Summary:

- Abbott’s share price is down 9% year-on-year – a rare occurrence for a company used to steady upside.

- The company earned an additional $8bn per annum from COVID test revenues in 2021 and 2022.

- Abbott’s Sturgis plant will be investigated by the DoJ in relation to baby powder that has been linked to two infant deaths.

- The launch of Freestyle Libre 3 in 2023 will be critical to the company’s share price performance. Abbott’s CEO sees it as a $10bn p.a. revenue product.

- These three issues – falling COVID revenues, infant formula manufacturing fallout, and Freestyle Libre 3 launch, will dictate Abbott’s share price performance in 2023. After 2023, Abbott may morph back into the company investors know and love.

Tim Boyle

Investment Overview – Ways To Assess The Opportunity With Abbott

There are key ways to look at an investment in Abbott Laboratories (NYSE:ABT), the Illinois-based healthcare giant that has achieved a market cap of $192bn (at the time of writing) largely based on the performance of its four major divisions – Established Pharmaceutical Products, Nutritional Products, Diagnostic Products, and Medical Devices.

The first is to take the long view. Since 2012, when the company spun out its Pharmaceuticals and Drug Development division into a new entity, AbbVie (ABBV), which has gone on achieve a market cap valuation >$250bn, Abbott has successfully grown revenues from $19.7bn in 2012, to $43bn in 2021 at a compound annual growth rate of a little over 9%.

Over the same time period, Abbott’s share price has grown in value from ~$30, to $110 at the time of writing – a gain of >250%, at a CAGR of >15% per annum. Abbott also pays a reasonably generous dividend of $0.51 per share per quarter, which translates to a yield of 1.9% at the time of writing.

Abbott has been profitable in every year since 2012, and has grown earnings per share in most years since 2012, to $3.93 in 2021, and – Abbott announced last week when reporting Q422 and FY22 earnings – to $5.34 on an adjusted basis in 2022.

In other words, Abbott stock screams “Buy and Hold” based on past performance, being a healthcare giant with an entrenched market position in all of its four key business divisions, that will continue to grow revenues, the dividend, and its share price.

The second way to look at Abbott is by studying its more recent performance in greater detail to be certain that past performance can actually be reproduced going forward, and looking at Abbott through this particular lens, the situation may feel less comforting.

For example, Abbott is guiding for diluted earnings per share of $4.3 – $4.5 in 2023, less than what was achieved in the prior year. This is largely due to a likely fall in COVID testing revenues, which were $7.3bn across the first nine months of 2022, but are likely to be ~$2bn in 2023, management says.

That means Abbott’s revenues will fall in 2023 for the first time in more than 10 years, and in fact, its Q422 revenues were down 12% year-on-year as sales of COVID tests fell from $2.3bn in Q421, to just over $1bn in Q422.

Abbott’s share price – up 75% overall across the past five years – has actually declined by 9% across the past 12 months, reflecting a strange phenomenon that has seen companies that have benefited from a significant increase in revenues through mass production of COVID-related products lose value rather than gain it.

The most prominent example of this is the giant Pfizer (PFE), which has earned >$100bn in additional revenue in 2021 and 2022 from its COVID vaccine Comirnaty and antiviral Paxlovid, only for its share price to decline by nearly 20% across the past 12 months

The question investors need to answer is whether Abbott shares’ recent decline in value – from $141 per share at the beginning of 2022, to $110 per share today, constitutes a buying opportunity, given the company’s long-term trend of outperformance, or whether it’s reflective of a decline in company performance that could restrict growth longer term.

Besides COVID, Abbott’s share price has been buffeted in 2022 by issues affecting its Nutrition division, more specifically, “manufacturing disruptions during 2022 of certain infant formula products at our Sturgis, Michigan, facility,” as management puts it in its Q422 earning press release.

As I commented in my last note on Abbott for Seeking Alpha back in May last year:

Abbott’s voluntary recall of its powdered baby food brands Similac, Alimentum and EleCare manufactured at its Sturgis, Michigan, facility, owing to cases of bacterial infection Cronobacter sakazakii, which have been linked to two infant mortalities, have not painted the company in a positive light.

I suggested then that I was revising my price target downward, to ~$130 based on discounted cash flow analysis using a model that saw revenues increasing at ~8% per annum after 2022 revenues of $45bn, but with Abbott not having hit that mark last year, and set to lose ~$6bn in COVID test revenues in 2023, I’m not sure I would forecast Abbott stock to come close to challenging former highs of >$140 this year, and see the share price more or less treading water in 2023.

The company is likely pinning its hopes for a return to long-term growth on its Freestyle Libre glucose monitoring device, named “best medical technology in the last 50 years” by the Gallen Foundation last year.

In the rest of this post I will discuss Q422 and FY22 performance in some more detail, and discuss the three issues that I believe will define share performance in 2023 – the fallout from the Sturgis manufacturing plant investigation, the decline of COVID test revenues, and the ongoing launch of the Freestyle Libre 3 automated continuous glucose monitoring device.

Issue 1: 2022 Performance – COVID Testing Revenues Surprise To Upside But Don’t Expect A Repeat In 2023

Before diving into revenue figures and performance and these three significant issues, it’s worth recapping on Abbott’s four major divisions.

With regard to Abbott’s Nutrition Division, I wrote in May last year that:

Abbott considers itself to be the global leader in nutrition, led by Ensure, its balanced nutrition brand for adults, Glucerna, its diabetes nutrition brand, and infant formula brand Similac... alongside the likes of Danone, Pfizer, Nestle, Baxter and a handful of others, Abbott is one of the industry’s incumbents.

With regard to diagnostics, Abbott defines the division in its Q322 10Q submission as follows:

Worldwide sales of diagnostic systems and tests for blood banks, hospitals, commercial laboratories, physician offices and alternate-care testing sites. For segment reporting purposes, the Core Laboratory Diagnostics, Rapid Diagnostics, Molecular Diagnostics and Point of Care Diagnostics divisions are aggregated and reported as the Diagnostic Products segment.

Medical devices includes “rhythm management, electrophysiology, heart failure, vascular, structural heart, neuromodulation and diabetes care products.”

Established Pharmaceuticals is defined by Abbott as “International sales of a broad line of branded generic pharmaceutical products.”

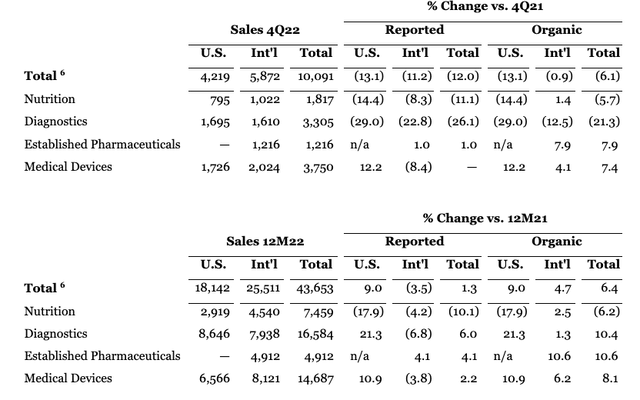

Of the four divisions, Diagnostics generated the largest share of revenues in 2022 – $16.6bn, or 38% of all revenues, with medical devices accounting for $14.7bn, or 34% of revenues, Nutrition $7.5bn, or 17% of revenues, and Established Brands $4.9bn, or 11% of revenues.

Abbott Q422 and FY22 revenues by division (Abbott Press Release)

Although at the beginning of 2021 Abbott Management had forecast for ~$2bn of COVID test related sales, in reality this figure ended up higher than in 2021 – $8.4bn versus $7.7bn in 2021.

Investors /shareholders should probably not expect such outperformance to repeat itself in 2023 however, given COVID test revenues fell to just $1.1bn in Q422, from $2.32bn in Q421. Again, the forecast is for $2bn of COVID test sales in 2023, with $750m of that realised in Q123.

This time, despite a recent surge of cases in China, the trend of cases ex-China in almost all other regions is downward, and although another spike in cases should not be discounted, Abbott Chairman and Chief Executive Officer (“CEO”) Robert Ford told analysts in Abbott’s Q422 earnings call that:

I think that’s the right number right now. Obviously, we see kind of society transitioning here. We’ve got a strong installed base. We’ve got manufacturing capacity. We haven’t factored in any kind of real surge but if that happens, we do have the capacity to be able to do that.

With government’s likely desperate to ease COVID related expenditures in 2023, Abbott will be more reliant on the emergence of a private COVID testing market in 2023, meaning the Diagnostics division may struggle to drive revenues in the double-digit billions in 2023. The private sector’s appetite for purchasing COVID tests will not be as large as the government’s.

Issue 2: Will Nutrition Get Back On Track?

Although the likely decline in COVID test revenues in 2023 is the most significant event affecting Abbott’s top line revenues in 2023, it’s important to also note the decline in Nutrition Division revenues in Q422 – 5.7% overall – and across the year as a whole – 6.2%.

With Established Pharmaceuticals and Medical Devices revenues rising by 11% and 8% in 2022 – in line with Abbott’s historic growth rates – a return to growth for the Nutrition divisions would at least see three of four Abbott divisions grow in 2023, and we should also note that ex-COVID, Diagnostics Division revenues were +9% year-on-year in 2022, reaching $8.2bn.

Abbott CEO Ford was able to sound a positive note in this regard on the Q422 earnings call, commenting:

Production at Sturgis is up and running. The team is working around the clock, nonstop, very hard. No. 1 focus here, as I said, was to serve the customers, get product back on shelves.

With that said, however, the Department of Justice is reportedly investigating Abbott and according to CNBC, the FDA has commented that:

The government alleges that powdered infant formula products manufactured at Abbott Nutrition’s Sturgis facility were adulterated because they were made under insanitary conditions and in violation of current good manufacturing practice requirements.

Although Abbott has said that its own internal testing suggested there was not a link between Sturgis and the tragic death of two infants, the DoJ investigation could significantly impact Abbott’s valuation so long as it’s ongoing, and there may be fines to pay or even closure of facilities if Abbott’s guilt is proven.

CEO Ford has said that ” I expect our business – our overall nutrition business to be growing at that pre-pandemic level between 4% and 6%,” and suggested that “our market shares in WIC (“women, infants and children”) have largely recovered and we are seeing a nice cadence of recovery in the non-WIC share here in the U.S.”

That may be true, but it may take much longer for the investigations to complete, and for Abbott’s reputation to recover from such a setback.

Issue 3: How Big Can FreeStyle Libre Grow?

Now that its COVID tests are likely to suffer a significant decline in demand, automated glucose monitoring device Freestyle Libre becomes the de facto most important product in Abbott’s product portfolio. Reporting on the device’s performance in 2022, CEO Ford told analysts:

In diabetes care, fourth quarter sales of FreeStyle Libre, our market leading continuous glucose monitoring system grew over 40% in the U.S. and global Libre sales reached $4.3 billion for the full year 2022.

Freestyle Libre has been a huge success for Abbott and sales are significantly ahead of the device’s closest rival, Dexcom’s “G6” device, which is expected to drive revenues of ~$2.9bn in FY22, up ~19% year-on-year, with revenues of ~$3.35 – $3.49 forecast for FY23.

Freestyle Libre has the more favorable price point, and it has the might of Abbott’s sales and marketing infrastructure behind it, whilst Dexcom is essentially a one product company, with a more limited (although not necessarily small, having paid for a Super Bowl advertisement in 2021) marketing budget.

Abbott received marketing approval for Freestyle Libre 3 in May 2022 – a 14-day system that no longer requires the user to scan the sensor, and is 70% smaller by total volume than Freestyle Libre 2. Meanwhile, Dexcom has not yet received US approval for its next-generation G7 device (although approved in Europe).

CEO Ford believes that Freestyle Libre can be a $10bn per annum selling product for Abbott, which would see the user base increase from ~4.5m today, driving $1k of revenue each, to >10m, presumably. Given that there may only be 8.4m Type 1 diabetics worldwide, however, that may be too ambitious a target.

Although, at one stage Abbott may have envisaged that its CGM devices could find a market in Type 2 diabetics, the emergence of drugs such as Novo Nordisk’s (NVO) and Eli Lilly’s (LLY) Mounjaro – both forecast to drive >$25bn in annual revenues from Type 2 diabetics – may restrict Freestyle’s ability to grow in this market.

Abbott is looking to create a new kind of product – Lingo – based around measuring additional biomarkers such as lactate and ketones – which is expected to launch this year, although my gut feeling is patients’ would prefer a medicine to a device where possible, and health monitoring technology outside of diabetes has long proven to be a tough market to crack.

To summarize, I would fully expect Freestyle Libre revenues to grow in 2023, and for the medical devices division to be capable of driving long-term double-digit annual growth, given Abbott’s R&D capabilities and status as a global leader in this industry.

With that said, new product launches can be tricky, and unlike Abbott’s most successful ever product, Humira, which became part of the AbbVie and earned >$20bn per annum for the Pharma, Freestyle Libre in its current form will not generate mega-blockbuster sales for a decade or more, as the product will need to be updated and ungraded on an almost annual basis to keep pace with the market.

Conclusion – After The Anomaly of COVID, Investors May Take Comfort From An Abbott They Recognize

It’s hard to explain how a company that adds ~$8bn to its top line – driving impressive margins for these revenues – ends up with a falling share price, but this is what happened to Abbott through 2022. Perhaps the company created unrealistic expectations, or perhaps the market’s expectations were raised too high, but the likelihood is we will discover the truth this year as these revenues ebb away.

In fairness, Abbott stock traded ~$90 prior to the pandemic and the additional COVID test revenues, and hit an all-time high of $141in late 2021 of >$140, while the additional revenues generated may be put to good use. Abbott reported current assets of $24.2bn, vs. current liabilities of $13.1bn and long-term debt of $17.3bn as of Q322, so the company is not overly-leveraged, but the contribution of the COVID test revenues in 2021 and 2022 may allow the company to seek out M&A deals, initiate share buybacks, or raise the dividend in 2023, which is to the advantage of investors.

The Sturgis plant issues affect Abbott reputationally perhaps more so than in the pocket, and so long as the company can successfully defend itself in this case any additional pressure on the share price may begin to ease. This is a developing situation the outcome of which is hard to predict.

In my view, since the three major share price catalysts affecting Abbott at the present time – the baby formula manufacturing issues, the loss of COVID test revenues, and the success (or otherwise) of Freestyle Libre and Lingo – will continue to play out through 2023, without investors having sufficient insight into what the outcomes will be, I’m not especially optimistic about Abbott’s share price prospects for 2023.

Looking further ahead, however, the company has shown through its 2022 results ex-COVID and outside of nutrition, and its forward guidance that it’s capable of returning of its reliable, pre-pandemic levels of division by division high single-digit annual growth, and that’s encouraging, and exactly what investors want from a company like Abbott.

Abbott shareholders are not looking for controversy or a revolutionary new product so much as they looking for steady, incremental and measurable growth, a growing dividend, and solid top and bottom line fundamentals.

That’s what shareholders were getting pre-pandemic, and that’s what I would expect them to get after 2023. This will be a year in which the company returns to a BAU environment again, and so long as it can show that it can still operate successfully in markets in which it enjoys incumbent status, buying stock in 2023 for <$110 will look like a solid opportunity.

Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.