Summary:

- Meta Platforms, Inc. investors have outperformed the S&P 500 significantly, with a nearly 40% YTD return in Q1.

- Meta demonstrates its financial prowess by rewarding shareholders with an enlarged repurchase authorization and initiating dividends.

- Engagement losses to TikTok have been curtailed as Meta looks to crimp TikTok’s advantage.

- The market must decide whether to value META as a digital advertising stock or one with significant AI capabilities.

- With the market trying to find its way over the last two months, investors should consider returning to the sidelines.

Anna Moneymaker/Getty Images News

Meta Platforms, Inc. (NASDAQ:META) investors have easily outperformed the S&P 500 (SPX) (SPY) in the first quarter, delivering a total return of almost 40% YTD. In my previous META article in January 2024, I urged investors to avoid cashing out too early. I highlighted Meta’s relatively cheap valuation and robust earnings growth estimates over the next few years. Bolstered by highly constructive price action underpinned by a fundamentally sound business model, I expected META to continue grinding higher.

Meta’s fourth-quarter earnings release in early February 2024 demonstrated the company’s confidence in delivering solid upside in the medium and long term. It assured investors of its focus on delivering shareholder value by instituting a dividend and also authorized a $50B share repurchase program. While management articulated that it expects Meta to post CapEx between $30B and $37B in 2024, the market seems to have moved past the worst headwinds of increased spending by Meta.

The leading social network has astutely leveraged its massive scale and financial resources to drive AI investments and data center buildout. As a result, it has moved past the peak headwinds engendered by Apple’s (AAPL) iOS ad-targeting restrictions, as Meta demonstrated the capabilities (subscription required) of its AI-driven probabilistic ad-targeting models. Coupled with the significantly improved engagement statistics with Reels (subscription required), Meta has fought hard and regained engagement following initial losses to TikTok (BDNCE) in 2021/22. The recent TikTok fallout in the US Congress could provide a welcomed lift to Meta if some form of legislation were signed into law to hamper TikTok’s presence in the US.

However, investors should consider that Shein and Temu have been prolific spenders in the US digital ad scene, driving the revenue accretion for Google (GOOGL) (GOOG) and Meta in 2023. Temu has become the “top advertiser by revenue for Meta in 2023,” as the Pinduoduo-backed (PDD) company spent almost $2B on Meta ads last year. Concerns regarding whether the growth cadence could be maintained are justified.

Furthermore, a recent report shed light on Temu’s preference to diversify its revenue exposure in the US in response to TikTok’s negative experience. As a result, it could dampen even more robust growth metrics over the next two years. Despite that, China accounted for just about 10% of Meta’s ad revenue base in 2023. Moreover, with Meta estimated to deliver about $158.5B in revenue this year, I wouldn’t be unduly concerned with near-term headwinds due to Temu’s caution.

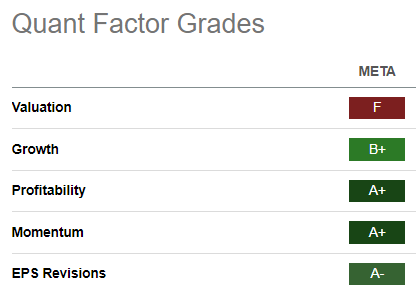

META Quant Grades (Seeking Alpha)

With META no longer valued cheaply relative to its sector peers (“F” valuation grade), CEO Mark Zuckerberg and his team must convince investors that its AI growth inflection is still in its early innings. The company is confident that it has the potential to monetize these opportunities over time. However, it’s reasonable to assume that Meta’s revenue accretion attributed to AI will likely be in ad optimization and more robust engagement through improved content recommendation. Analysts remain confident in Meta’s ability to recover its topline growth metrics, as seen with its solid “B+” growth grade. Therefore, a more pronounced AI rollout could see Wall Street valuing META more as an AI stock than a digital advertising stock, which usually attracts lower multiples.

Meta’s aggressive AI investments to build its AI infrastructure suggest that a valuation re-rating to reflect its status as a leading AI company has the potential to pan out. With META valued at a forward P/E of just under 25x, I don’t consider it as pricey against the market. However, consolidation over the next few months to take away some optimism from its recent rally is constructive. META’s rally has also stalled somewhat over the past two months below the $520 level as the market rotated. Whether META can hold above the $450 support level or suffer from a steeper pullback remains to be seen.

Is META Stock A Buy, Sell, Or Hold?

META has been an incredible performer over the past year, posting a 1Y total return of 130%. However, it’s critical to understand that investors shouldn’t expect such growth rates moving ahead as Meta laps more challenging comps against its performance in 2023.

Despite that, I didn’t glean sell signals on META. While META’s valuation is no longer as attractive, investors shouldn’t rush for the exit, even as they are sitting on significant gains.

Meta is well-positioned to deliver a valuation re-rating if it can demonstrate to Wall Street that Meta can monetize its AI investments beyond its current ad-targeting capabilities, leading to a significant rise in revenue per user. However, that remains a work in progress, which might not pan out over the next two years. Still, with generative AI taking the world by storm and evolving rapidly, I could be too cautious with my timeline.

Despite that, given the surge, I assessed that the market seems to have rotated out of META. As a result, I believe the risk/reward for META at the current levels is less attractive compared to my previous update in January.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!