Summary:

- The management team at Meta Platforms announced financial results covering the final quarter of the company’s 2022 fiscal year.

- Shares of the business roared higher in response to better-than-expected sales, cost-cutting initiatives, and a major share buyback program.

- The stock is still cheap and offers attractive upside from here, but the easy money has been made.

Justin Sullivan

Feb. 1 was a fantastic day for shareholders of Facebook parent Meta Platforms (NASDAQ:META). After the market closed, management reported financial results covering the final quarter of the company’s 2022 fiscal year. In addition to beating expectations on the top line, and in spite of missing expectations on the bottom line, shares of the company roared higher, climbing as much as 20% in after-hours trading. This came in response to multiple developments, including cost-cutting initiatives and a massive share buyback program. A few months ago, it likely would have been unthinkable to many investors that the stock could be trading as high as it is today. But for those who are bullish about the company, this is a well-earned reward that was easy to see coming. Moving forward, I do expect further upside for the company. Though I also think that the easy money has already been made. In response to these developments, I have not yet sold any of my shares in the business. After all, I’m still bullish about it. But I could see myself starting to decrease my position to some degree and, effective as of the publication of this article, I’m downgrading the company from a “strong buy” to a “buy.”

A fantastic outcome

Over the past year, my portfolio has materially outpaced the broader market. The upside experience has been driven in part, but not entirely by, the performance of Meta Platforms. In late October of last year, I started my initial position in the company and rapidly increased my stake in the firm. However, I do regret not buying a lot more. On Oct. 31, I wrote an article discussing why I was rating the company a “strong buy” after seeing the stock fall by more than 70% at one point during 2022. Since then, my own position in the company has generated a profit of 55.5% prior to the after-hours surge that shareholders enjoyed. By this point, I can say that my “strong buy” rating has played out nicely.

Author – SEC EDGAR Data

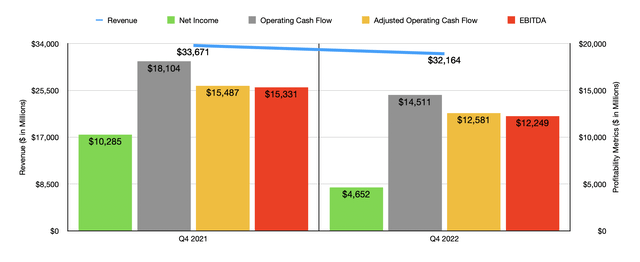

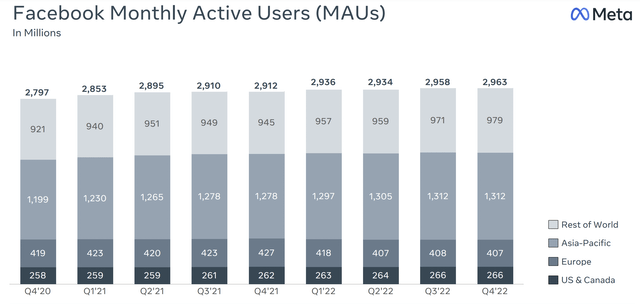

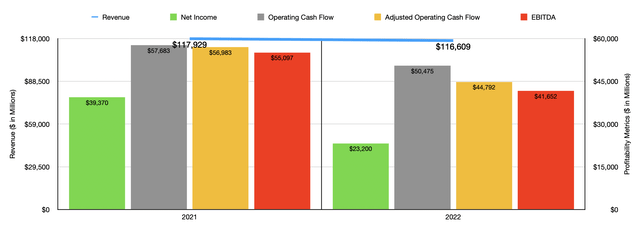

Bolstering the optimism that was already building around the company is the fact that management reported some rather solid financial results. For the final quarter of 2022, revenue came in at $32.17 billion. Although this is 4.5% lower than the $33.67 billion the company generated one year earlier, it did beat analysts’ expectations by roughly $475 million. Aiding the company was a rise in total user count. Monthly active users, also known as MAUs, hit an all-time high for the company of 2.963 billion. This was up from the 2.958 billion reported in the third quarter of last year and represented an increase of 1.8% over the 2.912 billion reported for the final quarter of 2021.

Meta Platforms

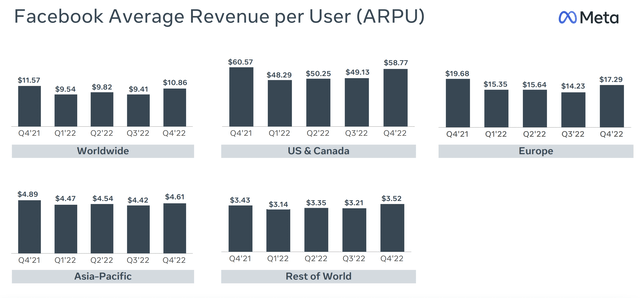

Although the company continues to struggle in Europe, with the total number of MAUs down by 1 million over the course of just one quarter, it experienced attractive growth in the developing economies. Another contributor to the outperformance, but performance that was still lower than it was a year earlier, was the ARPU generated by the firm. In the US and Canada, this number came in at $58.77. One year earlier, it was $60.57. For context though, in the third quarter of the year, it was $49.13. Such a seasonal uptick is common for the company. A similar trend can be seen when looking at the other regions in which it operates. Globally, ARPU of $10.86 came in lower than the $11.57 reported one year earlier.

Meta Platforms

On the bottom line, however, the company did not perform exceptionally well. But there’s a good reason for this. According to management, earnings per share came in at $1.76. That’s down from the $3.67 reported one year earlier and fell short of the $2.74 that analysts anticipated. However, it’s important to note that, previously, management had forecasted $2 billion in restructuring charges aimed at consolidating its office facilities footprint this year. That number has now been reduced to $1 billion because of the company’s decision to frontload certain charges for the final quarter of 2022. Notably, the company reported just under $1.81 billion in impairment charges associated with leases and leasehold improvements. It also recorded $1.34 billion in abandonment charges for data center assets.

Author – SEC EDGAR Data

Although the better-than-expected sales figures were likely instrumental in pushing shares higher, there were other developments that probably had an even larger impact. For instance, management announced that expenses for next year should be between $89 billion and $95 billion. That compares to what the company previously announced of between $94 billion and $100 billion. At the midpoint, that’s a reduction of $5 billion, a good portion of which could be attributable to the 11,000 employees the company let go. The firm also is reducing its budget for capital expenditures to between $30 billion and $33 billion. That compares to the $34 billion to $37 billion range previously anticipated. That’s another $4 billion in cash savings. Using all of this, combined with the cash the company has in excess of debt that amounts to $30.82 billion, the company feels confident enough to initiate a large share buyback program. During the final quarter of 2022 as a whole, the company repurchased $6.91 billion worth of stock. For 2022 in its entirety, this number came out to $27.93 billion. Under the original share buyback program, the company has $10.87 billion worth of capacity remaining. However, included in its earnings release was the announcement that it was initiating a $40 billion share buyback program.

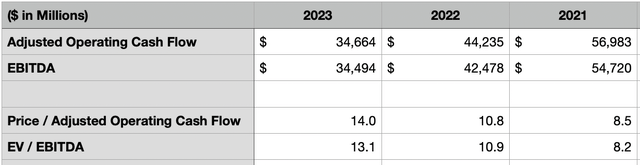

Taking the cost savings and applying the appropriate tax rate, I then added these numbers to my prior estimates for both operating cash flow and EBITDA for Meta Platforms for its 2023 fiscal year. All combined, I’m estimating that the company should generate operating cash flow this year of $34.66 billion and EBITDA of around $34.49 billion. While this is meaningfully lower than what was generated in 2022, it does still imply that shares of the company are trading at attractive levels. On a price to operating cash flow basis, the forward multiple on the company is 14. The EV to EBITDA multiple for the firm, meanwhile, should be 13.1. Using the data from 2022, these multiples would be 10.8 and 10.9, respectively, while for 2021, they should be 8.5 and 8.2, respectively.

Author – SEC EDGAR Data

Takeaway

As I wrote in my initial bullish thesis on Meta Platforms, the company looks undervalued. Having said that, it’s nowhere near as cheap as it was back then. Ultimately, I believe that the company will either abandon its metaverse initiative, scale it down completely, or achieve commercial success. In any of these scenarios, the underlying health of the company is robust and cash flows will rise materially given that the losses associated with its metaverse operations in 2022 totaled $13.72 billion. A return to the kind of performance achieved in 2021 or 2022 would indicate a great deal more upside than where shares are today. Of course, timing on this is everything. The picture looks better if a return to normalcy occurs earlier. But there’s no evidence that will be the case. Because of this uncertainty and how much shares of the company have risen, I do think it’s appropriate to have a more cautious ‘buy’ rating on the company than the ‘strong buy’ I had previously. As for my own personal holdings, I’m not exactly sure what I am going to do. Given how much the stock has risen, I likely will sell some of my stake in the firm as time goes on. After all, I run a very concentrated portfolio that only picks up the most attractive prospects. And while Meta Platforms does have additional upside that would warrant me keeping at least some of my holdings in the company, it also makes sense to allocate the capital elsewhere.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may sell some or all of my shares in the business at any time, depending on price and other news that comes out.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!