Summary:

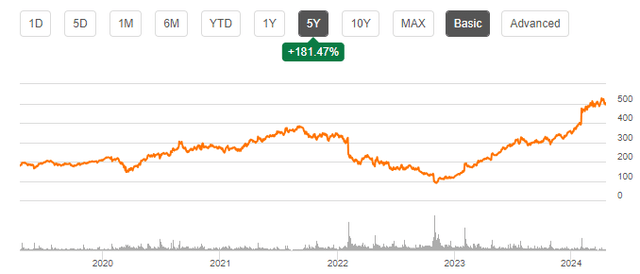

- Meta stock has outperformed the broader market since January 2024 and is still attractively valued.

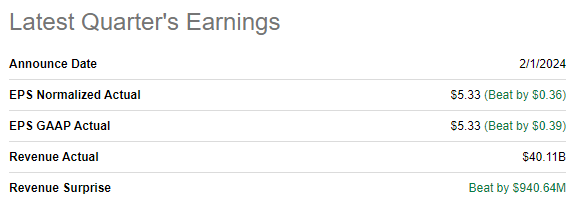

- The company’s latest quarterly earnings surpassed estimates, with strong revenue growth and tripled adjusted EPS.

- Wall Street analysts are optimistic about Meta’s upcoming Q1 2024 earnings release, expecting significant growth in revenue and EPS.

- My target price is $587.

Markus Volk/iStock via Getty Images

Investment thesis

My previous bullish thesis about Meta Platforms (NASDAQ:META) aged exceptionally well, as the stock outperformed the broader U.S. market by a wide margin since January 2024.

There were several developments over the last three months, and today I want to share my opinion about them and update my META target price estimates. Wall Street analysts are quite optimistic about the company’s further monetization potential. From the costs side, the company continues gaining efficiency and the recently announced new round of layoffs will add $30 billion value to shareholders, according to my calculations. The company also joined the generative AI race with its freshly released Llama 3 language model, alongside an image generator. My valuation analysis suggests that META is still attractively valued with a $587 target price. All in all, I reiterate my “Strong Buy” rating for META.

Recent developments

The company released its latest quarterly earnings on February 1, surpassing consensus estimates both on the top and bottom lines. Revenue growth accelerated in Q4 to 24.7% on a YoY basis. The adjusted EPS almost tripled, from $1.76 to $5.33.

Seeking Alpha

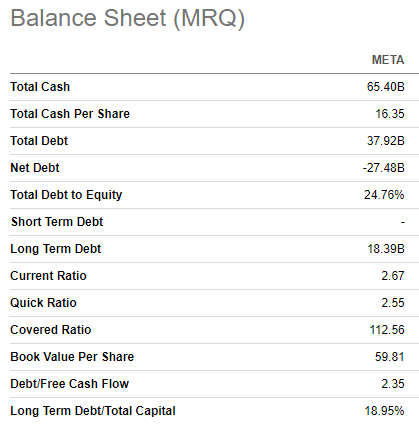

Strong EPS dynamics ensured stellar Q4 free cash flow [FCF] as well. The company generated $8.3 billion in levered FCF in Q4, which helped META to further improve its financial position. With a $65 billion cash pile and low leverage, the company has a great potential to exercise financial flexibility in case new investment opportunities emerge. Considering Meta’s stellar past acquisitions like Instagram and WhatsApp, there is a high probability that the management will be able to continue investing profitably.

Seeking Alpha

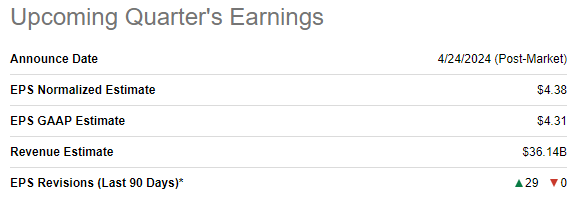

I am not paying much attention today to the latest report because Q1 2024 earnings release is approaching as it is scheduled on April 24. Wall Street analysts seem to be extremely optimistic about the earnings release, as there were 29 upward EPS revisions over the last 90 days. Quarterly revenue is expected to be $36 billion, which indicates a staggering 25.7% YoY growth. The adjusted EPS is expected to outpace revenue growth and expand from $2.20 to $4.38.

Seeking Alpha

According to Truist Securities, META is expected to beat Q1 consensus estimates, and the bank also raised its target price from $525 to $550. As Truist’s analyst, Youssef Squali suggests, the upgrade is thanks to the improved monetization and “a strengthened must-buy status within the digital ad ecosystem amid ongoing cookie deprecation and a volatile macro”. Citi’s optimism about META is even stronger, as the bank recently upgraded their target price from $525 to $590. Ronald Josey sees no negative impact on Reels engagement despite rising advertising loads, which likely means even more monetization potential for this video format.

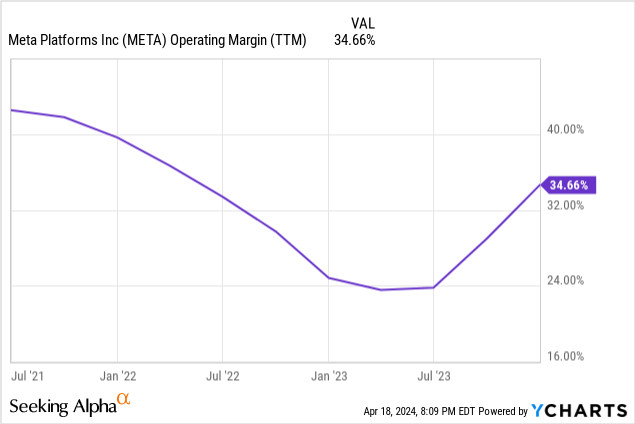

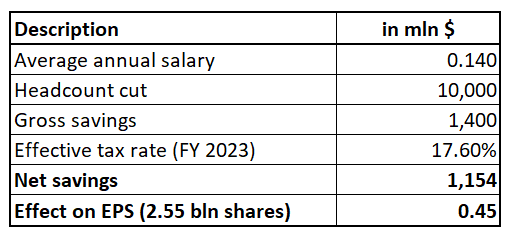

I tend to agree with Truist’s and Citi’s optimism. The operating margin dynamic is improving rapidly, after the company announced its “year of efficiency” in early 2023. The metric is heading towards its stellar 2021 levels and the planned 10,000 headcount cut, which was announced just a couple of days ago, will highly likely boost profitability further. In the same piece of information, it also says that the company will leave 5,000 roles that are currently empty unfilled. According to comparably.com, average salary at Meta is around $140,000 per year. My calculations suggest that this round of layoffs will save Meta net $1.15 billion per year, which results in a $0.45 annual EPS improvement. Considering 2.55 billion outstanding META shares and the current forward P/E of around 25, the layoff creates around $30 billion total value for shareholders.

Author’s calculations

The optimism about Meta’s revenue from Truist and Citi, and recent developments positively affecting the company’s costs side is a solid bullish blend, in my opinion. This indicates that the company is highly likely to beat Q1 consensus estimates and provide strong guidance for Q2 and the rest of FY2024.

Valuation update

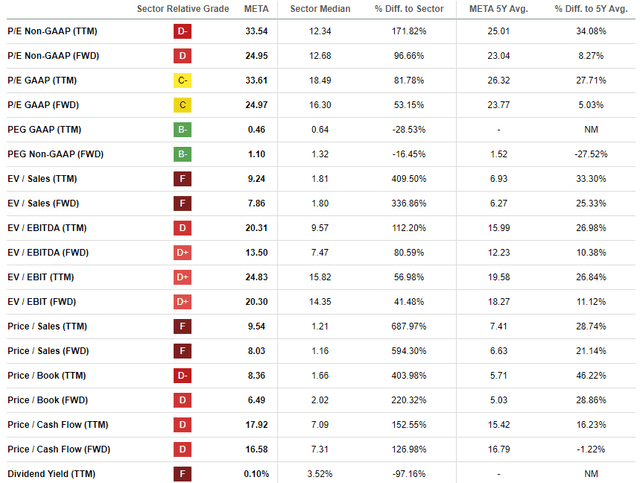

META more than doubled over the last twelve months with a 125% rally. The stock is also substantially outperforming the broader market in 2024 with a 40% YTD price increase. From the valuation ratios perspective, META is expensive compared to its historical averages. This might indicate overvaluation, though the gap between current and historical multiples is not dramatic.

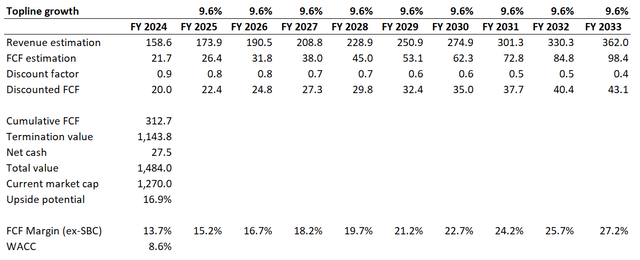

As my subscribers know, one valuation approach is never enough for me, and I must proceed with the discounted cash flow [DCF] simulation. Future cash flows will be discounted with an 8.6% WACC. I rely on revenue consensus estimates for the base year, which expect a $158.6 billion for FY 2024. For the years beyond, I use a conservative 9.6% CAGR. The TTM levered FCF ex-SBC margin is 13.7%, which I incorporate for the base year and project a 150 basis points yearly expansion.

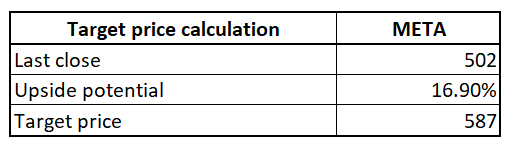

According to my DCF simulation, the business’s fair value is close to $1.5 trillion. This is 17% higher than the current market cap, which means that the stock is undervalued by this percentage. Such a discount for META looks like a no-brainer to me.

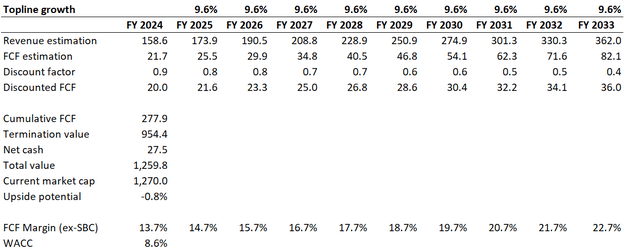

However, some might argue that 150 basis points yearly FCF expansion is too optimistic considering that revenue is projected to grow below 10% yearly. Therefore, I want to simulate one more scenario with the FCF margin expanding slower, by one percentage point.

Under this scenario, the stock appears to be perfectly valued at these levels. However, I want to emphasize that I tend to think that a more optimistic FCF scenario is more likely to unfold due to all the recent developments I have highlighted above. Moreover, a company like META, with its unmatched profitability and ecosystem of social media apps, deserves a premium to its fair value. Therefore, my target price is $587.

Author’s calculations

Risks update

As a growth stock, META is vulnerable to changes in cost of capital. Since it is driven by risk-free interest rates, the substantial uncertainty regarding the Fed’s next moves around monetary policy is a risk for the stock. The year started with optimism around expected three rate cuts in 2024, but the recent hot March CPI inflation data might mean that there can be less [or even none] rate cuts in 2024. The Fed’s hawkishness in decisions is unlikely to directly affect the business itself as Meta’s total debt is insignificant compared to its market cap, but will highly likely undermine the overall market sentiment around growth stocks. Therefore, should the Fed decide to leave rates higher for longer, META might experience a sell-off.

Despite Meta having a stellar profitability track record, the company had periods of betting big on highly unprofitable projects. Mark Zuckerberg’s massive bet on the Metaverse resulted in substantial profitability dips and vast investors’ disappointment, which had led to a big stock sell-off in 2022. The stock plunged from almost $350 to below $90 within just eleven months, the drawdown which not any investor can handle. Therefore, there is no guarantee that Meta’s founder will not decide to increase Metaverse spending again or join another financially controversial project.

Bottom line

To conclude, META is still a “Strong buy”. The business is robust both from the perspective of revenue growth and cost discipline. It is early to speak about prospects of a freshly released Llama 3 language model, but the fact that Meta is in line with the digital revolution underscores the company’s competitive edge. The valuation analysis suggests that the stock is still attractively valued, and the current share price is a good deal.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.