Summary:

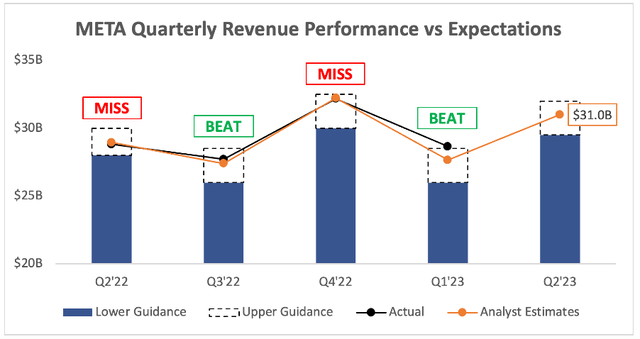

- Meta Platforms is set to report its Q2 2023 results, with analysts expecting revenue of $31.0B, representing YoY growth of ~7.6%, and EPS of $2.89, representing ~17% YoY growth.

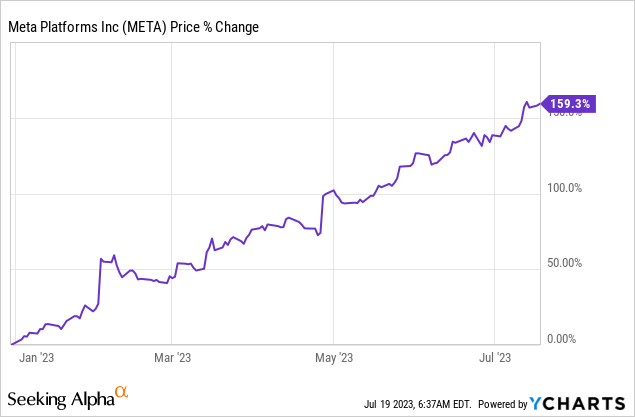

- The company’s shares have risen by 159% in 2023 and are more than 250% up from their 52-week lows, indicating that the stock market is pricing in a very positive business turnaround.

- Despite a positive outlook, Meta share appears to have priced in a lot of success already.

- It would take a stellar Q2 2023 earnings report to reward shareholders, but with the rollout of a new high-margin revenue stream in Meta Verified, a stellar report is not out of the question.

Chip Somodevilla

Investment Thesis

Meta Platforms’ (NASDAQ:META) mission is ‘to give people the power to build community and bring the world closer together’, and whilst the latter is somewhat debatable, the company has certainly changed the way we interact and connect forever.

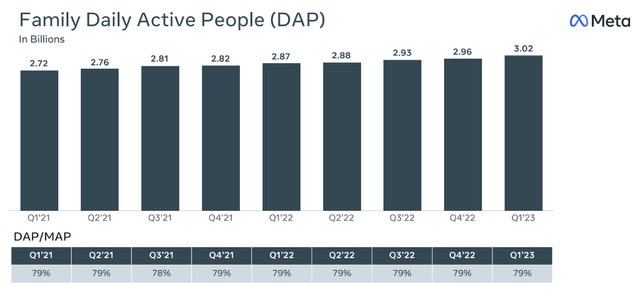

Meta’s core business revolves around its family of four apps: Facebook, Instagram, Messenger, and WhatsApp, which have a combined 3.02 billion daily active people – that is, ~38% of the world’s population use at least one of these apps on a daily basis. The company makes most of its money through advertising right now, with advertisers being able to showcase products across Meta’s Family of Apps to these 3.02 billion pairs of eyeballs.

Meta Q1’23 Earnings Presentation

It’s been a wild couple of years for Meta shareholders, with shares being on a bit of a rollercoaster as the company went from a social media company to a Metaverse company (anyone remember the Metaverse? That thing before AI but after Crypto?), and now I think it’s back to being a social media company that sells a headset every now and again.

This return to a focus on social media has been great news for shareholders so far in 2023, but the stock market is always looking ahead – so with that in mind, what should shareholders be watching out for next week when Meta reports its Q2’23 results?

Meta’s Q2 Earnings: Analysts’ Expectations

Meta is set to report its Q2 2023 results on Wednesday, July 26, after the market closes, and there are plenty of things for investors to look out for.

Starting with the headline numbers, analysts are expecting Q2’23 revenue of $31.0B, representing YoY growth of ~7.6%.

This would be Meta’s strongest quarterly revenue growth in over a year, which is surprising for a company that was consistently growing its revenue by double-digit percentages, but sadly that’s been the story for Meta recently.

Whilst a return to stronger growth is obviously a positive for investors, it is driven more by Meta’s poor performance back in 2022 than it is driven by strong business performance right now.

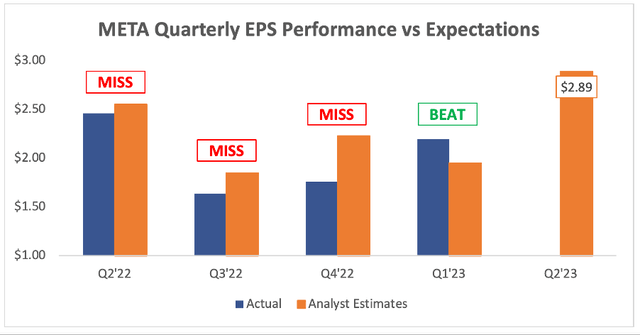

Moving down to the bottom line, and Meta is expected to deliver an EPS of $2.89, representing ~17% YoY growth.

The improving bottom line shouldn’t be a surprise, as Meta has shifted its focus away from the loss-making Reality Labs (aka Metaverse) segment and instead focused on making 2023 the Year of Efficiency – words that were guaranteed to excite Wall Street Analysts.

A beat on the top and bottom line in Q1’23 signalled the start of a turnaround in Meta’s fortunes, and we can see this improvement in the underlying business as well.

A Business Turnaround Is Underway

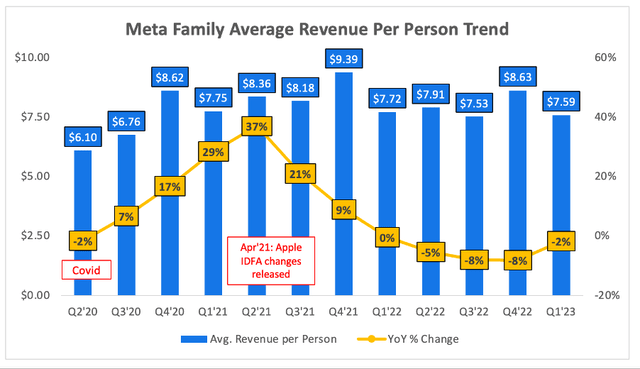

It’s no secret that Meta appeared to lose its way in 2021 and 2022, with a whole host of factors such as diving headfirst into the loss-making Metaverse or seeing a substantial negative impact on its existing business from Apple’s (AAPL) privacy changes. As CFO Dave Wehner said in the Q4’21 earnings call, the iOS changes were expected to be a $10 billion headwind in 2022 – ouch.

This scenario certainly played out, resulting in a pretty terrible year for Meta’s core Family of Apps segment.

Meta’s average revenue per person growth has been falling dramatically since Apple’s IDFA changes, but investors now believe the worst is over – and they may be right. The above chart shows that Q1’23 was the first time in almost two years that Meta’s ARPP YoY % change was better than the previous quarter. It was still a 2% decline, but shareholders will be hoping that this marks a new trend in improving ARPP as Meta shifts its focus back to its core business and continues to figure out how to improve monetisation.

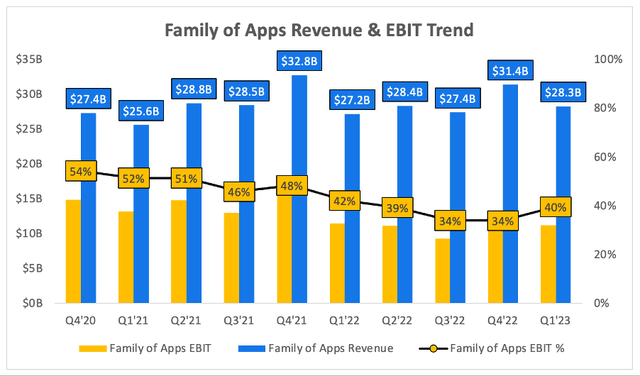

Q1’23 also appeared to be a turnaround for Meta’s Family of Apps operating income. From Q4’20 through to Q4’22, Meta saw its FoA operating margins plummet from 54% to 34% in just two years – whatever way you look at it, that’s a dire trend for a business.

However, it appeared to be Q1’23 to the rescue once again, as Zuck’s Year of Efficiency kicked in and Meta saw its FoA EBIT margins improve to 40%.

It’s clear that Q1’23 showed positive signs of a turnaround for Meta investors, and I would expect the company’s earnings next week to continue in a similar fashion, however, there is one small problem.

The Share Price Turnaround Has Already Finished

All investors should know that the stock market is a forward-looking mechanism. Even by definition, a company’s share price is supposed to reflect the present value of all future cash flows, so it makes sense that Mr. Market is always trying to predict the future.

The problem for any current or prospective Meta shareholder is that, whilst the business appears to be in the early stages of a turnaround, its shares look to have fully completed their recovery. Shares have risen by ~159% so far in 2023, and are more than 250% up from their 52-week lows.

So clearly the stock market is pricing in a very positive business turnaround, and whilst I understand the optimism, that doesn’t necessarily make Meta’s stock all that attractive right now.

I’m sure there are some of you reading this thinking, “Just because shares have risen by 250% off their recent lows doesn’t automatically mean they’re not undervalued”, and I agree with you! So, let’s quickly take Meta through my valuation model.

Meta Stock Valuation

As with all companies, valuation is tough. I believe that my approach will give me an idea about whether Meta is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

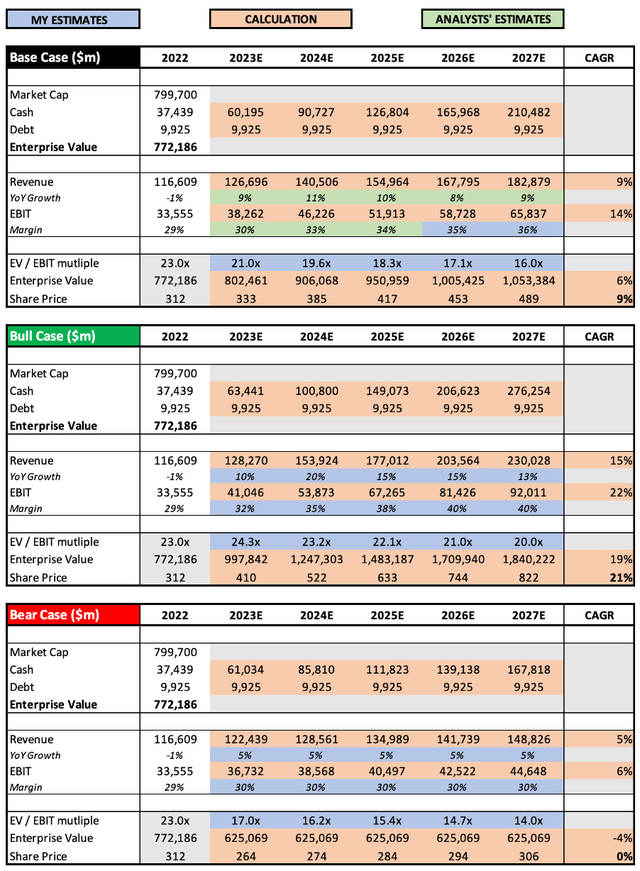

Author’s Work/Seeking Alpha / TIKR

I have updated the approach of my valuation model from my previous article in order to reflect analysts’ estimates more in my base case scenario, since these analysts will have more data to make their estimates on than I could ever dream of. Instead, I use the bull and bear case scenarios to add in more of my personal views and estimates.

In my bull case scenario, I am assuming that Meta can recover its revenue growth rates into the mid-teens, whilst also expanding its EBIT margins back to levels seen prior to 2021. I think this is certainly feasible, especially with the potential that new initiatives like Meta Verified could have on both the top and bottom lines.

My bear case scenario effectively assumes the complete opposite, in that Meta struggles to grow its revenue over the upcoming years, and as a result, margins and shareholders suffer.

Put all that together, and I can see shares of Meta achieving a CAGR through to 2027 of 0%, 9%, and 21% in my respective bear, base, and bull case scenarios.

Bottom Line

Meta shareholders have had a fantastic 8 months, and deserve to enjoy these returns after a rollercoaster couple of years.

Yet Meta remains a business in the midst of a turnaround, despite Mr. Market already deciding that the turnaround is going to be a success and pricing shares accordingly.

In my view, Meta shares do not appear to be too attractive at their current price, and unless the company can produce some stellar Q2 results next week and in the quarters and years that follow, it’s not one that I’ll be adding to my portfolio.

For that reason, I will reiterate my previous ‘Hold’ rating on Meta shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PINS, TTD, U, ROKU, PUBM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.