Summary:

- Despite some near-term uncertainties, I see double-compounding as the dominating force for META in the years to come.

- The combination of profit growth and large-scale share buybacks is simply overpowering.

- The ability (or privilege) to leverage with cheap and extended maturity adds further potency to the compounding forces.

tumsasedgars

META stock

I last wrote on Meta Platforms (NASDAQ:META) a bit more than 3 months ago. The article analyzed META’s path to $2 trillion market cap (see the screenshot below). In that article, I argued for a bullish thesis based on its growth catalysts, growth CAPEX investments, and reasonable P/E. Quote:

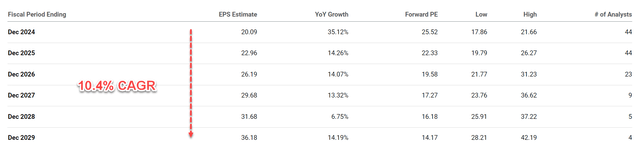

Analysts predict Meta’s EPS to grow from $20 to about $29.95 by 2027, translating into an annual growth rate of about 11%. I see this as a very likely scenario given its strong profitability, many catalysts, and aggressive growth CAPEX investments. Furthermore, I see good areas for META to crank up its growth CAPEX, and the top 3 areas in my view are its metaverse investment, monetization of WhatsApp, and the development of AI. In the meantime, the P/E ratio of META (26.4x at that time) was very reasonable and toward the lower end of the FAANMG group.

Seeking Alpha

Since then, the company has reported its Q1 2024 earnings. Given the updated information provided in the earnings report, this article will reiterate my bull thesis from a different angle. I will argue for META return potential from the angle of doubling compounding – the combined effects of EPS growth and share repurchases.

META stock: compounding via EPS growth

As mentioned in my earlier article, the consensus EPS estimates point to a robust growth rate (with 10.4% CAGR) in the years to come. This is of course the compounding forces that we are all familiar with. A 10.4% annual rate compounded for 6 years means a whopping 81% of EPS growth, from the current $20 per share to over $36 per share (and the implied P/E would drop to only 14x at that time). I certainly share consensus confidence in this compounding force. I expect strong revenue growth from increasing ad impressions as well as healthy user growth. Furthermore, I expect the current favorable operating results to continue, including its vast active user base, healthy user engagement, and favorable retaining rates.

As to be seen next, the potency of such growth becomes far more powerful once combined with the second compounding force.

Seeking Alpha

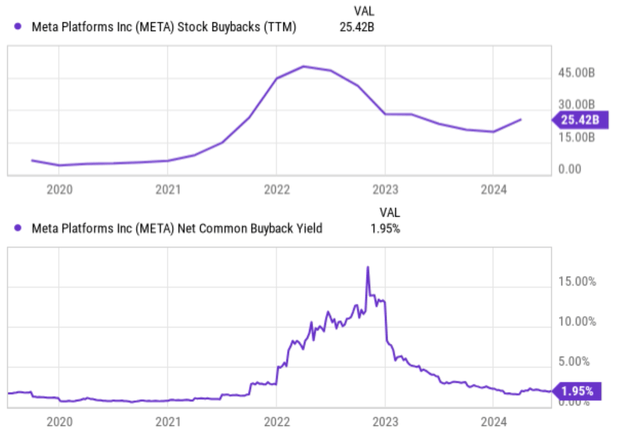

META stock: compounding via buybacks

META has been an aggressive buyer of its own stocks in the past, as you can see from the chart below, both in terms of dollar amount (top panel) and also buyback yield (bottom panel). Especially since 2022, its repurchase program cranked up substantially. The repurchases peaked at above $45B in 2022 on a quarterly basis as seen, translating into a buyback yield of close to 15%. The repurchase activities then eased in 2023, but are still quite sizable. In the most recent quarter, the repurchases still hovered around $25B. Looking ahead, I expect such sizable repurchases to continue. In its recent earnings report, META just announced an expanded repurchase program of $50B. Based on its $1.3 trillion market cap, this translates into a shrinkage of roughly 4% of its current outstanding shares.

Seeking Alpha

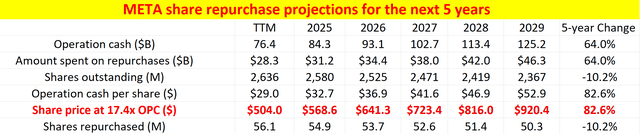

Based on the analyses so far, the table below illustrates the impacts of such double-compounding – the combined effect of profit growth and share-base reduction. In this table, I assumed the following parameters:

- First, I assumed META’s operating cash flow (OCF) to grow at a CAGR of 10.4% to be consistent with the consensus estimate discussed earlier (and again I think this is well-supported by its growth catalysts afoot)

- Second, I assumed META to keep spending the same percentage of OCF on share repurchases in the next 5 years. The percentage I used was 37%, obtained from the amount it spent on repurchases in recent years and its buyback plans announced.

- Finally, for the projection to work, I also had to assume the price at which the future buybacks are made. In the projection, I assumed the buybacks to be made at 17.4x of its OCF, which is the current.

Using these parameters, you can see that its profit will grow by about 64% in 5 years (10.4% compounded for 5 years). But on a per-share basis, the OCF would grow by more than 82% thanks to the reduction of the share count, which is projected to be about 10.2%. Since compounding works in a multiplicative way rather than an additive way, the combined effect of 82% is far larger than the sum of the individual effects (i.e., 64% plus 10.2%). Assuming the same valuation multiple (which, again, is relatively low in my view compared to the FAANMG group), shareholders would enjoy an 82.6% price appreciation.

Author

Other risks and final thoughts

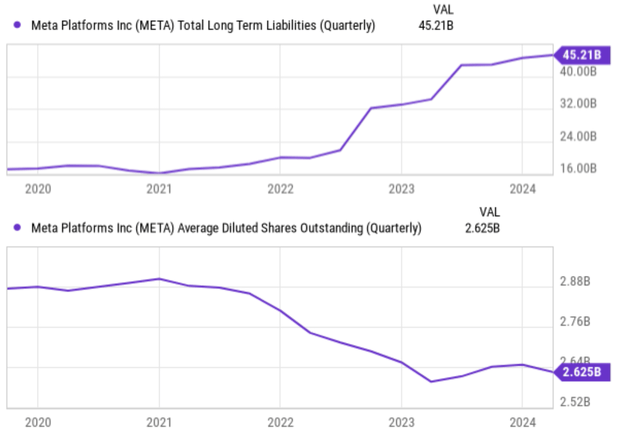

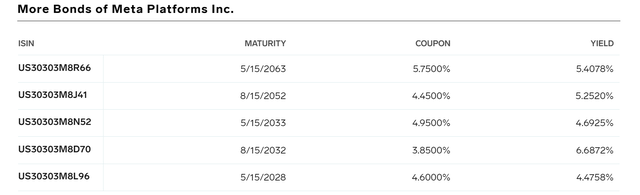

Actually, shareholders also get to enjoy a third compounding force because META is in a position to leverage at some of the best borrowing rates with extremely long maturity. It can effectively use such leverage to fund its share repurchases (and/or pay dividends) in the long term, as you can see from the trend of its long-term debt and share count in the next chart below. In the second chart below, you can see that a good portion of its long-term debt has maturity over 20 or even 30 years, with coupon rates mostly in the 4.5% to 5.75% range. The spread between the double-digit growth potential and the ~5% borrowing rates, compounded for 20 or 30 years at a scale of billions or even tens of billions, is simply overpowering in my view.

In terms of downside risks, potential investors should be aware of several caveats. Meta has experienced a couple of rough patches over the past decade and suffered large price corrections. These issues (at least some of them) are likely to re-emerge in my view. The top issue in my mind is its reliance on ad income. Nearly all its revenue comes from advertising on Facebook and Instagram. A reduction in spending by marketers, which sometimes accompanies a challenging economic environment, would thus have an outsized negative impact on META’s operating results compared to other tech firms. The second top issue on my mind was its R&D investment (or CAPEX investment in general). Meta invests heavily in emerging technologies. Such investment could pay off down the road but can sometimes prove a drag on profitability in the near term. Finally, given its dominant position in the social media space, Meta constantly attracts attention from regulators and privacy advocates. Such unwelcome attention sometimes escalates into lawsuits, government investigations, and fines, which can also trigger large price corrections.

To conclude, my verdict is that the reward/risk profile is still favorably skewed despite these risks, especially for long-term-oriented investors. I expect good odds for the force of double-compounding (or even triple-compounding if you also include its cheap and long-maturity leverage into consideration) to outweigh the negatives by a wide margin.

Seeking Alpha

Source: Business Insider

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.