Netflix: Recovery Is On Track But This Is Largely Reflected In The Share Price

Summary:

- Netflix still has significant potential for long-term growth. The latest actions by management (introducing an ad-based tier and cracking down on password sharing) should prove revenue accretive in the medium term, in my view.

- Subscribers’ growth was strong and broad-based in 4Q2022. UCAN and EMEA returned to posting meaningful growth, which likely indicates that the ad-based tier is showing early signs of success.

- F/X has been a key headwind for Netflix in FY2022, especially since 55% of the company’s streaming revenue is now generated from international markets.

- The rally in the share price is justified but most likely all the good news has been priced in.

Editor’s note: Seeking Alpha is proud to welcome SMR Finance as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

stockcam

Investment thesis

Netflix (NASDAQ:NFLX) is on the right path again. The company added 7.66 million subscribers in 4Q2022 signaling that the slump in subscribers in 1H2022 is now behind us. Netflix remains the clear leader in the streaming business despite the intensifying competition in the sector. The company continues to prove its ability to expand its content slate with attractive offerings which should keep its value proposition intact. Moreover, the new steps that management made (introducing an ad-based tier and the rollout of a program to crack down on password sharing) should prove to be revenue accretive over the next couple of years. However, the share price has been on a sharp rise, increasing by 22.3% on a YTD basis. The stock now trades at a 2-year forward P/E of 23x, which shows that valuation largely reflects low-teen growth in revenue and a 300 bps expansion in net profit margin. Unless I see more reasons for revenue to grow in the high teens (or above), my current recommendation for Netflix is a Hold.

A return to growth in subscribers

Netflix has successfully returned to posting positive growth in subscribers in the second half of 2022. The company had seen a massive increase in subscribers in the early part of the pandemic but was not able to build on that momentum. In the first half of 2022, the subscribers base decreased sparking panic among investors that the company’s growth days are over due to the increased competition in the streaming market.

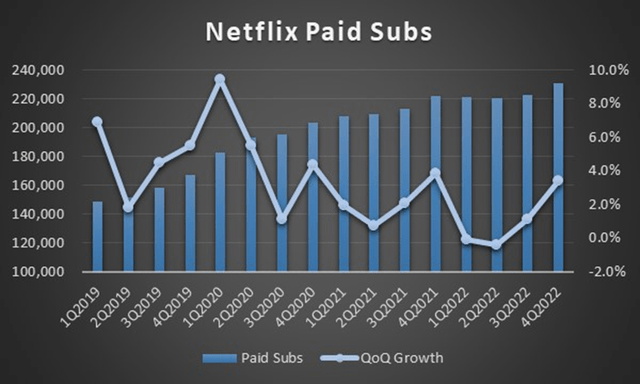

Figure 1: Total Paid Subs – On the Rise Again

Calculated by Author using data from the company

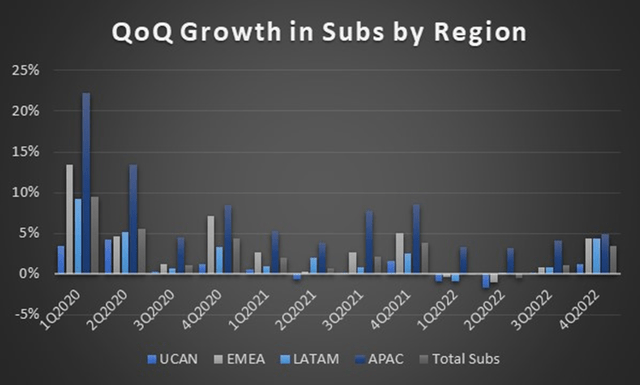

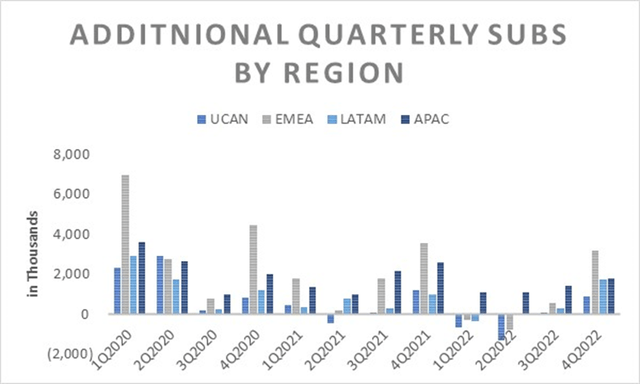

What I like about Netflix’s 4Q2022 results is that the growth in subs resumed across all markets. The United States and Canada (UCAN) region, which is the company’s most mature market, had been struggling to grow subscribers. Over the last two years, UCAN struggled to post any meaningful growth and had 5 quarters where growth was either zero or negative in that period. This is why I am delighted to see UCAN posting a 1.1% growth in subs in 4Q2022. Europe, the Middle East & Africa (EMEA) also registered a strong recovery in the quarter by posting 4.3% growth in subs.

Figure 2: Subs by Region – All Regions Are Rising

Calculated by Author using data from the company

Figure 3: EMEA, Largest Contributor to Additional Subs in 4Q2022

Calculated by Author using data from the company

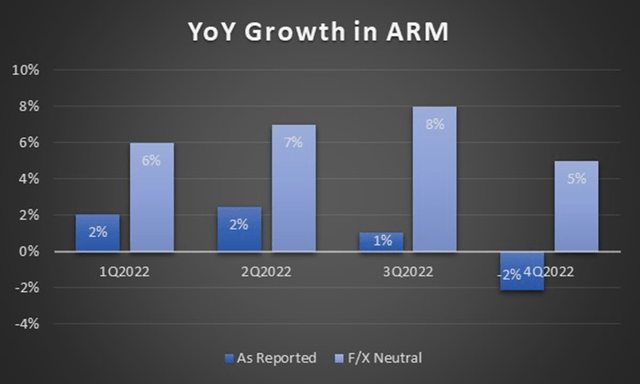

Stronger USD causes ARM to decline

Netflix posted a decline of 2% YoY in Average Revenue per Membership (ARM) in 4Q2022. However, adjusted for F/X movements, the F/X neutral ARM shows an increase of 5% YoY in 4Q2022. The stronger USD has been a major headwind for Netflix in 2022, as 55% of Netflix’s streaming revenue now comes from international markets. I believe it is very important to look at the F/X neutral ARM to assess pricing power and I do not see any reason to be concerned about that.

Figure 4: ARM – Negatively Impacted by a Strong USD

Calculated by Author using data from the company

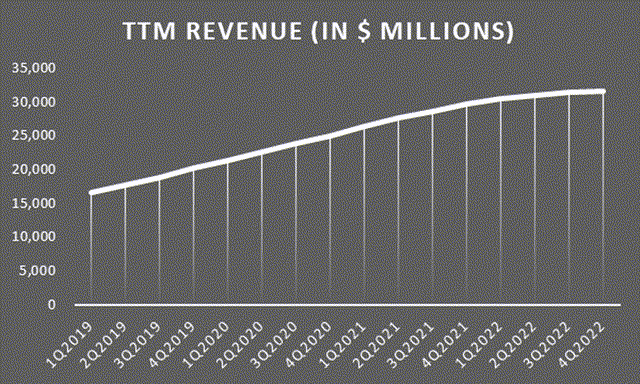

Factors that led to revenue slowdown are abating

Revenue for Netflix increased by just 6% in FY 2022 to reach $31.6 billion. This only 6% increase in the top line, which is considered a snail pace for the stock, was due to the F/X pressure and slowdown in subscribers’ growth. I expect that the actions that management is taking (introducing an ad-based tier and a rollout of a program to crack down on password sharing) could become key growth drivers (along with the ever-improving content slate). This is why I believe that the stock can comfortably achieve management’s targets of growing revenue in the low teens.

Figure 5: Revenue Growth

Calculated by Author using data from the company

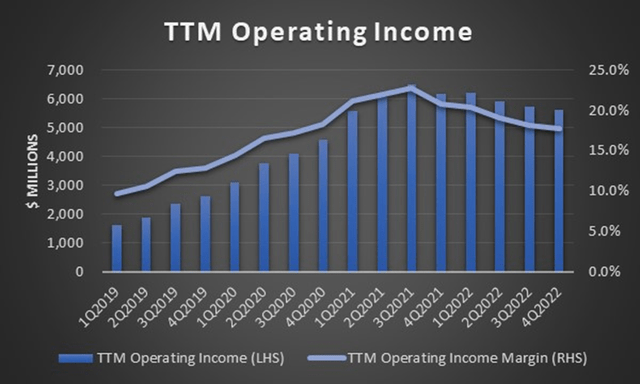

Operating profit margin has scope to expand due to operating leverage

Netflix achieved an operating profit margin of 17.8% in FY 2022. Moving forward, management is guiding for 100-200 bps expansion in the operating profit margin for FY 2023 due to the inherent operating leverage in the business. This is an important area to monitor for the company, as this is what leads to an improvement in FCF generation.

Figure 6: Operating Income Margin

Calculated by Author using data from the company

Short-term risks remain high due to the complexity of management’s actions

I believe the key risks for the stock come from rising expectations by investors, especially those heavily focused on growth in subscribers. It is very likely that the crackdown on password sharing could have some early negative repercussions, something management alluded to in their Q4 2022 earnings presentation. This could lead to some churn for a quarter or two. Also, it is likely the ad-based tier could lead to subscribers downgrading to the cheaper plans and we do not know yet if the revenue generated from ads will be able to fully offset the lost revenue. Overall, I believe that these risks are of a short-term nature and should not hinder the medium-term outlook for the stock.

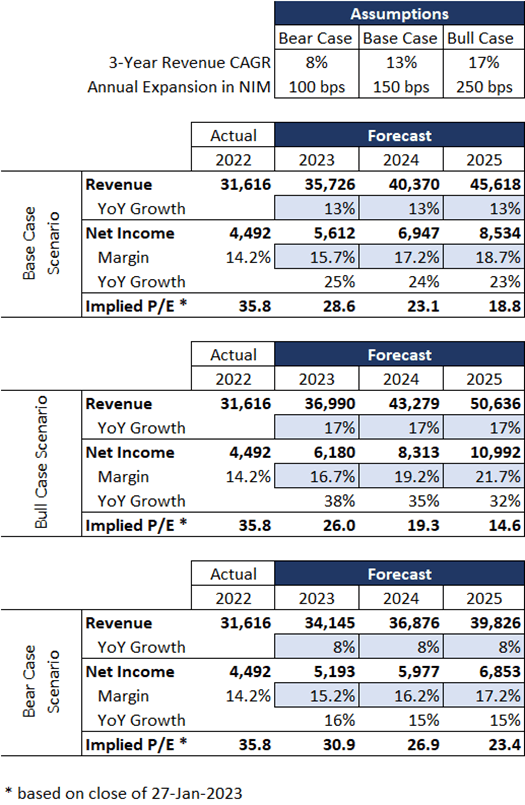

3-Year Outlook and Valuation

I formulated three scenarios for Netflix, where the base case largely reflects the guidance from management. For the base case, I modeled a 13% compound annual growth rate (CAGR) for the next three years combined with a 150 bps expansion in net income margin (I am assuming that the expansion in the operating profit margin will flow to the bottom line). In addition, I modeled two additional scenarios-a bull case and a bear case.

I calculated the implied P/E ratio for each scenario (Figure 7 below) and I believe that the stock price has already risen to reflect the base case outlook. I believe that the market is now expecting Netflix to return to high-teens growth in the top line. This is not farfetched but requires almost perfect execution on behalf of Netflix in terms of the new actions that management is taking. I would not bet against this company but I would want to see more evidence of sustained growth to subscribe (pun intended) to the bull case outlook.

Figure7: Outlook and P/E Ratio Under Different Scenarios

Calculated by Author using data from the company

Final Thoughts

Netflix managed to post impressive results in 4Q2022 which put behind the slowdown it was experiencing in H1 2022. Moreover, there are enough reasons to expect that this recovery will have legs that can lead to growth in revenue and an expansion in margins. There is some concern about churn in the short term as the company takes measures to put an end to password sharing; however, this should prove to be temporary. I believe that the YTD rally in share price has been justified and the share price seems fairly valued. I recommend holding on to the stock as there is scope for upward surprises in terms of growth in the coming quarters.

Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.