Summary:

- Tesla stock has rallied through most of 2023 during a time when consensus was estimating sales to grow +23% y/y but earnings to decline 15%.

- In Q2 2023, Tesla’s operating margins declined to 9.6% after enacting a series of price cuts.

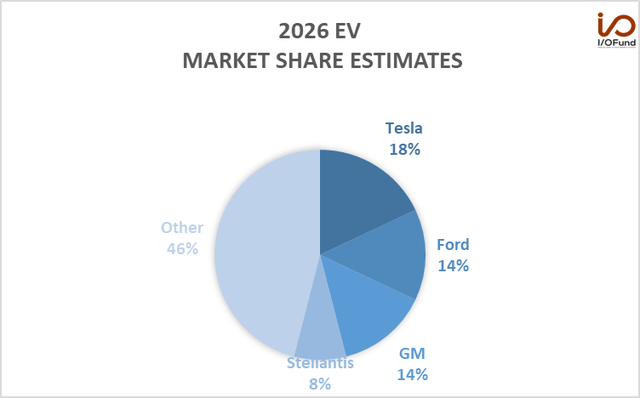

- Tesla’s electric market share peaked at 78% in 2018 and stood at 62% in 2022. By 2026, Merrill Lynch estimates it will decline to 18%.

piranka

As our investing group looks to position itself for the remainder of 2023, fundamentally, we’re avoiding “Crocodile Jaw” situations where the stock price is going up, but fundamentals are decelerating. This is one of the reasons we greatly reduced our Tesla, Inc. (NASDAQ:TSLA) position for a ~60% gain.

Tesla stock has rallied through most of 2023 during a time when consensus was estimating sales to grow +23% y/y but earnings to decline 15%. The main driver behind the decline in earnings estimates is that Tesla has decided to lower prices to increase volumes at the expense of margins.

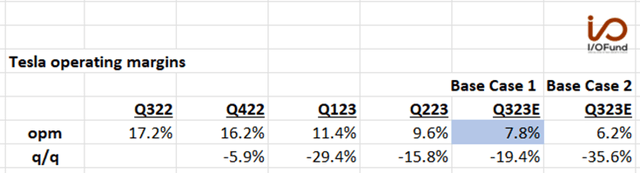

Starting in Q3 2022 through Q2 2023, operating margins have declined from 17.2% to 9.6%. Initially, Tesla cited making sure certain models qualified for the electric vehicle (“EV”) tax credit and later higher interest rates as the primary reasons for lowering prices.

Higher interest rates are effectively a price hike that increases monthly payments for those who finance their purchases. Tesla recently announced 84-month financing to lower monthly payments. Reducing the sales prices also helps lower monthly payments. Meanwhile, increasing EV inventory at dealerships and discounting at an industry level are likely other contributing factors.

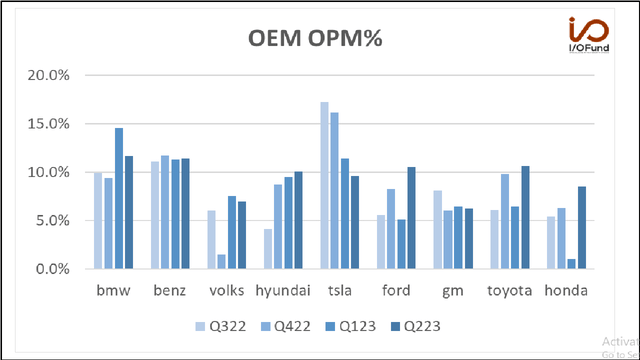

However, the challenge of higher interest rates is not unique to Tesla. All OEMs face the same obstacles. Below are reported operating margins for the major global OEMs from Q322 through Q223. Either they were relatively stable for the Germans and Koreans or bottomed in Q123 and have improved in the case of the Japanese.

Despite this, Tesla is the one OEM whose operating margins have continued to decline.

It’s Not Just Macro

This highlights that there are other forces at work beyond the macro. We believe it points to Tesla implementing a pricing strategy to gain market share. Taking into consideration the competitive factors at work will help in trying to decipher Tesla’s pricing strategy and how that will impact operating margins for the remainder of 2023. It is through this competitive analysis framework that we will try to parameterize how low Tesla’s operating margins can go.

For this analysis, we chose to focus on reported group operating margins. Although this metric includes non-EV businesses, we believe it’s the most objective and public measure to provide an apples-to-apples comparison across the auto landscape globally.

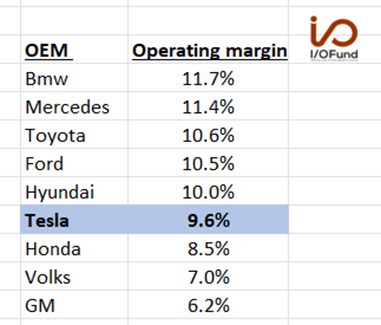

At the end of Q422, Tesla’s operating margin was 16%. To provide some context, at the time this was greater than the German OEMs. Tesla had firmly positioned itself in the premium segment.

The Germans have been dealing with their own challenges integrating EV offerings, and have been trying to catch up with Tesla. Perhaps sensing its competitive moat within the premium market was fortified, this gave Tesla an impetus to lower prices further to attack the mass market segment. In Q223, Tesla’s operating margins declined to 9.6% after enacting a series of price cuts.

Currently, this is how Tesla’s operating margins compare to its main competitors. As can be seen below, Tesla’s Q223 reported operating margins are below those of most of the major U.S., German, Japanese, and Korean OEMs.

YCharts

How Low Can Operating Margins Go?

Strategically, Tesla will likely continue to lower prices to increase its leading EV market share to stave off competition, which will intensify over the next few years. Tesla’s electric market share peaked at 78% in 2018 and stood at 62% in 2022. By 2026, Merrill Lynch estimates it will decline to 18%

In the most recent Q2 call, both Elon Musk and Zachary Kirkhorn, former CFO, signaled Tesla’s focus will continue to be on volumes.

Musk

“So, I think it’s sort of, it would be — I think it — it does make sense to sacrifice margins in favor of making more vehicles because we think in the not too distant future, they will have a dramatic valuation increase.”

Kirkhorn

“We continue to work towards our goals of maximizing volumes on our vehicle business … in a way that generates the capital to continue our pace of R&D and capital investments.”

Through this competitive analysis framework, we believe Tesla’s Q3 operating margins can decline to a level between Honda and VW. Taking the midpoint, operating margins may go to 7.8% compared to most recent 9.6%. If operating margins were to reach a level closer to – or below GM perhaps – that could be a sign they’re close to the bottom. This highlights the broader concern for investors in that Tesla has not provided any parameters nor guidance to assess how low margins may go. This is why we significantly reduced our position.

We have two base cases

Base Case 1 is that Q3 operating margins are between Honda’s and VW’s at 7.8%.

Base Case 2 is more bearish in that they reach GM’s at 6.2%. For now, we believe Base Case 1 is the most likely. Consensus opm estimates are higher, and consensus will have to revise down their Q3 and Q4 operating profit estimates if either case materializes.

In the medium term, there are reasons to be optimistic that Tesla’s strategic moves may bear fruit and its margins will rebound. In addition to lowering prices, the move from the CSS to Tesla’s NACS EV charging standard may help Tesla take market share away from those who have not yet announced plans to shift to NACS. Namely, Toyota (TM) and Honda (HMC), who together have a 25% automotive market share in the US. Meanwhile, Tesla deserves credit for maintaining its premium brand perception despite lowering prices. For now, the Tesla brand is almost synonymous with EVs. The refreshed Model 3 may further strengthen Tesla’s position in the minds of consumers.

Tesla’s Price Action:

We continue to see a bifurcated market, which has been one of the leading themes in 2023. Some markets/stocks have likely put in tops, while big tech, especially those names perceived to be involved in AI, suggest another high is likely. Tesla, Inc. stock falls into this latter camp, where one more high is still on the table before we have to deal with a bout of extended volatility. You can read more about our broad market analysis here.

The question for Tesla investors is whether the January low was a major low, or do we have one push lower before a major low is struck. There are some stocks, like Nvidia (NVDA) and Netflix (NFLX), for example, that will likely see similar bouts of volatility in the coming months, yet they have a high probability of making a lower high. Tesla could fall into this category.

There are two large counts that I’m tracking based on the current price information that account for these scenarios.

- Blue – The big picture here has TSLA making a higher low in the coming period of volatility. The key to this count will be a large pullback that both holds $147 and is a 3-wave retrace. If this happens, it will be setting up a great buying opportunity.

On a shorter time horizon, TSLA has ended the topping region from $300 – $325. We could see one more swing into the $325 region. This will be very strong resistance to monitor, if we get another push. The August low of around $213 will be very important. If we break below this level, then it is likely the top is in.

- Red – on a shorter time horizon, the above analysis applies to both counts. Where this one differs will be in the pattern of the larger retrace. Instead of a 3-wave retrace, it will have to be a 5-wave pattern that breaks below $147. If this happens, the odds will be quite high that we will see one more low before a major buying opportunity presents itself.

If you own Tesla stock or are looking to own Tesla, we encourage you to attend our weekly premium webinars, held every Thursday at 4:30 pm EST. This week, we will discuss Tesla, as well as a handful of other AI plays – what our targets are, where we plan to buy as well as take gains.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Check out my premium service “Tech Insider Network”

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our audited 3-year results of 47% prove we are a top-performing tech portfolio. This compares to popular tech ETFs at negative 46% and the Nasdaq at 19%.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services includes an automated hedge, portfolio of 10+ positions, broad market analysis, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.