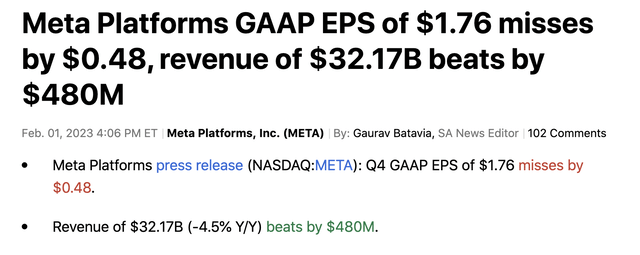

Summary:

- Meta Platforms, Inc. reported a surprisingly upbeat quarter with Q4 2022 numbers surging past estimates.

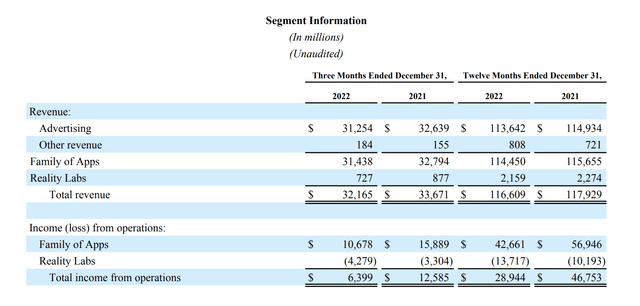

- The social media company continues to heal by reining in wild expense growth, though Reality Labs still lost $4.2 billion in the quarter.

- The tech giant trades closer to ~15x updated ’23 EPS targets with eventual upside from reductions in Reality Labs spending.

Justin Sullivan

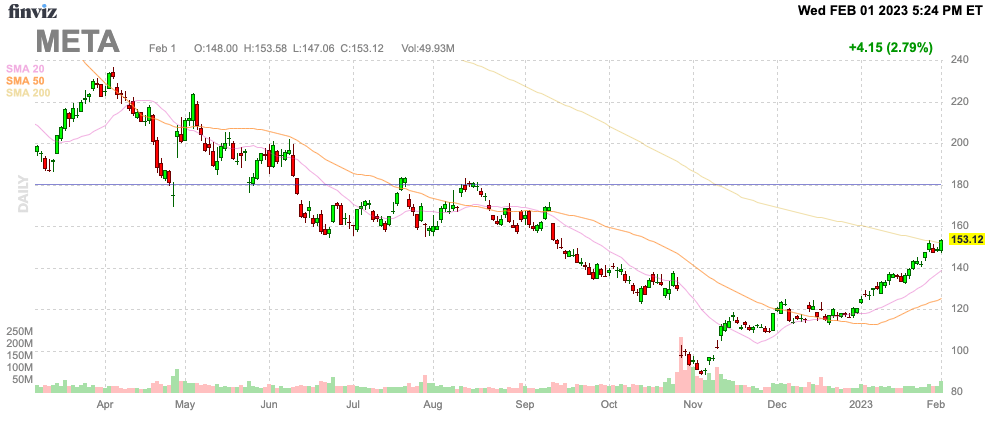

After the close, Meta Platforms, Inc. (NASDAQ:META) shocked the market with a big revenue beat and more cuts to spending. The social media giant continues to build the business, leading to META stock rocketing off the lows. My investment thesis remains very Bullish on the stock despite the nearly 100% jump off the lows since just November.

Source: Finviz

Better Than Feared

The Q4 2022 results can quickly be summed up as better than feared, especially after Snap Inc. (SNAP) fell over 10% following weak guidance for Q1’23. The market generally missed that the smaller social messaging company had internal issues, leading to a large part of the ad revenue hit in the March quarter.

Similar to Snap, Meta Platforms reported an increase in users. The Facebook and Instagram owner reported family daily active people (“DAP”) reached 2.96 billion in the quarter, up from 2.82 billion in prior year Q4. The company grew DAPs by 5% YoY, with even the old Facebook platform growing DAUs by 4%.

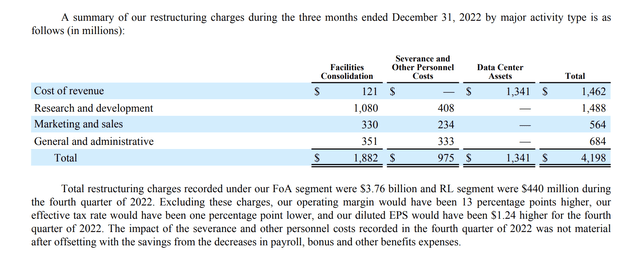

The tech giant has a major growth driver when users provide a 5% tailwind. In this regard, revenues beat analyst targets by $480 million. The GAAP EPS number technically missed analyst targets by $0.48, but this amount includes a massive charge of $4.2 billion for the workforce reduction and facility consolidation strategy.

As Meta Platforms, Inc. reported, these $4.2 billion in charges impacted Q4 2022 EPS by $1.24. Meta Platforms would’ve earned $3.00 per share when excluding the numbers, blowing past the analyst targets of only $2.24.

Source: Meta Platforms Q4’22 earnings release

As highlighted in past research on tech stocks, the market makes a huge mistake focusing on GAAP earnings considering the non-cash charges. Meta Platforms, Inc. stock has surged over 19% in after-hours due to the market focus on the solid revenues and the non-GAAP EPS focus.

The Q1’23 revenue guidance is inline with analyst targets around $26.75 billion at the midpoint. The market is probably more focused on the upside revenue target of $28.5 billion following the Q4’22 revenue beat by $0.5 billion.

Healing Self-Inflicted Wounds

Even with the announcement of job cuts and signs of reduced spending, Meta Platforms still managed to lose an escalating amount in their VR division. Reality Labs lost an amazing $4.3 billion in Q4 2022 alone, pushing up the annualized loss rate to an insane $17.2 billion.

Source: Meta Platforms Q4’22 earnings release

The tech giant will start healing via lowering the absurd expense growth expectations in 2023. Management guided 2023 expense targets for the year down ~$5 billion to a range of $89 to $95 billion, with a midpoint at $92 billion from a prior target of $94 to $100 billion.

Meta spent $25.8 billion on total expenses during Q4, though only $21.6 billion after stripping out the $4.2 billion in charges. The company had a normalized annual run rate at ~$86 billion for the year. In essence, Meta Platforms, Inc. is now guiding to minimal expense growth during the year, with the new quarterly total expense target of only $23 billion.

As highlighted in past research, the expense growth guidance comes mostly from higher cost of sales due to growth and the focus on a new VR headset, which comes with an increase in cost of sales. With the 11,000 employee reduction at the end of the year, Meta Platforms has reduced all of the true expectations for growth in operating expenses.

META stock is soaring due primarily to the focus back onto generating profits and strong cash flows to repurchase shares versus wild spending. After all, the Metaverse division only produced $0.7 billion in quarterly revenues, for a YoY decline.

Analysts were targeting a 2023 EPS of $8 and a big EPS beat in Q4, along with reduced expense growth, leading to the possible major upside to EPS targets. The Q4 beat alone pushes the EPS up to nearly $10 for 2022, and similar upside to expectations pushes the 2023 EPS target closer to $12. Don’t forget, Meta earned nearly $14 per share back in 2021.

Even at $180, Meta Platforms only trades at ~15x more reasonable EPS targets for 2023. Once one considers the $17+ billion of ongoing losses in Reality Labs (could grow), the tech giant could add back ~$5 in annual EPS by wiping out this large loss via either revenue growth or eventually cutting costs.

Takeaway

The key investor takeaway is that Meta Platforms, Inc. isn’t actually expensive after doubling in the last few months. The stock even has more upside from reining in costs in the future in the Reality Labs division in the scenario where revenues don’t rebound.

Investors shouldn’t chase Meta Platforms, Inc. stock with strong resistance at $180 where the stock is trading in after hours, though Meta can still be bought on weakness.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.