Summary:

- Meta Platforms reports Q4 earnings Wednesday after the bell, and 2023 couldn’t be any more in focus.

- While Q4 will show us the transition to better operating expenses, Q1 will show investors how serious its investments in getting the ad business off the floor are.

- Mark needs to remember he’s working from a position of weakness and not strength like in the past.

- Investors will not take kindly to changes in the spending game plan, especially if revenue growth returns do to easy comps year-over-year.

photoman

Meta Platforms (NASDAQ:META) needs good news come Wednesday after the bell when it reports Q4 earnings. After promising to rein in expenses early in 2022, the company’s third quarter report showed it hadn’t followed through on that as revenue fell 4% year-over-year while expenses rose 19%. This combination doesn’t bode well if the trend continues beyond a quarter or two. However, if Mark Zuckerberg can provide evidence the company’s revenue growth slide ends in 2022 and expenses truly come under control, the stock may have a fighting chance to find itself higher in the first half of 2023.

Meta’s stock has had a wild ride since its Q3 earnings report in October. In reaction, it dropped to levels I remember watching it rise through three-and-a-half years after its IPO. Funny enough, there was a gap on its chart needing to be filled, dating back to January 2016.

Somehow they always get filled.

But with Q3 in the rearview and Q4 and Q1 on deck to reset expectations, there needs to be a firm stand on two things:

- Revenue growth must stabilize and return positive (and it due to product growth not easy year-over-year comps)

- Expenses need to be held in check

I’ll detail these in reverse order.

New Expense, Who Dis?

After Meta’s push to go all in on the “metaverse” in 2021, the macroeconomic stage took a turn. No time like the shakiest time in the global economy to spend tens of billions of dollars on a new project. But this new project is Meta’s way out of the iOS (AAPL) targeting headwinds. In addition, alphabet (GOOG)(GOOGL) isn’t far behind with Android privacy changes, so it needs to get this figured out lest all of its revenue be at risk of poor targeting.

The problem is the metaverse isn’t a cheap endeavor. It requires massive, expensive infrastructure to host it. It also requires a critical mass to use it so it becomes profitable.

The entire point of the metaverse is to bring the experience to Meta’s house as opposed to relying on the platforms of its large audience hosts like Apple and Google (not to mention ad competitors in the latter’s case). If Meta can host the user experience, it’s free to target any way it wants from a technological perspective. It would no longer have to rely on third-party signals to create a return for its advertisers (customers). The problem is moving people to its platform and doing so relatively quickly as the hits to ad revenue keep coming.

The expense of the metaverse build-out has no guarantees. It’s not like Microsoft (MSFT), with a sure business providing AI infrastructure to OpenAI (ChatGPT) and other up-and-coming useful AI products. This is why Meta investors do not appreciate its massive spending during this struggling time. Management has not proven there’s something investable regarding the metaverse; it’s an unproven path.

So Mark and team are stuck between a rock and a hard place. They must move forward to a new platform business model but not spend themselves into the ground in the meantime. Therefore, on Wednesday, I’m looking for the company to show its managing expenses well while providing a path forward. The Q4 report may be more of the same as Q3, with poor revenue growth and exceedingly high expenses, but it’s going to be about Q1’s guidance and if the trend will reverse.

If the trend reverses, the market may begin to load up on the stock in anticipation of better fiscal management. With headcount reductions already in place and other spending constraints outlined, management just needs to follow through with the numbers.

Stop The Bleeding In The Ad Business

Here’s where spending on infrastructure and AI is more tangible and welcomed by investors. Management has been careful to show how it’s investing in AI to strengthen the targeting capabilities of its ad business in the face of the iOS headwinds.

First, we are significantly expanding our AI capacity…we expect these investments to provide us a technology advantage and unlock meaningful improvements across many of our key initiatives, including Feed, Reels and Ads.

– David Wehner, CFO, Q3 Earnings Call

While moving to the next-generation medium of interaction (vis-a-vis the metaverse, or what comes of it) is essential, the company can’t let the current platforms the ad business is built on go to the wayside. And it’s not like this advancement in AI ad technology will go to waste with the transition to the next medium.

This is what investors can get behind and will if the company can prove it’s making headway to reverse revenue growth declines and making inroads against the headwinds iOS – and soon-to-be Android – privacy changes are creating. But the numbers need to speak for themselves. Seeing internal returns on AI is one thing, but seeing the slide in revenue growth halt and reverse while operating expenses get reined in is another.

I’m looking for evidence management is finding traction in the AI department and has begun shifting more of its products to rely on AI on the earnings call. This would present itself as an improving revenue growth outlook outside of forex headwinds and a better alignment of OpEx to the current environment. The latter is important because the metaverse investments aren’t going to produce fruit in 2023, but AI-infused Feed and Ad products will. These two initiatives need to be kept on a tightrope to not disappoint investors but still have a long-term path forward.

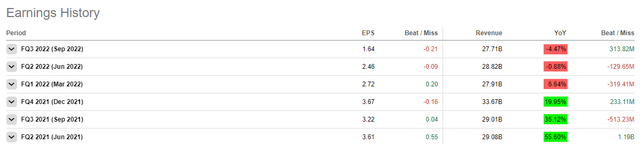

I will also be looking for why revenue growth is shaping up. FQ1 is the first quarter with an easy comp for the prior year. It’s when revenue growth began shrinking considerably, going from 20% to 6.6% from one quarter to the next.

Color coding mine (Seeking Alpha)

Easy comps need to be looked past to see where revenue growth originates. Instead, look for stronger ad impression numbers and a slowing price per ad deterioration compared to Q3. These are organic signs the revenue-generating products are turning around, and AI is incrementally returning ROI for advertisers.

Mark Needs To Remember His Position

In times past, Mark and his team have worked from a position of strength, having the best ad product on the market with the best results. But, unfortunately, his company in 2023 is working from a position of weakness, far from the strength it exuded before iOS privacy change. He needs to keep this in mind, as investors will not take kindly to any more expense jukes or changes to the game plan.

The bottom line is Meta’s management needs to find a more efficient way to invest in the metaverse to get themselves aligned with future mediums while regaining a footing in the business that brought them to where they are today. It’s as simple as Zuckerberg getting that message across and showing the company’s actions are aligned. If he shows progress on the ad business returning and metaverse expenses being kept in check but working forward, all will be smooth in the land of Mark.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Decrypt The Cash In Tech With Tech Cache

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Second, become one of my subscribers risk-free with a free trial, where you’ll be able to hear my thoughts as events unfold instead of reading my public articles weeks later only containing a subset of information. In fact, I provide four times more content (earnings, best ideas, etc.) each month than what you read for free here. Plus, you’ll get ongoing discussions among intelligent investors and traders in my chat room.