Summary:

- Texas Instruments is the industry leader in lagging edge chips.

- I believe the lagging edge is an attractive market with its lower capital requirements and strong tailwinds for growth.

- My DCF results in a base case price of $186, but I believe the stock to be attractive when below $170 to allow for a margin of safety (use volatility).

Editor’s note: Seeking Alpha is proud to welcome Value Oriented Investor as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Sundry Photography

I believe Texas Instruments (NASDAQ:TXN) is an excellent long-term holding. It is the market leader in a market with significant secular tailwinds which combined with its business strategy and scale, will allow it to increase its market share. Texas Instruments boasts one of the most impressive margin and return profiles of any company, and its strategic initiatives provide a line of sight for incremental margin improvement. Finally, management is an excellent steward of capital with significant distribution to shareholders.

Business Overview

Texas Instruments is a semiconductor company headquartered in Dallas Texas. It trades on the NASDAQ with the ticker TXN and a market cap of roughly $157 billion (as of 01/30/23, ~$173/share). Although widely recognized for their calculators, that is far from what Texas Instruments truly does as that makes up roughly 2% of revenue. Texas Instruments designs, manufactures, and sells analog and embedded semiconductors (~95% of revenue) to electronics designers and manufacturers globally. The company was founded in 1930 as Geophysical Service Incorporated and changed names in 1951. Texas Instruments is a top 10 semiconductor company by sales volume worldwide.

Vertical integration provides an increasingly superior business model, driving revenue growth

In recent years, fabless companies such as NVIDIA (NVDA), Apple (AAPL), etc. became market leaders in the digital industry. However, the characteristics of the analog and embedded processing industries limit the potential advantage of being fabless and make it a disadvantage. Manufacturing in these industries occurs using “lagging-edge” technology, which requires a lower level of capital expenditure and can be used for decades compared to a few years for the leading edge. Additionally, the products have a longer shelf life of several years to decades, compared to the two-year shelf life of the highest-end digital chips.

Additionally, lagging-edge manufacturing is being left behind. Analog chip companies are increasingly outsourcing production and foundries aren’t investing enough for demand tailwinds. According to Gartner, from 2020 to 2026, 12% of semiconductor equipment spending will be on 65nm+ nodes, which are almost all of the analog nodes and a significant percentage of embedded processing nodes. Texas Instruments represents at least 2% of this spending, meaning that it is responsible for 1/6+ of analog and embedded processor semiconductor equipment spending. This deteriorating supply of manufacturing is illustrated by GlobalFoundries (GFS) (the main outsourcing fab company for analog) boasting its pricing power in earnings calls, including Q3 2022, by saying “Average selling price, (ASP), per wafer, increased approximately 14% year-over-year, driven by ramping long-term customer agreements with better pricing, as well as, continued improvement in product mix”. When TXN’s competitors’ (COR) increases, TXN will be able to take market share, increase margins, or a mix of both. This dynamic will be especially important during boom cycles when fast ramping is crucial.

While the chips themselves are usually inexpensive, they are integral parts of systems. According to the Wall Street Journal, “A lack of simple chips, including 40-cent parts needed for windshield-wiper motors in F-150 pickup trucks, left it 40,000 vehicles short of production targets”. This exemplifies the necessity of reliability in the analog chip supply chain.

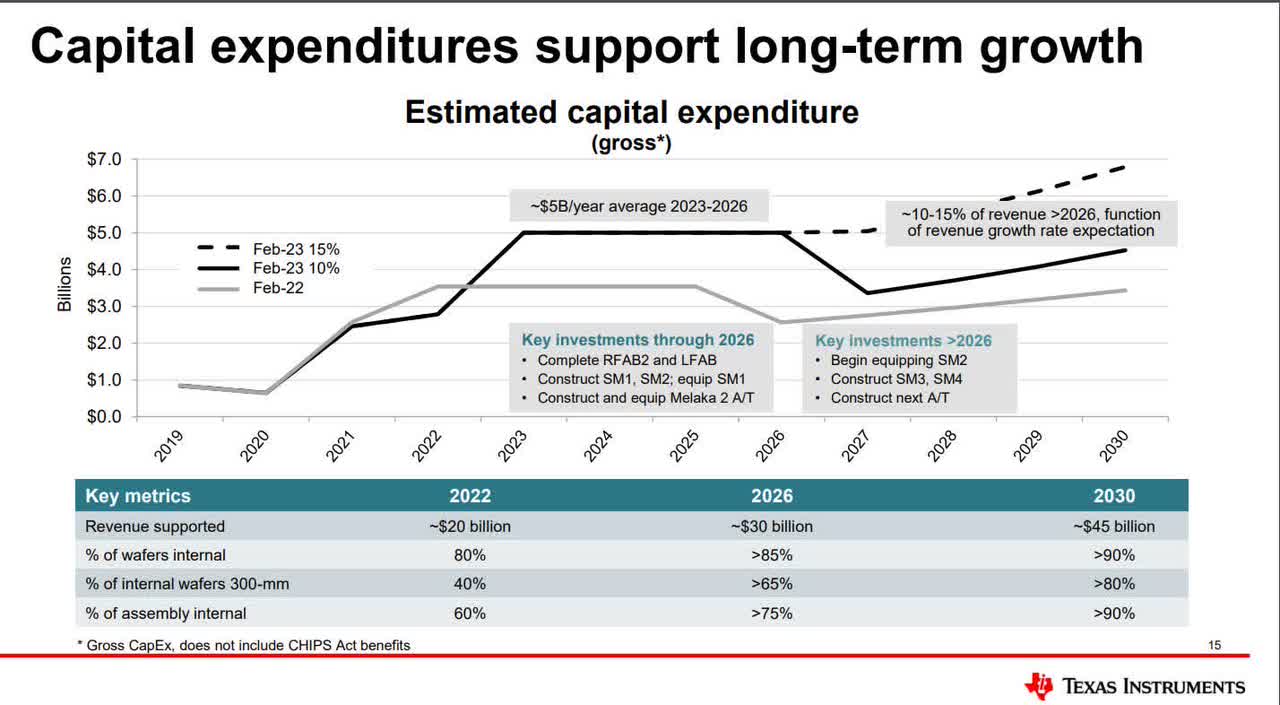

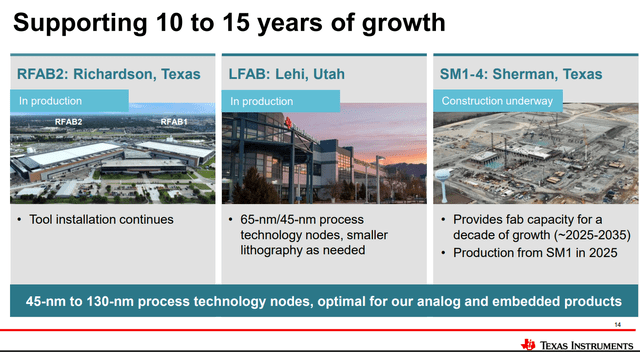

To take advantage of these market conditions, TXN implemented a “Fab Expansion” plan that will bring revenue supported by internal manufacturing from $18b (80% of revenue) to $45b (>90% of revenue) by 2030. Furthermore, TXN can manufacture 75% of its chips at multiple facilities. This combined with internal assembly (expected to rise from 60% to >90% by 2030) gives them greater control over their supply chain. Also, all new fabs will be built in the USA which is an important geopolitical stability factor with customers. As we see in the Ford example, supply chain reliability/inventory availability is of paramount importance in the semiconductor industry meaning TXN’s fab expansion plan will help win customer contracts (gaining market share), especially as aforementioned market conditions worsen.

Texas Instruments’ Production Footprint (Company Website)

TXN’s manufacturing and assembly/test sites are globally positioned, but the 6 additional 300mm fabs will all be in the US to take advantage of the government incentives, but more importantly geopolitical stability in the supply chain.

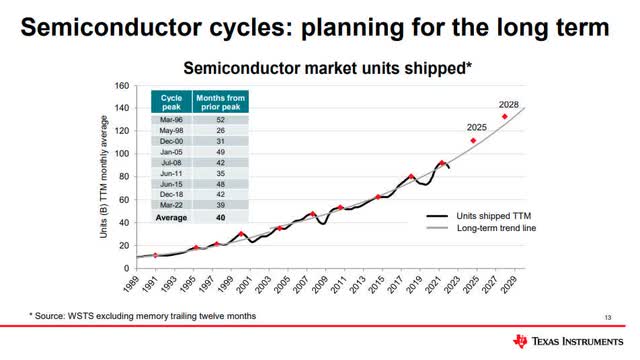

Texas Instruments 2023 Capital Management Presentation

As of Feb 2, 2023, TXN readjusted the already elevated CAPEX plan to support an increase in expected demand. See black vs grey trend lines. This new plan will cement its spot as the most reliable supplier of analog/embedded chips.

The 6 new 300mm fabs

Texas Instruments 2023 Capital Management Presentation

Analog/Embedded semiconductor industries have strong secular tailwinds which combined with TXN’s diverse revenue base and large product breadth, further, drive revenue growth

The analog and embedded processing industries are essential for the function of modern technology driving strong growth due to the increased use of chips for electrification and connectivity. The number of devices with chips and the number of chips per device will both increase, resulting in non-linear growth (see image below).

Texas Instruments 2023 Capital Management Presentation

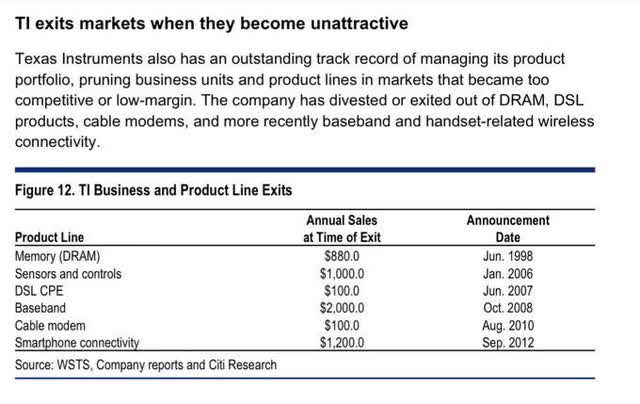

Furthermore, TXN has a history of exiting and entering markets at opportune times. Through targeted ((R&D)) spending, its proportion of revenue from the industrial and automotive end-markets grew from 42% to 65% (2013-2022) while they have started to focus less on non-high-growth markets like consumer electronics (see image below for its history of strategic exits).

TXN’s foresight has proven successful in the past, and so this transition to autos/industrial should follow suit.

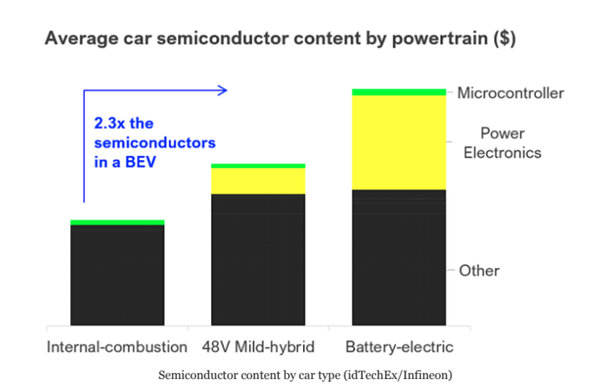

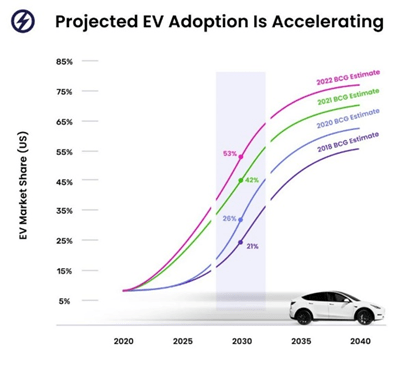

According to ASML (ASML), the automotive and industrial semiconductor markets are projected to have CAGRs of 14% and 12%, respectively, through 2030, compared to 9% for the overall semiconductor market. TI’s offerings are competitive and combined with their significant market share, sizeable R&D capacity, and the company’s vertical integration (providing a transparent, consistent supply chain) Texas Instruments is well positioned to gain market share, resulting in strong revenue growth. Looking at both images below, the exponential growth of EV adoption, combined with the factor more of chips needed for each EV will result in chip demand growing at the EV exponential rate multiplied by the factor of increased chips per car.

idTech/Infineon

BCG

Furthermore, Texas Instruments has a highly diversified revenue stream and large product breadth with little risk of significant disruption. No individual product accounts for more than 1% of revenue, and 40% of revenue comes from outside the top 100 customers. The company has an unmatched catalog of over 80,000 products and serves more than 100,000 customers. This unique portfolio breadth offers TXN a competitive advantage because when the customer is designing a system of chips, Texas Instruments can offer a much higher proportion of the necessary components (often 4x-10x more), so it becomes a one-stop shop. Furthermore, when a customer needs a custom chip, TXN’s portfolio provides a platform for quick innovation rather than invention because they usually have a similar offering. Therefore, they can supply the component in far less time. These are significant advantages for winning new contracts, especially in the automotive and industrial end markets which have complicated, large systems.

Highly attractive margin profile and return statistics

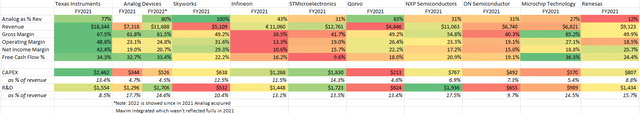

Texas Instruments has consistently reported GAAP numbers, demonstrating its commitment to consistency and transparency. In 2022, the company’s net income margin and gross margin were 44% and 69%, respectively. EBITDA was 56%, while free cash flow was lower than historical trends, 30%, due to increased capital expenditure. Despite this, Texas Instruments has a leading margin profile and is a cash-generating machine.

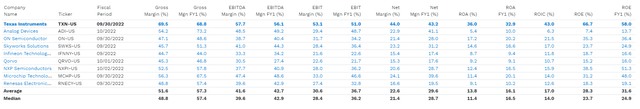

Operating Statistics Comp Table for the Top 10 Analog Semiconductor Companies (Author, Company 10K’s/20F’s)

Competitors in Chart: Analog Devices (ADI), Skyworks (SWKS), Infineon (IFNNY), STMicroelectronics (STM), Qorvo (QRVO), NXP Semiconductors (NXPI), ON Semiconductor (ON), Microchip Technologies (MCHP), Renesas (RNECY)

Texas Instruments boasts the best margin in all categories except free cash flow, which is second to Microchip Technology due to TXN’s much higher CAPEX spend (once it becomes more normalized it will retake the top position). 2021 is used since all 2022 results aren’t in.

Opportunities for margin expansion

A mix shift of revenue towards the higher margin analog market:

Analog has a historical operating margin in the mid-40s to low-50s, reaching 53% in 2021 (embedded processing and other were 39% and 32%, respectively). From 2016 to 2021, Analog’s share of overall revenue increased from 64% to 77%, and its share of overall operating profit increased from 70% to 83%.

A strategic shift towards more direct-to-customer sales:

Texas Instruments’ direct sales, as a percentage of overall sales, grew from 35% in 2019 to 70% in 2022. This growth is due in part to “investment in our sales and applications team, TI.com, business process and logistics” (TI 2021 Capital Management Presentation, 19). TI.com’s sales grew from 0% of revenue in 2018 to approximately 10% in 2022, although management attributes this strong growth to favorable market conditions. Texas Instruments is constantly improving the customer experience, driving superior relationships and more direct sales, meaning: margin.

The expansion of its manufacturing footprint with the addition of six new 300mm fabs:

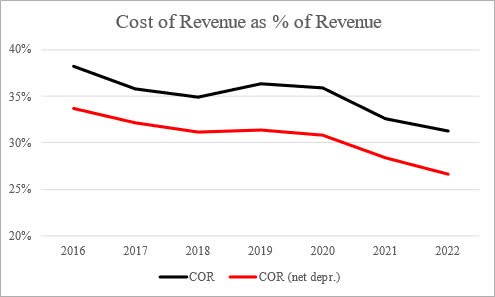

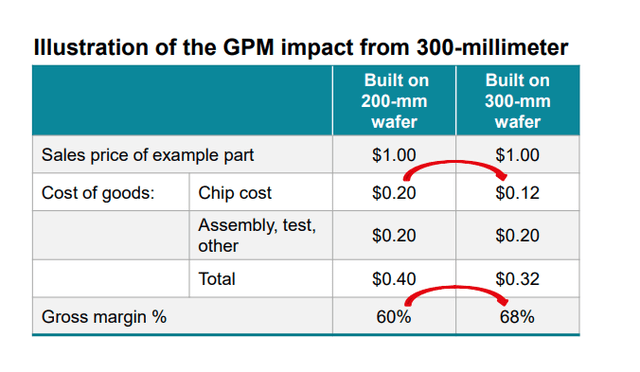

Management claims there is a 40% cost reduction per chip compared to 200mm wafer production. This is a major gross margin expansion opportunity. The benefits of the past implementation of 300mm manufacturing can be seen in the gross margin net depreciation graph (below).

Author’s Calculation with 10K’s

In the image below, management demonstrates the increased margin of 300mm vs 200mm fabs. The 40% chip cost reduction results in ~8% of gross margin expansion.

300mm Fab Benefits (Texas Instruments’ 2021 Capital Management Presentation)

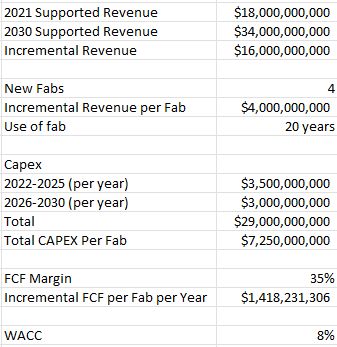

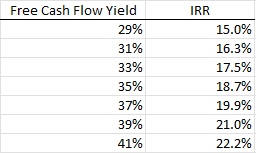

Below is back-of-the-envelope math with conservative estimates of only 20 years of use, all negative flows in year 0, and $7.25B cost per fab (the rest of the information comes from management’s capital allocation presentation). Even with very conservative estimates, it still produced high return estimates

Author’s Calculations Author’s Calculations

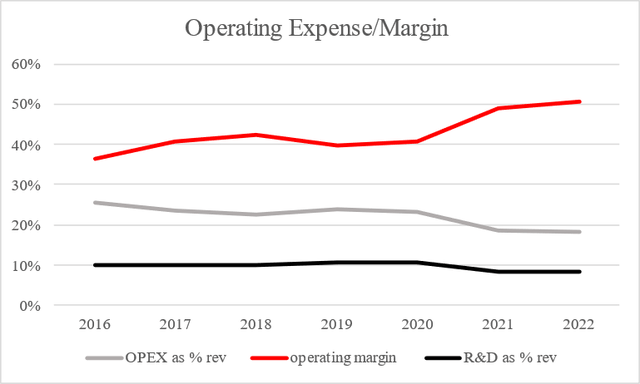

The graph below demonstrates TI’s success in growing its impressive margin profile. Furthermore, you can see that OPEX margin grew with R&D as a percentage of revenue staying relatively constant. This represents operating leverage due to SG&A not needing to grow with revenue.

Author’s Calculation from 10K’s

While the figure above shows the significant margin improvement TI accomplished, and I have identified specific initiatives that will further drive this trend, there are also unidentified opportunities for margin expansion. Through the increasing use of AI/ML and automation in manufacturing, and the potential for increased economies of scale and efficiencies through centralized fabs, among others. Overall, it is likely the upper limit for margins has not yet been reached, and incremental margin expansion is highly valuable for the company and investors.

Superior capital management with excellent returns to shareholders

Texas Instruments’ decentralized management structure allows management to focus on portfolio management and capital allocation, with a long-term focus on shareholder value. This focus is reflected in the company’s Investor Overview, which states:

- “We run the company with the mindset of being a long-term owner”

- “We believe that growth of free cash flow per share is the primary driver of long-term value”

- “Our strategy is comprised of a great business model, a disciplined approach to capital allocation and a focus on efficiency”

This approach is demonstrated through Texas Instruments’ strong dividend growth, with a dividend yield of ~3% and a dividend CAGR of 17% and 21% over the last five and 10 years. Additionally, from 2004 to 2022, the company reduced its share count by 47%, which, combined with strong operational performance, led to a CAGR of 11% for free cash flow per share over the same period.

Comps/Relative Valuation

Texas Instruments operates a superior business compared to its competitors in margin and return statistics. This can be attributed to the vertically integrated business model and high exposure to the lucrative analog market. (see chart below)

Competitors in Chart: Analog Devices, Skyworks, Infineon, STMicroelectronics, Qorvo, NXP Semiconductors, ON Semiconductor, Microchip Technologies, Renesas

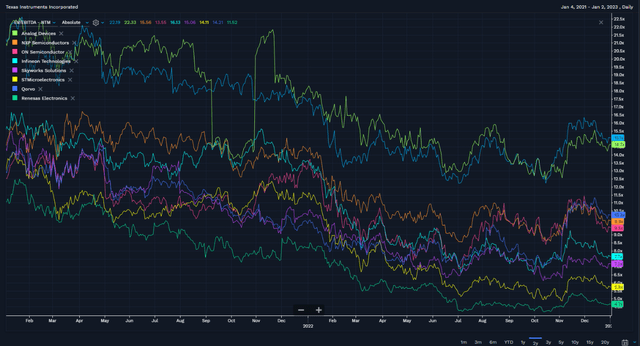

Below is the NTM EV/EBITDA for each of the above competitors and TXN (that FactSet data was available). Texas Instruments and Analog Devices trade at a premium to the rest of the analog players, but they are the two largest by market share and two of the most profitable.

Historical 2yr NTM EV/EBITDA (TXN is top blue for both) (FactSet)

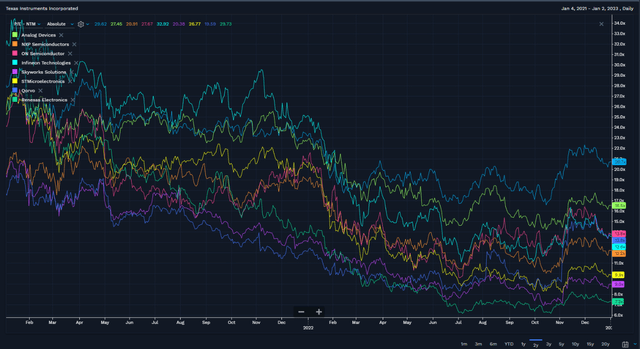

Below is the NTM P/E for each of the above competitors and TXN (that FactSet data was available). While again, TXN trades higher than competitors, I don’t believe this is a reason not to buy, as they are still at an attractive multiple (~20x NTM P/E) which is inflated by depressed NTM estimates. Furthermore, TXN is highly profitable, so topline growth will significantly reduce this multiple.

Historical 2yr NTM P/E (FactSet)

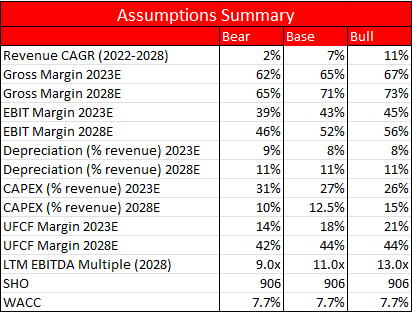

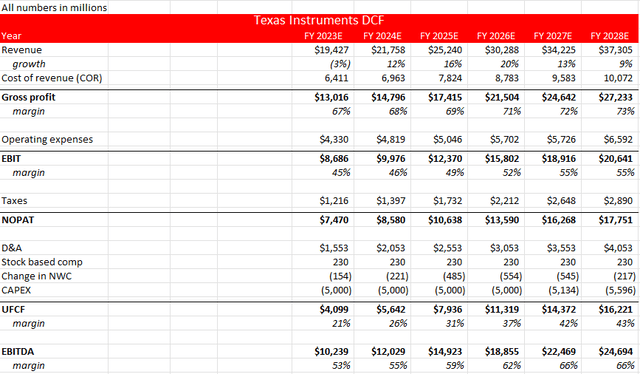

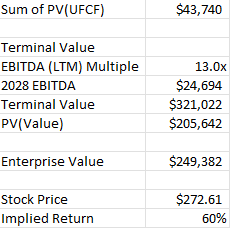

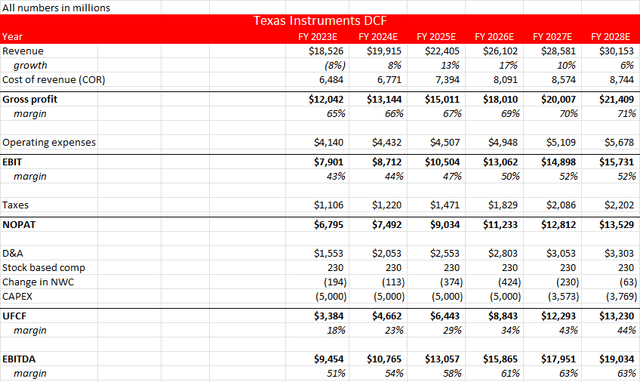

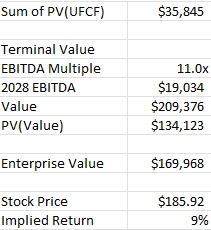

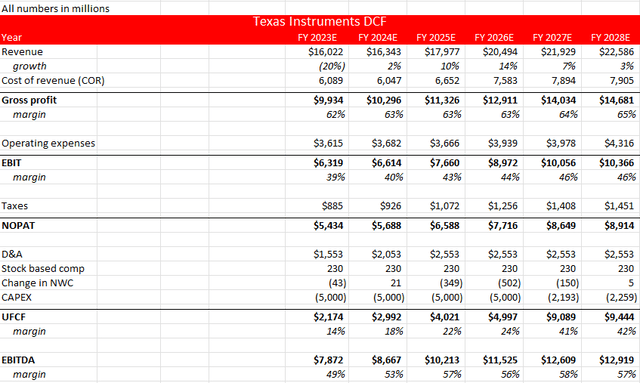

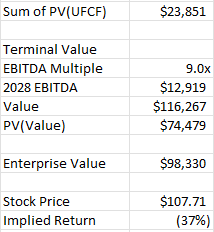

DCF Valuation

I used a DCF valuation with UFCF to obtain an enterprise value, and then backed out the equity value for an estimated share price. When available, I used management comments from earnings calls and presentations for base case assumptions. Free Cash Flow margins in the three different cases don’t vary as much in FY2028 as other margins because the committed $5B of CAPEX per year through 2026 will drive higher depreciation in the following years, but CAPEX will drop to 10-15% of revenue, depending on top-line growth (management comments). Therefore, the scaling of CAPEX as % of revenue drives a smaller variety in late years FCF margins by case. Notice, while there is incremental margin expansion baked in, EBITDA margins will be inflated due to higher depreciation driven by CAPEX. The FCF margins justify this by not inflating true cash flow. Historically, TXN trades between 11-16x LTM EV/EBITDA. I decided to decrease this range since the market would adjust for inflated EBITDA relative to true cash flow. Using a share price of $170 (my recommended buy level): the “bull” case has a 60% upside with a price target of $273, the “base” case has a 9% upside with a price target of $186, and the “bear” case has a downside of 37% with a price target of $108.

Author’s Calculations

Bull Case

Author’s Calculations Author’s Calculations

Base Case

Author’s Calculations Author’s Calculations

Bear Case

Author’s Calculations Author’s Calculations

The models show that expected top-line growth with minimal margin expansion (base case) can overcompensate for projected cash outlays for the manufacturing expansion, resulting in TI being currently undervalued. In the bear case, TXN will have grown revenue by 2% total from 2022-2028 and experienced margin compression. If this extreme situation takes place, the downside is still limited at a fair value of -37%. In my mind, if this were the case, management would pursue other revenue generators like using their increased capacity to become a fab like Intel (INTC). Regardless, if TXN experiences an 11% CAGR for the top line and incremental margin expansion, it will be a home run and a must-own. Therefore, I believe the upside outweighs the downside and is far more probable.

Risks

China

Roughly 50% of revenue is shipped to China. Recent geopolitical tensions have hurt trade relations with China, and specifically, the semiconductor industry has been greatly affected. Fortunately, TI hasn’t been affected since the focus is on high-end digital chips that are used to make advanced weapons. Management states the true proportion of Chinese revenue is roughly the same as Chinese GDP/world GDP (~18%).

Semiconductor Cyclicality

While we can’t control the cyclicality of semiconductors, many believe their ubiquitousness now will lead to a contraction of the peak-trough difference in the cyclical waves. Furthermore, Texas Instruments’ diversity of applications and customers makes it more correlated to the economy than the semiconductor industry as a whole, relative to other semis. Furthermore, this downturn could be similar to the downcycle of 95 where companies with PC exposure triumphed. Except for this time autos and industrials will be the two secular opportunities (65% of 2022 revenue). Therefore, while 2023 is forecasted for revenue decline, the decline could be subdued and the secular growth could overcompensate for the remainder of the downcycle.

Disruption/Loss of Market Share

Texas Instruments operates in highly competitive industries, so TI will need to continue to successfully innovate and leverage its competitive advantages to keep growing its share. For instance, a promising technology in inverters for EV batteries is Silicon Carbide chips (SiC). Texas Instruments isn’t seen as a leader in this field (although it is still a very niche market).

Execution of 300mm Fab plans

Any large-scale project like this comes with significant implementation risk, and due to the size of the project and its imperativeness to the success of TI’s strategy, any problems that arise will be material to TXN’s results.

Conclusion

Initiate position in Texas Instruments

While there may be a better time to buy TXN in the future if the market continues to roll over or semiconductors enter a worse-than-expected cycle, I don’t believe an enterprise value of ~$150B is an unattractive valuation for Texas Instruments. Texas Instruments is an industry leader in a market with significant tailwinds. Furthermore, TXN’s business model is superior to peers with the ability for further, incremental, margin expansion and mid to high single digits revenue growth for decades to come. My buy area is anything below $170/share, allowing for some margin of safety. I believe volatility in the market, combined with uncertainty in semiconductors, will provide ample opportunities to add to a position over time.

Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.