Summary:

- Exxon Mobil delivered record results for earnings, operating, and free cash flows in FY 2022.

- Exxon Mobil’s Q4’22 dividend raise was a disappointment considering the firm’s free cash flow prowess.

- Shares are more likely to go down than up.

JHVEPhoto

Exxon Mobil (NYSE:XOM) released a strong earnings sheet for Q4’22 which showed unprecedented profitability for the largest American oil major. Exxon Mobil’s operations generated $55.7B in earnings, $76.8B in operating cash flow and $62.1B in free cash flow, which were records for the company as well as for the industry. However, I continue to believe that Exxon Mobil is making a capital allocation mistake by following through with aggressive stock buybacks at the currently inflated valuation. Exxon Mobil also increased its fourth-quarter dividend by only 3.4% which, considering the amount of free cash flow Exxon Mobil is generating right now, was a disappointment. Because I believe we have already seen the peak in petroleum markets, I don’t believe Exxon Mobil’s record results are a reason to buy the stock!

Petroleum prices are consolidating

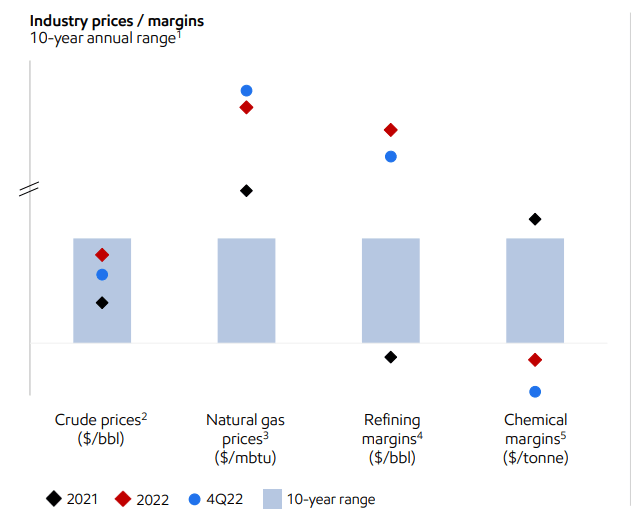

Petroleum prices have fallen from more than $130 a barrel almost a year ago to $80 a barrel today. Although Exxon Mobil generated record earnings and cash flow in FY 2022, the company’s Q4’22 summary shows that free cash flow has started to decline rapidly in the second half of the year. Exxon Mobil’s record earnings and free cash flow have occurred due to market tailwinds — chiefly energy supply fears related to the war in Ukraine — which has pushed petroleum and natural gas prices way outside of their historical ranges.

Source: Exxon Mobil

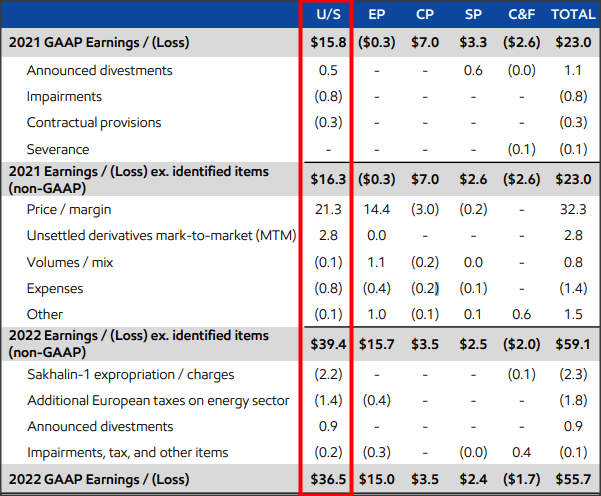

The result of this strong pricing environment has been a surge in earnings for Exxon Mobil’s production business. This segment posted a 131% year over year increase in earnings in FY 2022, primarily due to price/margins effects. In total, Exxon Mobil generated $55.7B in profits in FY 2022, 142% more than in the year-earlier period.

Source: Exxon Mobil

Free cash flow

Exxon Mobil generated an insane amount of free cash flow in the fourth-quarter. In Q4’22, Exxon Mobil generated $12.3B in free cash flow, but the company’s quarterly FCF was $9.7B below its Q3’22 free cash flow and $4.6B below Exxon Mobil’s Q2’22 free cash flow. For me, this trend strongly indicates that Exxon Mobil’s free cash flow peaked in the middle of FY 2022.

|

FY 2022 |

FY 2021 |

||||

|

$B |

Quarter 4 |

Quarter 3 |

Quarter 2 |

Quarter 1 |

Quarter 4 |

|

Cash Flow from Operating Activities |

$17.6 |

$24.4 |

$20.0 |

$14.8 |

$17.1 |

|

Proceeds from Asset Sales |

$1.4 |

$2.7 |

$0.9 |

$0.3 |

$2.6 |

|

Cash Flow from Operations and Asset Sales |

$19.0 |

$27.1 |

$20.9 |

$15.1 |

$19.7 |

|

PP&E Adds / Investments & Advances |

($6.7) |

($5.1) |

($4.0) |

($4.3) |

($4.6) |

|

Free Cash Flow |

$12.3 |

$22.0 |

$16.9 |

$10.8 |

$15.1 |

(Source: Author)

A good portion of this free cash flow is set to get returned to shareholders as stock buybacks which I continue to believe is a mistake. Exxon Mobil announced a $50B stock buyback due to record free cash flow in FY 2022, but buying back stock now means Exxon Mobil is buying near all-time highs. It would have been much better for shareholders, in my opinion, if the company announced a stronger increase in its Q4’22 dividend. Exxon Mobil grew its dividend by only 3.4% in the fourth-quarter although the company could have afforded a much stronger raise. A dividend raise is permanent which has higher value for dividend investors while stock buybacks only occur once.

Exxon Mobil’s valuation

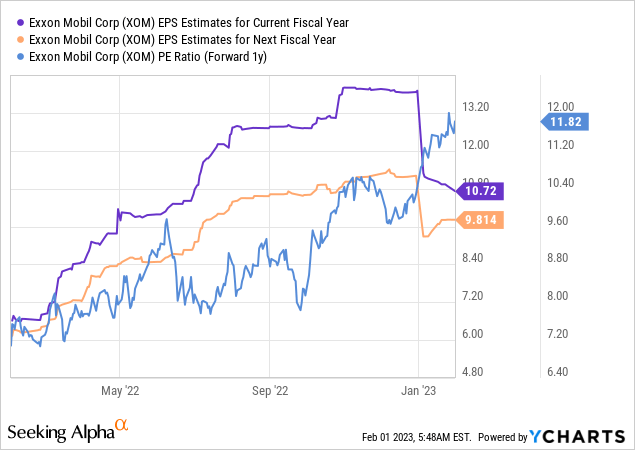

Consensus EPS expectations for FY 2023 show that analysts agree that Exxon Mobil is set for a down-year in earnings and free cash flow. Exxon Mobil is expected to generate EPS of $10.72 in FY 2023, implying a 24% decline year over year. Considering that Exxon Mobil’s earnings and petroleum prices are currently inflated, in my opinion, I believe that it is more likely for Exxon Mobil’s earnings to decline than grow materially from here. Based off of earnings, Exxon Mobil has a P/E ratio of 11.8 X which seems low, but a down-grade in EPS estimates is going to lead to a reset of Exxon Mobil’s P/E ratio to the up-side.

Risks with Exxon Mobil

There is a risk that petroleum and natural gas prices will continue to decline, putting downward pressure on Exxon Mobil’s earnings and free cash flow. Given Exxon Mobil’s record profitability in FY 2022, I believe weaker pricing for petroleum and natural gas are the two biggest risks for Exxon Mobil. On the other hand, a reopening of the Chinese economy could be supportive of petroleum and natural gas pricing. I consider this probability to be very low, however, and continue to believe that the risk profile is skewed to the downside for shares of Exxon Mobil.

Final thoughts

Exxon Mobil expectedly delivered record results regarding earnings, operating cash flow and free cash flow in FY 2022, but that should not be a reason for investors to buy into the oil major at this point.

Exxon Mobil’s profitability is way above the historical norm which makes it likely that the oil major is going to see a normalization in its earnings and free cash flow picture in FY 2023. I don’t believe that Exxon Mobil’s shares are attractively valued right now, given the earnings inflation the company has seen last year. Despite record profitability, I believe Exxon Mobil does not have much gas left in the tank to revalue to the up-side!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.