Summary:

- Meta stock surges as much as 20%, after the company reported Q4 2022 results.

- Although YoY revenue growth in Q4 2022 was negative 4%, the social media giant’s topline beat analyst consensus estimates by about $475 million.

- Absent restructuring charges, Meta’s adjusted EPS would have been $3.

- With Meta dedicating 2023 to ‘a year of efficiency’, I argue the company has lots of room to expand profitability in 2023 vs 2022.

- I update my EPS expectations for Meta. And I now calculate a fair implied share price of $254.56/share.

Justin Sullivan/Getty Images News

Thesis

Following the Q3 crash, I was a strong advocate of buying the dip in Meta Platforms (NASDAQ:META). And reflecting on the social media giant’s Q4 quarter, paired with a close to 100% price appreciation since the November 2022 valuation lows, my optimism proved correct–so far. With Meta dedicating 2023 to ‘a year of efficiency‘, I argue the company has lots of room to shift market sentiment away from the negative narrative surrounding the firms’ Reality Labs investments. In my opinion, Meta is committed to prove to investors that the social media giant remains a highly innovative, highly profitable technology giant. Reiterate ‘Buy’ rating; and raise target price to $254.56/ share.

For reference, Meta stock continues to be a strong relative underperformer: accounting for the latest 20% share appreciation (pre market), META stock is still down approximately 25% for the past twelve months, as compared to a loss of less than 10% for the S&P 500 (SPY).

Meta’s Q4 Results

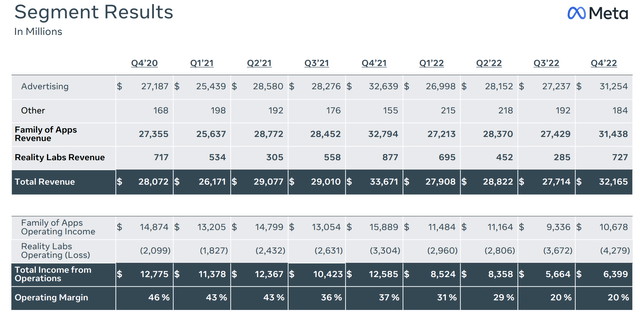

As compared to analyst consensus estimates, Meta’s Q4 results were mixed. During the December quarter, Meta generated total group revenues of approximately $32.17 billion, which reflects a year over year contraction versus the same period in 2021 of close to 4%. Although the negative growth is certainly disappointing, the social media giant’s topline beat analyst consensus estimates by about $475 million, according to data collected by Refinitiv. Moreover, absent any FX headwinds, revenues would have been $2.01 billion higher, reflecting an implied year over year expansion of 2%. For the FY 2022, Meta recorded $116.61 billion of revenues, an increase of about 1% as compared to 2021.

With regards to profitability, Meta continues to stumble. For Q4 2022, the firm’s operating income fell to $6.4 billion, which is about only half the level achieved in 2021 (operating income margin in Q4 2022 was 20%, as compared to 37% in Q4 2021). Adjusted EPS was recorded a $1.76, missing analyst estimates by 47 cents. However, it is worth pointing out that the net income in Q4 2022 includes $4.20 billion of restructuring charges. Excluding these costs, Meta’s adjusted EPS would have been $1.24 higher.

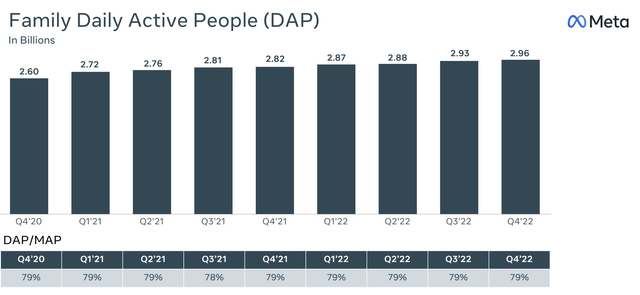

While financials are important, it is also worth noting that Meta’s social media network continues to grow and defend strong user engagement. In Q4 2022, daily active people (DAP) for the firms’ Family of Apps reached 2.96 billion, an increase of 5% year over year. Moreover, engagement remained at an all time record, with DAP/MAP still at 79%. CEO Mark Zuckerberg commented:

Our community continues to grow and I’m pleased with the strong engagement across our apps. Facebook just reached the milestone of 2 billion daily actives

Investors will likely appreciate that Meta repurchased $6.91 billion and $27.93 billion worth of stock in Q4 2022 and FY 2022 respectively. And in addition to the still outstanding $10.87 billion of authorized repurchases, Meta added a new $40 billion share repurchase program.

2023, A Year Of Efficiency

While Meta is certainly going to continue innovating in 2023, investors will surely cheer Zuckerberg’s commentary that the social media giant will dedicate 2023 to a ‘Year of Efficiency’:

The progress we’re making on our AI discovery engine and Reels are major drivers of this. Beyond this, our management theme for 2023 is the ‘Year of Efficiency’ and we’re focused on becoming a stronger and more nimble organization.

In the conference call with analysts, Zuckerberg commented that:

We’re working on flattening our org structure and removing some layers of middle management to make decisions faster, as well as deploying AI tools to help our engineers be more productive …

adding that

… [in addition to layoffs and real estate footprint reduction] There’s going to be some more that we can do to improve our productivity, speed and cost structure.

2022 was a challenging year. But I think we ended up having made good progress on our main priorities and setting ourselves up to deliver better results this year, as long as we keep pushing on efficiency.

That said, Meta now expects FY 2023 total expenses to fall somewhere in the range of $89-95 billion, which is about $5 billion lower than what has been guided in Q3. While the company has not given FY 2023 estimates, for Q1 2023, Meta expects revenues to fall between $26-28.5 billion. Notably, Meta’s Q1 2023 guidance also considers a 2% FX headwind as compared to Q1 2022.

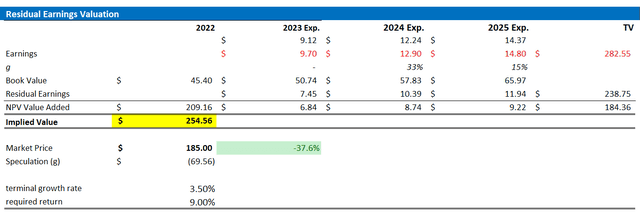

Target Price: Raise To $254.56

Reflecting on more cost discipline in 2023 vs 2022, I estimate that META’s EPS in 2023 will likely fall somewhere between $9.5 and $9.9. Moreover, I also update my EPS expectations for 2024 and 2025, to $12.9 and 14.8, respectively.

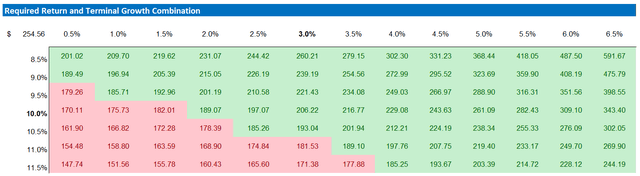

I continue to anchor on a 3.5% terminal growth rate (one percentage point higher than estimated nominal global GDP growth), as well as on a 9% cost of equity.

Given the EPS updates as highlighted below, I now calculate a fair implied share price of $254.56.

Below is also the updated sensitivity table.

Conclusion

Meta stock surges as much as 20%, after the company reported Q4 2022 results. And the market reacted reasonable, in my opinion. With Meta promising to investors a ‘Year of Efficiency’ the social media giant appears committed to prove to investors that the firm can remain highly profitable, while innovating and working on the next technology revolution — AI and the metaverse. Personally, given more cost discipline in 2023 versus 2022, I update my EPS expectations for Meta. And I now calculate a fair implied share price of $254.56/ share.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: not financial advise