Summary:

- Meta Platforms printed another strong quarter after the close today.

- META stock sold off a little in the immediate aftermath of earnings, but we remain bullish on the name in the medium term.

- We rate META stock at Hold with a price target of $676.

Markus Volk

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

On Fire, In A Good Way

The most impressive thing about Mr. Zuckerberg is not, in my view, the founding of Facebook (NASDAQ:META) as-was, nor his ability to remain at the helm despite all prior attempts to shoehorn some adult supervision into the corporate mix. What is most impressive is his ability to read the room and switch up company strategy to fit the market opportunity as it evolves.

The Facebook IPO was a bust, as everyone knows. There were technical glitches in trading on launch day, which didn’t help, but ultimately the stock just sold off after the event. This was, of course, for the simple and old-fashioned reason of “more sellers than buyers” but the nagging issue for Facebook in 2010-2012 was, But What About Mobile? As a primarily US business at the time, when smartphone penetration and cellular network speeds & coverage lagged vs. Europe, the company’s product story was all about personal computers as the terminal device. User behavior in the US changed rapidly with the 2007 launch of the iPhone; demand for high capacity low-dropout wideband CDMA cellular data ballooned and carrier capex wasn’t too far behind. And with that the US began to outpace Europe in mobile application development and usage. (It hasn’t looked back since). Zuckerberg, to his great credit, decided mobile was where the money was, and pointed the company at it, with great success.

As a result of the mobile-first strategy the company identified messaging and photos as a big opportunity. WhatsApp and Instagram both looked to be insanely expensive purchases at the time; now they both look cheap, Instagram ($1bn for negligible revenue) in particular.

The company hit a well-documented slowdown as ad spending took a hit in the 2022 rate-hike cycle. Zuckerberg responded to weakness with strength, ramping capex to the moon with spending on “Metaverse” applications – enhanced AR / VR in essence. This proved to be, so far, an expensive waste of time and, indeed, a hill on which Zuckerberg’s leadership of the company could have faltered and maybe died. Instead COO Sandberg was the casualty of the crisis; Zuckerberg embraced AI as the growth theme, put major capital to work behind it, the ad economy came back to life around the same time, and hey presto the stock is at all-time highs.

That is what a superb CEO looks like. Never mind that he remains younger than the average VP at the average company. If you want exceptional performance from the companies you own, you need exceptional leaders, and if you want exceptional leaders, you need people who look, act, and think differently; and you want leaders who are just like skilled traders – having no religion as to strategy but merely to sense where the win is now and then sail towards it.

Financial Fundamentals

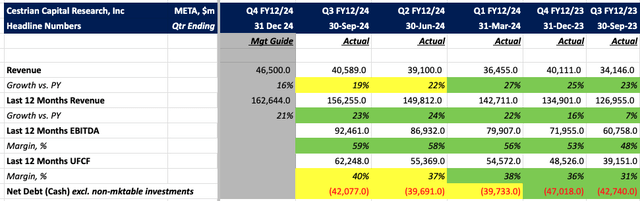

The company just put in a very strong Q3 performance. Here’s the headlines.

META Financial Summary

META Financial Summary (Company SEC filings, YCharts, Cestrian Analysis)

$150bn of trailing twelve month (TTM) revenue growing at 23% on that same TTM basis; 40% unlevered pretax free cashflow margins after the huge capex bills to pay for the AI investments; and $42bn of net cash on the balance sheet after buying back not far short of 400m shares since 2018 (source – YCharts.com). This is an incredibly strong business.

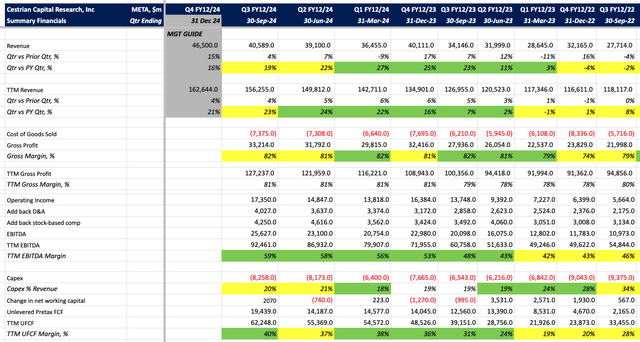

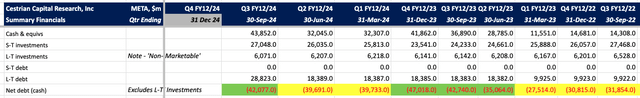

META Financial Detail

META Fundamentals I (Company SEC Filings, YCharts, Cestrian Analysis) META Fundamentals II (Company SEC Filings, YCharts, Cestrian Analysis)

Growth is slowing somewhat in the last couple quarters, but EBITDA and cashflow margins are trending up in compensation for that. This would be a problem for the stock, I think, if valuation multiples were sky-high, but as is usually the case with META, the valuation remains fairly muted.

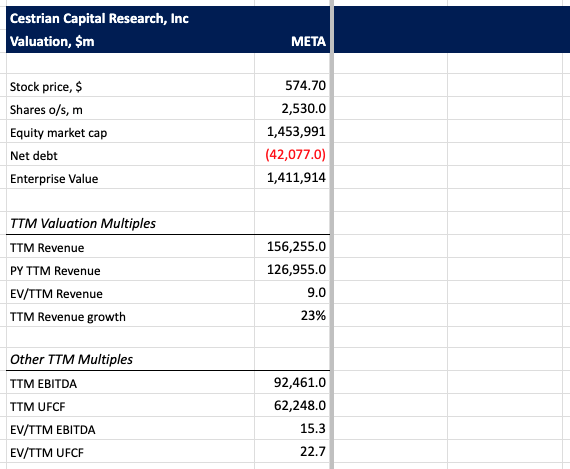

META Stock Valuation Analysis

META Valuation Analysis (Company SEC Filings, YCharts, Cestrian Analysis)

The market is asking you to pay 23x trailing twelve month unlevered pretax free cashflow. You’ll pay something of that order for a low-growth defense contractor, and before you say yes-but-dividends, it’s worth noting that META has a dividend yield of 0.3% vs say Northrop Grumman (NOC) dividend yield of 1.6% (in both cases, source – YCharts); hardly determinative. I do not think that META stock is expensive on fundamentals at this time.

META Technical Analysis

Whilst financial fundamental analysis can tell you something about the company which issues the stock that the market is trading, I find that only studying the price and volume behavior of the stock itself is all that much use when it comes to deciding when to buy or sell the stock.

Actually, that’s not true.

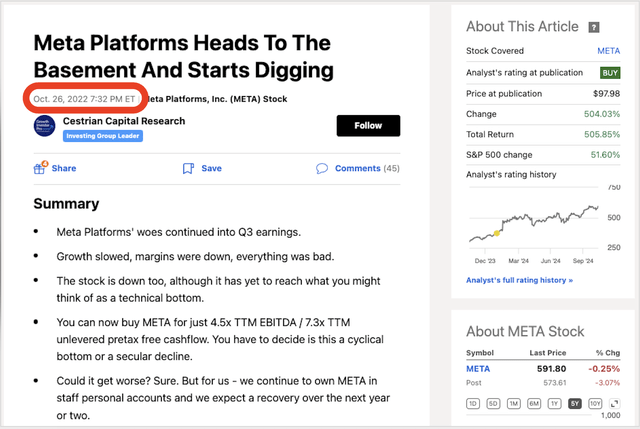

Sometimes, just sometimes, fundamental and technical analysis come together in a way so neatly that it’s hard to believe they are wrong. This is what happened in 2022 when we published this note:

Cestrian META Note October 2022 (Seeking Alpha)

In our “Growth Investor Pro” Investing Group service here on Seeking Alpha (this) we rated META at “Accumulate” between $96-157/share and have rated the name at “Hold” from $157/share on up. For us, by the way, “Hold” isn’t a euphemism for “Sell” as often seems to be the case amongst sell-side analysts. Since we write buyside research – which is to say for the benefit of investors rather than issuers – “Hold” means, er, “Hold”. And it’s been a righteous call so far.

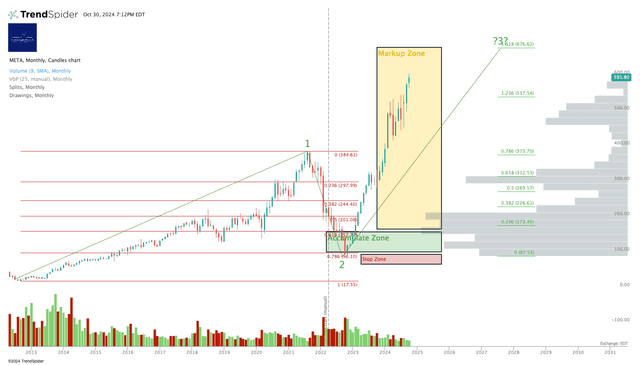

Here’s how we see the chart today. (You can open a full page version of this chart, here.)

META Stock Chart (Trendspider, Cestrian Analysis)

META Stock Rating

Based on the fact that revenue and cashflow growth remains strong, on what we see as an inexpensive valuation, and on our take on the stock chart, we continue to rate META at Hold. Our price target is $676/share because that represents a key technical level (the 3.618 Fibonacci Wave 3 extension of the Wave 1 placed at the Wave 2 low, timeframe in years as shown on the above chart) where resistance may kick in. The stock could go higher of course but in a continuing bull market we think that target can be hit, and we think that anyone taking gains there having accumulated in the $96-157 range could say they had managed their capital well.

Thanks as always for reading our work! As always we’re delighted to take comments and questions, objections and agreements, in the comments to this article.

Alex King, CEO, Cestrian Capital Research, Inc – 30 October 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Business relationship disclosure: See disclaimer text at the top of this note. Cestrian Capital Research, Inc is an affiliate partner of TrendSpider.

Cestrian Capital Research, Inc staff personal accounts hold no positions in META directly but do have exposure to the stock via ETF holdings in, inter alia, SPY, UPRO, TQQQ, CNDX, VUAG .

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Our Investor Community.

Our Growth Investor Pro service is one of the most highly-respected and most popular services on all of Seeking Alpha. And right now you can take a one-month trial for just $99 before deciding if you want to take an annual subscription. You can learn all about it here including the wall of 5-star reviews we’ve received in bear and bull markets alike.