Summary:

- It was a positive surprise that Meta was able to reduce costs faster than I expected, resulting in higher-than-expected EPS.

- I also did not expect the announcement of a dividend, although share repurchases remain a priority.

- Therefore, an adjustment to my EPS estimates is necessary to reflect these circumstances.

kenneth-cheung

The Meta Investment Thesis

As Meta Platforms (NASDAQ:META) has become my largest position in recent months due to the strong price appreciation, I remain convinced of the quality of the company, but continue to believe that there may be more attractive entry points in the future to buy additional shares.

In my last article, I therefore issued a Hold rating, as I did not expect the rapid rise to continue in 2024. I thought Meta was at a turning point, and I wanted to see how they were allocating their capital and how What’s App and AI were evolving.

And in the last 3 months since that article, some things have changed, but I still think a hold is the right call. But I also think that temporary pullbacks could be very interesting to buy shares because the future outlook is strong.

What has happened since my last article?

Meta is very active in developing new businesses, some of which are performing well, some of which are not, but overall they have a very attractive ROIC, as we will see in a later chapter. Facebook Dating is one of the less successful, but a nice addition to the regular Facebook application.

Threads, a competitor to Twitter, is one of the bigger projects of recent times, and in the beginning Threads had a hype as many users tested the feature. And Threads reached 100 million users faster than ChatGPT (MSFT), TikTok or Instagram. Unfortunately, after the initial hype, daily active users and minutes spent on the platform have declined, and right now it looks like Twitter will stay on top. But also reels were belittled by many in the beginning and today have a big share in the success of Meta in the last months. In this fast-paced world, things can change quickly.

On Facebook, for example, reels make up 1/3 of video time and have a 70% growth rate. And shorter videos mean more impressions, which means more ads to serve. So the more successful short videos become, the more ad revenue will increase.

And I am especially excited about the What’s App Assistant. I think Instagram has shown that Meta is very good at personalizing content based on data, and if they can continue that in What’s App, it will be a huge success. The combination of personalized social discovery and advertising is expected to be a major driver of growth.

Meta is also investing heavily in its AI infrastructure to benefit from assistants in What’s App Business that can automatically answer customer questions and perhaps even automate sales in the future. Based on data, the assistant could tell you exactly which product is best for you, potentially replacing a human salesperson.

And the idea of establishing Llama as an open source standard could also be a good move. If successful, this would most likely improve models and reduce computational costs. Plus the importance of this can be seen in the GPU market, where NVIDIA Corporation (NVDA) and Advanced Micro Devices, Inc. (AMD) are currently battling over whether NVIDIA’s CUDA will remain the industry standard, or whether AMD’s open source effort will prevail.

Banning TikTok would probably also have a positive effect on Meta’s business, as Shein or Temu would probably place even more ads on Meta’s platforms, from which they already profit immensely. Many are critical of the extreme investment in the metaverse, but I think it will create many new businesses for meta. SceneScript, a 3D scene reconstruction, is probably the result of this investment. In general, I firmly believe that mixed reality is the next step, and that Meta will lead the way. The potential is huge.

There are so many companies that only became big because of Instagram and are very dependent on that platform, and I think mixed reality has even more potential, but also risks, because I think virtual worlds have a huge addictive potential. But from an investor’s point of view, products that make customers addicted to them are a good thing. What it means for society, however, is a different question.

Meta’s Metrics and Balance Sheet

Meta continues to be in an excellent position with respect to liquidity and the balance sheet. Long-term debt of $18 billion is offset by cash and cash equivalents of $65 billion and TTM net income of $39 billion. Debt is easily serviced and TTM net income has also improved compared to the previous quarter. Overall, Meta is now even better positioned financially than it was last quarter.

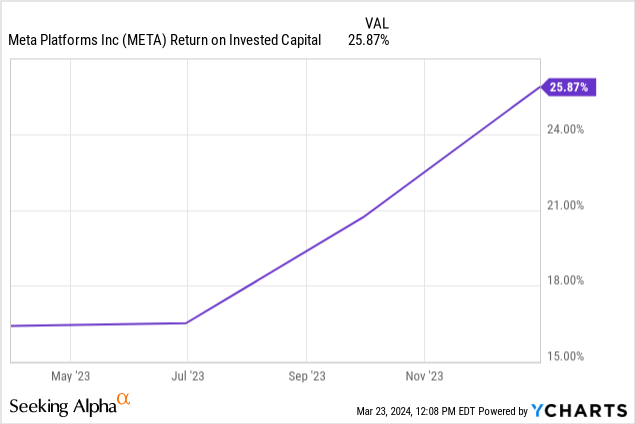

Capital Allocation and ROIC

The development of the ROIC, which was 20.70% in the last quarter and has now increased to 25.87%, is therefore positive. As a result, the ROIC-WACC spread, which was around 12% in the last quarter, also developed positively. The WACC remains at about 8%, so the spread is now 25%-8% = 17%, a great number.

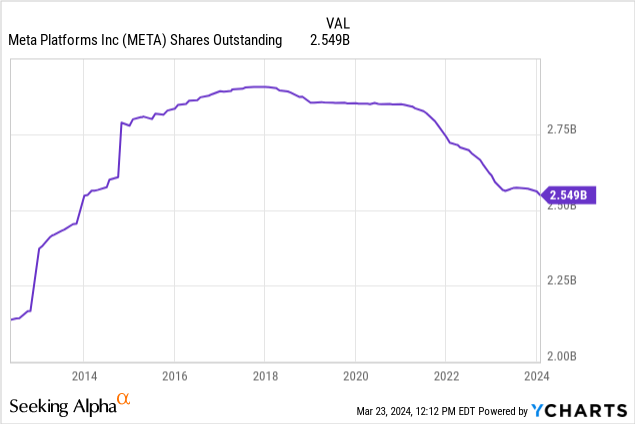

The development of shares outstanding is also positive, there were 2.6 billion shares outstanding in December and now there are only 2.54 billion. Since the shares are being repurchased at a fair value, they are also creating value for shareholders.

In the Q4 earnings call, Meta also said that share buybacks would be a priority over the newly created dividend. The dividend, to be honest, surprised me personally, but I think if they grow it over the next few years, combined with earnings growth and share repurchases, that could create a lot of value for shareholders.

Valuation and Reverse DCF

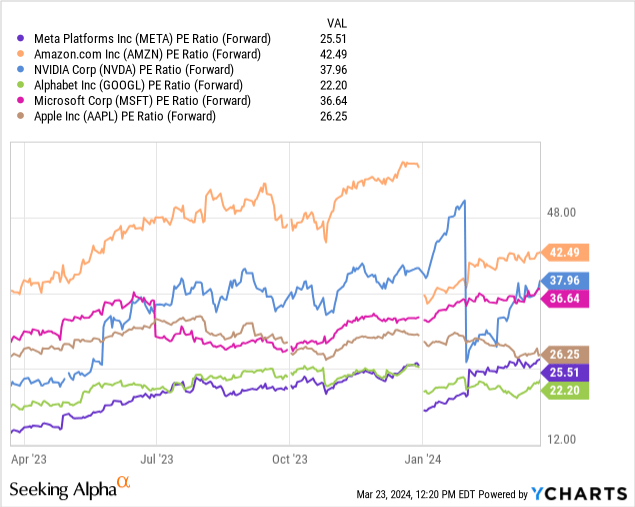

From a forward P/E perspective, the peer group and Meta are not expensive and I think are fairly valued. All have very solid businesses and are not astronomically overvalued when growth opportunities are taken into account. In fact, I would argue that Meta has the potential for multiple expansions. The 25x multiple seems fair to me, but a 30x multiple is also possible and not too high for a company of this quality.

I think one of the best ways to see if a company is fairly valued is to do a reverse DCF so we can see what the market is pricing in. And using a 25x exit multiple and TTM diluted EPS of $14.87, we find that the market is currently pricing in a 14% CAGR over the next 10 years.

Last quarter, the market was only pricing in a 13% CAGR, so the stock is slightly more expensive this quarter because the share price has increased more than the diluted EPS. Diluted TTM last quarter was $11.33 compared to $14.87 today.

The historical diluted EPS growth rate is 14.46% over the last 5 years and 37.95% over the last 10 years. Therefore, we can definitely say that the stock is fairly valued.

What could EPS look like in 5 years?

Seeking Alpha Earnings Estimates

My last earnings estimates were far too conservative. I expected $20 to $25 EPS in 5 years, but last quarter’s results made me think otherwise. I think $30 to $35 is more realistic, which would be between $750 on the conservative side and $1050 on the bullish side with a multiple of 25.

In both cases, however, there is good upside potential that should exceed the return of the S&P 500 (SPY) over the period. I simply did not expect Meta to be able to cut costs so quickly and therefore underestimated the impact. In fact, the execution of the management team and the growth opportunities in AI and assistants may even lead to a further underestimation of EPS.

Conclusion

I use Instagram a lot and have found a lot of interesting accounts on topics that interest me, as well as interesting events and businesses in my city. So I can definitely say that I feel the discovery impact of Meta, and the personalized ads in Facebook have already led to the occasional online purchase.

In addition, I’m very excited about the assistants for What’s App and Instagram, and I have high expectations for them and believe they will be great growth drivers. In addition, I believe that the Meta stock is currently fairly valued, but given that the swings between 52-week highs and 52-week lows are often relatively large, I believe that pullbacks in 2024 are very likely and offer better points to buy more shares or start a position.

As a result, I maintain my Hold recommendation, as I built most of my position at a much lower entry price. However, I will probably buy more Meta shares later in the year as I am very confident in the company’s future. But I am also not of the opinion that it is a big mistake to buy now at these fair prices.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.