Summary:

- Shares of META experienced a significant price decline after the earnings call, but this was an overreaction, and shares have already started to rebound.

- The sell-off was unwarranted as META delivered a double beat and showed tremendous growth, and the revenue forecast should not dictate the share price.

- META faces risks such as regulatory, social, and competition, but it is still positioned for long-term success and has the potential to be a dominant force in AI.

Derick Hudson

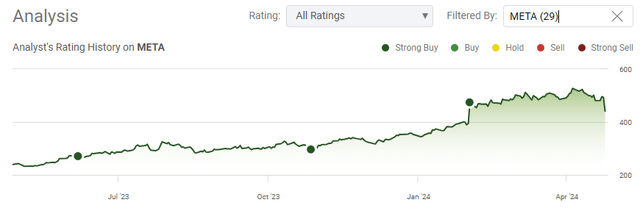

I didn’t want to write this article the night of Meta Platforms (NASDAQ:META) earnings because I wanted to see how the week ended. I am not surprised in the slightest that shares have already started to rebound, as the massive price decline was an overreaction. Shares of META went into the earnings call down -12% and continued falling into the -16% range as Mark Zuckerberg focused heavily on CapEx spending. At one point, shares flirted with breaking through the $400 level and had a fifth of the market cap evaporate in less than an hour. The individuals selling after hours didn’t even have time to digest earnings or listen to the call, which I believe will be a mistake. META has been on a phenomenal run, and I can’t fault anyone for taking a profit, but after going through the earnings report and the commentary from the conference call, I believe there is a lot of room for shares of META to run going forward.

META produced a phenomenal quarter with a double beat and tremendous growth, but the investment community wasn’t thrilled with Q2’s revenue forecast of $36.5 to $39 billion because the midpoint is below the consensus estimates of $38.3 billion. This is a horrible reason for shares to sell off, considering that META hadn’t even released its projections, and the street doesn’t know META’s business better than META. There is still a very real possibility that META beat the revenue forecast that the street was looking for. I think a more realistic reason for the sell-off would have been if it had started halfway through the earnings call on fears that Mark Zuckerberg would revert to his old ways and spend even more than his increases to CapEx were expected to be after going through an efficiency turnaround. As I expected, shares rallied back over $40 from where I saw them reach over the next two days, and I believe shares of META are undervalued and will overperform for long-term investors.

Seeking Alpha

Following up on my previous article about META

I didn’t turn bearish in 2022 when shares breached the $100 level, and I wrote an article (can be read here) indicating why there was massive upside potential after the 2022 Q3 debacle. Since then, shares of META have jumped 369.94% with a total return of 370.43% after the dividend, compared to 30.74% for the S&P 500. In my last article about META (can be read here) from the beginning of February, I discussed why implementing additional buybacks and starting a dividend program was a good use of capital. After the earnings drop, shares went down by -3.55% compared to the S&P 500, increasing by 3.74%. I am following up on my previous article to discuss why I think the market got this wrong and why META will be a long-term winner for investors.

Seeking Alpha

Risks to investing in Meta Platforms

When it comes to a company that generates $36.46 billion in revenue and $12.37 billion in net income over a 3-month period, it’s hard for some investors to look at the risk factors. While META is one of the most profitable companies, they face regulatory risk, social risk, and competition even though sometimes it doesn’t feel that way. It’s no secret that some elected officials aren’t the biggest fans of META, especially after all the hearings and the number of times Mark Zuckerberg has been dragged to the hill to testify. There could come a time when regulators deem social media a threat and pass regulations that change the landscape throughout the sector. META can spend as much as they want to innovate, but there could come a day when social media companies are looked at similarly to tobacco companies, depending on who is elected as our representatives. META faces social risk, as there could come a point where disconnecting from social media apps becomes increasingly popular. There is also a competitive risk, and while META has a stranglehold on the market today, as new technologies emerge, there could be future threats to the business as to how humans interact and connect with the outside world.

Why I believe the META meltdown on Wednesday was unwarranted and projections being released prior to actual guidance should have no relevance on share price

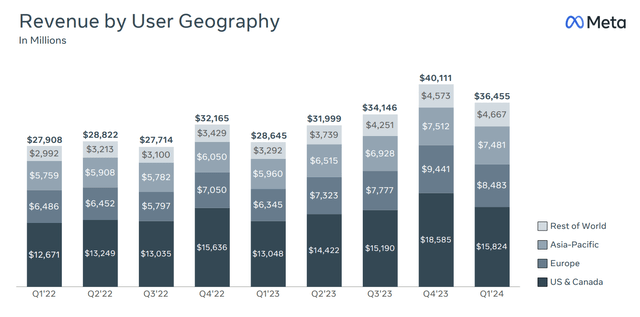

Before the earnings call even kicked off, shares of META declined by over -12% because the street’s consensus outlook for revenue in Q2 was $38.3 billion, which was above the midpoint of META’s guidance. At this point, the earnings call didn’t occur, and there was no way anyone could have read through the 10-Q, the initial sell-off was based on a headline without actually digesting the numbers. META delivered a top and bottom line beat as they produced $36.46 billion in revenue, which was $240 million ahead of expectations, and generated $4.71 in GAAP EPS, which was a beat of $0.39. Rather than the double beat being celebrated, especially when Q1 2024 revenue was its second-largest quarterly revenue produced in META’s history, the street decided to sell the news. META’s Q2 forecast of $36.5 to $39 billion is likely to generate QoQ forward growth and has the potential to be its largest revenue-producing quarter ever, depending on if they beat the top end. META is one of the largest companies in the world, yet they accelerated its growth trajectory. In Q1 2023, revenue grew by 2.84% YoY, while in Q1 2024, META produced 27.27% YoY revenue growth. META has also set the tone for 2024, starting with the largest amount of revenue and net income it’s produced to start the year after 3-months. In 2022, META went into Q2, having produced $27.91 billion in revenue and $7.47 billion of net income, then in 2023, META started the year generating $28.65 billion in revenue and $5.71 billion of net income. The fact that shares were selling off after significant YoY growth was announced for Q2 and META started the year generating $12.37 billion in revenue and $12.37 billion in net income is an opportunity for long-term investors.

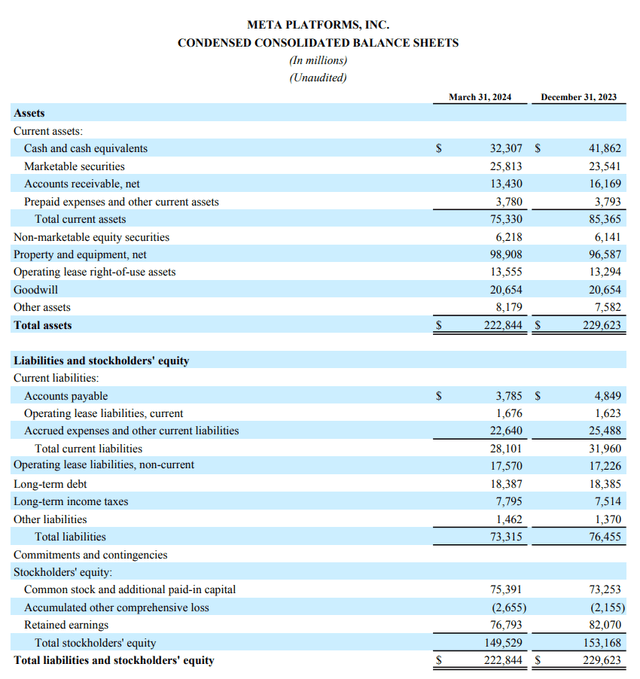

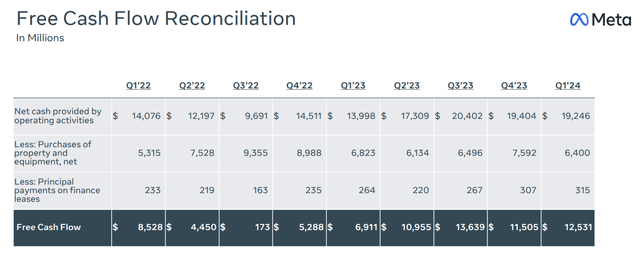

Meta Platforms

Shares of META continued to slide when the earnings call started. Mr. Zuckerberg immediately started discussing increased CapEx spending, and the market freaked out. This is where I draw a line in the sand because you either believe in Mr. Zuckerberg or you don’t. I have been a shareholder since the IPO and have added shares along the way. As a truly long-term shareholder, I feel that Mr. Zuckerberg deserves a lot of leeway and has earned the right to allocate capital to endeavors that he believes will increase shareholder value in the future. He has built META from the ground up, and isn’t tapping the debt markets to fuel growth. There is $32.31 billion in cash on hand, with an additional $25.81 billion in marketable securities on the balance sheet. META has over $58 billion in liquidity while producing $12.37 billion in net income and $12.53 billion in free cash flow (FCF) in Q1. META is generating $4 billion in profits each month, yet investors still question Mr. Zuckerberg’s instincts as to what the best path is forward. There is $18.39 billion in long-term debt on the balance sheet, which could be eliminated tomorrow with a check, or canceled out after two quarters of profitability. META is an unleveraged profit center that has more than 1/3rd of the global population utilizing its products each day. I think that anyone who doubts future success needs to get over the capital allocation and losses that Reality Labs has sustained. They need to look at the big picture and then decide if they want to go along for the ride.

Meta Platforms

There is no way to disregard that A.I. is real and will be extremely important to the future of computing. The amount of capital that is being deployed by big-tech almost ensures its full capability will be reached in the future. META is shifting its resources from the Metaverse to A.I., and it’s an important move. This gives META a seat at the table, and they will be one of the driving forces behind A.I. rather than being dependent on Alphabet (GOOGL) or Microsoft (MSFT). META AI will deliver many different services, including its A.I. assistant, which will be embedded throughout its apps and hardware. META is also looking to assist the creator population by creating Ais that will help creators engage with communities and their fan bases. META is also looking to create A.I. for businesses to increase the customer experience from purchasing to customer support. META has introduced Llama 3, which is a large language model (LLM) that acts like ChatGPT or Google Bard by generating answers based on human inputs. Llama 3 has enhanced performance and has a larger data set than its previous versions, as META has one of the largest data sets on which to train its models. We don’t know the extent of what A.I. will become in the future, but it’s hard to deny that it will be a driving technological force. The combination of META’s capital allocation, engineering proficiency, and underlying data makes them a front-runner in the A.I. space. Unfortunately for start-ups, and other businesses, the A.I. race could be controlled by a few companies, and with META shifting gears, it’s hard to see them not being one of the winners that takes most.

Shares of META sold off further when Mr. Zuckerberg discussed increasing the CapEx spend. If shareholders want META to be a dominant force in A.I. and the next computing platform, then it’s going to take a large capital spend to get there. META made tremendous CapEx investments on a quarterly basis in 2022, and it paid off in spades as the amount of cash being generated from operations has significantly increased. Historically, shares of META have been volatile as they scaled new products, and it’s always worked out for shareholders. Mr. Zuckerberg was clear that the business would run in an efficient manner, but for the future of META to scale, existing and future resources need to be deployed to the Meta AI venture. META can either just tread water and let their competitors control the narrative, or go fully scorched earth and be a fierce competitor in the A.I. space. Ultimately, I would rather use the scorched earth approach because it will likely make their product offerings more appealing to their consumers and create additional future opportunities that will lead to increased profitability. The increased CapEx spend of in 2024 of $35-$40 billion rather than $30-$37 billion is irrelevant in the grand scheme of things, considering their level of profitability and cash on hand. META is in a position to be at the forefront of the next evolution of computing, and if they miss this opportunity, it could be detrimental to the long-term success of the business and negatively affect shareholder value down the road.

Meta Platforms

Shares of META look inexpensive and long-term shareholders should be excited about the future

In Q1, META generated $12.53 billion in FCF, which allowed it to pay $1.3 billion in dividends to shareholders while repurchasing $14.6 billion in shares. Since starting a buyback program in 2018, META has repurchased 369 million shares, which is 12.7% of the company’s total shares. META just paid its first quarterly dividend of $0.50 to shareholders. On the conference call, management indicated that they are in a strong financial position to support their future investments in the company while returning capital through buybacks and dividends to shareholders. A $2 annualized dividend may not seem like much when the share price is $443.29 as the yield is less than half a percent, but for long-term shareholders, this could be a 1.6% yield on capital if you grabbed shares at $125 during the previous sell-off or even a 5-10% yield on capital for shareholders since META’s first-year public. META is in a position to grow the dividend and become a dividend growth company, while maintaining buybacks as they position the company for increased profitability in the future.

Seeking Alpha

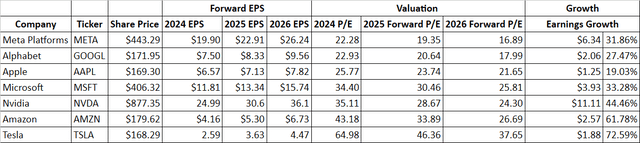

Currently, 4/7 of the Magnificat Seven have reported earnings, and I have updated the forward earnings estimates and price to FCF metrics for each of the companies. META is expected to generate $19.90 of EPS in 2024 which means it’s trading at 22.28 times 2024 earnings. This is the lowest P/E in the Magnificat Seven, and this trend will be extrapolated through 2026. From the end of 2024 through 2026, META is expected to grow its EPS by 31.86% or $6.34, and it is projected to generate $26.24 of EPS in 2026. Currently, the Magnificent Seven trades at an average of 35.52 times 2024 earnings, which is well above the 22.28 times META trades for. Looking out to 2026, the peer group trades at 24.43 times earnings, while META trades at 16.89 times. The only other company that is close to META is GOOGL, and its EPS growth over the next two years is projected to be 27.47% compared to 31.86% from META. I think META is trading at a dirt cheap valuation based on its current and forward earnings potential compared to its peers.

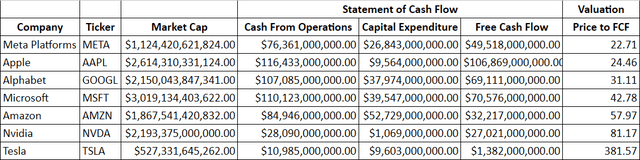

I also look at the price to FCF metric because at the end of the day, you’re paying the current value for all of a company’s future cash flow in investing. META has generated $76.36 billion in cash from operations over the trailing twelve months (TTM) and produced $49.52 billion in FCF. Today, there are only two companies that trade for less than 30 times FCF, and that’s Apple (AAPL) and META. META trades at 22.71 times its FCF, which is cheap for a lot of value companies, let alone a company that’s part of the Magnificent Seven. For instance, The Coca-Cola Company (KO) has a market cap of $266.17 billion and has generated $9.75 billion in FCF over the TTM, placing its price at 27.31x FCF. I think META has the best value proposition based on today’s fundamentals out of all the companies that are part of the Magnificent Seven.

Steven Fiorillo, Seeking Alpha

Steven Fiorillo, Seeking Alpha

Conclusion

I think that we’re going to see shares of META climb back to the $500 level over the next several months, as the sell-off was unwarranted. The large volume that shares of META experienced when earnings dropped was an overreaction, as all the price action occurred without digesting earnings. META trades at the cheapest current and forward valuation of all the companies in the Magnificent Seven and is expected to continue growing its profitability YoY. META just delivered its strongest Q1 in the history of the company, and investors are quibbling over a few billion dollars of additional CapEx spend. I think this will be looked back on as a shakeout of investors who didn’t believe in Mr. Zuckerberg’s vision or instincts in how to take META to the next stage in its evolution. I think that META shifting its focus to A.I. is a problem for its competitors and could open up tremendous value to be unlocked from its family of apps and future products. I think META represents a strong opportunity for long-term shareholders, and Mr. Zuckerberg has earned the right to increase CapEx spending.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AAPL, AMZN, GOOGL, TSLA, KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.