Summary:

- Micron stock rallied 93% since last November due to the company’s impressive renaissance after facing a bit of geopolitical headwinds during the 2022-2023 fiscal years.

- My analysis suggests that the company is poised to deliver strong quarterly earnings on June 26 with likely positive forward-looking comments from the management.

- My valuation analysis indicates that all positives are likely priced in, as MU stock is slightly overvalued.

hapabapa

Investment thesis

I was completely wrong with my “Hold” rating for Micron (NASDAQ:MU) last November because the stock gained 93% since then. The company demonstrated revenue and profitability recovery dynamic much better than expected, and that was the big catalyst for the stock to rally.

The company is indeed fundamentally strong. The company’s revenue and EPS renaissance after massive political headwinds of the last couple of years is impressive. My analysis suggests that the company is likely to deliver strong earnings on June 26. However, the discounted cash flow simulation shows overvaluation of the stock, meaning that all positives are likely already priced in. All in all, I reiterate my “Hold” rating for MU.

Recent developments and earnings preview

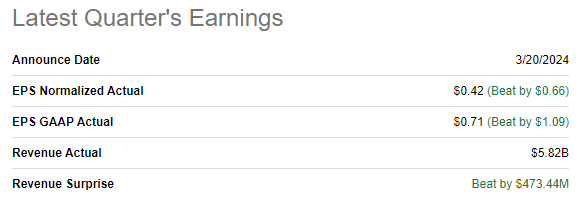

MU released its latest quarterly earnings on March 20, when the company crashed consensus estimates with massive revenue and EPS surprises. Revenue grew by a massive 57.7% YoY, the adjusted EPS was $0.42 after being deeply negative in the same quarter last year.

Seeking Alpha

The company’s 3.3% operating margin finally became positive after several quarters of struggling against political headwinds caused by the “Trade war” between the U.S. and China. However, it is still too far to Micron’s historical stellar operating margin levels of above 30%.

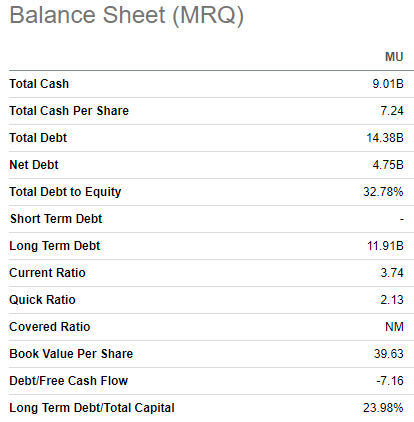

That said, Micron’s cash generated from operations was below than capital expenditures, which means that the free cash flow is still negative. Nevertheless, the company’s balance sheet is still very strong with $9 billion cash pile and total debt levels representing less than 10% of the market cap. Healthy liquidity metrics underscore Micron’s fortress financial position. I always pay a lot of attention to the balance sheet because it is a solid indication of financial flexibility to achieve the company’s growth and innovation goals. From the capital allocation perspective, it looks that the management is extremely efficient, especially considering the massive headwinds and losses of the last couple of years.

Seeking Alpha

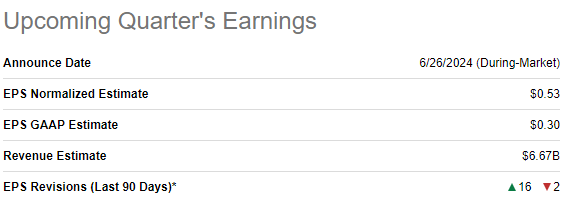

A long time passed since the last earnings release, so I am not going into deeper details. Moreover, the upcoming quarter’s earnings release is very close to us as it is scheduled for release on June 26. Wall Street’s sentiment around the upcoming earnings release is quite positive, with sixteen upward EPS revisions over the last 90 days.

Seeking Alpha

Fiscal Q3 2024 revenue is forecasted to be $6.67 billion, 78% higher than the same quarter of 2023. The adjusted EPS is expected to expand sequentially from $0.42 to $0.52, which is a bullish sign indicating momentum of the company’s operating leverage.

Another reason to be optimistic about the upcoming earnings release is Micron’s solid earnings surprise history. If four quarters of the company’s struggles between FQ3 2022 and FQ2 2023 are excluded, Micron consistently delivered strong revenue and EPS surprises. This means that the management has solid visibility of the business performance unless there are some external unfavorable disruptions. Since Micron’s challenges due to geopolitical factors are mostly in the rearview mirror, it is highly likely that the company will once again deliver solid earnings.

The management’s forward-looking statements will be crucial as well, and I think they have positive news to share as well. For example, in early June, the company announced sampling of its next-gen GDDR7 graphics memory with the industry’s highest bit density. During the earnings call, the management might share more insights into this information and its effect on the company’s long-term financial performance.

The GDDR7 news was not the only one in respect to rolling out new products. In early May, Micron announced delivering crucial LPCAMM2 with LPDDR5X Memory for the new AI-ready Lenovo ThinkPad P1 Gen 7 Workstation. According to the release, the product reduces power consumption while delivering 1.3 times faster performance than the company’s previous generation analog.

Valuation update

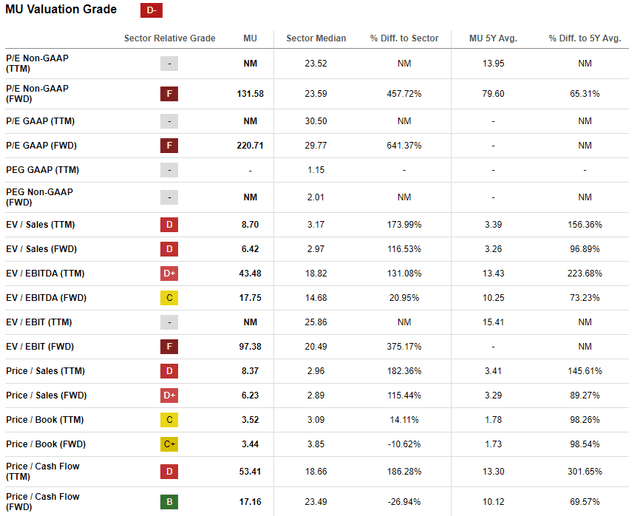

MU rallied by 112% over the last twelve months, several times outperforming the broader U.S. stock market. Performance in 2024 is also robust, with a 63.5% YTD share price increase. Valuation ratios became quite high after MU’s massive rally of the last several months. However, the last time I covered the stock its valuation ratios were also high, and it was not an obstacle for the share price to almost double.

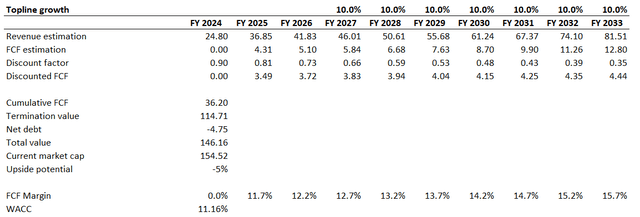

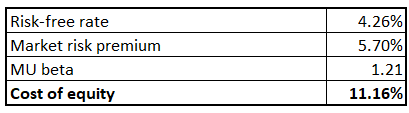

Therefore, I must conduct the discounted cash flow [DCF] model simulation. Last time, the upside potential suggested by my DCF was 17%, much more modest than the actual rally. Therefore, this time I have to be more attentive with assumptions selection. I will start with calculating WACC by myself, instead of relying on external sources.

As we saw in the previous section, Micron’s total debt is $14 billion, which is below 10% of the company’s current market cap. Due to the insignificant role of debt in Micron’s total capital structure, I will use the cost of equity as the discount rate for my DCF. Based on the CAPM approach, Micron’s cost of equity is 11.16%. All variables for the CAPM formula are easily available on the Internet.

Author’s calculations

I use revenue consensus estimates for the years 2024-26 because it summarizes the opinion of more than a dozen of Wall Street analysts, which looks reliable to me. For the years beyond, I implement a 10% CAGR, which is my personal judgment. The judgment is based on the fact that Micron’s revenue mix is evolving. While various sources forecast mid-single industry CAGRs for DRAM and NAND over the long term, the SSD industry is expected to thrive with almost 19% CAGR. Since MU expands into SSD, I think that incorporating a low double-digit revenue CAGR is fair.

For the FCF margin assumption, we need to look back a bit. The TTM FCF ex-SBC margin is negative, which makes my zero assumption for FY 2024 quite reasonable. Wall Street analysts expect the adjusted EPS to skyrocket from $1.06 in FY 2024 to $11.84 in FY 2026. Fiscal year 208 was the last time Micron’s bottom line was that strong, the company generated a 12.2% FCF margin. Therefore, I apply this level for FY 2026 FCF margin with a 50 basis points yearly expansion. On the contrary, for FY 2025 I deduct half a percentage point from FY 2026 levels.

The business’s fair value is very close to the current market capitalization, indicating that the upside potential is limited. My DCF model’s assumptions look quite optimistic, which means that Micron’s valuation is unlikely to be attractive here.

Risks to my cautious thesis

The most obvious risk to my cautious thesis is my poor track record in giving ratings to Micron. While overall, I have quite a decent success track record with a 5-star rating from Tipranks, Micron is one of my few big pains. I started with a Sell rating last August and upgraded it to Hold in November, and both recommendations did not age well. Therefore, readers should keep that in mind before making final decisions.

As I mentioned before, the company will release its quarterly earnings soon, which might be a big positive catalyst for the stock price. According to Micron’s share price history, it spiked by 14% on March 20 after the latest earnings release. Almost the same happened after another earnings release in late December 2023 when the share price increased by almost 9% on December 31. Therefore, this trend might persist, and the upcoming earnings release might send the stock even higher.

The overall market sentiment is positive, and it is difficult to call it cautious, especially considering Nvidia’s unstoppable rally even after the company surpassed $3 trillion in market capitalization. Aggressive market sentiment also can be against my cautious stance. However, rallies are not infinite, as we all know.

Bottom line

To conclude, Micron is still a “Hold” in my opinion. It is difficult to argue that the company’s fundamentals are strong, but all the positives are likely already priced in. My valuation analysis suggests that the stock is slightly overvalued, which means that expectations are already high.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.