Summary:

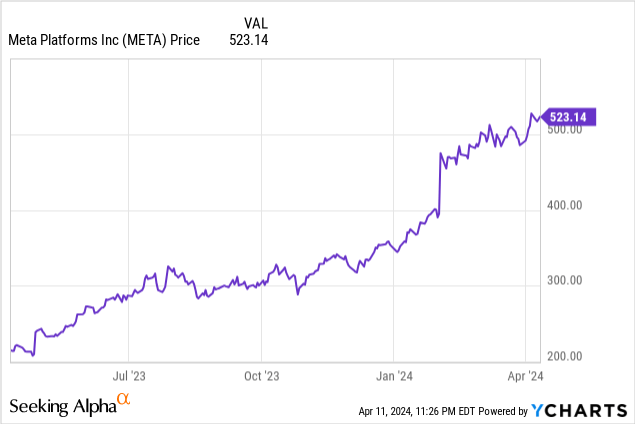

- Meta has rallied sharply this year as fundamentals continue to exceed expectations.

- The company continues to add daily active users (DAUs), particularly in the U.S. where it generates the highest advertising revenue.

- And despite reducing its cost structure y/y, Meta continues to have a head start in many emerging technologies such as the metaverse.

- The stock looks reasonably valued at a 26x P/E against this year’s earnings estimates, especially considering double-digit earnings growth and a hefty cash reserve.

grinvalds

Suddenly, the mood in the markets has gone from euphoric to cautious, all driven by expectations over the pace of interest rate cuts. Amid all this, though I’ve moved a good chunk of my portfolio into short-term bonds and cash, it’s a good time to revisit several exceptional growth stories to retain in our holdings.

Meta Platforms (NASDAQ:META), in my view, is one of those exceptional names. Even though the stock has already jumped ~50% year to date, this rally has been backed by both top and bottom line strength, with Meta both recovering its advertising dollars as well as growing users again in the U.S., while at the same time focusing on efficiency to deliver outsized EPS gains.

I last wrote a bullish note on Meta back in November, before the big stock market rally and when the stock was still trading closer to $330 per share. Evaluating my position now after a massive rally, ordinarily I’d be inclined to lock in some gains: but at the same time, we should acknowledge the fact that Meta has made some bona fide fundamental strides to accompany its rally. Its top-line growth is amplified by rigorous cost cuts. At one point, Meta investors were concerned about the company’s push to invest in infrastructure to address user privacy and safety concerns: now that this spend is in the rearview mirror and the company has turned its attention back to the bottom line, we have substantial earnings growth to look forward to. All in all, I am remaining bullish on Meta.

We also can’t discount the sheer dominance or breadth of Meta’s product portfolio. Unlike other social media companies that are single platforms and are highly subject to the fad nature of the social media landscape, Meta operates the behemoth of the social media world (Instagram) while also operating other platforms that are more popular overseas (WhatsApp).

Note as well that with expectations for Meta rising (backed, in my view, by continuously progressing metrics every quarter), its valuation also doesn’t look unreasonable. Wall Street analysts are expecting revenue growth of 17% y/y this year and $20.02 in pro forma EPS (+35% y/y), and 12% y/y revenue growth and $23.17 in pro forma EPS in FY25 (+15% y/y)

This puts Meta’s P/E multiples at 26x FY24 P/E and 23x FY25 P/E. Factoring in the expected 30%+ earnings growth this year, Meta’s FY24 PEG ratio, meanwhile, is just 0.7x.

As a reminder for investors who are newer to Meta, here’s my updated long-term bull case on the company:

- Leading portfolio of social media applications. Facebook has the leading market share of any social media platform on the planet and has dominated the space for nearly two decades. New introductions like Threads and Reels showcase Instagram’s ability to jump on newer trends and compete directly with hot startups.

- Head start in the meta verse. Among all of the large tech companies, Meta’s Mark Zuckerberg has been the most outspoken about the opportunity that the company has for a metaverse economy, which is reflected in the company’s new name. If and when this takes off, Meta will have the first mover advantage.

- Other bets. The company also has an established platform in AR/VR devices, with its Meta Quest lineup. Though currently a small piece of the overall pie, this has the potential to develop further if metaverse platforms truly do take off.

- Room to grow in absolute users, including and especially in lucrative developed markets. Meta continues to grow daily active users and engagement even in the U.S., which has been a problem spot for many fellow smaller social media companies like Snap and Pinterest.

- Room to grow in engagement. Whether we like it or not, we’re glued to our phones now, and the emerging Gen Z has never experienced life before the smartphone. Meta is delivering double-digit y/y growth in ad impressions, which will continue to trend upward the more time we spend on social media.

- Immensely profitable. Especially now as Meta turns its focus to the bottom line, rich 20%+ GAAP net margins are coming to the forefront and delivering healthy EPS growth in a company once thought to be growing at all costs.

All in all, investors would be wise to hold on to their Meta stock for further upside.

Q4 download

Meta last reported earnings in February, which investors cheered on as many core metrics showed incredibly favorable trends.

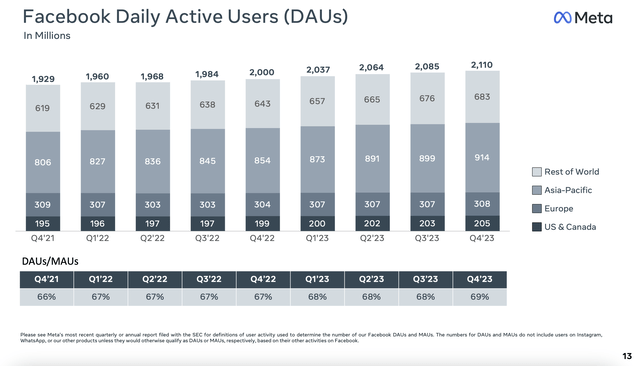

The first and foremost metric to watch for Meta is DAUs, which trended quite favorably in the most recent quarter:

Meta DAUs (Meta Q4 earnings deck)

The company added 25 million DAUs sequentially in Q4, even faster than 21 million net adds in Q3. DAUs grew 5.5% y/y, also faster than a 5.1% y/y growth rate in Q3.

But the underlying mix of DAU growth is also worth pointing out. We note that the company added 2 million net-new DAUs in the U.S. and Canada, which is Meta’s highest revenue grossing region. ARPU in this region (average revenue per user) grew 16% y/y to $68.44, which is roughly 3x the ARPU of a European user and 13x the ARPU of an Asia-Pacific user. Whereas many social media companies are starting to report over saturation in the U.S. (Snap is a big example here), it’s comforting to note that Meta continues to grow user engagement in the U.S. Again, constant feature innovation may be a big pull here, as offerings like Threads upend and take share from other platforms like X.com. The sheer breadth of functions that the Facebook family of apps is able to offer – from marketplace features to enterprise work chat and interest-based groups – is the moat that keeps Meta in a position to continue growing its user base.

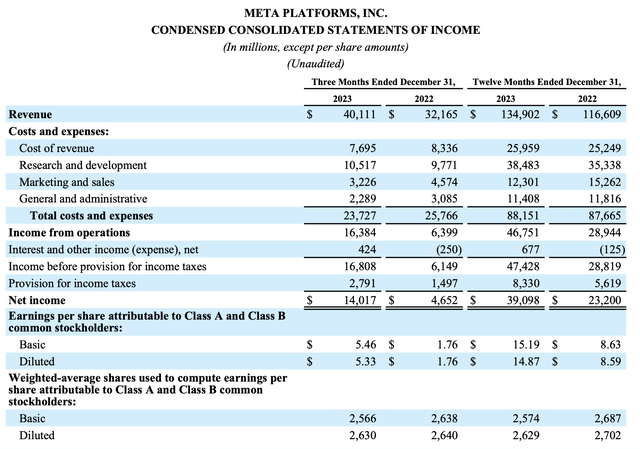

Meta Q4 results (Meta Q4 earnings deck)

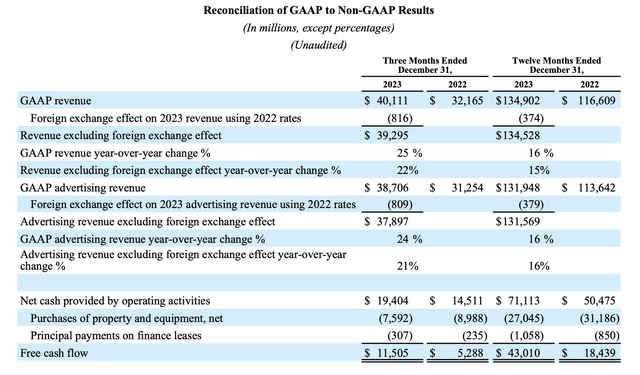

Revenue, meanwhile, soared 25% y/y to $40.1 billion, well ahead of Wall Street’s $39.2 billion (+22% y/y) expectations. And even more impressive yet, as previously mentioned, Meta’s tight lid on costs actually allows the company to reduce total cost by -8% y/y to $23.7 billion, despite the revenue growth.

We can’t emphasize this enough: it’s a truly rare occurrence to have a tech company that is growing at a double-digit pace while also trimming costs.

We do note that Meta is anticipating a return to cost growth this year, which is why the Street is forecasting “only” ~30%+ EPS growth in FY24 (versus nearly doubling EPS for FY23). Per CFO Susan Li’s remarks on the company’s Q4 earnings call on spending priorities:

First, we expect higher infrastructure-related costs this year. Given our increased capital investments in recent years, we expect depreciation expenses in 2024 to increase by a larger amount than in 2023. We also expect to incur higher operating costs from running a larger infrastructure footprint.

Second, we anticipate growth in payroll expenses as we work down our current hiring underrun and add incremental talent to support priority areas in 2024, which we expect will further shift our workforce composition toward higher-cost technical roles. Finally, for Reality Labs, we expect operating losses to increase meaningfully year-over-year due to our ongoing product development efforts in AR/VR and our investments to further scale our ecosystem.”

Still, we have to appreciate the largesse of Meta’s cash flow generation capabilities. In FY23, the company delivered $43 billion of free cash flow (110% of GAAP net income), which more than doubled y/y:

Meta FCF (Meta Q4 earnings deck)

We note that Meta has ~$47 billion of net cash on its balance sheet, which represents roughly 4% of its market cap: so on an “ex-cash” basis, Meta’s P/E and PEG multiples are also 4% lower (i.e. its 26x FY24 P/E is 25x on an ex-cash basis).

Key takeaways

Healthy user growth, a surge in revenue driven by increased advertising demand, and strict cost controls leading to tremendous cash flow – there’s a lot to like about Meta, and its valuation multiples don’t look unreasonable either. Continue riding this stock for further upside.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.