous peak.

Increase in engagement rate and ad impressions is a better metric to watch because price per ad can vary a lot due to outside factors like macroeconomic issues or the competitive landscape.

Success in Reels will also have a long-term impact on how Wall Street views the future growth runway for the company. Instead of a few mature apps, the market will likely view Meta as a more robust platform with the ability to add new social media trends within the ecosystem and also build good monetization tools.

TikTok Fall is Likely

TikTok is still a major competitor within short-form videos. The current White House administration has taken a strong stance against TikTok. We can also see more legislators and presidential candidates voice their opposition to TikTok. At the same time, TikTok has been making massive investments in lobbying. Senator Mark Warner has mentioned that TikTok spent $100 million on lobbying which reduced the momentum on banning the app.

However, this lobbying is unlikely to help as geopolitical tensions rise and most Western countries are closely looking at any national security threat from these social media apps. A ban or restriction by U.S. will likely be followed by European Union and other major Western countries. India has already banned TikTok in 2020 after border issues with China.

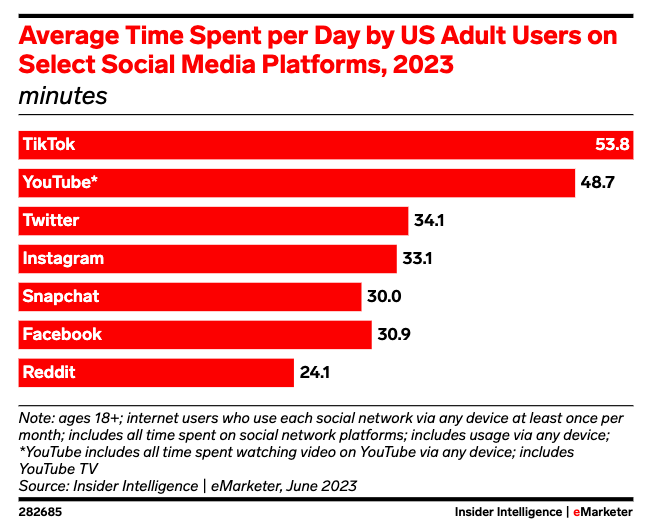

Insider Intelligence

Figure 3: Time spent per day by U.S. adult users on social media platforms.

A recent report by Insider Intelligence mentions that TikTok is still a leading social media platform ahead of Instagram and Facebook. According to the report, the average U.S. adult spent 53.8 minutes on TikTok while spending only 64 minutes on Instagram and Facebook combined. Any ban or restriction on TikTok will push the users to look for alternative options and Reels is the ideal platform for most users.

Lower competition from TikTok will increase the price per ad for Meta as the demand for ad space on Meta’s platform should increase.

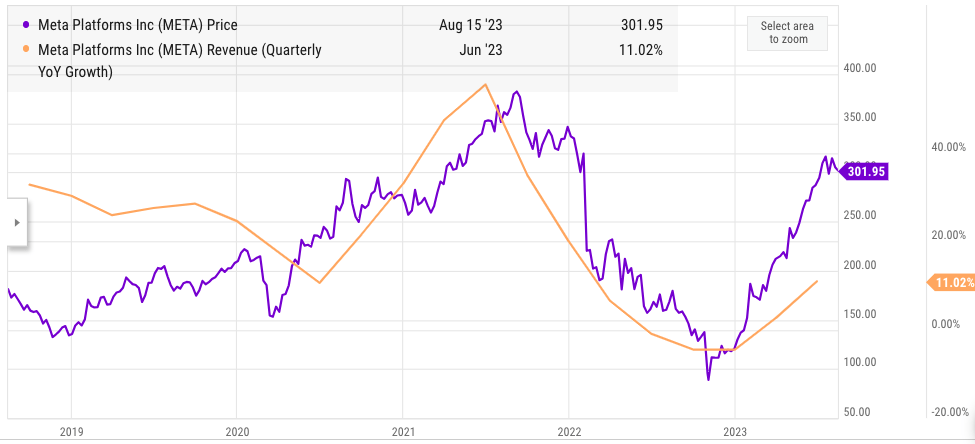

Figure 4: Meta’s MAUs in the last few quarters.

Meta’s MAUs in U.S. and Europe have become stagnant as most of the adult population is already covered. Future growth in Meta will depend on the ability of the company to monetize the current user base in a more effective manner. The improvement of revenue from Reels is a good example of how Meta could deliver growth despite a stagnant user base. If Reels is able to capture most of the user engagement on TikTok, it will massively improve the average revenue per user and the overall growth trajectory of the company.

Sustainable Double-Digit Revenue Growth

Meta has undertaken a massive cost-cutting initiative and reduced its headcount. This has helped improve the net income. However, the company would still need to have a path for robust revenue growth in order for Meta stock to perform well.

Ycharts

Figure 5: Close correlation between YoY revenue growth and stock price.

Meta’s stock price has had a very close correlation with the quarterly YoY revenue growth for the past few years. Investors should closely watch the future revenue growth potential of Meta in order to gauge the long-term returns of Meta stock. Despite a saturated user base, Meta has a number of options to deliver good revenue growth in the next few years.

We will likely see further monetization of Reels as the user engagement increases and a ban on TikTok will also improve the trajectory. Meta has added Threads and this initiative could follow the path of Reels. Meta’s Reality Labs has been a drag on the company’s profitability and has not contributed to the top-line growth. But as the VR industry matures, we could see Meta in a leadership position. The company has already announced some initiatives to monetize users on Quest platform.

Impact on Stock Price

Meta stock has increased by 140% year-to-date. This has led some analysts to reduce their buy rating. However, when we look at other big tech companies in terms of forward pe, Meta stock is still quite reasonably priced. Meta also has a good growth runway, which should allow the company to deliver double-digit growth over the next few years.

Figure 6: Comparison of forward pe and quarterly YoY revenue growth of Meta, Apple, and Microsoft.

Prior to 2022, Meta had a higher quarterly YoY revenue growth compared to Microsoft (MSFT) and Apple (AAPL). Rapid growth in Reels has helped the company beat Microsoft and Apple in terms of YoY revenue growth in the recent quarter. The future growth runway of Meta is stronger than most of the big tech peers, which should help the stock outperform them over the next few years.

Meta has reduced the buyback pace, but the company has significant cash reserves which can be invested in reducing the outstanding stock. This will be another tailwind for the stock in the long term.

Investor Takeaway

Meta has reported over $10 billion annualized revenue rate for Reels. This is a big jump from $3 billion rate last fall. The company is in the initial stages of monetization for Reels, and we could see a much larger revenue base from Reels in the next few years as new AI tools are used to give better experience to users. A ban on TikTok is likely as geopolitical tensions are rising. This will be a big tailwind for Reels as the engagement rate increases and the company will be able to charge a higher price per ad.

Meta’s stock performance has closely followed the revenue growth rate in the last few quarters. The company is in a good position to deliver double-digit revenue growth over the next few years, which should help the stock deliver good returns. Despite the recent bull run, Meta stock is trading at 25% discount compared to Microsoft and Apple in terms of the forward pe ratio. On the other hand, the YoY revenue growth of the company is higher than these big tech peers and the future growth potential also looks better than other big tech companies, making the stock a Buy at current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.