Summary:

- Meta Platforms’ stock crashed after its last release, partially because its $173 million in free cash flow declined dramatically compared to prior quarters.

- Previously, FCF between $5 billion and $9 billion was the norm.

- Thanks to cost-cutting, Meta will likely report multi-billion dollar FCF again in Q4.

- This will represent a large sequential (i.e., quarter-over-quarter) jump in FCF.

- Positive FCF growth on a year-over-year basis may remain elusive.

Allen And Company Annual Meeting Brings Business Executives, Media Moguls, And Politicians To Sun Valley, Idaho Kevin Dietsch

Meta Platforms, Inc. (NASDAQ:META) is set to release earnings on Wednesday, February 1. Analysts are expecting $31.7 billion in revenue and $2.22 in earnings per share (“EPS”). Expectations are not particularly high. The analyst consensus is about halfway between the lower and upper ends of the company’s guidance (given in the third quarter release) and implies a significant year-over-year decline in revenue.

Whether or not Meta Platforms will beat estimates, I can’t tell you. I do think there’s a case to be made that revenue will be relatively strong, but the cost side is quite unpredictable. The actual figures are anybody’s guess, but there is one positive development that can be predicted with confidence:

A large sequential increase in free cash flow (“FCF”). The reason this can be predicted with confidence is because FCF was artificially lower in Q3. In the third quarter, Meta reported just $173 million in FCF, when figures between $5 billion and $9 billion were common in prior periods. Meta’s FCF came in low in Q3 because of a big increase in capital expenditures, driven by new data center investments. For example, the company bought 500 acres of land in Kansas to build new data centers in. Maintenance costs on data centers are lower than the cost of building them, so we can reasonably expect capital expenditures to be lower in future quarters than in Q3. Should the pace of spending have slowed in Q4, then free cash flow will see strong growth on a sequential basis-though not necessarily year-over-year.

How Will Meta’s fourth quarter results look

Meta Platforms’ upcoming earnings release will show investors a lot of things they want to see, including the usual revenue and profit figures, as well as updates on the investments in Reality Labs (i.e., the Metaverse) and Instagram Reels. VR investments and competition from TikTok have been putting pressure on Meta in recent quarters, so arguably the updates on these business segments will be even more significant than the big-picture financials. However, the financial factors are more quantifiable than operational ones, so I will focus mainly on those for the remainder of this article.

Here’s what we know heading into the Q4 release:

-

Meta did $33.6 billion in revenue in Q4 2021.

-

It expects $30 to $32.5 billion in Q4 2022.

-

It expects a 7% foreign currency headwind.

-

It expects costs in the range of $85 to $87 billion.

-

It laid off 11,000 workers in the early part of the fourth quarter.

How much free cash flow will Meta be able to generate, given the information above?

First things first:

Let’s look at the revenue guidance.

Revenue

Meta said in its Q3 release that it would earn $30 to $32.5 billion in revenue. It also said that currency would be a “7% headwind to revenue.” The U.S. dollar weakened against foreign currencies in the fourth quarter, so most likely, that headwind was weaker than predicted. There is, therefore, a decent chance that Meta will do better on the revenue front than was initially forecast.

How much better?

Well, assuming that CFO David Wehner was right initially (about the number of ads sold and the constant-currency ad rates), we could see revenue up to 3% higher than what was expected.

Here’s some math on that: at the time Wehner made his forecast, the Euro was almost exactly $1, and was down 12% (against the dollar) from its level at the start of the year. At the end of the quarter about to be reported, the Euro was only down 6% from the start of the year. So, when Wehner made his “7% impact” forecast, the Euro was down a lot more than it is now.

There are other foreign currencies that Meta sells in, and the picture was rather similar with them: the U.S. dollar index (USD vs a basket of six global currencies) slid in the fourth quarter. So it looks like many foreign currencies will be more valuable than Wehner had forecast. In Q3, Meta’s actual revenue was 6% lower than its constant-currency revenue. Wehner predicted a 7% headwind for Q4. It appears, then, that Wehner had modelled for further gains in the dollar, when in fact a decline occurred.

If I’m right about all of the above, then Meta has a good chance of a revenue beat in Q4. At the time Wehner gave his Q3 guidance, the US dollar index was at 111. At the End of Q4, it was down to 103.5. The lower the dollar index goes, the more valuable foreign currency becomes. So, we may see a foreign currency headwind less than what Wehner forecasted.

It’s important to note that only foreign currencies can be a “headwind” to dollar-results, because revenue collected in dollars is reported in dollars. So, the revenue that Meta is earning in the U.S. is not part of the forecast “7% headwind.” Foreign currencies make up 55% of Meta’s revenue, so a “7% headwind” requires a 12.7% decline in these foreign currencies. In fact, the dollar index gained just 7.9% year-over-year in Q4 (it declined sequentially) implying the basket of foreign currencies fell 7.3%. Multiply that by 55%, and we get a 4% expected headwind, rather than 7%. The expected result of this is that revenue should come in between $31.96 billion and $33.54 billion, instead of the $30-$32.5 billion that was forecast.

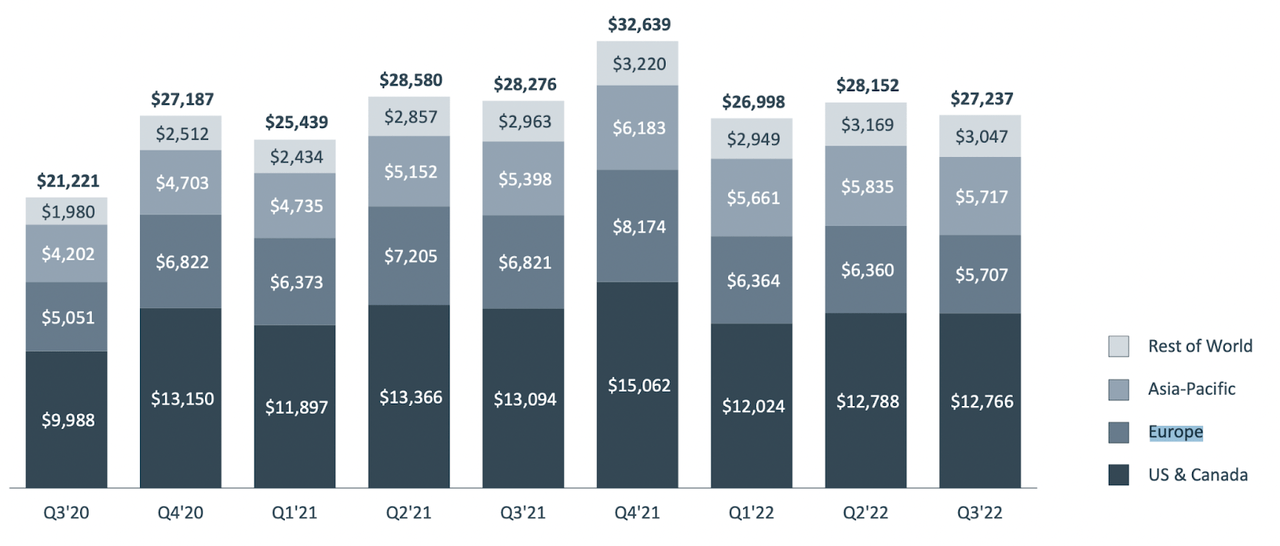

Meta Platforms revenue by region (Meta Platforms)

The Cost Side

Having looked at Meta’s revenue forecast, we can now look at the cost side of the equation. This we know for sure will improve, leading to a likely increase in free cash flow, at least on a sequential basis.

We know Meta laid off 11,000 employees in “early November.” According to Comparably, median compensation at Meta is $150,000. $150,000 times 11,000 is 1.65 billion. On a quarterly basis, that’s $412.50 million. The layoff occurred a third of the way through Q4, so we can reasonably predict that $272 million will be saved on employee compensation in the fourth quarter. Now, there may be severance packages and other perks in the mix here, so the final amount that shows up in the fourth quarter release could be lower. But there’s a good chance that free cash flow goes up on lower employee compensation expense.

There’s another reason for free cash flow to go up in the fourth quarter-at least sequentially: Meta’s FCF was held back massively by a $9.3 billion purchase of property, plant and equipment (“PPE”). The purchase of PPE was so massive that it plus some lease payments caused $9.6 billion in operating cash flow to shrink to $173 million in FCF! Assuming that investment won’t recur, then there’s potential here for FCF to come in close to $9.6 billion. I’ll stop short of actually predicting that that will happen, but I’d say that $5 billion is quite achievable here.

The Matter of Dilution

The final matter impacting Meta’s cash flows for the year ahead is the recently announced 425,000,000 increase in maximum authorized shares. With 2.74 billion shares outstanding now, that’s a 15.5% increase in shares outstanding. The potential dilution here is considerable; however, the shares mentioned in Meta’s filing have merely been authorized, not issued. Most likely, the issuance of these shares will occur gradually, over time; so that Meta’s ongoing buybacks will offset the impact of dilution.

Valuation

Having looked at Meta’s cost and revenue picture, it’s time to look at the valuation.

At today’s prices, Meta trades at:

-

14.5 times earnings.

-

3.5 times sales.

-

3.2 times book value.

-

7.36 times operating cash flow.

These are pretty low multiples.

We can also value Meta in terms of its terminal value-a “partial” discounted cash flow approach that assumes no growth. Meta has not delivered positive revenue growth recently, so conservatism demands that we not assume growth.

Meta had $9.71 in FCF per share in the last 12 months. The current 10 treasury yield is 3.5%. Discount $9.71 at 3.5% and you get a $277 price target. Discount it at 10% (i.e., with a very high-risk premium), and you get a $97.1 price target. The mean of these two price targets is $187. So, if the actual risk is moderate, then Meta should still have upside at today’s prices, even after rallying 60%.

The Big Risk to Watch

The big risk to Meta Platforms, Inc.’s shareholders is cost discipline. Meta has attracted a lot of criticism from investors for being loose with its spending. Much like Google, it hired too much during the 2020/2021 tech bubble and had to lay off the excess workers later. Much of Meta Platforms, Inc. stock’s recent rally was due to the fact that the company laid off 11,000 workers, which should save over a billion dollars per year. That tends to argue for an increase in free cash flow, but we do know that Meta is still buying land for data centers, and making big investments in the Metaverse.

There is some risk that Meta Platforms, Inc.’s fourth quarter free cash flow comes in lower than I’m anticipating. Nevertheless, it should increase on a sequential basis.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.