Summary:

- Reels has the potential to contribute significantly to Meta’s revenue, reaching $5 billion by the end.

- Overlay ads in Reels offer increased monetization benefits and minimize disruption to user experience.

- The introduction of new GenAI tools and creative optimization could boost Reels’ revenue by 5-18%.

- By applying a ~19X multiple, stock should trade around $325. (providing investors ~12% upside from current trading price).

grinvalds

Investment Thesis

Huge potential of Reels, driven by increased monetization benefits and possibilities offered by overlay ads.

As overlay ads function as banners or stickers placed atop Reels, it ensures that the user’s viewing experience remains uninterrupted by advertisements. This marks a departure from Meta’s (NASDAQ:META) conventional advertising approach, which involves placing ads between content segments. In my opinion, the introduction of overlay ads has the potential to accommodate a higher volume of ads within Reels while minimally disturbing the user’s interaction. Adopting a more conventional advertising method could transform Reels into a revenue-enhancing factor by 5% on a larger scale. Furthermore, the incorporation of overlay ads to cover 25% of Reels might yield an additional advantage of 13%, resulting in a cumulative benefit of 18%.

REELS and AI Discovery Engine

Reels is positioned to become a substantial contributor to run rate revenue, potentially reaching the $5B mark by the conclusion of 2023. This projection is supported by Meta’s disclosure that Reels had achieved a run rate of $3 billion in business as of the third quarter of 2022. Additionally, Meta indicated that the remaining quarterly impact of $500 million from Reels monetization would be balanced out by the end of 2023 or early 2024.

Even if the full extent of this enhancement doesn’t directly reflect in Reels, I anticipate positive outcomes for Meta. This could manifest either as a reallocation of advertising funds toward other monetization avenues (including Stories and the Newsfeed) or through increased Cost Per Click (CPC) rates. The supplementary $2 billion in revenue implies a 2%-point tailwind, contributing to the growth of Meta’s consolidated revenue for 2024 and the subsequent years.

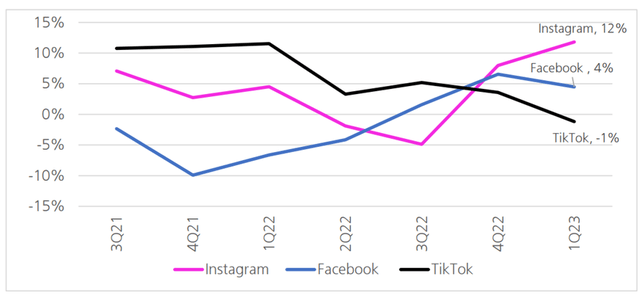

The time individuals spend on Meta, especially on Instagram, has shown a noteworthy acceleration. Recent data from Sensor Tower’s mobile app analysis indicates a 12% year-over-year growth in daily time spent per user during the first quarter of 2023. The core Facebook app has also experienced a 4% growth, with both apps displaying an increased pace of activity (Figure below illustrates the changes: Instagram exhibited a 12% YoY growth in daily time spent per user in 1Q23, while Facebook saw 4% growth). Conversely, TikTok witnessed a 1% decline in daily time spent.

Source: Chart made by Author using Sensor Tower data

REELS Monetization:

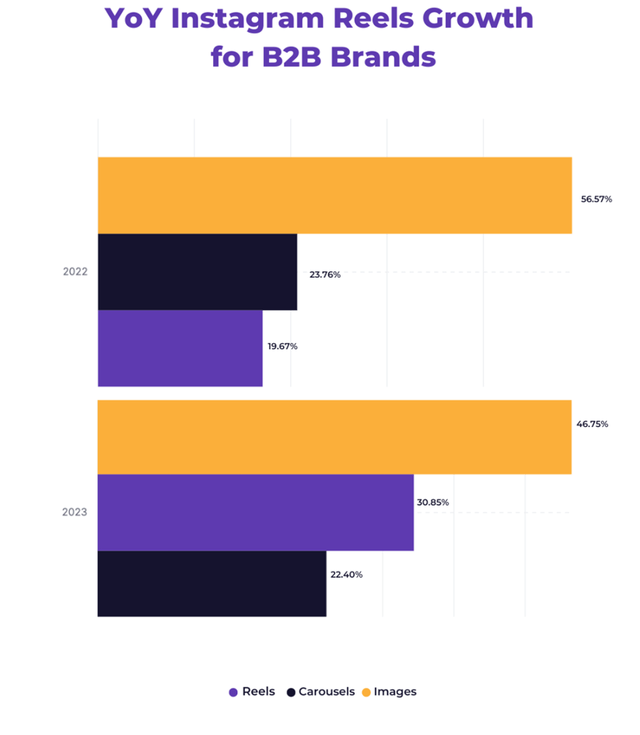

Regarding revenue generation, a significant factor in boosting revenue per Reel user seems to lie in augmenting the ad load within Reels and enhancing creative optimization. Meta is expected to apply the insights gained from the introduction of Stories, while also expanding its reach among the existing advertiser pool (with over 40% of Meta’s advertisers having adopted Reels ads by the fourth quarter of 2022).

During a recent event, the Chief Financial Officer of Meta mentioned the potential for enhancing Reels monetization by concentrating on the following aspects:

- Demand Enhancement: Efforts are being directed towards expanding demand by incorporating additional formats into Reels, thereby enabling a comprehensive range of campaigns to run on the platform.

- Performance Improvement: Leveraging artificial intelligence, Meta aims to experiment with diverse versions of optimizations, such as determining the ideal size for elements like the share button, to enhance overall performance.

- Supply Increase: To augment ad delivery, the focus is on increasing ad load. However, the CFO also acknowledged the need for further refinement in understanding the optimal ad load and ad placement.

Although it’s still in the early stages, addressing the challenge of creative optimization, especially for short-form video formats like Reels, could potentially benefit from the introduction of new GenAI tools. Meta has already begun the rollout of these tools. Among them, a particularly crucial tool under testing is known as “Image Outcropping.” This tool employs AI to dynamically adjust creative assets to suit varying aspect ratios across different surfaces, such as Stories or Reels.

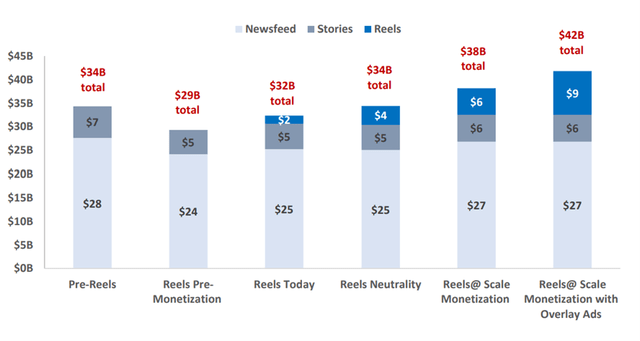

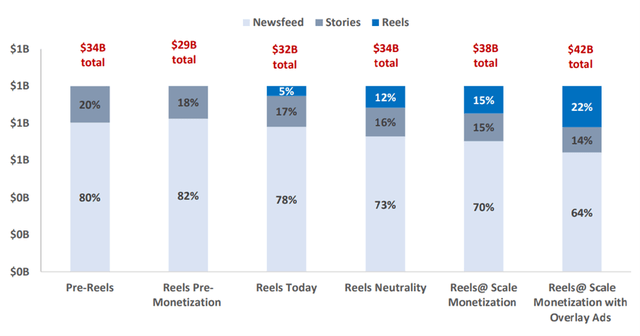

As we delve deeper into the potential for monetization and paint a comprehensive picture of the Reels format’s revenue possibilities, it emerges that the Reels format could potentially pose a revenue challenge of approximately 15%, which translates to around $5 billion. However, this apparent challenge could ultimately transform into a substantial boost of 5-18% to Meta’s ad revenue. The critical discoveries arising are as follows:

- Reels’ Revenue Dominance: In the long run, Reels has the capacity to claim a more substantial share of Instagram’s revenue composition compared to Stories. This is due to the unique characteristic of Reels, where content is often experienced with sound-on, resulting in better viewership rates as opposed to Stories or the Newsfeed. This notion finds support not only in Meta’s official communications but also from corroborating studies.

- Amplified Time Spent: As Reels reaches a steady state, it is anticipated to significantly contribute to the overall time users spend on the platform. This extended engagement window presents Meta with the opportunity to present a higher number of advertisements, not only within Reels but also across other sections like the Newsfeed and Stories.

- Enhanced Ad Load Potential: A noteworthy aspect is the potential for a greater ad load within Reels, particularly when considering overlay ads.

To summarize, this framework paints a dynamic picture of Reels’ revenue trajectory, indicating its initial revenue headwind could transition into a substantial tailwind for Meta’s ad revenue growth. The distinct characteristics of Reels, coupled with the possibilities presented by overlay ads and increased engagement, underscore its potential as a pivotal revenue driver for Meta’s advertising endeavors.

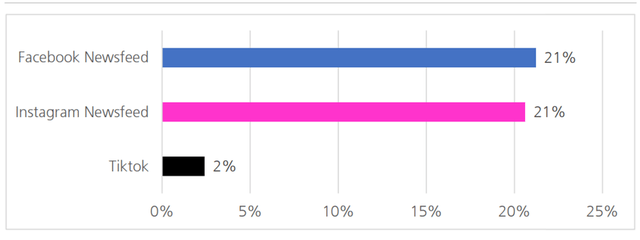

Source: Chart made by author using company disclosures; AppAnnie; SensorTower data Source: Chart made by author using company disclosures; AppAnnie; SensorTower data

Considering CPMs, and if we assume Stories attain 90% of the Newsfeed CPM, as indicated by management commentary on their near-parity monetization. Advertisers note slightly discounted CPMs for Stories, but my view diverges due to increased ad density and shorter user engagement. Meta can deliver more impressions per minute in Stories, balancing the 10% CPM discount.

Monetization Progress and Reels’ Path to Neutrality

Presenting my current position within the Reels monetization journey and the factors propelling Reels towards neutrality, the key assumptions are as follows:

- Enhanced Time Spent: Reels has notably driven a 15% surge in time spent on Instagram, a figure slightly below our initial steady-state assumption of 35%. SensorTower data reveals that through the first quarter of 2023, Reels triggered over a 15% increase in time spent compared to its launch in mid-2021.

- Adjusted Reels Ad Load: My assumptions for Reels’ ad load are set at 15% for the current state and 20% for neutrality. These estimates are informed by Meta’s remarks indicating their ongoing efforts to introduce all ad formats to Reels. Furthermore, with around 40% of advertisers adopting Reels, these figures reflect the evolving nature of ad load.

- CPM Adjustments: While we can anticipate Newsfeeds and Stories to maintain elevated CPMs relative to pre-Reels levels, aligning with Meta’s described budget dynamics, we need to recognize the need to adjust them as Reels monetizes. To address this, I presume Reels CPMs to be at a 25% discount to Stories CPMs for the current state and 10% discount for neutrality. Meta may offer incentives for advertisers to accommodate the evolving nature of Reels.

- Overlay Ads Transition: To achieve neutrality, I anticipate that overlay ads will account for 10% of the format, deviating from our steady-state assumption of 25%. This adjustment stems from the format’s newness and insights from our channel checks.

Creator Payout Program:

An additional recent initiative that will contribute to the advancement of Reels monetization is the alteration in Meta’s approach to incentivizing creators within the Reels platform. Traditionally, creators on Reels have accessed three distinct revenue streams through Meta:

- Business Collaborations: Meta facilitates a direct connection between brands and creators through a dedicated creator marketplace. Within this ecosystem, brands have the ability to filter and select creators based on criteria such as gender, age, follower count, interests, and the demographics of the creator’s engaged audience.

- User Contributions: Users on the platform can engage with creators in multiple ways. They can send creators “Stars,” each worth $0.01, which is utilized for on-demand live videos, as well as text and photo posts. Additionally, virtual gifts and subscriptions can be offered by users, enabling them to support creators in innovative ways. Subscriptions often come with exclusive benefits or supplementary content.

- Meta’s Role: Throughout its history, Meta has been involved in the revenue sharing arrangement. This program allows creators to earn revenue through their content, with Meta participating in the monetization process.

Key Management Commentary on REELS for the first quarter of 2023:

- Resharing Boost: Reels are evolving into a more social feature, with users resharing Reels exceeding a remarkable 2 billion times daily. This marks a doubling of resharing activity in just the last half-year.

- Enhanced Engagement: The Reels format is contributing to increased engagement across the app. This growth in engagement has also led to Meta gaining a larger share in the realm of short-form video content.

- AI-driven Monetization: The utilization of artificial intelligence is further enhancing the efficiency of Reels’ monetization efforts. Over the course of a single quarter, Reels’ monetization efficiency has risen by more than 30% on Instagram and more than 40% on Facebook.

- Neutral Monetization Projection: There remains a continued expectation that Reels will reach a point of neutrality in terms of overall ad revenue, potentially by the end of this year or early next year.

- Ad Load Expansion: Although ad load on Reels is currently lower compared to other platform surfaces, there is still untapped potential for ad load growth within Reels. This suggests that the platform has not yet reached its maximum ad load capacity.

- Incremental Engagement: Over time, Reels have demonstrated an increasing contribution to overall user engagement. This highlights the growing significance of Reels within the engagement landscape.

- Rising Demand: The demand for Reels ads themselves is progressing favorably. The focus is on unlocking advertiser objectives on Reels, a process that is evidently showing substantial progress and is expected to continue to expand advertiser demand for this format.

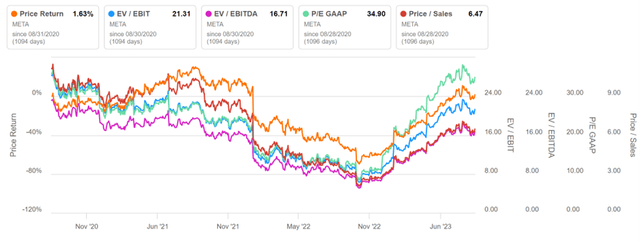

Valuations:

By applying a ~19X multiple, stock should trade around $325. (Providing investors ~12% upside from current trading price). This selection of an 19x multiple aligns with a market-level valuation and represents a suitably cautious approach. This choice is underpinned by my anticipation that Meta will achieve a compounded annual EPS growth rate of 24% within the coming three years.

Reviewing Meta’s trading history over the past five years, the valuation has ranged from 12 to 28 times the Next Twelve Months (NTM) EPS. This context further supports my decision to employ an 19X multiple for this price target calculation, considering the market’s historical valuation range.

Conclusion:

In summary, whole Reels monetization journey hinges on these strategic assumptions, which reflect the evolving landscape and insights drawn from both data analysis and industry trends. These combined avenues create a multifaceted ecosystem that empowers creators on Reels to monetize their content and establish diverse revenue streams. The recent changes in the approach to creator incentives are expected to further enhance the overall monetization potential of the Reels platform.

Risk Statement:

This valuation is determined based on a multiple of GAAP EPS. There are several notable risks that could lead to a decrease in value like:

- A broader decline in advertising activity could adversely affect our valuation.

- The impacts stemming from changes in iOS, particularly those related to ad targeting and measurement, might have a negative influence.

- Changes in the regulatory landscape, alongside evolving interpretations of antitrust laws, could pose risks.

- There’s the potential for user growth and engagement to be hampered by competition from platforms like TikTok.

- Shifting user engagement towards less monetizable sections of the app, such as Reels, and uncertainties regarding the long-term monetization potential of new formats are possible challenges.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.