Summary:

- META’s AI investments have been paying off extremely well, as observed in the massive rebound in FY2023/ FQ1’24 revenues, with AAPL’s privacy headwind well behind us.

- META’s investments will eventually be top/ bottom line accretive, with generative AI SaaS being here to stay as multiple Big Tech companies also intensify their multi-year investments.

- Given the regulatory headwinds against TikTok and $16B of US-based revenues at stake, META may very well retain its global dominance in the social media scene moving forward.

- With META inherently cheaper than its Magnificent Seven peers, it remains a Buy at every dip, aided by the raised consensus forward estimates through 2026 and the healthier balance sheet.

Ole_CNX/iStock via Getty Images

We previously covered Meta Platforms, Inc. (NASDAQ:NASDAQ:META) in January 2024, discussing why we had re-rated the stock as a Buy, with the management still reporting expanding operating margins and improving performance metrics across its social media platforms.

Combined with the returning global ad spend, we had believed that the social media giant remained well poised to grow sustainably over the next few years.

By now, META has recorded an impressive rally of +43.5% at its peak, well outperforming the wider market at +10.1%, before the drastic pullback as the market over-reacts to the raised FY2024 capex guidance.

Even so, we believe that the AI investments have been paying off, as observed in the massive rebound in revenues/ operating margins/ FCF generation in FY2023 and FQ1’24, with the Apple (AAPL) privacy headwind well behind us.

Combined with the potential tailwinds from the TikTok ban, we believe that META is likely to continue dominating the global social media scene moving forward.

META’s AI Investments Are Already Bearing Fruit – The Market Has Over Reacted

For now, part of the market’s over-reaction is attributed to META’s higher FY2024 capex midpoint guidance of $37.5B (+33.4% YoY), compared to the original midpoint guidance of $32.5B offered in the FQ3’23 earnings call (+15.6% YoY), with the investment intended “to support our AI roadmap.”

At the same time, the management expects “CapEx to continue increasing next year (FY2025) as we invest aggressively to support our ambitious AI research and product development efforts.”

With the raised expenditures well reversing META’s 2023 Year of Efficiency, it is unsurprising that the market has reacted as it has, with the stock painfully retracing by -10.5% within a day.

Then again, we believe that the market has over-reacted indeed, since the management has long communicated that the reduced 2023 capex is mostly attributed to “shifts in CapEx into 2024, from delays in projects and equipment deliveries, rather than a reduction in overall investment plans.”

At the same time, META’s FY2024 capex guidance of $37.5B still comprises a reasonable 25.2% (+4.4 points YoY) of the full year’s estimated revenues of $148.42B (+10% YoY), based on the annualized FQ1’24 revenues of $36.46B (-9% QoQ/ +27.3% YoY) and FQ2’24 midpoint guidance of $37.75B (+3.5% QoQ/ +18% YoY).

This is compared to the FY2023 ratio of 20.8%, FY2022 ratio of 27.4%, FY2021 ratio of 16.3%, FY2020 ratio of 18.2%, and FY2019 ratio of 22.1%.

Readers must also note that it is vital for META to invest in its AI capabilities. This was due to the drastic disruptions in the ad-targeting scene after AAPL imposed significant privacy changes in 2021, which had resulted in the ad-giant’s impacted FY2022 revenues of $116.6B (-1.1% YoY).

Therefore, with the intensified AI investments into Reels, enhanced business Facebook/ WhatsApp monetization opportunities, and improved ad conversions already bearing fruit, we can understand why the management has opted to raise their capex.

This has been observed in META’s FY2023 revenue growth to $134.9B (+15.7% YoY) and operating margin improvement to 37.2% (+8.4 points YoY). The same has been observed in its FQ1’24 revenues of $36.45B (-9.1 QoQ/ +27.2% YoY) and growing operating margins of 37.9% (-5.8 points QoQ/ +12.7 YoY).

Therefore, while the CEO may have touted that META is “spending more on AI ahead before payoff,” we can see how their efforts have yielded great results in FY2023 and FQ1’24.

This is especially since it has generated robust Free Cash Flows of $42.99B (+133.3% YoY) and margins of 31.8% in FY2023 (+16.1 points YoY), with FQ1’24 numbers of $12.53B (+8.9% QoQ/ +81.3% YoY) and 34.3% (+5.9 points QoQ/ +10.2 YoY), respectively.

At the same time, the social media giant’s balance sheet remains heathy, with a net cash position of $39.7B in FQ1’24 (-15.5% QoQ/ +44.3% YoY) and its $18.5B of long-term debts well laddered through 2063.

If anything, much of META’s intensified Capex in 2023 is attributed to the bulk purchase of Nvidia’s (NVDA) H100 at a hefty estimated sum of $5.25B, based on the 150K in shipment and $35K in average price.

Despite so, META has put in another big order for approximately 200K units in 2024, to make up approximately 600K units of H100 equivalent in compute capability, on top of other AI chips and its in-house custom chip, Artemis.

With generative AI SaaS being here to stay and multiple Big Tech companies similarly announcing intensified multi-year investments, we believe that META’s guidance remains reasonable, since it will eventually be accretive to its top and bottom lines.

META’s Social Media Dominance Remains – TikTok Likely To Be Shut Down In The US

At the same time, given the multiple headwinds against TikTok, it appears that META may very well retain its global dominance in the social media market moving forward.

For context, the latest update from ByteDance highlighted that the management “would prefer shutting down its loss-making app rather than sell it, if the Chinese company exhausts all legal options to fight legislation to ban the platform from app stores in the US.”

This appears to be a tit for tat event, with China recently “ordering Apple (AAPL) to remove META’s WhatsApp and Threads from its app store in the country,” on the grounds of “national security.”

Readers must also note that TikTok has already been banned in India, Iran, Nepal, Afghanistan, and Somalia, amongst others, naturally triggering tailwinds for META’s Instagram and Facebook, which command 74.7% and 71.38% of market share in India by 2023, respectively.

META also reported growing Family Daily Active People of 3.24B (+1.5% QoQ/ +7.2% YoY) and ARPU of $11.20 (-9.1% QoQ/ +18.2% YoY) in FQ1’24, further demonstrating its ability to grow its user base while improving its monetization capability.

As a result, we believe that it is important for META to aggressively invest in its AI/ algorithms to better monetize new and existing users while generating better ad spend return.

For now, the Financial Times has reported that TikTok reports $16B of revenues in the US in 2023, with most of it likely attributed to ad-related sales.

Assuming that TikTok is eventually banned in the US, we may see META’s top/ bottom lines benefit moving forward, given that Facebook ranks number 1 in the US social media market share at 75.3%, along with Instagram at second place with 63.95%, Facebook Messenger at third place with 61.3%, and TikTok at fourth place with 50.2%.

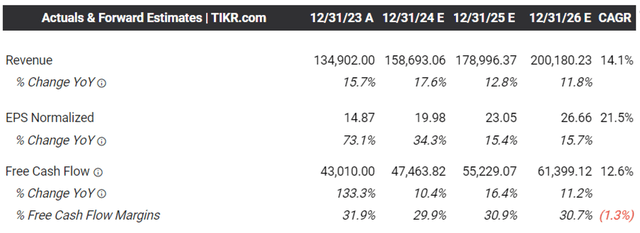

The Consensus Forward Estimates

Tikr Terminal

Perhaps this is why the consensus have moderately raised their forward estimates, with META expected to generate a top/ bottom line CAGR of +14.1%/ +21.5% through FY2026.

This is compared to the previous estimates of +10.9%/ +14.3% and the historical CAGR of +25.4%/ +19.7% between FY2016 and FY2023, respectively.

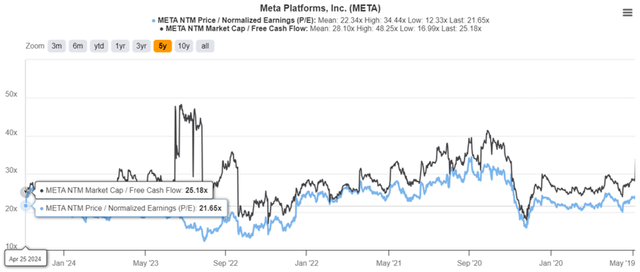

META Valuations

Seeking Alpha

And it is for this reason, we believe that META is not expensive here, especially due to the moderation in its FWD P/E valuations from the 5Y mean of 23.05x and the recent peak of 26.40x to 21.65x at the time of writing.

With META also inherently cheaper than its Magnificent Seven peers, such as Apple (AAPL) at 25.73x, Google (GOOG) at 23.71x, Amazon (AMZN) at 42.43x, Nvidia (NVDA) at 31.88x, and Tesla (TSLA) at 63.50x, it is undeniable that the former is highly attractive at current levels.

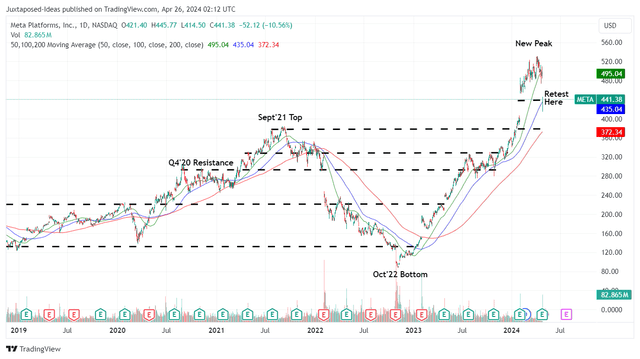

So, Is META Stock A Buy, Sell, or Hold?

META 5Y Stock Price

Trading View

For now, META has already retraced dramatically by -10.5% within a day, with the stock also trading below its 50 day moving averages.

Despite so, we believe that this pullback is well-deserved, since the stock is finally trading near our fair value estimates of $414.10, based on the LTM adj EPS of $17.41 and the 1Y P/E mean of 23.79x.

It also triggers an improved upside potential of +43.6% to our long-term price target of $634.20, based on the consensus FY2026 adj EPS estimates of $26.66.

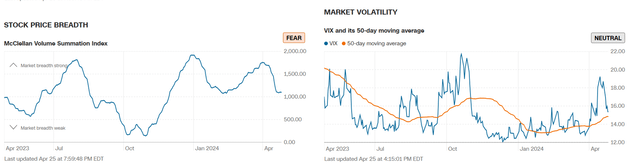

Market Volatility Index

CNN

With the McClellan Volume Summation Index already nearing its 1,000x base line and the VIX Index moderating, it appears that the recent correction may already be over, with META likely to be well supported at current levels.

However, we also want to offer a few notes of caution.

1. With the next FOMC meeting set to occur by May 01, 2024, there may be near-term volatility as the market awaits the Fed’s message, with the March 2024 CPI still appearing to be inflated and the macroeconomic normalization likely to be prolonged.

2. While META’s AI capabilities appear to be promising, as discussed by a fellow contributor here, we believe that the management’s focus on Reality Labs/ Metaverse have yet to be widely embraced.

This is due to the segment’s slower monetization with FQ1’24 revenues of $440M (-58.9% QoQ/ +29.7% YoY) and cash burn at operating losses of -$3.84B (-17.2% QoQ/ +3.7% YoY), with an eye-watering operating margins of -872% (-439 points QoQ/ +337 YoY).

Therefore, while META’s Family of Apps have reported expanding operating margins of 49% (-4.8 points QoQ/ +9.4 YoY), it remains to be seen when Reality Lab’s profitability drag may reverse and along with it, the pessimistic sentiments surrounding the Metaverse ambitions.

As a result, while we may continue to rate the META stock as a Buy, readers may want to time their entry points depending on their dollar cost averages and risk appetite.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AAPL, TSLA, GOOG, AMZN, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.