Summary:

- Meta is experiencing strong growth in its user base, surpassing expectations and solidifying its market dominance.

- The company’s advertising metrics, including ad impressions and average price per ad, are performing well, attracting advertisers and driving revenue growth.

- Meta is investing heavily in AI technology, particularly in content generation, user engagement, and advertising, positioning itself for future success in the social media and tech industries.

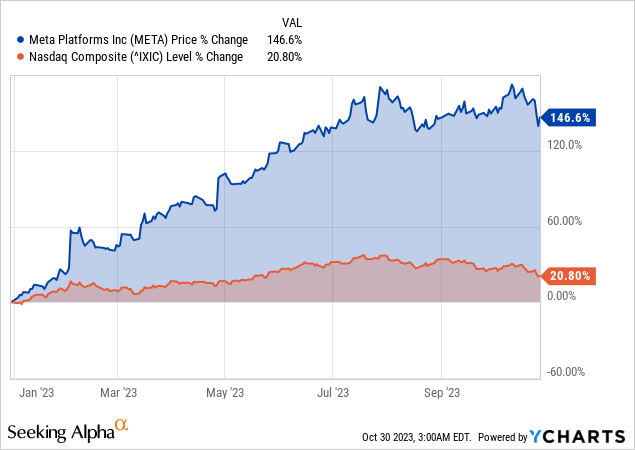

- The strong buy rating is reaffirmed for the stock with a target price of $400 in the next 12 months.

Kinwun/iStock via Getty Images

Investment Thesis

Following the overreaction in the last year for Meta Platforms, Inc. (NASDAQ:META), with overblown fears for a slowing user base and increasing competition from TikTok, the giant’s growth story is back with a burgeoning user base that is growing at a pace that leaves analysts scrambling to update their projections. Boasting an eye-popping 3.14 billion Family Daily Active People and 3.96 billion Family Monthly Active People, they’re a testament to Meta’s unshakeable market grip and a signifier of its ever-expanding digital empire. Meta’s growth is back, and combined with its improving outlook, the strong buy rating is reaffirmed.

Massive User Base Growth and Strong Advertising Metrics

Meta boasts a colossal and continually expanding user base, one of its primary strengths. In September 2023, Meta recorded an average of 3.14 billion Family Daily Active People (DAP), suggesting a substantial 7% YoY growth, beating expectations of 3.09 billion.

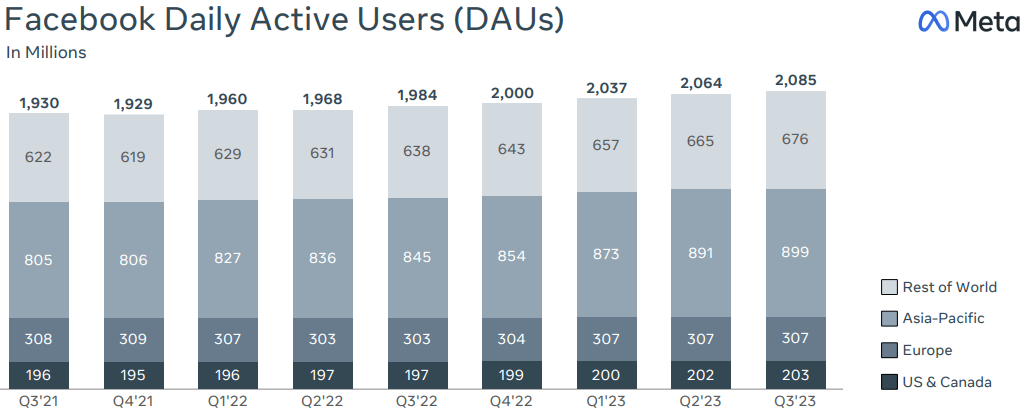

Similarly, the company had 3.96 billion Family Monthly Active People (MAP), marking a 7% YoY growth, surpassing expectations of 3.88 billion. The core Facebook platform had 2.09 billion Daily Active Users (DAUs) on average for September 2023, registering a significant 5% YoY increase that also breached the street expectation of 2.07 billion. Similarly, Facebook boasted 3.05 billion Monthly Active Users (MAUs), reflecting a steady 3% YoY increase in line with expectations.

Earnings Presentation

Fundamentally, Meta’s massive user base is a fundamental strength that offers numerous advantages. Firstly, it provides a vast and diverse audience for advertisers, making it an attractive platform for marketers looking to reach a broad demographic. A large and growing user base is particularly valuable for advertising-driven companies like Meta, as it allows them to capture a larger share of the digital advertising market.

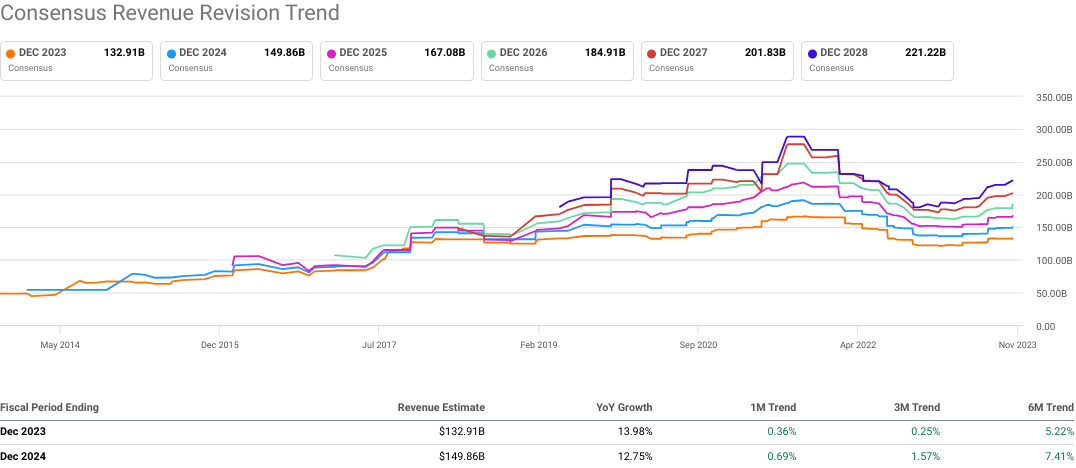

Finally, the scale of its user base enhances its network effect, making it increasingly challenging for competitors to enter the social media and digital advertising spaces. Users are drawn to platforms with the most extensive user bases, further reinforcing Meta’s dominance in the ad industry. As a result, an expanding market share may continue to support its revenue growth, leading to improved expectations for 2024 revenues.

seekingalpha.com

In terms of ads, Meta’s (advertising platform’s) ability to deliver impressive advertising metrics reinforces its growth potential. For instance, in Q3 2023, Meta delivered a remarkable 31% YoY increase in ad impressions across its Family of Apps, surpassing expectations (29.6%). However, the average price per ad decreased by 6% YoY, outperforming expectations, which had anticipated a more substantial 9% decrease.

Finally, the significant increase in ad impressions is a testament to the platform’s popularity and effectiveness for advertisers. Advertisers are drawn to platforms that can deliver their content to a broader audience, making Meta an attractive advertising destination.

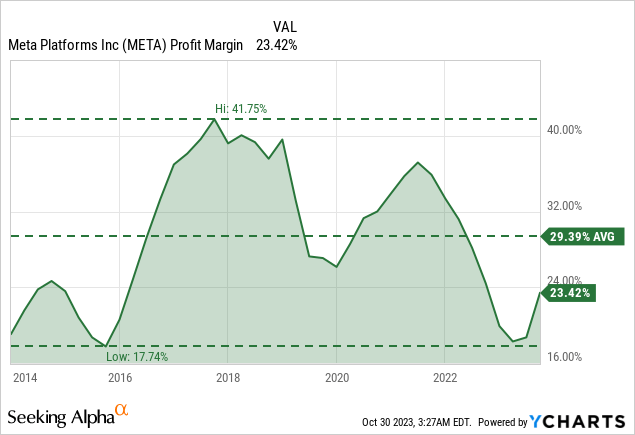

Meta’s Q3 2023: 23% Revenue Surge, Strong ARPU & Cost Cuts Boost Stocks

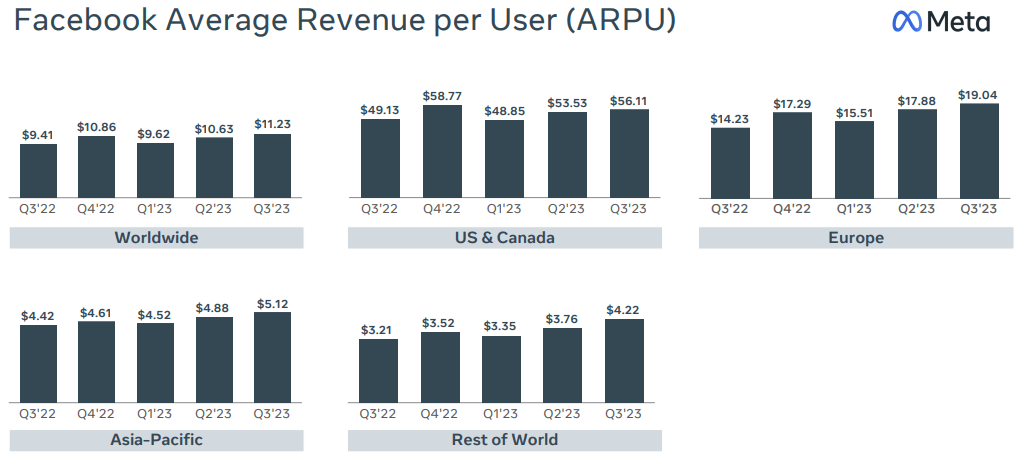

In Q3 2023, Meta recorded revenue of $34.15 billion, reflecting a robust 23% YoY growth. In detail, Facebook’s Average Revenue per User (ARPU) experienced growth of 5.6% sequentially and 19.3% YoY, with ARPU growth (both sequentially and YoY) experienced in all regions. Rapid revenue growth is an appealing factor for investors, driving stock performance and market confidence in the company.

Earnings Presentation, Q3 2023

Meta’s “Year of Efficiency” plan yields tangible results, with total costs and expenses for the quarter dropping to $20.40 billion, representing a notable 7% YoY decline. Additionally, efficient cost management contributes to Meta’s profit margins, as with lower expenses, the conglomerate has freed up capital for investments in AI and data centers, which is expected to be $30–35 billion in 2024.

Lastly, the strong fundamentals of the company concentrate on its liquidity, which stands at a substantial $61.12 billion at the end of the quarter. The company generated an impressive $13.64 billion free cash flow during the quarter. Immunizing the company from the Fed’s higher for longer stance as debts stand at $18.4 billion.

AI Breakthrough: Reshaping Social Media, Commerce, and Wearable Tech

Meta has focused on an extensive AI roadmap that encompasses various aspects of its ecosystem. The launch of the AI Studio platform aims to empower users to create and interact with diverse AIs, offering a wide range of applications from productivity to entertainment. The rollout of Emu, an image creation model, is noteworthy for its potential to revolutionize content generation and user engagement.

The early alpha launch of business AIs reflects Meta’s vision for AI integration across all industries. By offering businesses the ability to interface with customers through AI, Meta is positioning itself to play a pivotal role in the digital transformation of commerce. Additionally, the upcoming release of creator AIs demonstrates the company’s focus on fostering communities and empowering content creators.

Looking forward, the allocation of significant resources to AI in 2024 underlines its strategic importance. Meta recognizes that AI will be a driving force behind product and business performance, with a particular emphasis on generative AI. This technology is poised to transform content creation and user experiences, potentially setting Meta apart in social media and tech.

Furthermore, developing foundation models like Llama 2, with more than 30 million downloads in September, highlights Meta’s focus on open-source AI. By fostering a robust ecosystem of AI developers and enthusiasts, the company aims to tap into collective intelligence and maintain a competitive edge.

Creator AI

Notably, Meta’s AI-driven feed recommendations produce tangible results, with a 7% increase in time spent on Facebook and a 6% increase on Instagram. This highlights the effectiveness of AI in enhancing user engagement and retention. As AI evolves, these recommendation algorithms will likely become even more influential, cementing Meta’s position as a platform that keeps users engaged.

The success of Advantage+ shopping campaigns, reaching a $10 billion run rate, showcases Meta’s prowess in AI-powered advertising. Moreover, over half of advertisers are utilizing Advantage+ creative tools to optimize their ads. This adoption indicates that businesses recognize the value of Meta’s AI-driven advertising solutions.

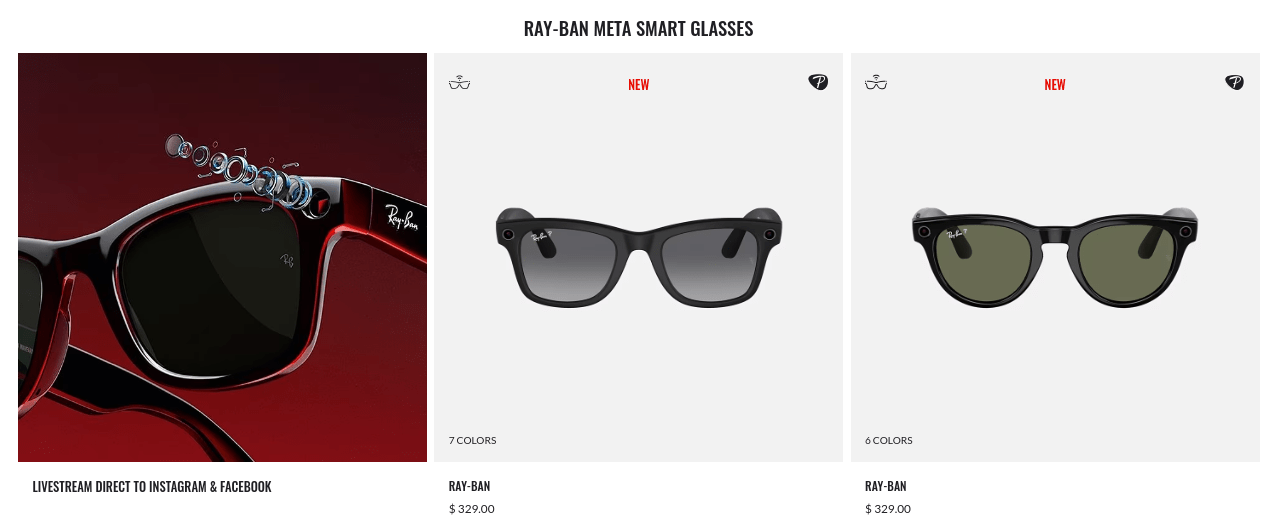

Meta’s Visionary Leap: Ray-Ban Smart Glasses Fueled by AI

One of the most intriguing and forward-looking aspects of Meta’s business is its foray into smart glasses. The company has launched the next generation of Ray-Ban Meta smart glasses, which offer various improvements over the first generation. These glasses feature a better camera, clearer audio, a lighter design, more styles, and a new capability to live stream video. However, what truly sets these smart glasses apart is the integration of Meta AI.

Further, the inclusion of Meta AI in smart glasses allows users to ask questions and receive answers directly through the glasses. This integration transforms smart glasses into AI-powered assistants that can see and hear what the user sees and hears.

Furthermore, the positive early reviews of the Ray-Ban Meta smart glasses indicate consumer interest in this product. However, the critical factor will be sustained adoption and the ability of Meta to enhance and expand the features of these glasses. The success of smart glasses could open up new revenue streams for Meta, particularly in the sale of hardware and services associated with these devices.

Meta’s Ray-Ban

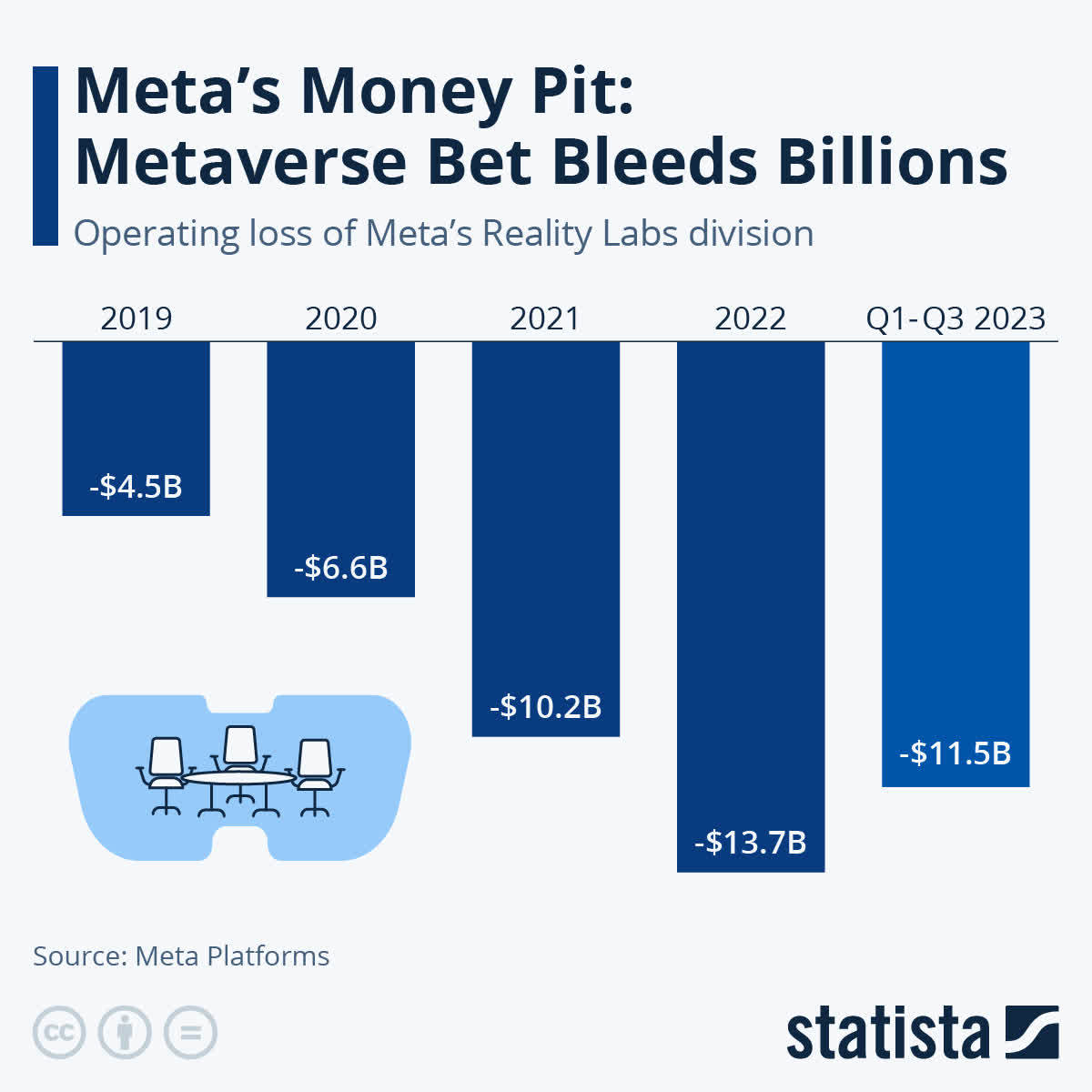

While Meta’s strategic vision is promising, there are financial considerations. The company’s projection of increased expenses in 2024, ranging from $94 billion to $99 billion, reflects its substantial investments. Key factors contributing to expense growth include higher infrastructure-related costs, increased depreciation expenses, and a significant YoY rise in operating losses for Reality Labs, driven by AR/VR product development and ecosystem scaling.

Quest 3 Ignites the Metaverse Vision

Moving to Meta’s vision of the Metaverse, its investment in mixed reality devices is groundbreaking. Quest 3, a mainstream mixed reality headset, is a substantial leap forward in this direction, offering a next-generation chipset with double the graphics performance, an improved display, and a 40% thinner form factor compared to its predecessor.

Integrating Meta AI into Quest 3 and smart glasses is a strategic move that could further enhance the adoption of these devices. Meta AI, designed to answer questions, provide real-time information, and generate photorealistic images, positions the company to compete in the mixed reality and smart glasses markets.

On the other hand, Meta is making significant strides in developing software for the Metaverse, a concept that envisions a shared, immersive, and interconnected digital environment. The company’s Horizon platform, designed for creating and experiencing virtual worlds, shows growth.

New worlds like Super Rumble and Citadel are coming online, indicating the expansion of this metaverse ecosystem. Finally, the testing of Horizon for phones, tablets, and PCs signifies Meta’s intention to make the Metaverse accessible across a wide range of devices.

Overall, Meta expects the operating loss from Metaverse to continue into 2023 and 2024. Therefore, the Metaverse will remain unprofitable for the mid-term and continue to hurt the overall profitability of the company.

Statista

Meta’s Short-Form Video and Business Messaging Drive New Ad Revenue Frontiers

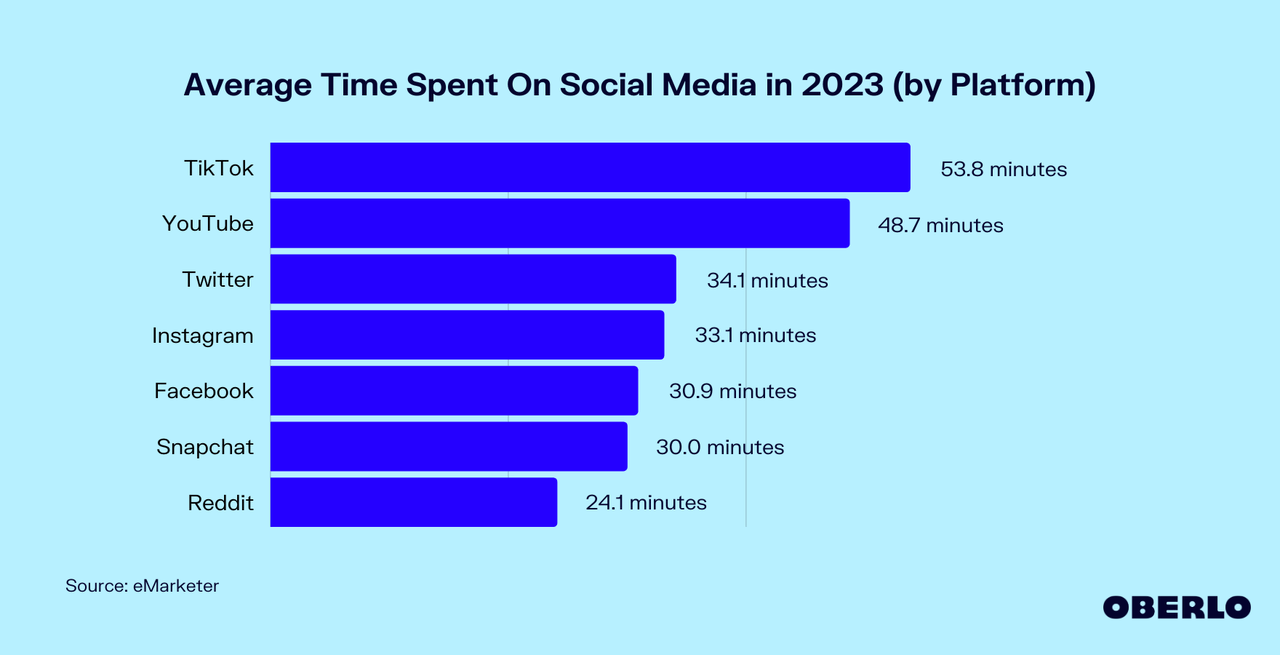

Meta has made significant strides in its efforts to promote and monetize Reels. Since its launch, Reels has driven more than a 40% increase in the time spent on Instagram, suggesting that the platform’s users are engaging with this TikTok-inspired short-form video feature. Even more interesting is that Reels has reached a monetization milestone earlier than expected, and it’s now estimated to be net neutral to the company’s overall ad revenue.

Notably, this is a critical development for Meta, as it showcases the potential for short-form video content to become a substantial source of ad revenue. Given the success of TikTok, there’s no doubt that short video content is a powerful way to engage users and advertisers. Meta’s commitment to Reels and its plan to grow it as part of its video services portfolio are strategic. More than half of the time spent on Facebook and Instagram is dedicated to video services, and by focusing on Reels and similar features, Meta aims further to cement its position in the short-form video space.

Oberlo

Another promising aspect of Meta’s future lies in business messaging. The company reports that over 600 million conversations between people and businesses occur daily on its platforms. This highlights the growing trend of consumers interacting with businesses through messaging apps.

Interestingly, over 60% of people on WhatsApp in India message a business app account each week. The revenue from click-to-message ads in India has also doubled YoY. Additionally, WhatsApp Business Platform generated messaging revenue of $293 million in Q3, which increased by 53% YoY. Apart from that, WhatsApp ad revenue has already hit a multi-billion-dollar annual run rate and is growing.

Fundamentally, business messaging is particularly prominent in countries with a lower cost of labor, like Thailand and Vietnam. In these regions, a significant portion of commerce happens through text-based customer interactions. However, in areas where labor costs are higher, this approach may not be economically viable. Meta sees the opportunity to bridge this gap by leveraging business AI to reduce labor costs and expand commerce and messaging into larger economies worldwide.

Finally, the growth of Click-to-Message ads, particularly Click-to-WhatsApp ad revenue, is a positive development. The company is working to enable further conversions and sees the potential of AI to make business messaging more efficient.

Threads: Meta’s Rising Star Against X

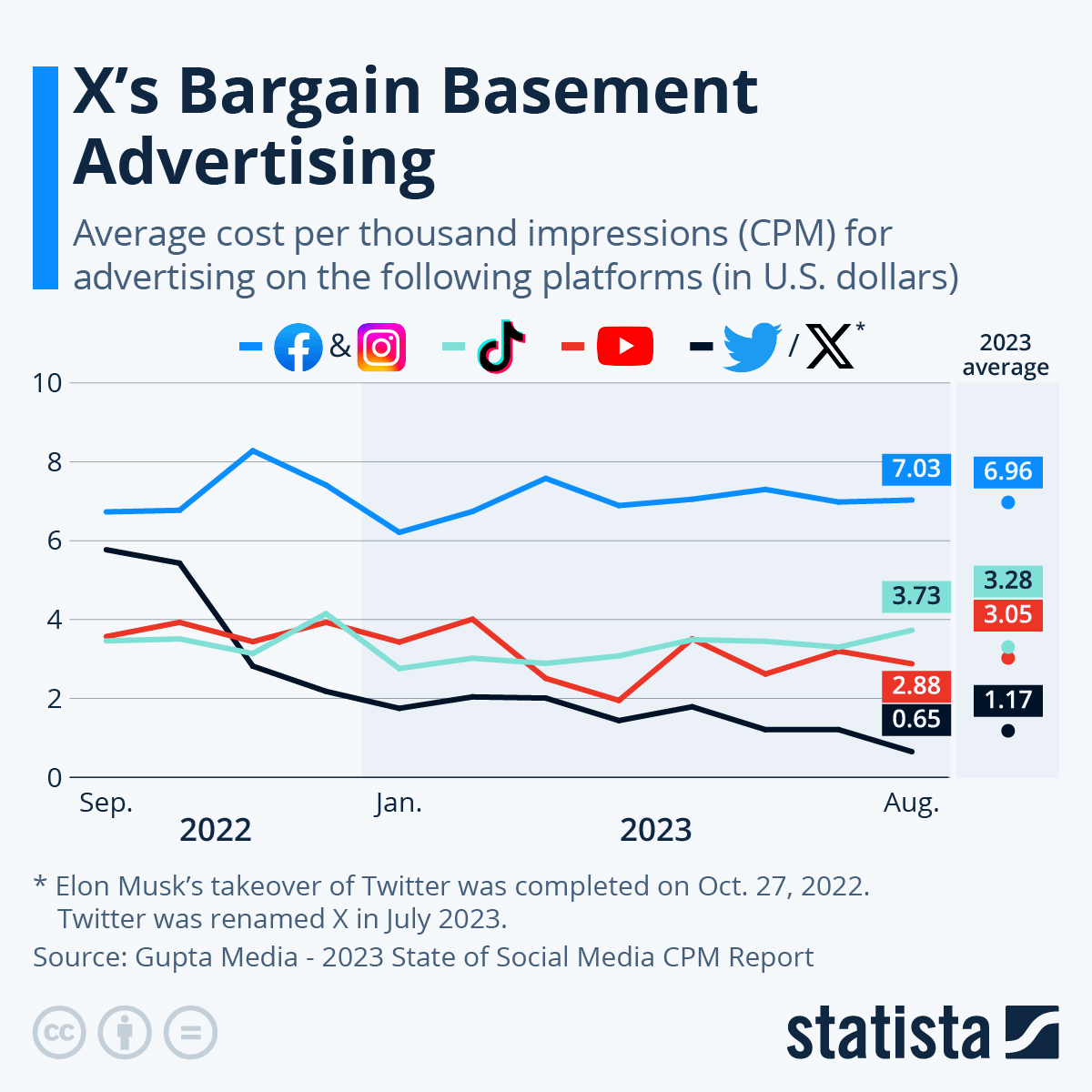

Meta’s Threads, which has just under 100 million monthly active users, represents another puzzle in the company’s forward-looking strategy to capture the market share against X (formerly Twitter).

Threads, as a communication app designed for close friends, is showing positive early signs. This app could be seen as Meta’s answer to the rise of ephemeral messaging and the desire for more private communication channels. While the number of users is still relatively modest compared to Facebook and Instagram, Threads can potentially serve as a platform for targeted advertising and monetization (based on the advertisement moat of Meta). Lastly, Threads may benefit from Meta’s edge on cost per thousand impressions (CPM), while X is experiencing a significant drop in CPM under the Musk flagship.

statista

Meta Faces Ethical and Regulatory Hurdles Despite Stock Surge

First and foremost, Meta is grappling with significant ethical concerns. The recent lawsuit by California and over two dozen states alleges that the company exploits young people for profit and exposes them to harmful and addictive content.

The core issue here is that Meta’s primary motive is perceived as profit-driven rather than user-centric. The company’s actions appear to prioritize financial gains over the well-being of its users, especially teenagers and children. This ethical dilemma can erode trust, not only among users but also among investors, who may hesitate to support a company with such questionable values.

In addition to these ethical concerns, Meta is facing heightened regulatory scrutiny. The lawsuit, filed by 41 states and the District of Columbia, underscores the growing regulatory challenges confronting the company. Increased regulation poses a substantial risk as it could limit Meta’s ability to expand and innovate freely. Moreover, regulatory challenges typically entail higher compliance costs and the potential for significant fines, all of which can hamper the company’s growth.

Finally, there are increasing regulatory headwinds for the company (in the EU and the US) that could significantly impact its performance. For instance, the FTC is targeting a significant modification of its consent order and imposing additional operational restrictions.

Takeaway

Meta is on a robust growth trajectory, defying earlier market concerns about user base stagnation and competition. Its tremendous and increasing user numbers demonstrate its strong market strength, which is vital for attracting advertisers. The significant growth in ad impressions, despite lower ad prices, indicates the platform’s continued appeal to marketers. Overall, Meta’s aggressive growth and innovation strategies, combined with its significant user base and revenue growth, position it as a formidable force in the digital and tech landscape, albeit with challenges.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.