Summary:

- Meta’s recent earnings show strong YoY growth in revenue across all geographic regions, reflecting a healthy rebound in their business.

- The Family of Apps division performed exceptionally well, with advertising revenue increasing by 24% YoY and strong user data indicating consistent growth.

- Concerns arise with the Reality Labs division as revenues stagnate, expenses increase, and operating losses widen, posing uncertainty for Meta’s bet on the Metaverse.

- Meta’s AI efforts look promising, with its release of Code Llama earlier this year and the release of a GPT-4 competitor in 2024.

- Risks include legal concerns as Meta faces lawsuits from 41 states and the District of Columbia over claims of exploiting young people.

Justin Sullivan

Thesis

Meta Platforms, Inc. (NASDAQ:META) has had a roller coaster few years. At the height of quantitative easing by the Fed in 2021, Meta’s business soared. That was short lived, as Meta’s ads business stagnated with the rate hikes by the Fed and their massive bet on the Metaverse translating into massive costs and expenses. As a result, the stock was punished severely by investors with the stock falling around 75% from the 2021 peak. However, Meta has managed a V-shaped rebound as their business has experienced a massive turnaround. Their most recent earnings show that Meta experienced YoY growth in important areas. I believe one area that causes concern is Reality Labs as revenues are stagnating, expenses are expected to increase further, and operating losses are widening. However, Meta does have some positive catalysts, particularly with their AI development efforts. Currently, Meta trades at a mid-level valuation when compared to the past few years. With still much uncertainty as to the direction of Reality Labs but a promising turnaround in the rest of its business, I believe that Meta is currently fairly valued and deserves a Hold rating.

Earnings

Firm-Wide Analysis

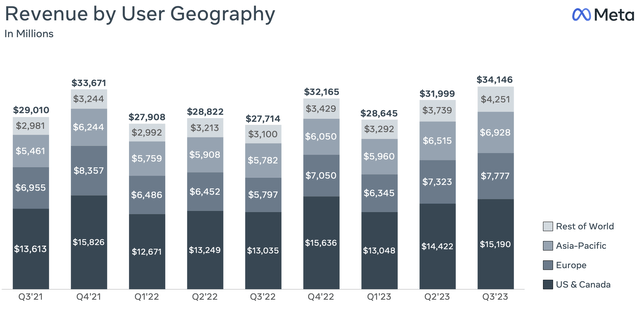

The following analysis uses data from Meta’s earnings press release, presentation, and earnings call transcript. Meta reported total revenue of $34.146 billion which is up 23% YoY. All geographic areas showed YoY growth as US & Canada reported $15.190 billion, up from $13.035 billion. Europe showed strong growth as they showed revenue of $7.777 billion which is up from $5.797 billion. The Asia-Pacific showed relatively less growth as revenue is only $6.928 billion, up from $5.782 billion. Lastly, the Rest of World reported $4.251 billion, an increase over the prior year quarter’s $3.100 billion. In my view, these were very strong revenue figures and reflects a healthy rebound in Meta’s business across all geographic regions.

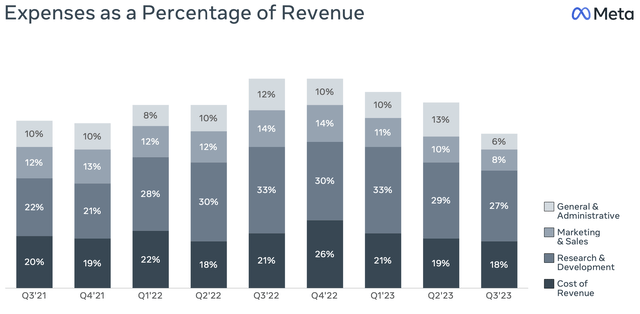

Another promising sign is the decline in expenses. Meta reported only $20.4 billion in total expenses, which is down 7% YoY. Breaking it down, cost of revenue was up 9% as there were higher infrastructure related costs partially offset by lower content costs. R&D costs were up 1% as there were higher headcount-related costs from Family of Apps and Reality Labs partially offset by lower non-headcount-related Reality Labs operating expenses. Marketing & Sales expenses were down a whopping 24% as they had lower marketing spend and headcount-related costs. Lastly, General & Administrative expenses showed the largest decline as they are down 39% on lower legal-related expenses. As well, they ended the quarter with over 66,100 employees down 7% from Q2. Overall, I believe these results shows that Meta has been very successful with cutting their costs and boosting their earnings metrics as a result.

The strong revenue figures and impressive cost cutting translates into very impressive income figures. For operating income, they reported $13.748 billion which is up a massive 143% YoY. This also reflects a large increase in operating margin as it increased from 20% to 40%. It is a similar story for net income as Meta reported $11.583 billion, up 164% YoY. Lastly, for diluted EPS, it is up 168% YoY to $4.39. CAPEX in the quarter was shown to be $6.8 billion down significantly YoY from $9.518 billion due to lower server and data centre construction spend. All things considered, FCF is reported to be $13.639 billion, up from only $173 million in 22Q3. From my analysis, as a whole, Firm-Wide performance was very strong as there was improvement in key areas and metrics that clearly shows to me that Meta has completely turned around their business and is back to winning ways.

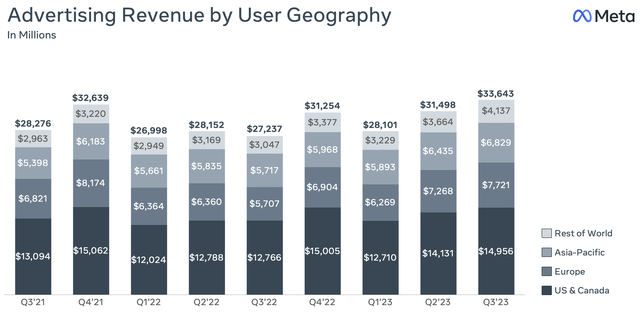

Family of Apps

The financial performance within this division was very strong. Advertising revenue was $33.643 billion, reflecting a 24% YoY increase. The largest contributor to the increase was online commerce vertical followed by CPG and gaming. For Other revenue, they reported $293 million which is up 53% YoY as a result of strong business messaging revenue growth from WhatsApp Business Platform. This resulted in total revenue being $33.936 billion, up 24% YoY and operating income being $17.490 billion, up from $9.336 billion reflecting a 52% operating margin. Their ad-impressions showed improvement as well as it was up 31% YoY driven by strong results in the Asia-Pacific and Rest of World. However, average price per ad was down 6%. Overall, I believe the financial performance of Family of Apps was incredibly strong and even more impressive given the current highly uncertain economy.

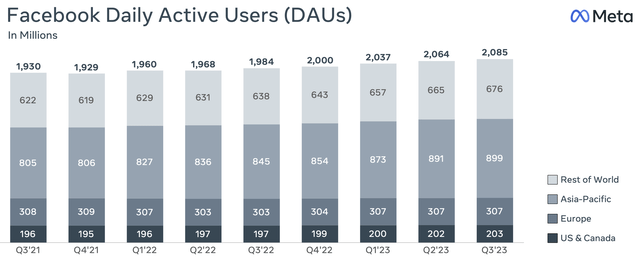

Their user metrics remains strong as well. For the Family of Apps, they reported Daily Active People of 3.14 billion, up 7% YoY while their Monthly Active People was 3.96 billion, also up 7% YoY. Family Average Revenue per Person also showed improvement as it increased from $7.53 to $8.71. For Facebook, DAUs were reported to be 2.085 billion people, an increase of 5% YoY, while MAUs only had a 3% increase to 3.049 billion people. Lastly, Facebook average revenue per user was up from $9.41 to $11.23 worldwide with all geographic regions showing increases. In my view, user metrics reinforces the turnaround argument as growth remains consistent and resilient.

Reality Labs

As a whole, Meta provided little info for this division. They had revenues of only $210 million which is down 26% YoY on lower Quest 2 sales. Expenses were flat, however, as they remained at $4.0 billion due to higher headcount-related expenses being offset by lower non-headcount-related operating expenses. This all results in an operating loss of $3.742 billion vs. a $3.672 billion loss in 22Q3. Even though information is limited, I believe these results are quite concerning for investors as it seems Reality Labs is bleeding cash while the revenue outlook is highly uncertain for the metaverse. It is still a large unknown whether Zuckerberg’s massive metaverse bet will be a success or a flop at this point.

Guidance

Meta expressed that it is focused on its ability to deliver an engaging experience for its community and also improving monetization. For Q4, they expect total revenue in the $36.5-40 billion range. For FY23 expenses, they now expect $87-89 billion down from an earlier $88-91 billion expectation. However, for Reality Labs, they are expecting operating losses to increase YoY for FY23. For 2024, they expect higher infrastructure-related costs and growth in payroll expenses due to the addition of incremental talent to support priority areas. In 2024, Reality Labs is expecting operating losses to further increase meaningfully due to ongoing product development efforts in AR/VR and investments to scale the ecosystem. Overall, I find Reality Labs’ guidance quite concerning as it seems like the losses have no end in sight. Also expenses are projected to rise and could potentially deter some investors.

Recent Developments

Ads Business

According to a Oct 30th Seeking Alpha post, Meta is offering ad-free subscriptions for Facebook and Instagram in Europe as they try to meet regulatory requirements in the EU in regards to data privacy. The stock was up 4% following the news showing investor optimism. It is reported that people in the EU, EEA, and Switzerland can continue to use the ad-based version for free. Starting this November, users can subscribe for 9.99 euros/month for the web version or 12.99 euros/month for iOS/Android. Users’ personal info will not be used for ads when they are subscribed. In my view, this is a positive development as it seems Meta has found a good way to satisfy the regulatory requirements. While I personally believe that few people will subscribe, Meta’s business is back on solid footing in Europe as a result of this subscription offer.

Metaverse

In late September, a Seeking Alpha post reported that Meta had released a new Quest 3 headset at their Connect developer conference. The new Quest 3 will reportedly cost $499 and includes VR and AR technologies. It is also reported to be thinner, have upgraded lenses, have a new controller, and use Qualcomm’s (QCOM) Snapdragon X2 Gen-2 chip. Meta has 500 games/apps for Quest 3 and Xbox cloud games are coming this December. The Quest 3 was reported to have started shipments on Oct 10th. As a separate product, Meta also released its next-gen Ray-Ban smart glasses that can play music, take calls, and livestream. It will reportedly cost $299 and availability started on Oct 17th in 15 countries. I believe this is an important development as it shows Meta is highly committed to being at the forefront of metaverse technology, especially with Apple’s (AAPL) Vision Pro coming out next year.

AI

According to a Seeking Alpha post, in late August Meta launched Code Llama, a LLM that can use texts prompts to generate and discuss code. It is reportedly free for research and commercial use and can be used as a productivity and educational tool to assist programmers in writing robust and well-documented software. Code Llama is a code specialized version of Llama 2 and was created through training of Llama 2 on Meta’s code specific datasets. Lastly, it is reported to support Python, C++, Java, PHP, JavaScript, C#, Bash, and more. In another development, it was reported by Seeking Alpha in September that Meta is developing a new AI model to rival GPT-4. It’s reportedly aiming to be as powerful as GPT-4, much more powerful than their Llama 2, and will be ready next year. The model could be used to build services that produce text, analysis, and other outputs. It is reported that the training for the model will be done on Meta’s own infrastructure and will be starting early next year. In my view, these are important developments as it shows Meta is committed to AI technology even though it is betting big on the metaverse. It shows to me, that Meta is aiming to dominate on multiple fronts and investors may be rewarded as a result.

Valuation

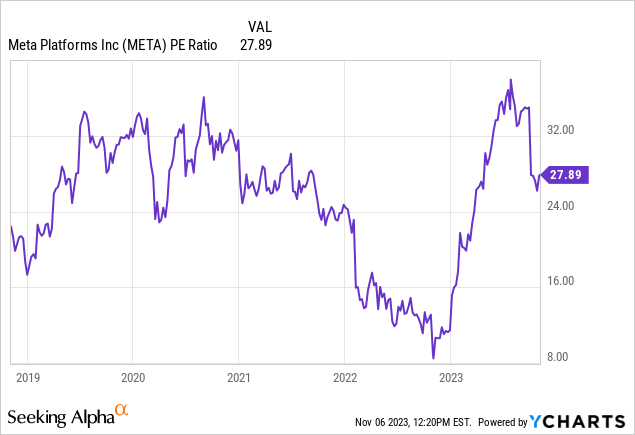

Meta currently trades at a P/E of around 28 and that is around the average of the past 5 years. It has rebounded significantly along with the resurgence of its business and stock but is also down significantly from the highs of earlier this year.

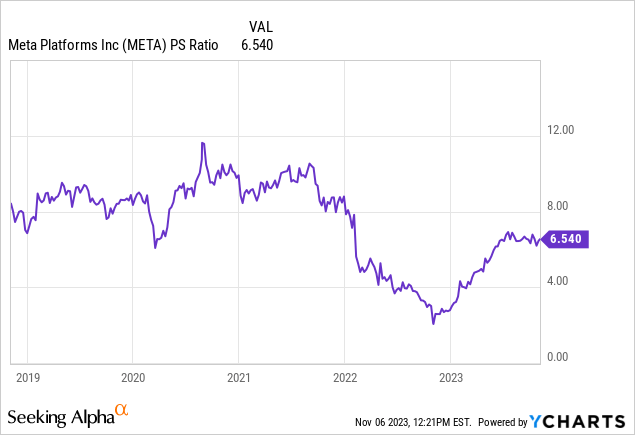

It is a similar story for the P/S ratio. It is currently at around 6.5 and is at a low-mid range for the past 5 years. Like with the P/E, the P/S has rebounded significantly since the 2022 trough as Meta’s dramatic turnaround propelled its stock back over $300.

When evaluating its P/E and P/S ratios, I believe Meta is currently fairly-valued. In my view, the significant multiple expansion from the 2022 trough is justified as Meta’s business has shown a remarkable V-shaped recovery. On the other hand, however, Reality Labs is continuing to bleed cash like there’s no tomorrow and revenues for the division shows no signs of increasing any time soon. Meta is really a tale of two cities. Its traditional legacy ads business is back in full force as the earnings results show but its large bet on the metaverse is a risky one and could potentially be very costly if the metaverse does not unfold the way Zuckerberg envisions it. Therefore, despite the rebound in the P/E and P/S being justified by their ads business resurgence, these multiples do not deserve new near-term highs since I believe the uncertainty of Reality Labs will weigh on Meta’s valuation for the foreseeable future. Therefore, I believe their current valuation is correct and Meta deserves a Hold rating.

Risks

As discussed in the valuation analysis above, a major risk is the uncertainty in the Reality Labs division. In October, a Seeking Alpha post reported that a TF International Securities analyst sees Meta’s Quest 3 demand continuing to weaken. Analyst Ming-Chi Kuo said that demand has likely declined significantly since the launch and estimates 2H23 shipments of the Quest 3 to be only 2-2.5 million units compared to an initial estimate of over 7 million units. In addition, the FY24 shipment estimate is only at around 1 million units. For the new Ray-Ban smart glasses, Kuo said Meta is forecasted to ship 1.5 million units over the lifecycle of the entire product, below the 2 million mark of the predecessor. It is reported that the previous Ray-Ban Stories Smart glasses ended up with only 300-400K units shipped, far below expectations and the glasses have below 50,000 active users. In my view, these developments are worrying as it shows Meta’s metaverse bet is extremely risky. The demand for these products have not been anywhere near strong as exhibited by weak shipment figures and low revenue in Reality Labs.

Another risk is Meta’s legal concerns. In late October, a Seeking Alpha post reported that Meta is being sued by California and over 2 dozen other states arguing that Instagram and Facebook are exploiting young people for profit and also giving them harmful and addictive content. It is reported to be a bipartisan suit filed in federal court in California. In total 41 states and D.C have filed suits against Meta. The complaint read “Its motive is profit, and in maximizing its financial gains, Meta has repeatedly misled the public about the substantial dangers of it social media platforms.” Social media companies, including Meta, are reportedly facing hundreds of lawsuits claiming they are causing adolescents and young adults anxiety, depression, eating disorders, and sleeplessness as a result of addiction to social media. In my view, this is a significant risk as these lawsuits could result in fines, reputation damage, or a forced change in their algorithms. With their ads business being by far their largest revenue generator, these legal risks warrant some concern.

Conclusion

Meta has experienced a dramatic turnaround in the last year and its most recent earnings show that it is going in the right direction in terms of the ads business. Recent developments are also a cause for optimism as Meta is overcoming regulatory hurdles in Europe and strengthening its AI positioning. However, the main concern I have for Meta is their Reality Labs division. Expenses are elevated and expect to increase further while revenue has dropped YoY. Even though the Quest 3 and new Ray-Ban Glasses are innovative next-gen products, the risk involved with building out the Metaverse is still substantial. Today, Meta trades at a mid-level valuation in terms of the past 5 years P/E and P/S ratios. In my view, the current valuation is fair due to the balance of a strong ads business resurgence and a cash-bleeding risky metaverse bet. Therefore, all things considered, I believe Meta is a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.