Summary:

- I am generally skeptical of Wall Street ratings to avoid herd thinking.

- This time in the case of Meta Platforms, Wall Street cheered its Q4 earnings report and the “Year of Efficiency.”.

- And I am aligning myself with this opinion, too, as I see its impacts to be long-lasting.

- I see Meta management’s plan as viable to bring its profit margins back to the 30% range.

spxChrome/E+ via Getty Images

Thesis

I am generally skeptical of Wall Street ratings, mostly to avoid herd thinking. In the case of Meta Platforms, Inc. (NASDAQ:META), I think Wall Street has paid too much attention to the short-term fluctuations in its advertising revenue, user growth, and engagement metrics. However, the key to applying any rule is to know when to abandon it. And in the case of its Q4 earnings report (“ER”), Wall Street responded positively. After being battered by a loss of 2/3 of its share prices in 2022, Wall Street cheered the Q4 report, and its share prices went up by ~20% after the ER.

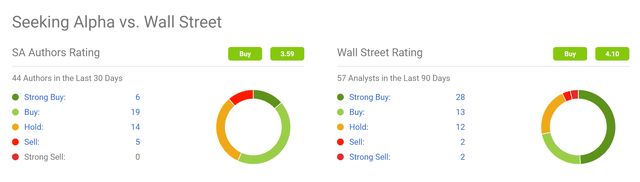

In the meantime, the sentiment seems to diverge between Wall Street and Main Street, as evidenced by the following survey. META is one of the most fiercely debated stocks on Seeking Alpha, with 44 authors having written about it in the past 30 days. Only 6 of these authors recommended a Strong Buy, corresponding to a ratio of roughly 1 in 8. In contrast, Wall Street issued a total of 57 opinions during the same period, with 28 of them rating the stock as a Strong Buy, corresponding to a ratio of almost 1 in 2.

In the remainder of this article, I will explain why I am aligning myself with Wall Street opinions this time. The main reason is that I see Wall Street is cheerful for the right reason this time. Unlike the above-mentioned metrics (e.g., quarterly revenues or user engagement) that are so randomly fluctuating, I see CEO Mark Zuckerberg’s commitment to efficiency and cost control to generate more fundamental and long-lasting impacts.

Zuckerberg’s gradual shift in style

Media outlets have had very differing opinions and perspectives on Zuckerberg and his leadership of META. Some media outlets have criticized him for various reasons, such as the handling of user data and the wasteful spending on futuristic pursuits (such as the Metaverse concept). While others have praised his vision and strategic direction for the company (essentially for the same things that the haters criticized him).

This time, the media seems to both agree on Zuckerberg’s goal for 2023 to be the “Year of Efficiency.” Indeed, his new commitment to cost control and efficiency improvement is a sign that his management style is shifting. Controlling costs and increasing profitability is always important, no matter how visionary the goal is. And this is new commitment is also quite timely. Higher operating expenses were the major reasons for its underperformance in recent quarters in my view.

And next, I will examine his managerial capabilities and make some projections based on the potential impact of his planned cost control and efficiency measures.

Zuckerberg’s managerial challenges and scorecard

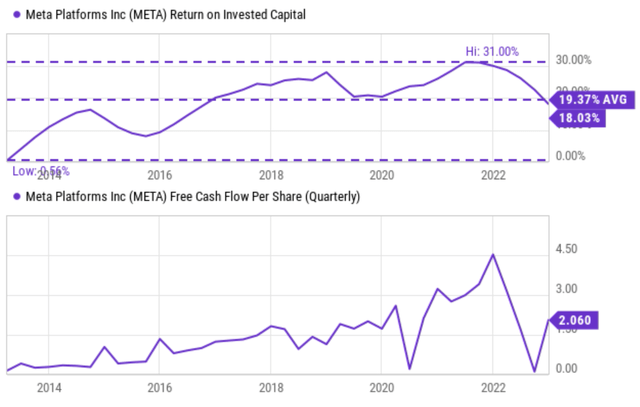

You can get a good feeling of Zuckerberg’s managerial challenges in 2022 and also his scorecard from the chart below in recent years. He has successfully led META to achieve spectacular free cash flow and profitability in the good years till the year 2022. Looking at the top panel, key profit metrics like return on invested capital (“ROIC”) have steadily climbed to a peak near 31%. And its free cash flow (“FCF”) per share on a quarterly basis also set a record high of $4.5 per share at the end of 2021.

Then came the strong headwinds in 2022. To wit, its ROIC plunged to the current level of 18%, slightly below its long-term average of 19.4%, and also its FCF dipped to almost zero in the previous quarter. It has recovered to a positive $2.06 in the most recent quarter, but is still a far cry from its peak level.

In order to form a projection of the potential impacts of the new cost control and efficiency measures, we will need to dive deeper and see what knobs Zuckerberg can turn.

The knobs that Zuckerberg can turn

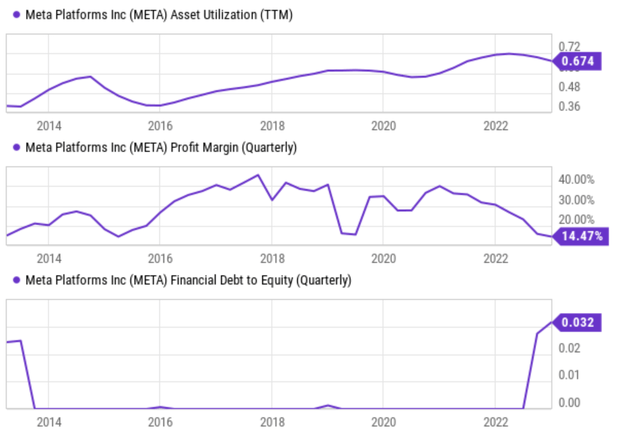

The DuPont theory suggests that CEOs can enhance profitability by adjusting the following three parameters: profit margin (“PM”), asset turnover ratio (ATR, as known as asset utilization rate), and leverage. The product of these three parameters then yields the ultimate profitability (either measured by ROE or ROIC). Of these three parameters, I consider PM and ATR to be the good knobs to turn, and leverage is the bad one to turn, especially over a certain threshold. The three panels in the plot below illustrate how Zuckerberg has been turning, and what he can turn differently in the future, on each of these knobs.

As seen, in the past, Zuckerberg has consistently improved META’s ATR (or asset utilization). Its ATR has improved from ~0.37x in 2015 to the current level of 0.674x, almost at its own peak level. This level is also consistent with other similar peers like Google (GOOG) (whose ATR is also on average around 0.7x in recent years). META’s leverage knob is very simple – it does not use leverage at all, as you can see in the bottom panel. Its financial-to-equity ratio is essentially zero (0.03).

Its recent profitability pressure all came from the 2nd knob: profit margin. As seen, META’s PM has been impressively high before 2022, and hovered near the 40% level from 2017 to 2021. Then the margin dramatically nose-dived to the current level of 14.4%, not only far from its peak but also substantially below its long-term average (about 26%) and also its peers like Google (about 18% in recent years).

As aforementioned, I see the higher operating expenses as the major reasons for this PM underperformance, particularly due to the overexpansion in terms of its headcounts, research and development, and new capital projects. For example, its headcount alone has expanded ~20% year-over-year as of December 31, 2022.

Now looking forward, META has announced the following plan in its ER to address all the above issues. The following statement is quoted from its ER with emphases added by me:

During the quarter ended December 31, 2022, we took several measures to pursue greater efficiency and to realign our business and strategic priorities. This includes a facilities consolidation strategy to sublease, early terminate, or abandon several office buildings under operating leases, a layoff of approximately 11,000 of our employees across the FoA and RL segments, and a pivot towards a next generation data center design, including cancellation of multiple data center projects.

These changes are expected to translate into an EPS improvement of about $1.5 down the road based on my estimates and bring its PM back to the 30% range. It is not as high as its peak of 40%, but robust enough even when compared against the most competitive companies even in the FAAMG group. As commented by management in the ER, these measures would have improved EPS by $1.24 and margin by 13% in Q4 already (again, the emphases were added by me):

Excluding these charges (referring to the restructuring charges mentioned above), our operating margin would have been 13 percentage points higher, our effective tax rate would have been one percentage point lower, and our diluted EPS would have been $1.24 higher for the fourth quarter of 2022. The impact of the severance and other personnel costs recorded in the fourth quarter of 2022 was not material after offsetting with the savings from the decreases in payroll, bonus and other benefits expenses.

Risks and final thoughts

META entails other risks too besides the need to curb its expenses and improve PM.

For example, META faces significant competition from Apple (AAPL) and Google in the digital advertising space. In particular, Apple dramatically disrupted META’s ad conversion rates when it made modifications to its operating system regarding app tracking transparency.

And many of its metaverse initiatives are too futuristic at this point and won’t generate meaningful profit till years later.

To wrap up, I usually do not side with Wall Street to avoid herd thinking. However, in Meta Platforms, Inc.’s case here, my view is aligned with Wall Street’s opinion. At the same time, I see the efficiency improvement plans that Zuckerberg just announced to create long-lasting impacts, in contrast to the quarterly fluctuations that Wall Street ratings typically focus on. It is feasible in my view that these efficient improvement measures can bring it PM back to the 30% range. Combined with its robust asset utilization and zero leverage, I see a company that remains well-positioned in the social media space.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.