Summary:

- Meta’s Threads platform is gaining momentum against X, formerly called Twitter, as new controversies surround Twitter.

- Elon Musk’s Twitter has recently been cancelled by several high profile advertisers and he ended up using expletives for these advertisers which will likely cause faster advertiser flight.

- If advertisers start viewing Twitter as a toxic place, they will have to shift their advertising budget towards Meta.

- It is difficult to build and scale up a social network and Meta is showing that it is becoming a one-stop shop for advertisers looking for stable social platform.

- Success in Threads and Reels should help Meta improve its moat and allow Wall Street to give better valuation multiple for the ad business of the company.

Justin Sullivan

After the initial hype around Meta’s (NASDAQ:META) Threads in the initial phase, we have seen slower addition of new users. However, the recent controversies surrounding X, formerly called Twitter, will likely help Meta significantly. Elon Musk has used expletives while referring to advertisers who have canceled their advertising on X. This will increase the pace at which other advertisers will reconsider their decision to spend on ads within X. According to Reuters, big spenders like Disney and Comcast have increased spending on Instagram after dropping ads from X. It is very difficult to sustain a social network and it requires a more lowkey public profile by the top management. We could see X becoming more subscription based platform and most of the ad business moving to Meta. In a previous article, it was mentioned that Meta could deliver strong revenue growth as monetization in Reels improves.

Meta has made some changes in the placement of Threads which should allow more visibility for this platform. By the end of 2025, we could see greater customer engagement within Threads which should boost the overall engagement of Meta’s social network. The success of Meta in Threads and Reels makes a strong case for the long-term moat of the company. Any future social trends would likely be absorbed or replicated with Meta’s social platform giving the company a longer runway for growth. Despite the massive bull run in 2023, Meta is still trading at a discount compared to Apple (AAPL) and other big tech companies. There is significant long term potential within the company which should help the stock deliver good returns.

Headwinds for X helps Threads

The recent statements made by Elon Musk have hurt X platform significantly. The full repercussions are not yet visible but we should see a gradual move of ad dollars from Twitter to other platforms. At its peak in 2021, Twitter made a revenue of close to $5 billion and we could see these ad dollars move towards other digital media platforms. Meta is an ideal option for advertisers as it offers greater stability and the management has a long experience in dealing with controversial content.

Meta has also made some changes to Threads which increases the visibility of this platform for its userbase. This is a major incentive for advertisers who are looking for a more stable platform.

It should be noted that Meta has had its own issues with content moderation but the company continues to make significant improvements in removing toxic content from its platform. The growth of AI will also likely help Meta build better tools to remove content it deems unsuitable for its platform.

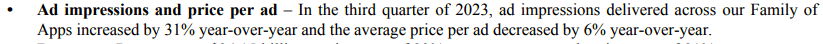

Company filings

Figure: Improvement in ad impressions delivered by Meta in the recent quarter. Source: Meta Filings

Meta has already shown a major jump in ad impressions delivered on its platform in recent quarters. In the third quarter of 2023, Meta’s ad impressions increased by a staggering 31%. The average price per ad decreased by 6% YoY as more ads are shown on Reels which is monetized at a lower cost. However, over time we should see Meta benefit from higher ad impressions and deliver a better average price per ad.

Time spent on Meta’s platform

One of the key metrics for Meta is the time spent by users on its platform. Even if the monetization of the platform is lower than expected, a higher time spent on Meta’s network gives an indication of the future growth potential of the company. Very few social networks in the past have been able to gain significant traction in terms of customer engagement. It is easier to increase monetization compared to increasing customer traction.

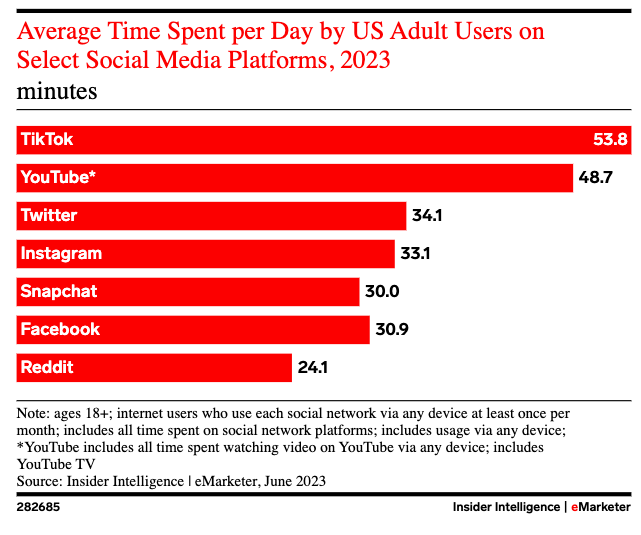

eMarketer

Figure: Time spent by US adults on different social networks. Source: Insider Intelligence

In a recent report, eMarketer estimated the time spent by US adults on different social platforms. TikTok and Twitter were at 1st and 3rd place respectively with 53.8 minutes spent on TikTok and 34.1 minutes spent on Twitter daily.

Meta has already shown a good progress against TikTok with its Reels platform. The regulatory and legislative headwinds for TikTok will also push more customers toward Meta. The recent issues related to Twitter will help improve the time spent by users on Meta’s platform.

Meta has proved very efficient in monetizing its customer base. Higher time spent by customers on Meta’s platforms should improve the price per ad over the next few years as the company gains greater pricing leverage due to fewer alternatives.

Better moat for Meta

One of the key reasons why Meta has a lower valuation multiple compared to other tech majors like Apple and Microsoft (MSFT) is because of the quality of the earnings. Meta gets a bulk of its revenue from advertising which has a lower moat compared to platform owners like Apple. We saw a major headwind for Meta when Apple changed its privacy policies. This shows that Meta is still dependent on other platforms which reduces the future security of its revenue and earnings base.

A big success by Threads will likely change this narrative as the time spent on Meta platform will increase dramatically. It will also show that Meta can easily replicate other social platforms and gain a new revenue stream. This increases the long-term runway for the company and also reduces the volatility in revenue.

Impact on Meta’s stock

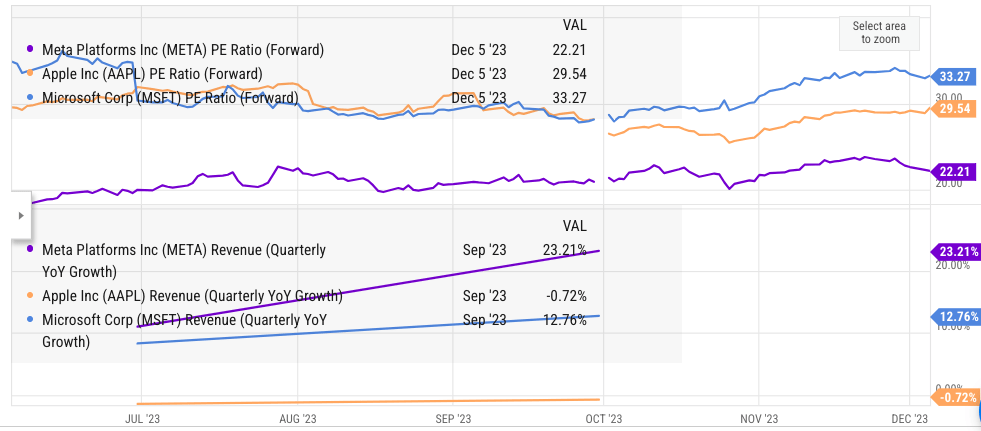

Meta has stock has jumped by over 150% YTD. This has given some investors doubt over whether the bullish rally will continue in the future. However, if we look at the forward PE multiple of META, it is still significantly undervalued. Meta’s forward PE multiple is 22 while Apple is 30 and Microsoft has a forward PE multiple of 33.

Ycharts

Figure: Comparison of META with Apple and Microsoft. Source: Ycharts

On the other hand, Meta is showing a faster YoY revenue growth. The forward revenue growth estimate of Meta has also increased significantly as the company continues to monetize Reels. It is likely that Threads will also improve the monetization trajectory of Meta in the next few quarters.

Wall Street could give Meta a much higher multiple if it sees a longer growth runway and a strong moat. The recent stumbles of Twitter will be a big boon for Meta. It is highly likely that a bulk of advertisers will shift from Twitter to Meta. Twitter will also have to change its business model to a subscription-first platform making it a niche platform. Higher time spent by users on Meta’s platform should allow the company to gain better price per ad. Meta stock remains a good bet when we look at the recent developments within the social media platforms and the current valuation of the company.

Investor Takeaway

Meta will gain a big boost as advertisers move away from Twitter. Recent actions of Elon Musk also show that Twitter would likely end up becoming a subscription-based platform. This should also increase the customer traction on Threads. Meta is already increasing the visibility of Threads within its platform. The company also reported a staggering 31% YoY growth in ad impressions delivered in the recent quarter. Greater monetization of Reels and Threads will place Meta in a good position to improve its revenue growth.

Meta stock is trading at 30% discount compared to Apple when we look at forward PE multiple. Apple’s YoY revenue growth has been negative while Meta is showing over 20% YoY growth. This trend can continue for the next few quarters as Meta continues to increase ads on Reels and also uses AI to improve the price per ad through better targeting.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.