Summary:

- The best deals are made in the moments of maximum pessimism and it is probably too late now.

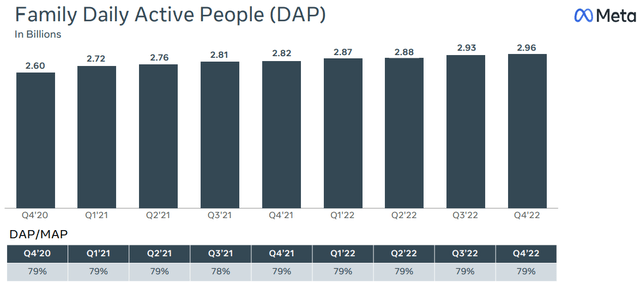

- The number of people connecting to one of Meta’s apps every day continues to grow inexorably.

- Meta’s buyback is not necessarily positive news.

Kevin Dietsch

It has been a while since my last article on Meta (NASDAQ:META), and since then the price per share has roughly doubled. Several times I pointed out how undervalued Meta was, but today I cannot reiterate the same. Buying at $100 per share or $180-190 is quite different and by now that opportunity has probably faded.

Mr. Market realized that he made a mistake

At the height of pessimism Meta was seen as doomed, and any news was an excuse for the price to fall. Over the course of the months I heard all sorts of criticisms, and the most popular were:

- Facebook is a dead social network and no one uses it anymore.

- Meta is spending all its money in the Metaverse, an unworkable and useless concept.

- TikTok is taking over and Instagram is not growing like it used to.

- CapEx is unsustainable and free cash flow has suffered permanent damage.

- The core business is in decline and without a future.

These are just a few, but there were many others. Meta basically seemed on the verge of extinction and it had become almost a fashion to go against this company and especially against Mark Zuckerberg’s ideas. In any case, it is well known that the best deals are made when everyone is scared and pessimistic, and at the end of 2022 we were in one of those times. Having reached a low of $88, Meta was discounting a doomsday scenario and it had become difficult for the situation to get any worse. But then, gradually, from that $88 low the market began to see Meta through other eyes, and certainly the sprint of the S&P 500 helped.

In any case, we are not talking about a lifetime ago, but just three months ago. So, what has changed since then as Meta’s price per share has more than doubled? Nothing. The only relevant change has been only the price per share. The company has always been very clear about its medium- to long-term targets, and after the last quarterly report they remain the same.

In my opinion, Mr. Market simply realized over time how absurd it had been to price Meta at $88 per share. The moment of extreme pessimism seems to have passed, and criticism proved to be futile in the face of data that objectively testified that Meta was far from dead.

Users are growing and TikTok will be less and less of a problem

Despite strong optimism after the release of Q4 2022, there were no strong positive changes, or at least nothing that could not have been assumed already from previous quarters.

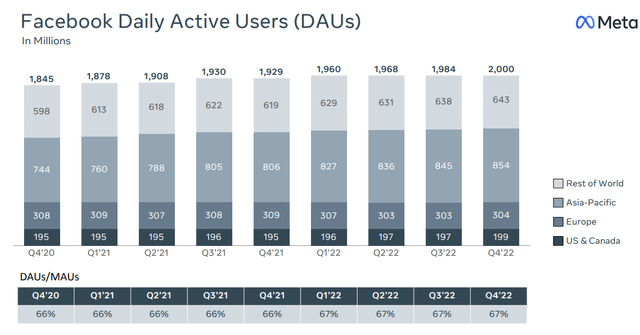

The number of people connecting to one of Meta’s apps every day continues to grow inexorably, chasing away (once again) all the criticism about the impossibility of improving this figure. Also, what can we say about Facebook, the social network that no one uses anymore?

Simply that, for the umpteenth quarter, daily users are increasing more and more and have reached 2 billion. The West may be saturated, but there is still a huge chunk of the population in the East that could potentially sign up for Facebook in the future. India, with 416 million people is the country with the most users, yet this figure represents only 29% of its population. There is still ample room for growth in the East.

Instead, what can we say about the useless Reels that cannot compete with TikTok? Simply that the market is realizing that it has been too shallow.

It is true that Reels still burn money for Meta, but according to Mark Zuckerberg, monetization is getting closer and closer, and most importantly, people want to see more and more of them.

Reels plays across Facebook and Instagram have more than doubled over the last year, while the social component of people resharing Reels has grown even faster and has more than doubled on both apps in just the last 6 months. The next bottleneck that we’re focused on to continue growing Reels is improving monetization efficiency, or the revenue that’s generated per minute of Reels watched. Currently, the monetization efficiency of Reels is much less than feed, so the more that Reels grows, even though it adds engagement to the system overall, it takes some time away from feed and we actually lose money. But people want to see more Reels though, and the key to unlocking that is improving our monetization efficiency so that we can show more Reels without losing increasing amounts of money. We’re making progress here, and our monetization efficiency on Facebook has doubled in the past six months.

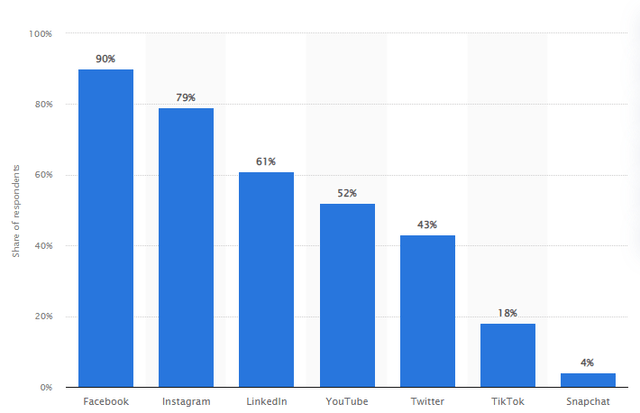

Once it solves the monetization problem and attracts more and more users, I doubt that TikTok can keep up with Meta. Its users may have grown exponentially since the pandemic, but the effectiveness of its advertisements is significantly lower than Meta’s. It is not enough to have 1 billion active users if the business is not profitable.

As we can see from this chart, marketers around the world have no doubt about which platforms are the best for advertising a business. Facebook and Instagram are a certainty, while TikTok has a share of only 18%.

But why is there such a divergence? Simply, TikTok’s ads are not as effective as those of Facebook or Instagram.

The data available to TikTok regarding its users is far less than that of Meta; therefore, the latter is able to develop more targeted and effective ads. Moreover, it should be specified that not only Meta has problems monetizing short videos, but so does TikTok. ByteDance, the company that owns TikTok, reported an operating loss of $7 billion last year, certainly a less than positive result for a company that has more than 1 billion active users. Finally, as if that were not enough, a ban on TikTok is increasingly expected due to national security concerns. I won’t go into too much detail, but certainly at the moment the Chinese video-sharing social media platform is not well regarded. So, tough competition, operating losses and possible ban in my opinion are all good reasons to believe that in the medium to long term Meta can defeat even TikTok. Moreover, Mark Zuckerberg’s words testify that Reels are gaining more and more acceptance.

Regarding this last statement, I would like to end this paragraph with a personal observation. This is not the first time that Meta has “copied” a feature of another social media and placed it within its platforms in order to wipe out the competition. It has happened before, for example, with Snapchat’s Stories, and it is happening again now with the introduction of Reels to eliminate TikTok. This behavior, which may seem “unfair” to some, I believe is the essence of this company’s competitive advantage. As long as you are within the law, anything goes, even integrating on your own platforms what has been successful on others. In the end, what matters is active users and profitability, not the sterile criticisms that are raised every day.

The reason Meta is so successful at doing this is that it takes advantage of the network effect of its platforms, which are used by nearly 3 billion people every day, combined with the fact that the company has been investing billions in its algorithm for years to make ads more and more effective. The habit of connecting to Facebook and Instagram is now rooted in the entire West, and it is almost impossible to oust these two titans. Not even the introduction of a new, more popular social media (Snapchat, TikTok) is a problem for Meta, as it will immediately integrate its unpatentable features and people will eventually be fine with that despite initial complaints. The numbers speak for themselves, and no matter how criticized Mark Zuckerberg’s social networks are, users are growing more and more every year.

What to expect in 2023

2022 was a complex year for Meta, struggling with high CapEx and revenues that were struggling to grow for the first time. The market did not take it well, in fact it punished Meta even more than it should have by plunging the price per share to 2015 levels. In any case, in 2023 Meta’s approach should not be so different from 2022, but there will be a greater focus toward reducing excess expenses.

According to Mark Zuckerberg’s words, this is the ‘year of efficiency,’ or the year in which Meta will try to optimize its operations by reducing expenses as much as possible.

We closed last year with some difficult layoffs and restructuring some teams. When we did this, I said clearly that this was the beginning of our focus on efficiency and not the end.

In my opinion, this choice was almost forced. The current macroeconomic environment disfavors revenue growth for companies whose revenues come from advertising, which is why Alphabet also decided to follow a similar strategy. When revenues are struggling to grow, it is wise to think about reducing expenses to at least try to have an overall positive effect on margins.

Total expenses for 2023 will be between $89-95 billion compared to previous forecasts of $94-100 billion. Meta’s reduction in expenses will be mainly due to the following factors:

- Capital expenditures between $30-33 billion compared to the previous estimate of $34-37 billion due to a new, more efficient architecture of the data center construction. Despite the reduction, these expenses will remain many times higher than previous years and will continue to support mainly the Family of Apps segment.

- Flattening the organizational structure by removing some levels of middle management to make decisions faster. In addition, new AI tools will be implemented that will make engineers more productive.

- Secondary projects that are not getting the desired results will be cut, increasing the focus on primary projects.

Meta has been much criticized in the past year because of the strong negative impact that investments have had on the income statement, so this is a sign that from 2023 the approach will be more conservative than in 2022. This could be the year when the foundations will be laid for a new growth cycle.

Buyback

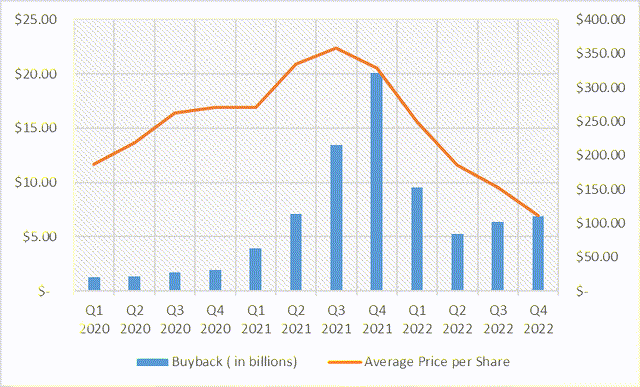

In Q4 2022 Meta surprisingly announced that an additional $40 billion will be added to the $10.90 billion remaining to buy back its own shares. This is a huge amount overall, and given the +25% in the following days it is evident that the market reacted well to this news. With fewer shares outstanding Meta’s EPS could increase, and shareholders will see their ownership share increase. At first glance this seems like positive news, but there is, however, one important aspect that needs to be considered: buyback is not always a positive factor.

Buying back own shares is worthwhile when the company buys them at a favorable price and believes it is the best way to allocate its capital. In recent years, however, Meta has proven to do exactly the opposite.

This chart I created highlights the quarterly buybacks with the average price per share for each quarter, and what we can see is that Meta bought heavily on the highs. Between Q3 2021 and Q4 2021 there was a buyback of almost $35 billion when the price per share was well above $300 per share. By the time the price per share collapsed in 2022, the buybacks had significantly less weight.

So, because of Meta’s mistiming, my doubt is whether we will end up in such a situation again this time since Meta has $50.90 billion available to buy back its own shares at a time when the stock is no longer that undervalued. At $100 per share it was a bargain, but now we are around $180-190. If the upward trend continues the buyback may not be that effective, and this would undermine the main goal of 2023, which is to improve efficiency in order to reduce expenses. Saving a few billion on CapEx may not be that important in the face of a $50 billion misallocation to buy back its own overvalued shares.

The buyback does not change my opinion on Meta, which certainly remains positive, but it is a factor to monitor.

Fair value

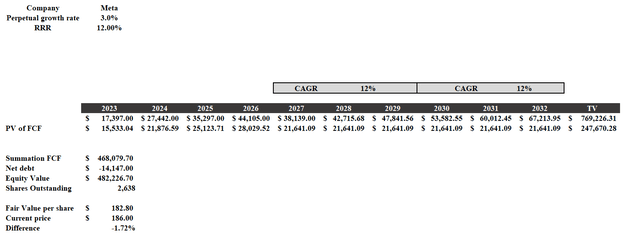

To calculate Meta’s fair value I will use a discounted cash flow which will be constructed as follows:

- Required rate of return of 12% per year. Since Meta is a risky investment I consider it reasonable to require a return higher than the average return of the S&P 500.

- The expected free cash flow from 2023 to 2027 represents an estimate by TIKR Terminal analysts, which I believe is very conservative. Consider that in 2021 Meta generated $39.11 billion of free cash flow in a stable economic scenario and without a huge CapEx. From 2028 to 2032 I included a growth rate of 12% per year.

- The source of net debt and outstanding shares is TIKR Terminal.

According to these assumptions, Meta’s fair value is $182.80 per share if we want a 12% return per year. Currently, the company is therefore properly valued which is why it can no longer be considered a strong buy. In my opinion it remains a buy since at this price it could provide a decent annual return, but we are in a totally different situation than we were a few months/weeks ago. At $100 or less Meta was undoubtedly a bargain, now it might simply be a good investment.

The best deals are made in the moments of maximum pessimism and it is probably too late now. In any case, never take anything for granted in the financial markets. It is unlikely that Meta will hit new lows, but the coming months may surprise us.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Make your own choices, this is just my opinion.