Summary:

- Opendoor has navigated a volatile operating environment in recent years and demonstrated that the iBuying business model is more resilient than many expected.

- Despite this, Opendoor is still not profitable, and needs to demonstrate that partnerships can lower the cost of acquiring customers.

- Opendoor’s valuation is still modest, creating significant upside potential if the company can execute going forward.

- Housing market conditions are more fragile than is widely believed though. Current issues will not be resolved just through a small drop in mortgage rates.

Feverpitched

Opendoor (NASDAQ:OPEN) has faced a volatile operating environment over the past few years, which all things considered, the company has navigated reasonably well. While Opendoor still needs to prove the viability of its business, iBuying has already demonstrated far more resilience than many expected. The competitive landscape has also become more favorable, with Opendoor establishing beneficial partnerships with companies like Zillow (Z) and Redfin (RDFN).

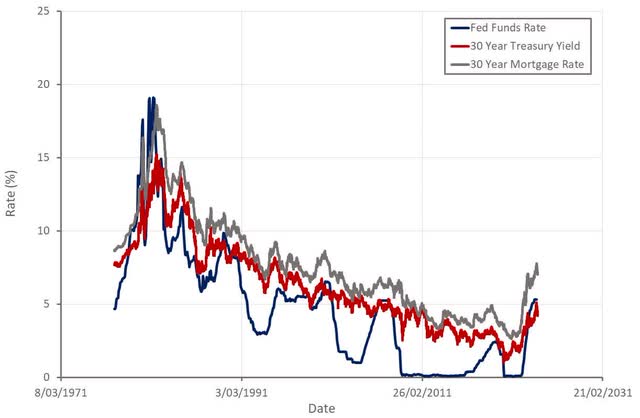

In the near-term, interest rates and the macro environment are likely to drive Opendoor’s share price. There is a growing consensus that inflation is heading towards the Fed’s target, causing a sharp decline in longer-term interest rates. This is widely expected to jumpstart the housing market, which had largely frozen due to affordability issues. While this may be the case, Opendoor’s business is more dependent on price stability than a booming housing market.

Investors also need to consider that given recent experience, banks will be cautious about lending at low rates again. In addition, macro uncertainty remains elevated, which will contribute to a reluctance to lend.

Beyond the interest rate environment, it is also worth considering that the housing supply/demand balance is not as healthy as is widely believed. The labor market is basically as strong as it has ever been, which is highly supportive of housing demand. If the labor market weakens, home prices may remain pressured, independent of interest rates. The housing market also exhibits momentum, with price increases in recent years creating its own demand. If the housing market enters an extended contraction, price decreases will likely mute demand.

Recent housing market weakness and the equity bear market in 2022 were the result of rate rises, not economic weakness. If economic conditions deteriorate meaningfully, rate cuts will not help. An extended housing market downturn may not be a death sentence for Opendoor though. Similarly, a strong housing market is unlikely to help Opendoor achieve profitability. The company still needs greater scale, while maintaining efficient operations, and it needs to lower customer acquisition costs.

Market

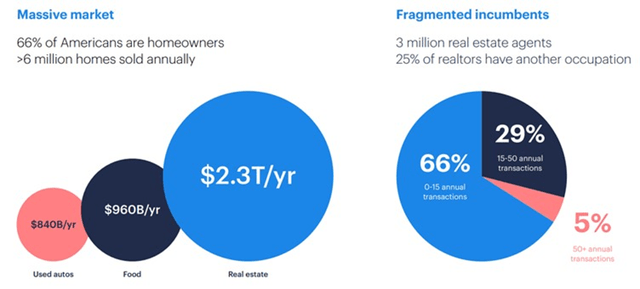

Opendoor’s iBuying service aims to modernize the process of buying and selling a home and in turn, create a superior consumer experience. Despite iBuying existing for a number of years, the market is still largely a blue ocean. Less than 1% of real estate transactions are currently online and the market remains highly fragmented.

While Opendoor potentially has a large opportunity ahead of it, the company is limited by the number of homes it can accurately price, which Opendoor refers to as its buybox. Based on its current buybox, Opendoor believes its addressable market is around 650 billion USD. While this is expanding, iBuying is only ever likely to be feasible for a minority of transactions.

Figure 1: Real Estate Opportunity in the US (source: Opendoor)

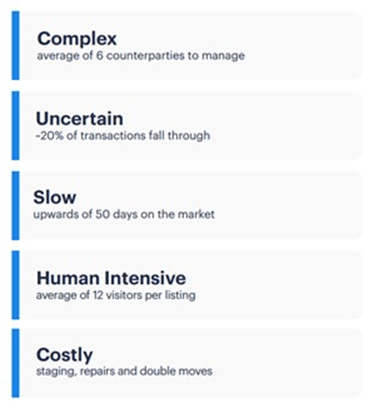

Part of the reason that iBuying has gained traction is that the current process is complex and time-consuming. For example, 20% transactions fall through, frustrating both buyers and sellers. Around two thirds of sellers are also buyers, creating pressure to manage two transactions at the same time.

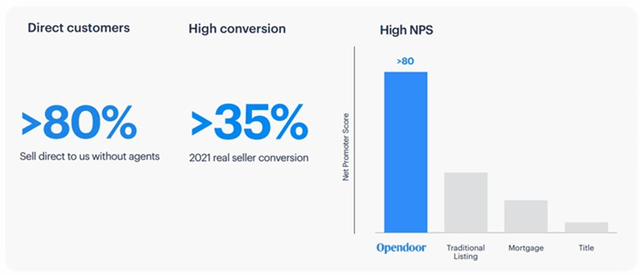

By providing sellers with a low friction service that reduces uncertainty and time, Opendoor can create a vastly better experience. This is reflected in the company’s Net Promoter Score which is around 80.

Figure 2: Problems with the Existing Process (source: Opendoor)

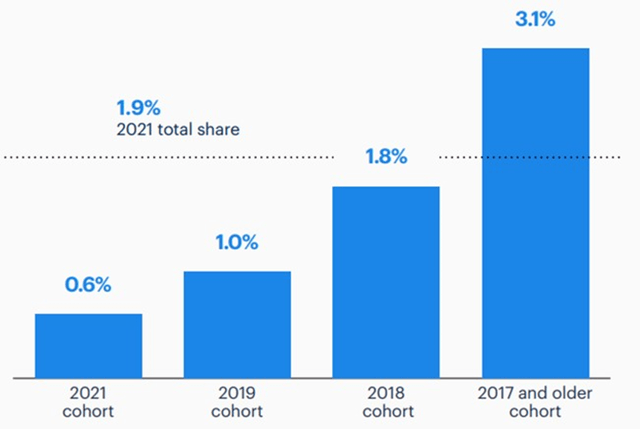

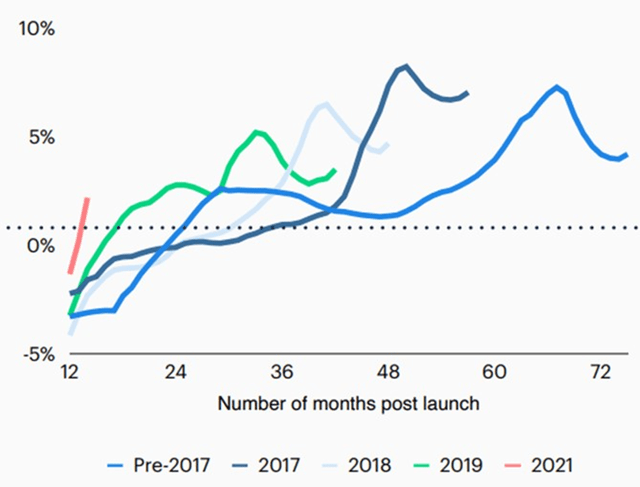

Opendoor currently has a presence in 53 markets and in 2021 had a 1.9% market share across its markets. Market share is a somewhat meaningless metric for Opendoor’s business though. Any company willing to bid more for homes can establish a large market share, but unless this is done profitability, it does not create value.

Opendoor has generally increased its market share over time after entering a new market and has a market share of around 4% in its more mature markets. Based on the company’s current estimated addressable market, Opendoor could generate around 26 billion USD revenue if it had a 4% share across its markets.

Figure 3: Opendoor 2021 Market Share by Year of Market Launch (source: Opendoor)

Beyond its core business, Opendoor also has a large opportunity in adjacent markets, like title and escrow, loans and insurance. While these markets are not as large, they offer far better margins. Success in adjacent markets is likely a necessity given the low margin and volatile nature of Opendoor’s core business.

Figure 4: Potential Expansion into Adjacent High Margin Services (source: Opendoor)

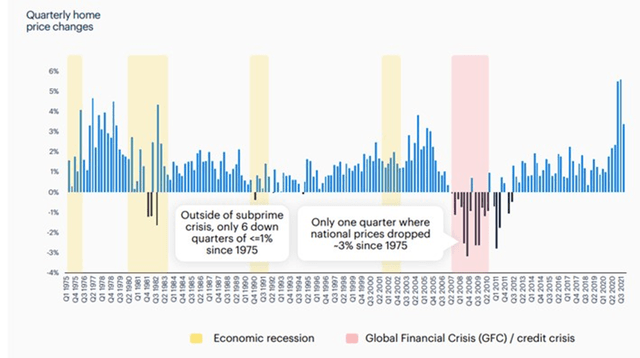

While iBuying, and adjacent markets, present a large opportunity, no company has demonstrated that it is viable yet. Many investors have also been skeptical about how iBuying companies would navigate a market downturn. Opendoor has managed recent market conditions relatively well, but it hasn’t been properly challenged yet. Changes in home prices are an important determinant of risk and profitability and home prices have been fairly stable, despite a large drop in transaction volumes.

Opendoor is currently assuming 4-6% annual home price appreciation to determine its expected contribution margin. It should be noted that housing has benefitted from a number of one-time tailwinds over the past 40 years (declining interest rates, normalization of two income households, etc.). Future price rises are likely to be weaker than in the past and eventually converge with income growth rates. This probably puts home price increases at the lower end of Opendoor’s expected range.

Figure 5: Quarterly Change in Home Prices (source: Opendoor)

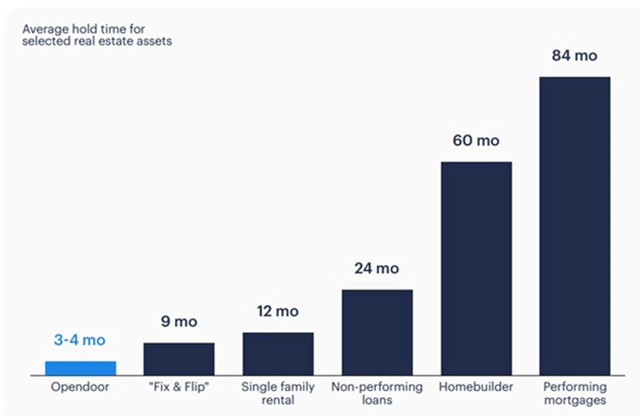

There is little Opendoor can do to control market conditions, but it can minimize risk and maximize returns by improving inventory turnover. Opendoor holds homes for a far shorter period of time than most other buyers, limiting its exposure to market downturns and reducing the financial cost of holding inventory.

Figure 6: Average Hold Time for Selected Real Estate Assets (source: Opendoor)

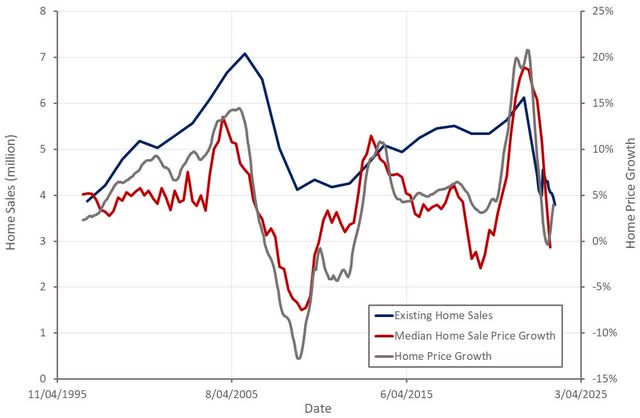

Current market conditions are challenging, but they are different to a normal downturn. The rapid rise in home prices, combined with a sharp increase in mortgage rates, has made housing unaffordable for a large portion of the population. As a result, transaction volumes have been crushed, even though prices have held up relatively well. This is likely due to the fact that the labor market is still strong, and homeowners will generally not sell at a loss unless forced to.

Opendoor has stated that it is focused on market clearance rates, as it believes that this reflects the balance of supply and demand on the market. Market clearance rates remain above historical norms. This reflects a lack of willing sellers rather than strong demand though.

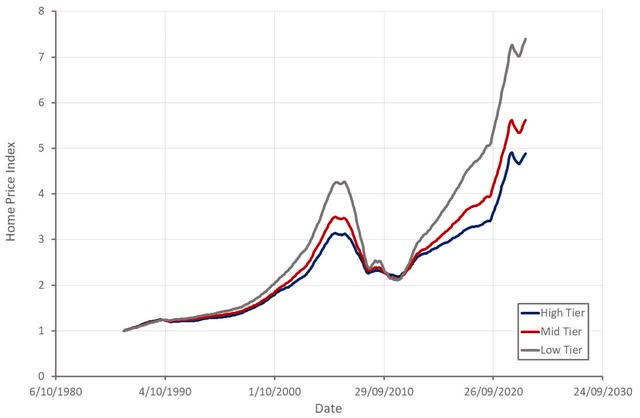

Affordability is driving buyers towards smaller and less expensive properties. For example, the average home size (square feet) transacted in November 2023 is roughly 4.5% less than November 2020. This has caused the median home sale price to decline significantly, even as home price indices have shown relative stability. It has also caused the value of lower priced homes to increase faster than higher priced homes. These dynamics are relatively common towards the end of an economic cycle and would likely reverse sharply if the labor market weakens.

Figure 7: Home Sales in the US (source: Created by author using data from The Federal Reserve)

Figure 8: Home Prices in the US by Price Tier (source: Created by author using data from The Federal Reserve)

The dramatic rise in interest rates over the past two years, particularly longer-term rates, is something that hasn’t been seen in over 40 years. While many people consider this a normalization of rates, it is anything but. Debt levels and asset prices have surged in recent decades, and the housing market is a clear demonstration of how parts of the economy no longer function with higher rates.

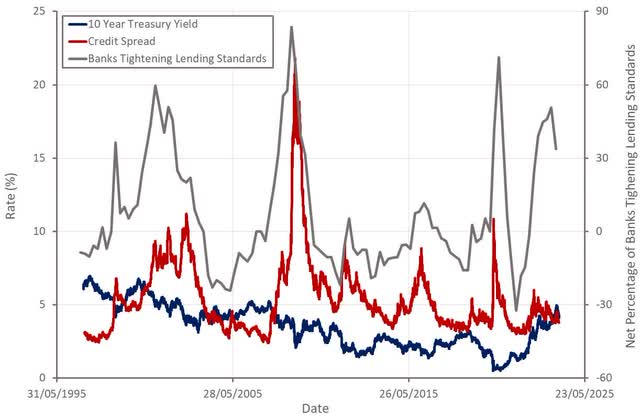

While rates are likely to decline significantly from current levels, mortgage rates may remain relatively elevated. Banks have been badly burned by an extended period of low interest rates followed by a rapid rise. It is hard to see banks rushing to lend at low rates again given this experience. Many banks are also likely to be resolving balance sheet issues for years to come, although Fed support is helping with this issue.

Figure 9: Interest Rates in the US (source: Created by author using data from The Federal Reserve)

iBuying is a capital-intensive business, making Opendoor dependent on interest rates and credit conditions.

Buyer Broker Commission

A jury recently ruled against NAR and other brokerages in one of several lawsuits that are challenging home sellers having to pay the buyer broker’s commission. Opendoor’s core business does not derive revenue from the buyer broker commission, with the company incurring this as a cost when selling homes. The impact of a reduction in the buyer broker commission on Opendoor is not really clear. It will reduce Opendoor’s costs, but this may just end up being passed through in the form of lower home prices, depending on market structure. While the impact may be neutral, it seems likely that Opendoor can capture at least some of the value created if this change occurs. The buyer broker commission constitutes roughly 2.5% of Opendoor’s overall cost structure, meaning that if Opendoor could capture all of this, its unit margins would increase significantly.

Opendoor

Opendoor is the leading iBuyer in the US, but this is a somewhat meaningless title until the iBuyer business model has been shown to be economically viable through the course of a business cycle. The viability of iBuying is determined by spreads and customer acquisition cost. Spreads are determined by holding and selling costs and the ability to accurately price homes. Spreads were at record levels in late 2022, but Opendoor has been reducing them through 2023. While larger spreads are probably necessary when house prices are unstable, it leads to less efficient paid marketing. In response to this, Opendoor reduced its paid marketing spend by 80% in 2023. With spreads now compressing, Opendoor is beginning to increase marketing spend again. Opendoor is currently only purchasing around 1,000 homes per month though, compared to a peak of 5,000-6,000 homes per month.

Pricing accuracy, along with the potential for inventory value drawdowns, has been a primary cause of concern in regard to the iBuying business model. Pricing accuracy is as much about bidding discipline as it is about data, algorithms and market conditions as some homes are more amenable to price prediction than others.

In terms of margins, bias should be more important than precision as the law of large numbers should largely take care of precision. Greater precision could allow Opendoor to acquire more homes though by reducing the margin of safety the company needs when bidding on a home. Opendoor likely needs to bid somewhere slightly below what it thinks an actual home is worth to account for pricing accuracy. If accuracy improves, it could either lead to improved margins or allow Opendoor to bid more for a home. Opendoor has stated that it is currently choosing to pass through cost and pricing accuracy improvements. Opendoor could also benefit from being able to identify mispricing in the market, by avoiding bidding for homes that are overvalued and targeting homes that are undervalued.

While pricing accuracy should improve with access to data, Opendoor will always be dependent on price stability over its 3-4 month holding period. As a result, accuracy is also likely to drop at turning points in the market. Approximately 35% of Opendoor’s inventory is under resale contract at any given time though, reducing risk.

Opendoor is investing in computer vision to help it understand home condition, which should lead to improved pricing. The company is also using AI to understand home condition based on customer inputs like chat conversations, images and videos.

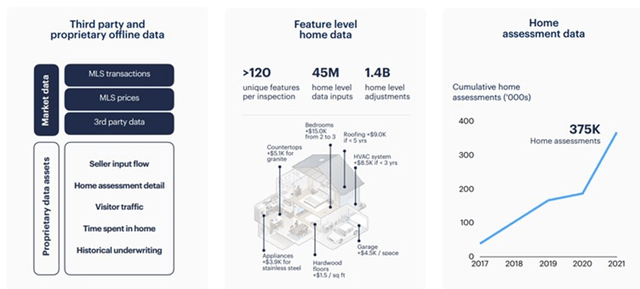

Figure 10: Opendoor Data (source: Opendoor)

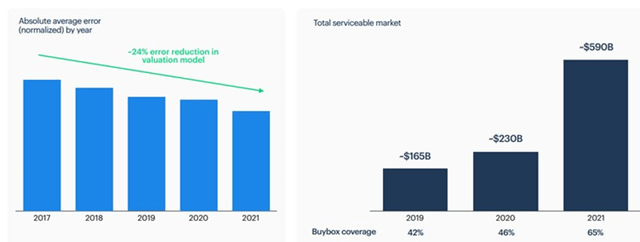

Opendoor has shown data demonstrating that the accuracy of its valuation model is improving, although the impact of this on the company’s margins is currently unclear.

In addition to impacting profitability, valuation model performance determines Opendoor’s serviceable market. Opendoor started by purchasing only in homogeneous markets, but as its models improve it can acquire a greater variety of homes.

Figure 11: Pricing Model Performance and Buybox Coverage (source: Opendoor)

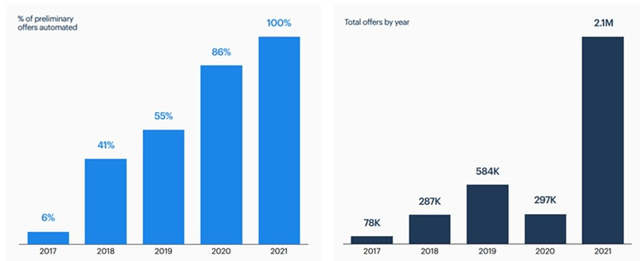

Increased automation of pricing suggests greater confidence in the company’s ability to price accurately. This both makes the business more scalable and should help to support margins.

Figure 12: Opendoor Pricing Automation (source: Opendoor)

Selling and holding costs are also important to the success of Opendoor’s business. Opendoor’s selling costs should decline with scale and experience, and there are also likely economies of density. The company continues to develop technology and improve processes in an attempt to reduce selling costs.

Maintenance quality could also impact sale prices. Opendoor has stated that maintenance quality is improving, with agent feedback indicating that listed home quality improved by over 10% throughout the year.

Holding period and the cost of capital are also important cost drivers, both of which Opendoor has limited control over. There is some scope for Opendoor to reduce the time it takes to prepare a home for sale though. This would reduce inventory risk in addition to holding costs. While interest rates have risen sharply, credit spreads remain low, reflecting the relative health of most of the economy. This stands in stark contrast to the willingness of banks to lend, which has fallen as a result of the inverted yield curve. Opendoor’s financing costs have clearly risen, negatively impacting the business, but in the event of a true economic downturn this situation would likely be far worse.

Figure 13: Financial Market Conditions in the US (source: Created by author using data from The Federal Reserve)

In terms of customer acquisition, Opendoor is focused on partnerships to reduce costs. This includes homebuilders, agents and online real estate platforms like Zillow, Realtor and Redfin. Opendoor is also partnered with around 90 homebuilders and recently announced a deal with eXp, the largest independent real estate company in the world. Customer acquisition costs through these channels are fixed, which should help Opendoor to reach more sellers in a cost-efficient manner. Acquisitions through partnership channels increased 33% sequentially in the third quarter.

Outside of Opendoor’s core home buying business, there are high margin opportunities in adjacent verticals. Opendoor’s title and mortgage business is an underappreciated strength, particularly title and escrow, with the company having attach rates in excess of 80% on both sides of the market. This business benefits from the fact that Opendoor has already acquired customers and can offer add-on services with low marginal cost.

Figure 14: Indicators of Business Effectiveness (source: Opendoor)

Financial Analysis

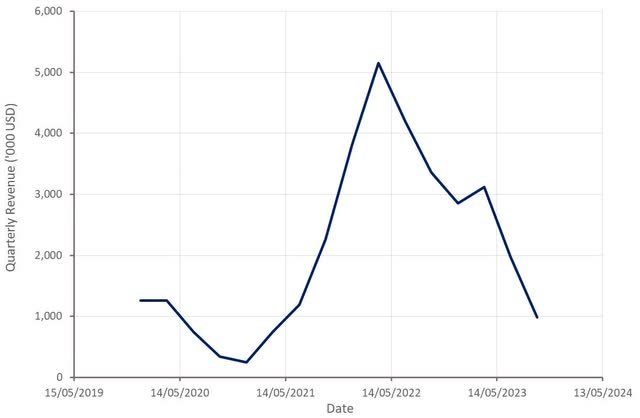

Opendoor generated 980 million USD revenue in the third quarter, roughly a 70% decline YoY. I view revenue as a somewhat meaningless metric for Opendoor without considering margins, as the company can choose to generate as much revenue as it wants if it is willing to take losses.

Revenues have declined as Opendoor has been forced to pullback on home purchases due to greater price uncertainty and difficulty moving inventory. This situation is beginning to change now though and will likely be aided by the recent decline in longer-term interest rates. Opendoor purchased 3,136 homes in the third quarter, a 17% increase sequentially. This came against an 8% decline in average new listings within Opendoor’s buybox in its markets.

Opendoor observed a softening in housing market conditions during the third quarter, leading the company to lower fourth quarter guidance. In response to weaker conditions, Opendoor lowered its prices to help it meet its clearance objectives, which presents a headwind to revenue and contribution margins. The slowdown in resale clearance rates has also caused the sale of some of Opendoor’s older inventory to shift into the fourth quarter, which will be a drag on contribution margin in the fourth quarter. Opendoor now expects to purchase around 3,000 homes in the fourth quarter and generate 800-850 million USD revenue.

Figure 15: Opendoor Revenue (source: Created by author using data from Opendoor)

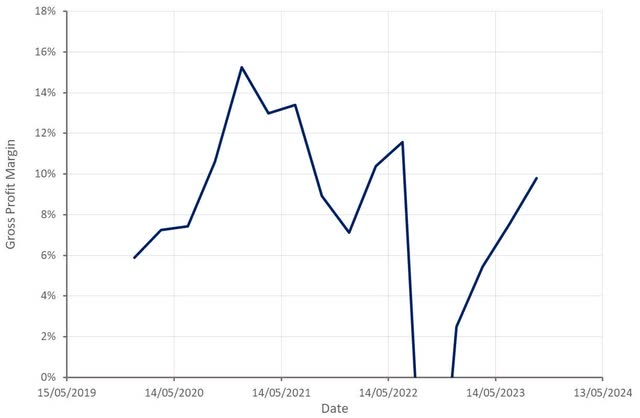

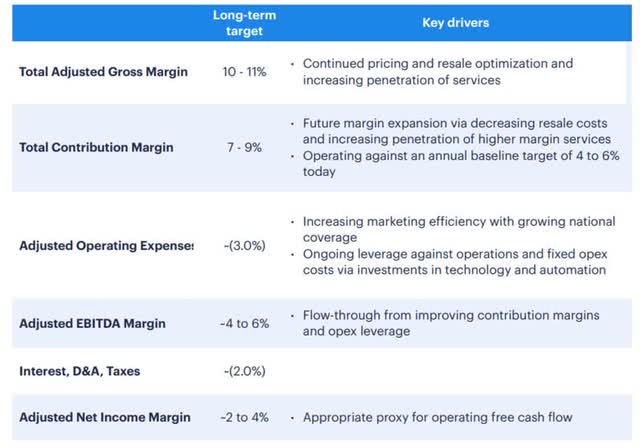

Opendoor’s contribution margin was 4.4% in the third quarter, up from -4.6% in the second quarter, which was attributed to the performance of Opendoor’s new book of homes and a shift in mix away from old book resales. Opendoor’s new book of homes generated gross margins of 12% and a contribution margin of 9.2% in the third quarter. Opendoor’s contribution margin is expected to be in the 1.9-2.9% range in the fourth quarter.

While Opendoor’s margins continue to be relatively low, and volatile, the company has demonstrated an ability to improve margins as its existing markets mature. This suggests that Opendoor should progress towards profitability as its pace of market expansion slows.

Figure 16: Contribution Margin Less Marketing Expense as a Percentage of Revenue (source: Opendoor)

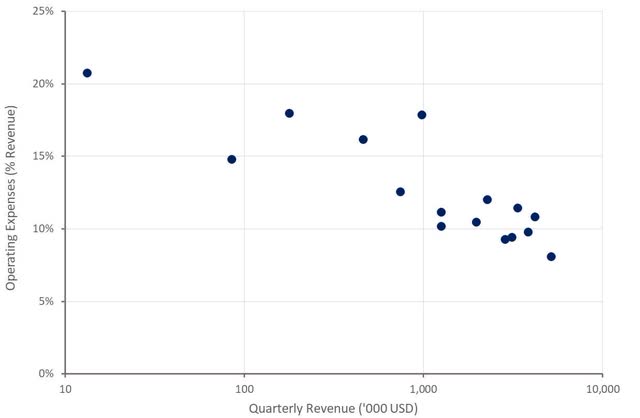

Opendoor has demonstrated that it can generate reasonable gross profit margins under relatively normal housing market conditions. From a value creation perspective, the key question now appears to be whether Opendoor’s operating expense efficiency can be improved sufficiently to generate respectable operating profits.

Figure 17: Opendoor Gross Profit Margin (source: Created by author using data from Opendoor)

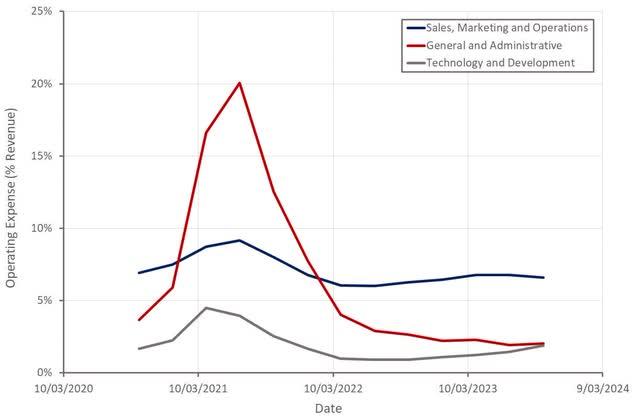

Opendoor has demonstrated that there is substantial leverage inherent in its business, meaning that with sufficient scale, the company should be expected to achieve profitability. The scale and nature of Opendoor’s business means that the burden of technology and development and general and administrative expenses are already low. Improved operating profits therefore need to come from sales and marketing efficiency.

Figure 18: Opendoor Operating Expenses (source: Created by author using data from Opendoor)

Opendoor’s conversion rate and customer acquisition costs are related to its average spread, with larger spreads increasing acquisitions costs. This limits the extent to which Opendoor can drive bottom line improvements through pricing. Opendoor is trying to overcome this through partnerships which provide fixed customer acquisition costs and efficiency.

Despite recent partnership initiatives, direct to consumer paid marketing was still responsible for 60% of contracts in Q2. Investors should watch for the impact of partnerships on sales and marketing expenses in coming quarters, as this will be critical to Opendoor’s future.

Figure 19: Opendoor Operating Expenses (source: Created by author using data from Opendoor)

Opendoor has a goal of achieving adjusted net income profitability by 2024. Breakeven is anticipated to occur at around a 10 billion USD annual revenue run rate, which would require Opendoor to return to roughly 2,200 home acquisitions per month. This appears to be possible but will be largely dependent on housing market conditions.

Investors should not make the mistake of looking at Opendoor’s cash flows as these predominantly reflect the balance of home purchases and sales, rather than giving any insight into profitability.

Figure 20: Opendoor Long Term Margin Targets (source: Opendoor)

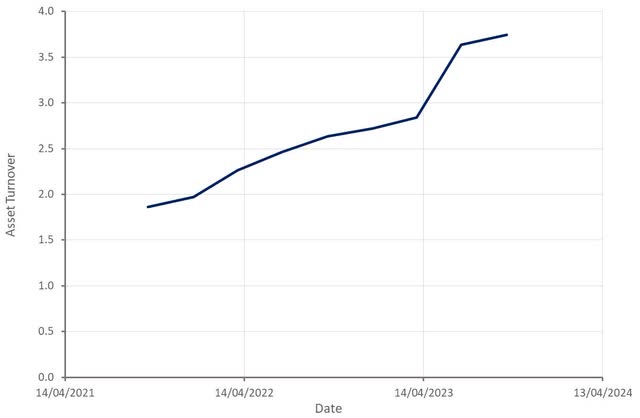

Opendoor’s target net income margin is low, meaning its capital efficiency is also crucial to generating returns in excess of its cost of capital. The company’s asset turnover (adjusted for cash) has generally been increasing and is approaching a level where returns in excess of the cost of capital are becoming feasible. This metric should be closely observed as the company moves back into a growth phase though.

Figure 21: Opendoor Asset Turnover (source: Created by author using data from Opendoor)

At the end of the third quarter Opendoor had 1.2 billion USD of unrestricted cash, cash equivalents, and marketable securities. Opendoor also had 8.4 billion USD in asset-backed borrowing capacity, of which 3 billion USD was utilized.

Conclusion

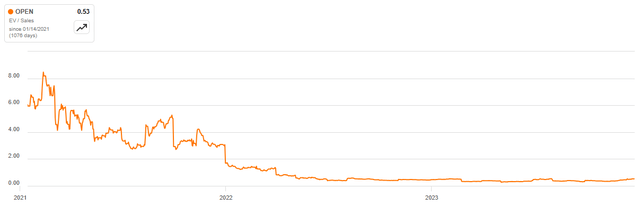

Opendoor’s valuation is still low, provided that the company can demonstrate its business model is viable. I expect that under more normal housing market conditions Opendoor will move towards profitability as its business scales and matures. How much value this creates for shareholders will be largely dependent on Opendoor’s ability to penetrate higher margin adjacent verticals and reduce the burden of sales and marketing through partnerships.

I believe that iBuying presents a long-term opportunity but there is probably too much near-term optimism baked into Opendoor’s share price. The housing market is far weaker than most investors believe, and this is not an issue that will be simply resolved by a small drop in mortgage rates.

Figure 22: Opendoor EV/S Multiple (source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.