Summary:

- The social media giant has successfully encouraged daily users to engage with Reels, improving time spent on Meta platforms as opposed to rival platforms.

- Ads between short-form videos that appear in the same format as the organic Reels feel less intrusive by blending in with other videos, improving ROI potential for advertisers.

- Zuckerberg’s guidance suggests that investors should expect more adequate ad-revenue generation from Reels towards the end of 2023 or my mid-2024.

- The onset of short-form video consumption trends should have been relatively easier to handle for Meta as a shift from Stories to Reels.

- The considerable time lag between TikTok’s rise and adequate Reels monetization puts into question Meta’s ability to efficiently adapt to social media shifts that are notably different from Stories/Reels.

grinvalds/iStock via Getty Images

Meta Platforms (NASDAQ:META) has been ridden with multiple dilemmas lately, from Apple’s iOS changes to trying to persuade investors that its metaverse gambit will pay off. A key headwind to its core business has been the rising and intensifying competition within the social media space, not least from Chinese rival TikTok. Meta’s counter-strike through the launch of Reels two years ago has been a vital initiative in fending off the risk of losing users to rival platforms. Though the company has been slow in recovering displaced revenue amid the shift in users’ time towards Reels; Meta’s lackluster agility in its core business undermines revenue growth going forward.

Meta’s dive into short-form videos

Meta’s dive into short-form videos began with the launch of Instagram Reels in August 2020 across 50 countries, followed by the launch of Facebook Reels in September 2021 in the US, and a global rollout in February 2022. Meta has been investing heavily in Reels to capably challenge TikTok, designating a $1 billion creator fund to encourage the creator community to produce Reels on Instagram/Facebook through monetary rewards, including the Reels Play bonus program, as well as Artificial Intelligence [AI] advancements to augment algorithmic recommendations of Reels on Feeds.

As incoming Chief Financial Officer, Susan Li, shared on the Q3 2022 earnings call:

In the Q2 call, we had shared that a single AI advancement in scaling our recommendations models had led to a 15% watch time gain for Facebook Reels, and that gain has continued to grow. And we expect that there will be additional watch time improvements coming from that work.

The social media giant has successfully induced daily users to engage with Reels, improving time spent on Meta platforms as opposed to rival platforms. Meta currently offers two advertising formats through Reels, either through overlay ads that appear on Reels in the form of banners/stickers, or through 30-second video ads that appear between organic Reels. The latter potentially offers a more effective advertising solution if used aptly; advertisers can make their ad content appear as organic Reels videos, making the viewers feel as if they are watching a regular Reels video back-to-back, while the advertiser passively builds an impression for their product/ service. Such ads between short-form videos that appear in the same format as the organic Reels feel less intrusive by blending in with other videos, thereby subduing the risk of diminishing the consumer experience, and offering a better way to generate impressions than intrusive pre-roll and mid-roll ads on longer video formats, improving the Return on Investment [ROI] potential for advertisers. As Chief Business Officer, Marne Levine, shared on the Q3 earnings call:

What we are focused on is making sure that businesses get a strong ROI on Reels. And one example that shows that we are delivering on this in terms of our investments is Corkcicle, which is the insulated drinkware brand that added Reels to its business-as-usual strategy and saw a 34% higher return on ad spend

The social media giant is showing promising potential at offering a new, effective ads placement avenue through Reels, to keep advertisers engaged with Meta platforms. In fact, Meta is wisely leveraging its multi-platform prominence to broaden creators’ audience accessibility, by enabling them to cross-post their Reels between Instagram and Facebook. This consequently also allows advertisers to reach more users, augmenting the appeal of Meta’s advertising solutions over single-platform rivals. CEO Mark Zuckerberg proclaimed on the Q3 earnings call:

There are now more than 140 billion Reels plays across Facebook and Instagram each day. That’s a 50% increase from 6 months ago. Reels is incremental to time spent on our apps. The trends look good here and we believe that we are gaining time spent share on competitors like TikTok.

Meta is making better progress than advertising rival Google (GOOG) (GOOGL) in the short-form video space. During Alphabet’s Q3 2022 earnings call, SVP and Chief Business Officer Philipp Schindler shared that YouTube Shorts had “30 billion daily views”, which is the same number of views they proclaimed earlier in the year. Google is also striving to expand the audience-base for its YouTube Shorts through enabling viewability on its smart TV app.

Meta is not agile enough

On the Q2 2022 earnings call, former COO Sheryl Sandberg proclaimed:

On Reels, we have a playbook where we, I think, do a very good job building products that consumers love to use and then building ad formats which match those products so they can integrate nicely into the consumer experience. So we learned from Stories how to do that, and I think part of the faster adoption of Reels ads is that we are getting better at this.

The relatively faster Reels ads adoption has indeed led to a combined (Instagram & Facebook) annual revenue run-rate of $3 billion, though the new source of advertising revenue still does not make up for the displaced ad revenue from its classic Instagram/ Facebook Feeds. While Meta has aptly been advancing its recommendation algorithms to boost Reels engagement and curb users from spending time on TikTok feeds, it has not been able to readily and adequately monetize this shift in content consumption trends, undermining Meta’s revenue growth. As Zuckerberg shared on the Q3 earnings call:

Even with the progress we have made, we are still choosing to take a more than $500 million quarterly revenue headwind with this shift, but we expect to get to a more neutral place over the next 10 – sort of 12 to 18 months.

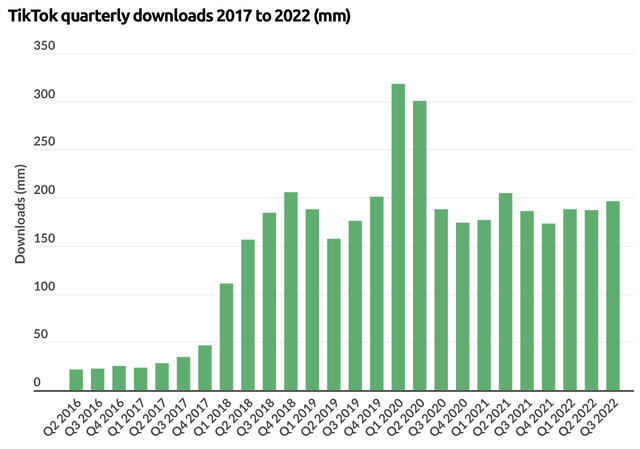

Given that Meta had a playbook based on ad formats around Stories, it is reasonable to expect faster monetization to recover displaced ad revenue more adequately. 12-18 months is a long time in the trendy social media world where users’ interaction and content consumption preferences keep shifting. For context, TikTok launched in mainland China in September 2016, and became more prevalent worldwide since 2018 amid widening global accessibility.

Meta hit back with the launch of Instagram Reels in August 2020, and subsequently with the launch of Facebook Reels in 2021. As per Zuckerberg’s guidance, investors should expect Meta to reach a more neutral position (more adequate ad-revenue generation through Reels) towards the end of 2023 or by mid-2024. This would suggest that it takes Meta about 3-4 years since launch to competently shift its revenue-generation strategy, and about 6-7 years since the rise of TikTok. These are long time lags in an industry where social media trends keep shifting. Sandberg had also highlighted that video ad formats are more difficult to create than static image ads, and that small businesses require help using these new ad formats. Despite its prominence as a social media platform for over a decade, Meta is still not agile enough to adapt to shifting trends proficiently, particularly from a monetization perspective, impeding its ability to sustain lucrative revenue growth rates from its core business going forward.

No social media platform stays popular forever. Back then it was Myspace, today it is TikTok (and its subsequent copycats), and going forward it could be entirely new social media platforms that we haven’t heard of yet. Meta’s strategy of keeping up with shifting social media trends used to be driven by M&A activity, particularly with the acquisitions of Instagram and WhatsApp. Amid intensifying regulatory scrutiny, M&A has become a less viable growth strategy, enhancing the need for industry-leading innovation. Meta has indeed been striving to make its platforms stickier, such as introducing marketplace/shopping features, aiming to encourage users to spend more time and connect with people in new ways. That being said, Meta is simultaneously investing heavily in its virtual reality technology, the Metaverse. Whether the gambit will pay off or not is a separate subject matter altogether, but it does undermine the amount of resources Meta is able to allocate towards innovation endeavors in its core products to stay competitive in the social media industry.

A note on Socially Responsible Investing [SRI]

Ethical and socially responsible investing is becoming increasingly prevalent, as investors seek to invest in companies that better reflect their moral principles and values, and want to avoid profiting from morally-deprived business activities. It is worth highlighting the moral hazard that Meta stock exposure entails. Over the years, Meta has been plagued by various data privacy and data misuse scandals. In 2021, whistle-blower Frances Haugen revealed how the company was aware of its algorithmically-driven recommendations harming young users’ mental health, creating “a toxic environment for some teen girls already experiencing negative feelings about their bodies”. While the company has tried to defend itself by claiming that “8 out of 10 US teens who use Instagram and filled out a survey said Instagram either made them feel better about themselves or had no effect on how they feel about themselves”, the response reflects Meta’s indifference to the issue, as “the other 20% remaining is still significant on a platform boasting billions of users worldwide”.

While Meta’s algorithms deliver success in terms of inducing users to stay engaged on the platform and/or shop on the platform, it is worth taking into consideration that these algorithms also incur negative consequences on certain users’ mental health. Meta’s dubious mannerisms for keeping users engaged with the platform is very likely to extend into Meta’s strategies for promoting engagement and encouraging users to spend more time on its virtual reality product, the Metaverse, which could indeed induce more cases of mental health issues. The company’s track-record of prioritizing profits over users’ health is disheartening from an SRI stand-point.

The purchasing of SRI-unfriendly stocks like Meta increases the value its shares, enriching employees of the company through stock-based compensation packages, and enabling the company to raise more capital through follow-on offerings on the stock market, thereby funding SRI-unfriendly business activities.

Summary

Meta’s venture into short-form videos certainly offers promising potential in creating new sources of advertising revenue. The company has indeed been able to successfully increase user engagement with Reels to improve time spent on its platforms over rival platforms.

As social media trends continue shift, Meta will continuously need to adapt its platform offerings, and subsequently its ad solutions/ formats to maintain an adequate inflow of advertising revenue. The onset of short-form video consumption trends should have been relatively easier to handle for Meta as a shift from Stories to Reels. However, the notable lag between launch and adequate monetization puts into question Meta’s ability to efficiently adapt to future trends that are notably different from Stories/Reels. Meta indeed needs to work harder to ensure swift deployment of new ad solutions among advertisers, in order to better mitigate headwinds to top-line growth induced by shifts in social media trends going forward.

Any buying or selling decisions in Meta stock should take into consideration all business divisions/ product lines aggregately. Given that this article focuses particularly on Reels, a neutral ‘hold’ rating will be assigned to the stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.