Summary:

- Meta Platforms has experienced a significant rally in 2023, driven by a rebound in the advertising market.

- The company’s investments in the Metaverse and AR/VR devices are expected to pay off in the future, but the business is causing a $5 EPS hit currently.

- The stock has the potential to hit $500 in 2024 based on a core business generating up to $25 in EPS and a 20x PE multiple.

Gilnature/iStock via Getty Images

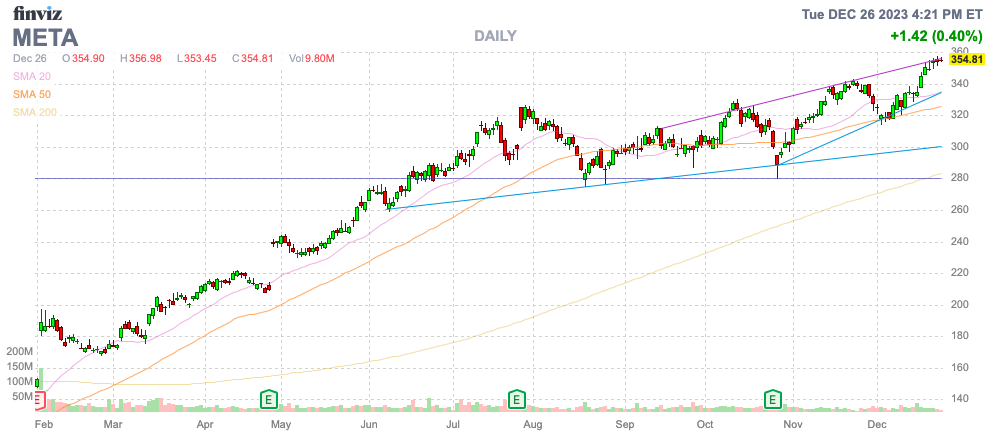

Meta Platforms (NASDAQ:META) has seen a huge snapback rally in 2023 due to mostly a rebound in the advertising market. The social media stock was left for dead in late 2022 with a dip below $100, so Meta still hasn’t topped peak 2021 levels on this big rally. My investment thesis is ultra Bullish on the stock for another big year in 2024 due to surging profits and investments in the Metaverse and AR/VR devices to ultimately pay off.

Finviz

Huge Investments

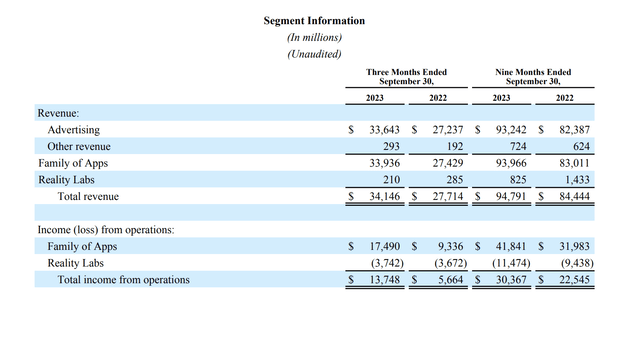

As 2023 wraps up, Meta has again finished the year with limited results shown from the Metaverse and AR/VR devices. These businesses are reported under the Reality Labs segment results, with revenues slumping to only $210 million in Q3’23 while losses jumped further to $3.7 billion.

Meta is now losing income at a nearly $15 billion annualized pace from the Reality Labs division. The company will either start producing meaningful revenues and reduce losses, or the company will start cutting spending levels.

The recently released Meta Quest 3 device has struggled to gain the desired traction, with Apple (AAPL) now expected to release the Vision Pro in February. The high-end mixed reality device should usher in a new level of performance in the AR/VR market, possibly helping Meta develop future devices.

The Vision Pro has breakthrough technology, but the headset will come at a major cost of $3,500+ to consumers. Apple analyst Ming-Chi Kuo is now forecasting shipments reaching 500,000 units in 2024 for ~$1.75 billion in sales.

Meta has recently claimed the ability to either duplicate or exceed this technology from Apple. The company has advanced technologies not included in the Quest devices for various reasons from cost to function.

The futuristic headset released at a recent presentation has impressive technology such as holographic optics, a retinal resolution display, a module for variable focus, multi-view eye tracking, neural passthrough, and reverse passthrough. Douglas Lanman, Director of Research at Meta’s Display Systems Research department, suggests Meta could produce this headset based on materials currently available.

In our view, this continues to support the theory that Meta remains the leader in the space. Apple is on the verge of releasing the most advanced AR/VR device, but Meta has appeared hesitant to bring such a device to market considering the cost hurdle, but Vision Pro might highlight the benefit of bringing such a headset to market in order to boost the interest in the technology.

As highlighted earlier this year in prior research, Meta has a strong roadmap for future devices and smart glasses in comparison to Apple:

- 2023: Quest 3 – 2x thinner, twice as powerful

- 2023: Smart glasses – 2nd generation device

- 2024: Quest 4 – photorealistic, codec avatars

- 2025: Smart glasses – 3rd generation with a display and a neural interface

- 2027: AR glasses

The smart glasses appear to have all been pushed back a year, but the latest news suggests the company has far more technology in the cupboard to release.

Path To $500 In 2024

Meta currently trades at nearly $355 with just 3 trading days left in 2023. The stock hit a high above $380 in late 2021 and the company is now producing record sales and profits despite the massive spending on Reality Labs.

The company has reported the following Q4 metrics for the last 5 years, including the projection for the soon-to-end quarter:

- Q4’23E: $4.93, $38.86B (21.1% growth)

- Q4’22A: $1.76, $32.17B (-4.5%)

- Q4’21A: $3.67, $33.67B (20.0%)

- Q4’20A: $3.88, $28.07B (33.2%)

- Q4’19A: $2.56, $21.1B (24.6%)

The social media company has made huge progress in Reels and other aspects of legacy business in order to boost sales following the impact of the Apple IDFA jolt to the advertising business. Yet, the stock still hasn’t hit new record prices, providing the upside potential for next year.

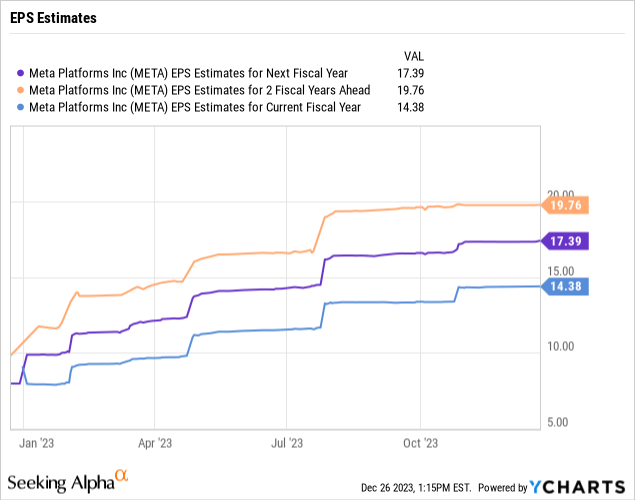

As the below chart highlights, the current consensus analyst estimates have Meta generating substantial EPS growth over the next couple of years. By the end of 2024, the stock will start trading based off the consensus 2025 EPS targets of $19.76.

An investor can quickly slap a 25x forward multiple on the stock and reach the $500 price target. The better news is that the Reality Labs division holds back EPS by $5 per share, based on the $15 billion loss and 2.6 billion shares outstanding.

Assuming the EPS estimate boost through 2025 is entirely due to earnings growth from the advertising business and not related to reduced losses from Reality Labs, Meta would have a core business earnings potential of nearly $25 per share. An investor would easily slap a 20x PE multiple on the core business and assign a $500 price target to the stock.

At any moment, Meta could easily cut the Reality Labs business and quickly boost EPS estimates. The company wouldn’t have a promising future in the Metaverse and AR/VR devices by making such a decision, which is why investors should increasingly value the stock excluding those losses, knowing the future will be even brighter from work in this area.

As mentioned in the prior research, Meta appears poised to ride the AI wave as well with the AI assistant technology released earlier this year. The company will increasingly disperse AI technology on the Facebook, Instagram, and WhatsApp platforms.

Takeaway

The key investor takeaway is that Meta is still cheap based on the growth opportunity ahead. The company likely has up to a $25 EPS potential in 2025 for the core business, leading to the $500 price target for 2024.

The AR/VR device opportunity remains a bonus to the stock as Meta continues to develop a leading roadmap in the segment. Investors should see the Vision Pro release in the next few months as a potential to open up the market, not a sign that Meta has relinquished any lead to Apple.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.