Summary:

- Meta delivered staggering Q1 performance, with robust growth across all critical business and financial metrics.

- The market’s negative reaction to the increased CapEx guidance overlooks the fact that not investing in AI poses a greater risk than investing in it.

- A discounted cash flow model suggests Meta’s fair share price is $567, indicating a 20% upside potential.

J Studios

Introduction

I had a thesis about Meta (NASDAQ:META) is February and the stock delivered a 1.31% return since then, notably behind the S&P 500. However, this underperformance is caused by the market’s reaction to the latest earnings release. Taking profits after Meta delivered a massive rally in 2023 appears predictable, but I always prefer to rely more on fundamentals rather than temporary sell-offs. Today I want to explain why Meta’s fundamentals are still intact and why the after-earnings sell-off is likely to be temporary. The market’s pessimism was caused by the management plan to boost AI CapEx, but I think that in the current big AI race, betting big on this venture is the soundest decision. Moreover, the valuation is still very attractive, and I am inclined to reiterate ‘Strong Buy’ for META.

Fundamental analysis

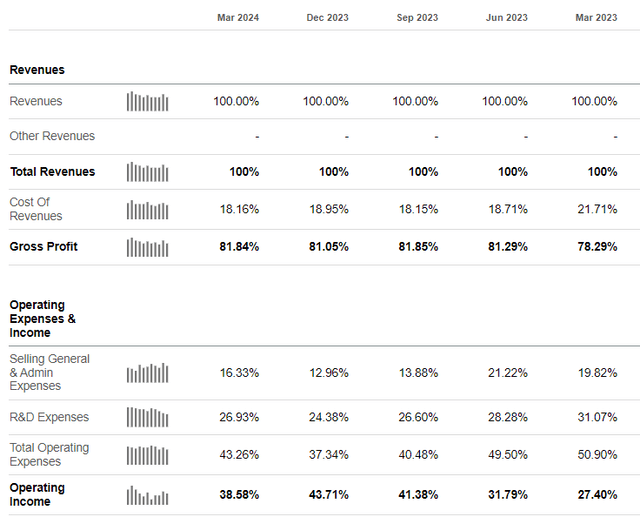

Meta reported its Q1 earnings on April 24, delivering a strong 27% YoY revenue growth and the adjusted EPS increasing from $2.20 to $4.71. The EPS improvement was ensured by strong operating performance, which we can see from META’s Q1 margins profile compared YoY. SG&A and R&D expenses grew slower than revenue, which enabled META to expand its operating margin from 27.4% to 38.6%.

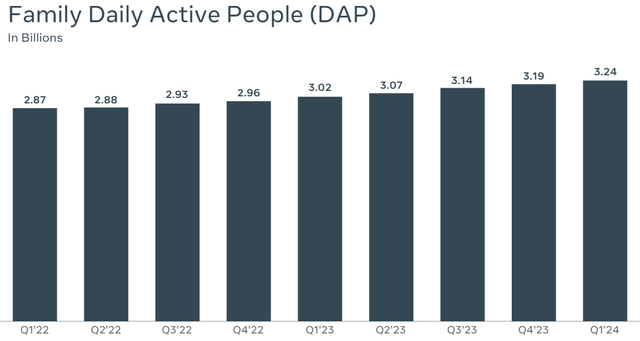

The company’s digital advertising revenue grew by 27% YoY due to positive dynamics in the industry. Meta’s advertising revenue strength was fueled by the growth in the number of users. Despite large comparative figures, Meta’s ‘Family of Apps’ demonstrated a 7% YoY growth in the number of Daily Active People, which is defined as a registered and logged-in user of Facebook, Instagram, Messenger, and/or WhatsApp (‘Family products’) who visited at least one of these Family products through a mobile device application or using a web or mobile browser on a given day.

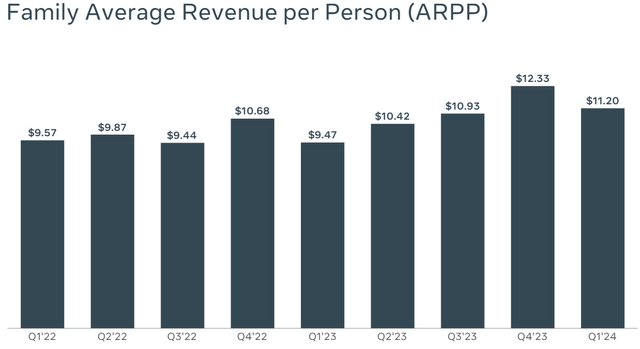

The scale of Meta’s Family of Apps audience affects the company’s image as a strong digital advertising platform. Therefore, I consider the audience growth to be a strong positive sign for investors. The audience expansion also enables Meta to exercise pricing power, which leads to increased average revenue per person (‘ARPP’). ARPP grew by an impressive 18% YoY in Q1 due to the 6% increase in average price per ad and 20% growth in impressions. Since Meta’s all critical success metrics demonstrate expansion, I think that the company will be able to sustain stellar growth for longer. According to the Q1 earnings call, the management expects Q2 revenue to be in the range of $36.5 billion to $39 billion. This means that Q2 revenue growth is expected to be 18% YoY at the midpoint of the provided range.

Apart from enjoying the top-line strength, the EPS improvement was also ensured by the company’s deep cost optimization, which took place in 2023. The company recorded all severance costs last year and now its cost structure is optimized. There were no mentions regarding new cost efficiency initiatives during the earnings call. Therefore, the EPS expansion after FY 2024 will likely be steadier and will correlate more with revenue growth.

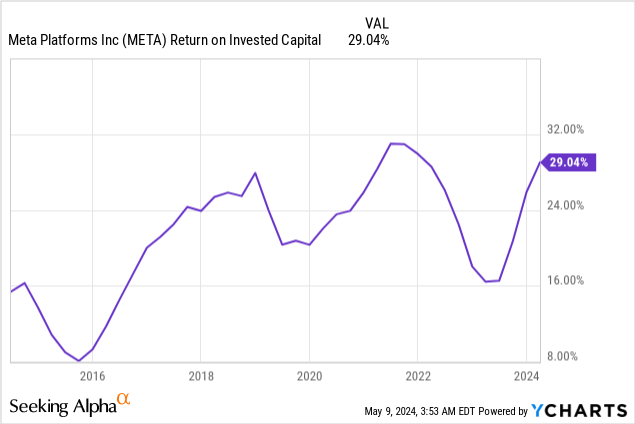

Despite delivering strong Q1 earnings, the stock saw a notable sell-off and dropped by around 10% after the release. The pessimism was caused by Mark Zuckerberg’s comments that Meta will increase its capital spending on generative AI ventures in FY 2024 and years beyond. While increased CapEx apparently means more risks for investors, I am optimistic because of Meta’s stellar profitability, especially from the perspective of return on invested capital (‘ROIC’).

Moreover, I think that in the current environment of emerging AI capabilities, not investing in AI is much riskier than ramping up the company’s AI CapEx. Without investments in innovation, Meta might be disrupted by new technologies, which will likely significantly shorten the life cycle of the company’s business. It is difficult to assess the impact of Meta’s recently released large language model called Llama 3 which was introduced in mid-April on shareholders’ wealth. However, it is a crucial project, and I will be watching closely to developments around it because leveraging AI capabilities will likely unlock more revenue streams for Meta’s family of Apps from the long-term perspective.

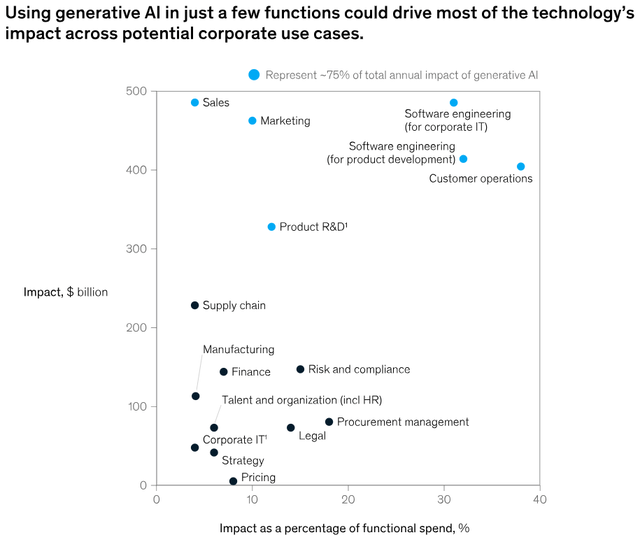

According to Statista, the Generative AI market is expected to show an annual growth rate (‘CAGR’) of 46.5% between 2024 and 2030, meaning that the industry is extremely hot. Moreover, according to McKinsey, generative AI can bring trillions of dollars in economic benefits annually and the sales and marketing industry will be the major beneficiary of this revolution. That said, since Meta is the global digital advertising powerhouse, leveraging AI capabilities is a crucial venture and ramping up CapEx spending appears to be a strong strategic move.

Due to its scale and footprint, Meta faces significant regulatory risks, which I will describe in more detail in ‘Mitigating factors’. However, recent regulatory developments were quite beneficial for Meta as on April 24 Joe Biden signed a bill that could potentially ban TikTok, a social network considered to become a robust competitor for Meta’s Instagram. In case TikTok is indeed banned, I consider it to be a positive catalyst for Meta, as it will protect Meta’s dominance in social networking for longer.

Valuation analysis

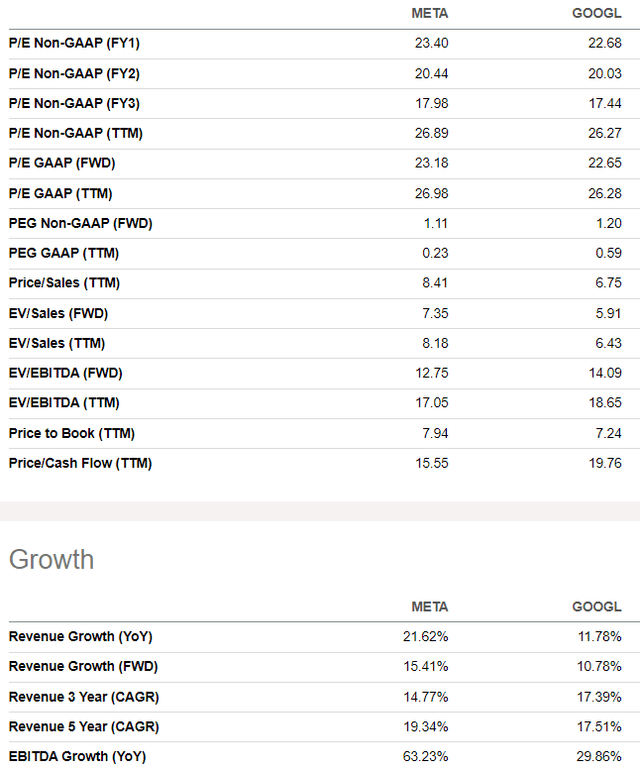

Performing peer valuation ratios analysis for Meta is not easy because it is a unique company and there is no other public social media conglomerate in the world of comparable footprint. The only comparable company that I see is another digital advertising powerhouse, Google (GOOGL). Therefore, let me compare valuation ratios of META and GOOGL. As shown below, valuation ratios of both companies are very close to each other. However, I would like to emphasize the momentum in revenue growth of Meta and Google. Meta demonstrated notably higher YoY revenue growth and forward expectations are also better compared to Google. Therefore, META appears to be attractively valued from the ratios perspective.

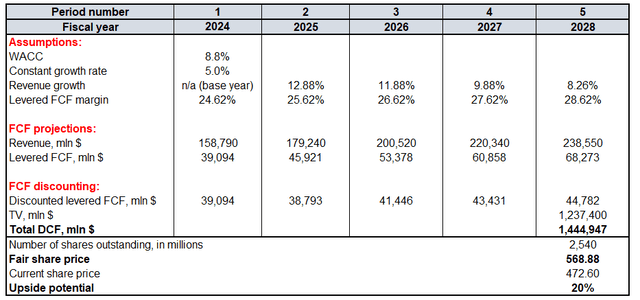

To figure out META’s fair share price, I must run a discounted cash flow (‘DCF’) model with an 8.8% WACC. Considering strong secular factors which will highly likely support Meta’s growth for longer, I reiterate a 5% constant growth rate. Wall Street analysts’ revenue projections forecast a 12.88% revenue growth in FY 2025 and slight deceleration for the years after 2025 and this trajectory appears to be reasonable to me. I use a TTM levered FCF margin, which is 24.62% and forecast a 100 basis points expansion per year. My optimism around the potential FCF margin improvement is backed by the projected revenue growth and Meta’s history of metric improvement as the business scaled up. According to Seeking Alpha, there are 2.54 billion META shares outstanding. With all these assumptions, my DCF model suggests that META’s fair share price is $567 and there is a 20% upside potential.

Mitigating factors

As shown in my ‘Fundamental analysis’, Meta has billions of daily active users and its key business metrics are expanding across the board. The company not only demonstrates revenue strength but also is disciplined in respect of costs. Therefore, the biggest risk I see from the fundamental perspective is rigorous regulations around Meta’s Family of Apps. About a month ago, the EU has launched investigations into the largest U.S. technology companies, including Meta, on ‘suspicion that all these companies are failing to comply with a new landmark European law designed to promote competition in digital services’. Last year, Meta was fined $1.3 billion in Europe for violating data privacy rules, which increases the probability of new fines in Europe as a result of recent investigation.

Meta does not only face regulatory risks in Europe, but also has risks domestically. Latest news suggest that the Texas attorney general sues Meta’s Facebook over facial-recognition practices. Due to Meta’s massive footprint and implementation of advanced technologies which might be legally controversial from a data privacy standpoint, I expect regulatory scrutiny to remain a significant risk for the company. New investigations might lead to substantial fines and reputational damage to Meta.

Conclusion

Meta continues demonstrating massive revenue growth, which is accompanied by stellar and expanding profitability. Despite the market’s pessimism around the management’s decision to ramp up AI CapEx spending, I am optimistic because leveraging Ai capabilities and having its own large language model means that Meta is in a race with AI leaders like OpenAI and Anthropic. The valuation is still very attractive, and I am inclined to reiterate a ‘Strong Buy’ rating for Meta.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.