Summary:

- Meta announced its Q4 earnings, exceeding expectations on the top line by 1.5%, but falling short on the bottom line by 20.8%.

- Following a disappointing Q3 earnings call, Meta appears to have gained insight into and appreciation for the needs and desires of its investors.

- The key highlights from the announcement included an increase in share buybacks, reductions in capital expenditures, and a lowered outlook for operating expenses.

- Due to a 50% surge in its stock price since our last report and an updated valuation, we have adjusted our position in META towards an index.

Leon Neal

By Antonio Velardo

Investment Thesis

Since the release of new earnings by Meta (NASDAQ:META), we have been following up on our last report, which got a very positive response. After our last report, META has shown a very positive recovery and has since gone up roughly 50%. This has given us more confidence in our valuation, which we will update with the release of new information and analyze where we stand.

There has been a significant amount of positive news regarding META lately; however, considering the recent rally, we are cautious and maintain our stance as value investors by avoiding paying for growth. In light of this, we believe that investing in an index such as QQQ (QQQ) would be a more favorable option than maintaining an investment in META, from a conservative perspective.

Q4 Earnings Highlights

In Q3’s earnings call, Mark maintained his bullish stance on Metaverse and the CAPEX and operating expense requirements without giving any regard to investor sentiment or market conditions. After that, META was hit very hard in the markets, and they had to change their stance and align it more with the market expectations. Meta announced massive layoffs, which helped cool the sentiment and recover the stock.

This time around, apart from the reported financials, META has shown that they understand what shareholders want, and they have given a little bit of everything that investors wanted in the form of announcements about the increased focus on efficiency leading to CAPEX cuts and cutting down unprofitable projects, decreased operating expenses outlook and increase of $40b in the share buyback program.

During the fourth quarter, the company repurchased $6.9 billion of Class A common stock, and the total share repurchases for the year were $27.9 billion, with $10.9 billion remaining on the authorization, leading to a total of $50.87b of share repurchase plan.

In terms of financials, during the fourth quarter, the company generated a revenue of $32.2 billion, a 4% decrease YoY but 1.54% more than expectations of $31.68b. Foreign currency headwinds were significantly contributing to a $2b impact when compared to the last year’s rates.

The expenses for the quarter were $25.8 billion, a 22% increase from the previous year. The cost of revenue increased by 31% due to the write-off of certain data center assets and increased infrastructure costs, while R&D expenses rose by 39%. Marketing and sales expenses grew by 4%, and G&A expenses decreased by 7%. The driving factors behind these expense increases were operating lease impairments and employee-related costs.

The company reported an operating income of $6.4 billion in the fourth quarter, resulting in a 20% operating margin. The net income was $4.7 billion or $1.76 per share, 20.8% less than expectations.

Since Meta has announced 11,000 layoffs and some of the costs this year were of non-recurring nature, we agree with the company on the decreased outlook for operating expenses for the full year ahead from $94-100b to $89-95b.

META has announced a shift towards new data center architecture, which supports both AI and non-AI workloads and is more cost-efficient. So, the CAPEX requirements have also been cut from earlier estimations of $94-100b to $89-95b now.

Family of Apps

In the Family of Apps segment, the community continued to grow, with an estimated 2.96 billion people using at least one of the apps daily and 3.74 billion monthly in December. Daily active users for Facebook increased by 71m and reached 2 billion for the first time in December, a 4% increase.

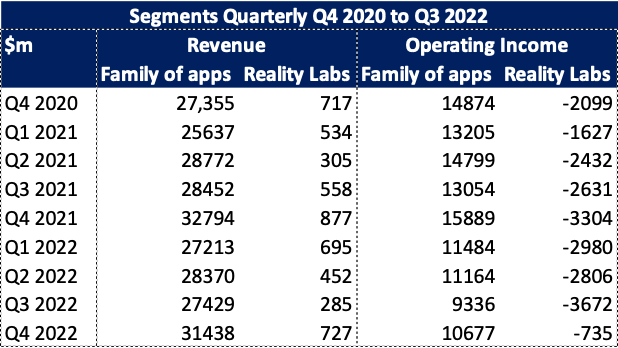

The total revenue for the Family of Apps in Q4 was $31.4 billion, down 4% YoY. The decline in revenue was due to weak advertising demand and an uncertain macroeconomic landscape. Strong growth in WhatsApp business messaging revenue was offset by a decline in other line items. The company continues to invest heavily in the Family of Apps. The expenses for the Family of Apps were $20.8 billion in Q4, up 23% due to restructuring and increased infrastructure costs, with an operating income of $10.7 billion and a 34% operating margin.

Reality Labs

In the Reality Labs segment, Q4 revenue was $727 million, down 17% due to lower Quest 2 sales, while expenses were $5 billion, up 20% mainly due to employee and restructuring costs, resulting in an operating loss of $4.3 billion.

Segments Q4

Moat Investing

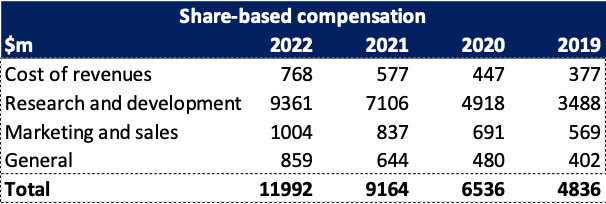

When we look at the cost related to share-based compensation, it is up 31% YoY, with an increase of 148% over three years. It is increasing at a substantial rate, but the share buyback program is more than enough to offset any possible dilution from this.

Share-based Compensation

Moat Investing

Updated Valuation Model

We are updating our valuation models with the new reported figures. We won’t be explaining our methodology or the calculations as we explained them in much detail in our last report.

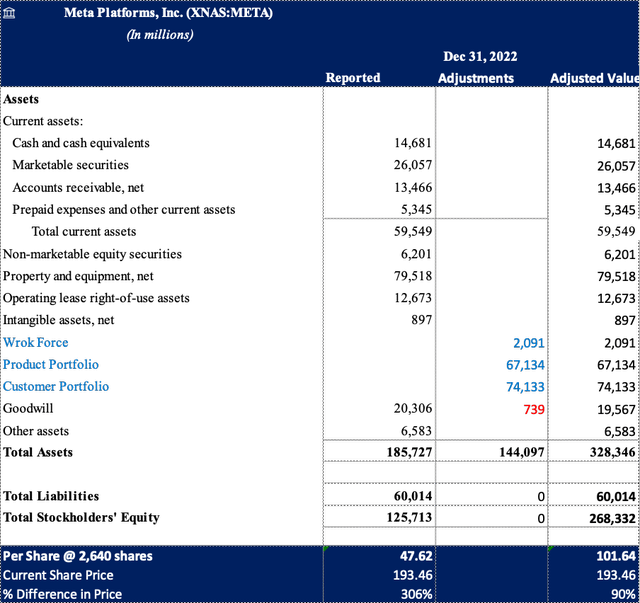

In terms of asset valuation table below highlights the updated model with the latest financials and reworked intangible assets calculation. We get an impressive adjusted book value of $101.64, an increase of 15% from our earlier valuation of asset value.

This increase is mainly related to an increase in calculated intangibles, an increase in the reported book value, and a decrease in the number of shares due to buybacks.

Asset Value

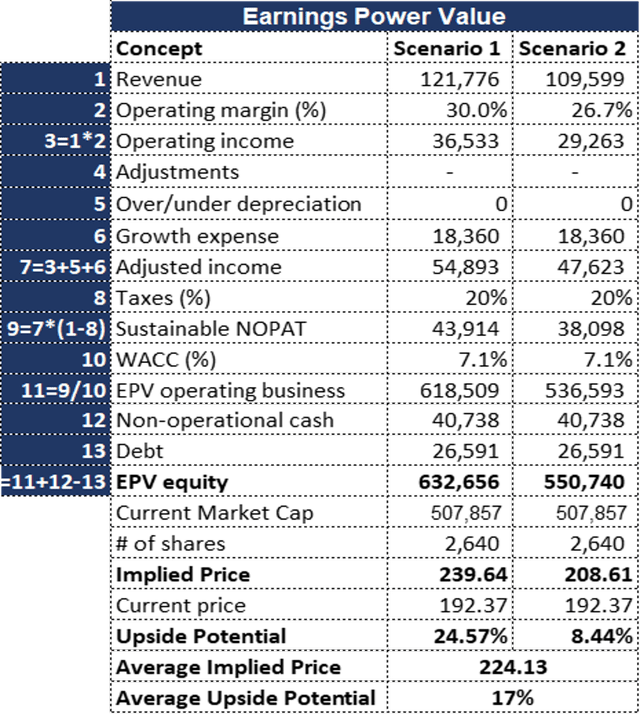

We have built two scenarios for EPV, with the first scenario being the optimistic one. We are using the consensus revenue in the first column and 10% less in the conservative scenario.

With the announced cuts, layoffs, and decreased outlook for operating expenses, margins are going to improve from the current levels. We are using 30% in our optimistic scenario and a consensus 26.7% margin in the second scenario.

With the increased focus on Reels monetization and monetization efficiency by META, we believe both revenue and margins will improve, and this is one of the business sides from which we believe they can achieve a good amount of growth.

Improving the functionality of WhatsApp for business use with click-to-message services and creating a marketplace for businesses will help a lot in terms of monetizing a segment in which there is no direct ads revenue.

We have recalculated intangibles and growth expenses associated with them by using the perpetual inventory method for the product portfolio and the reproduction method for the customer portfolio. These amounted to $18b, up from $13.7b, mainly because of an increase in the number of daily active users, R&D expenses, and sales & marketing expenses.

Using a tax rate of 20% and WACC of 7.1%, we get a valuation of around $240 in our optimistic scenario and $208 in our conservative case. With an average of $224, the upside would be 17% from the current levels.

Earnings Power Value

Final Remarks

In a time when people have started to see some growth opportunities other than in realty labs, we believe multiples will not go to the suppressed levels they were before. People might be willing to pay more now, but with the expected weakness in the market that can cause even more delay in the recovery of the ads business, it’s a risk that needs to be understood.

With so much debate about the expectations of recession, the soft or hard landing, we believe that even with the increase in reels monetization and efficiency, it’s still a risk that we won’t be willing to take for a possible 17% upside.

Because of a beautiful rally of 50% in the stock since our last report and the above-mentioned reasons, we believe it’s better to cash in on our Meta’s position and invest in an index or ETF like QQQ.

If they are successful on the metaverse front, this stock will be at its all-time high, the levels from where the current valuations will look very cheap, but as explained in the last report, this is a risk we are not willing to take as value investors.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.