Summary:

- Meta Platforms crushed earnings predictions for the first quarter.

- The social media company surprised the market with its revenue growth, better than expected top line results and a growing user base.

- Meta Platforms also saw improved free cash flow margins in Q1’23.

- The valuation remains highly attractive, despite a strong valuation rebound in the last 6 months.

Justin Sullivan

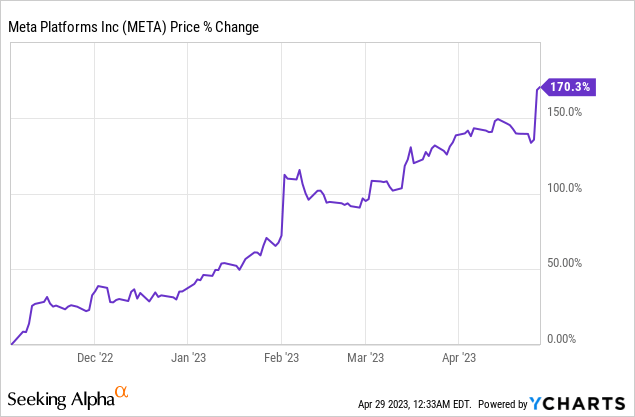

Despite a challenging advertising market and three straight quarters of revenue declines, Meta Platforms (NASDAQ:META) changed the narrative on Wednesday when it reported 3% year over year revenue growth. Meta Platforms delivered one of the strongest earnings sheets so far in the tech sector and the social media company crushed top line and EPS estimates as well. Additionally, Meta Platforms issued a strong outlook for the second-quarter and saw a material improvement in its free cash flow margins. Although Meta Platforms has seen a 170% increase in its share price since November 2022, the stock is still an attractive deal based on its earnings valuation!

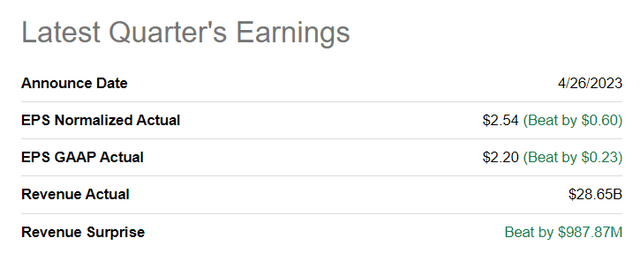

Strong earnings performance relative to estimates

Meta Platforms reported revenues of $28.65B for the first-quarter, showing 3% year over year growth and beating estimates easily. The revenue beat was significant, as revenues surpassed the estimate by almost $1.0B. The results also show that the advertising market is seeing signs of stabilization, a factor that I indicated in my last article about Alphabet (GOOG) as well.

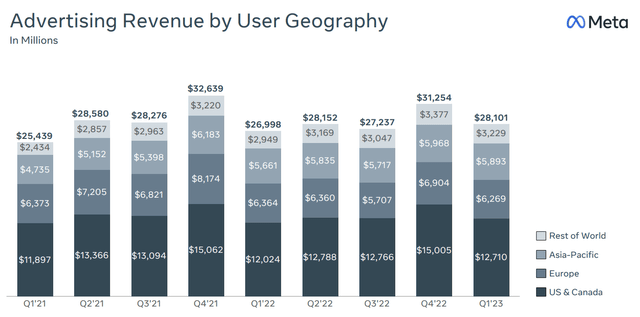

Meta Platforms generated advertising revenues of $28.1B, showing 4% growth year over year. The social media company has reported slowing revenue growth for three straight quarters, so the uptick in revenues in Q1’23 may indicate that the digital advertising market is seeing recovering strength, despite high inflation and concerns over economic growth.

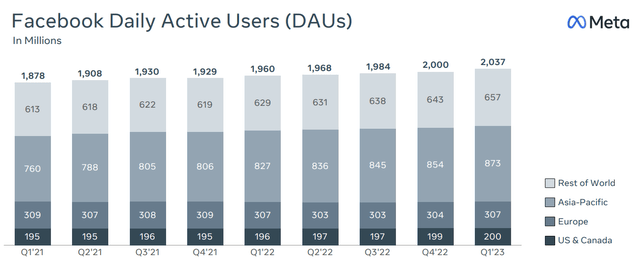

What was also good news for Meta Platforms was that the company’s user base kept expanding in the first-quarter. Facebook’s daily active users increased by 37M to 2.037B, showing quarter over quarter growth of 2%. Concerns over Meta Platforms’ user growth have weighed on the company’s valuation last year, especially because rivals such as TikTok captured the attention of a younger user demographic. The increase in users shows that Meta Platforms is still growing which bodes well for the company’s advertising revenues.

Strong outlook for Q2’23

Meta Platforms sees revenues of $29.5-32.0B for the second-quarter which translates to a year over year revenue growth rate of up to 11%. The forecast implies that Meta Platforms sees continual advertising revenue upside in a recovering market.

Free cash flow and improving FCF margins

Meta Platforms is one of the free cash flow-strongest companies that technology investors can buy. The social media company generated $6.9B in free cash flow in Q1’23 as the company scaled back some of its investments and recently announced pay-roll cuts. An improved cost structure was a key reason why I thought that Meta Platforms’ shares could go into a new up-leg!

Organic revenue growth in the advertising business paired with aggressive cost cuts have led to an improvement in the firm’s free cash flow margin as well. In Q1’23, Meta Platforms’ free cash flow margin crossed over 20% again and reached its highest level since Q1’22, at 24.1%. Due to its free cash flow strength, Meta Platforms announced a $40B stock buyback which I believe is a game changer for the social media company.

|

in mil $ |

Q1’22 |

Q2’22 |

Q3’22 |

Q4’22 |

Q1’23 |

Y/Y Growth |

|

Revenues |

$27,908 |

$28,822 |

$27,714 |

$32,165 |

$28,645 |

2.6% |

|

Operating Cash Flow |

$14,076 |

$12,197 |

$9,691 |

$14,511 |

$13,998 |

-0.6% |

|

Purchases of Property/Equipment |

($5,315) |

($7,528) |

($9,355) |

($8,988) |

($6,823) |

28.4% |

|

Payments on Finance Leases |

($233) |

($219) |

($163) |

($235) |

($264) |

13.3% |

|

Free Cash Flow |

$8,528 |

$4,450 |

$173 |

$5,288 |

$6,911 |

-19.0% |

|

Free Cash Flow Margin |

30.6% |

15.4% |

0.6% |

16.4% |

24.1% |

-21.0% |

Source: Author

Meta Platforms’ valuation

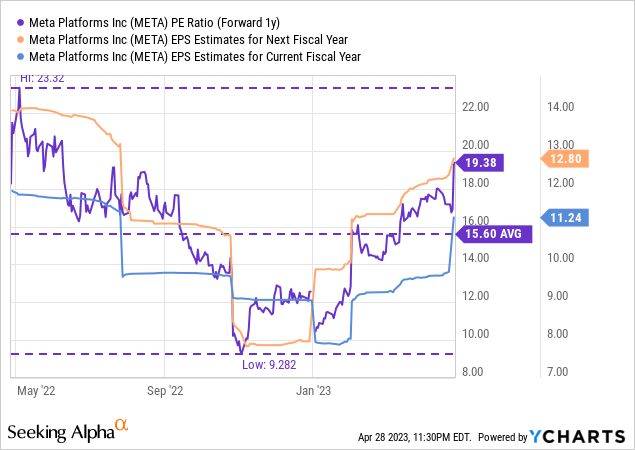

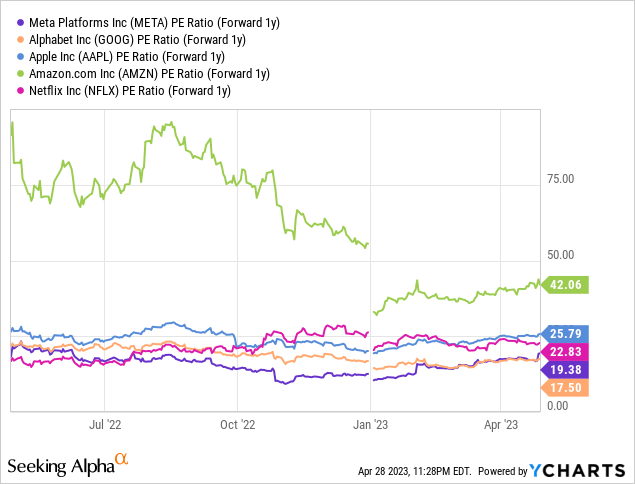

Meta Platforms remains one of the most attractively valued large-cap technology companies in the market. Despite a 170% increase in the share price since November 2022, META is still a good deal, in my opinion, because the social media company’s earnings valuation is out of touch. Meta Platforms is currently valued at an earnings multiplier factor of only 19.4X, despite having considerable free cash flow prowess and FCF margins in excess of 20%.

Meta Platforms’ EPS trend is very positive as well as analysts have started to raise their estimates after the company presented a stronger than expected earnings sheet. The social media company’s P/E ratio surpassed its 1-year average P/E ratio in the first-quarter, but I continue to believe that given META’s earnings and free cash flow power, the stock is undervalued.

Compared against other FAANG stocks, Meta Platforms has an attractive valuation as well: the company’s P/E ratio is the second-lowest with only Google being cheaper.

Risks with Meta Platforms

The biggest commercial risk for Meta Platforms is that the advertising market shows new signs of weakness which could indicate renewed top line and free cash flow pressure. I also see Meta Platforms’ aggressive investments in the Metaverse as a risk factor as accelerating product investments were the reason for a sharp contraction in the company’s free cash flow margins lately.

Final thoughts

Meta Platforms delivered a strong earnings sheet for Q1’23 that beat estimates and showed the market that the state of the digital advertising industry is improving. Additionally, Meta Platforms convinced the market with a strong user count, improving free cash flow margins which are the result of scaled back investments and cost cutbacks, and a solid outlook for the second-quarter. Although the stock has rallied in recent months, I believe the valuation is fundamentally supported by free cash flow and with a P/E ratio of only 19.4X, the risk profile remains highly attractive, especially if the advertising industry continues to rebound!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.