Summary:

- Market seemed to have over-reacted to Meta Platforms’ Q4-22 revenue beat.

- Meta faces a dilemma between committing to Year of Efficiency and increasing investment in Reality Labs.

- Reels likely won’t drive incremental revenue until early 2024, when TikTok Ad revenue is estimated reach $18B by 2023.

Galeanu Mihai

Meta (NASDAQ:META) reported its Q4-22 earnings with $1.76 EPS (including restructuring charges of $3.76B and $440MM for Family of Apps and Reality Labs respectively), and $32.17B in revenue beating street’s revenue expectations.

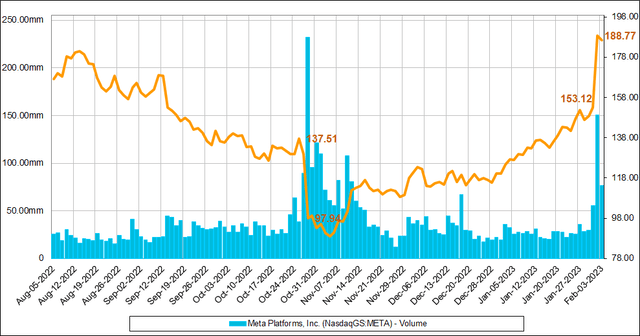

META soared from $153 to $189 (+24%) with 150MM trading volume. This is in contrast to 232MM selloff post Q3-22 earnings resulting in -29% stock price drop due to EPS miss ($1.64 vs $1.89 expected).

During Q4-22 earnings call, the company did a great job ‘selling’ their product strategies on WhatsApp, Reels, and AI, as well as plans on improving cost efficiencies with infrastructure and organizations. Except the mass layoff in Q4, I have seen limited evidence supporting the doubled stock price within three months. The market clearly just reacted to Meta’s quarterly results. In my previous articles (Meta: Ads Business Growth At Risk; Meta Bets On WhatsApp To Replicate WeChat Success; Meta’s Ads Risk With ARPU And CPM) I mainly discussed Meta’s risk with advertising. Today I want to share a few more thoughts around their Q4-22 earning discussions.

Meta faces a dilemma between committing to Year of Efficiency and increasing investment in Reality Labs

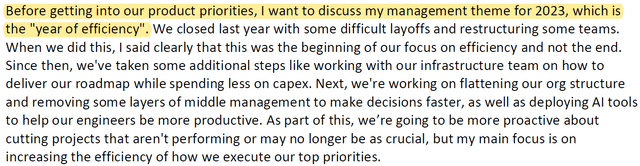

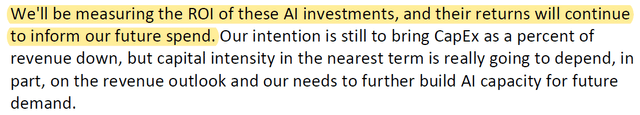

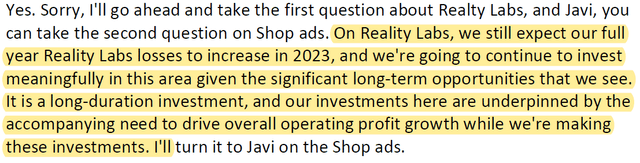

The company stated that 2023 would be the “year of efficiency” with mass layoff and restructuring as the starting point in Q4-22, and efficiency efforts will continue for Infrastructure, Org structure, and AI tooling. Specifically ROI of AI investments will be measured to inform their future spend. The company also made it clear that Reality Labs losses would continue to increase in 2023 from an already very pricey endeavor with $13.7B loss in 2022.

There are several problems between committing to efficiency and increasing investment in reality labs.

First, driving efficiency normally comes with costs of slowing down growth. If Meta indeed is going to fulfill their commitment in cost optimization, it means growth of some businesses will more or less be affected. Since Metaverse is still their long-term bet, in order to deliver on their vision, infrastructure would be critical to support the development. Although the company wanted to measure ROI of AI investments, guess how hard it would be to measure the return for this multi-year journey?

Second, comparing with Cloud leaders on the market, anecdotally Meta is pretty new in infrastructure capacity planning and CapEx optimization. I can think of various things that might limit Meta from moving fast. The foundational work of metering infrastructure usage by workload, the operational excellence in right-sizing data center footprints, and the trial and error required to understand tradeoffs between utilization and performance by workload. Just to name a few.

All in all, I am positive that a flatter organization would allow Meta to move faster, more thoughtful hiring plans will help keep HC costs under control. But infrastructure efficiency will be a tough dilemma Meta has to face, and eventually Meta will have to determine the ranked priority between Reality Labs investment and efficiency commitment.

Reels likely won’t take off until early 2024

Reels, a short-form video product, is what Meta competes with TikTok. Unfortunately, the company seems lacking conviction in moving fast. As stated in Q4-22 earnings call, Reels monetization efficient is much less than feed, and revenue neutral will only be achieved by the end of this year or early 2024.

“We are not quantifying the gap in monetization efficiency between Reels and other services. We know it took us several years to bring the gap close between Stories and Feed Ads. And we expect that this will take longer for Reels“.

Note that by the end of 2023, TikTok is estimated to reach $18B in ad revenue. This is one of the tradeoffs when Meta leads the construction of future’s metaverse.

Finally, although MAUs hit new highs, it worries me a little that Ads in North America has been trending flat. Growth in APAC and ROW means lower ARPU, lower CPM to offset higher volume of impressions. One of the potential reasons could be that advertisers started rationalizing their budget allocation and shifted towards Retail Media Networks and Short-form Video Ads. See my previous article, Walmart: Doubling Down In Retail Media Network.

Conclusion

I overall remain neutral for META stock. On the positive side, Meta repurchased $28B worth shares in 2022, and announced $40B share buyback in 2023. Meta also started talking about Ads monetization for WhatsApp. Getting fit is also a critical path for tech giants to regain growth momentum. On the flip side, I am skeptical how much efficiency improvement will materialize, and also feel slightly disappointed about the ramping plan for Reels in 2023.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.