Summary:

- Micron Technology is thriving in the high bandwidth memory market, leading to a profit beat and strong forecast for the next quarter.

- The company’s HBM3e shipments are scaling up, with expectations of significant revenue contributions by 2025 and a market share increase to 25%.

- Micron’s 4Q24 earnings showcased a 93% YoY sales increase and a 23% operating income margin, driven by soaring HBM demand.

- With a low profit multiple and potential for substantial rerating, I see MU as a compelling growth story in the AI market.

Monty Rakusen

Micron Technology, Inc. (NASDAQ:MU) (NEOE:MU:CA) is crushing it in the high bandwidth market right now, leading the chip company to a profit beat and a fantastic forecast for the next quarter.

Micron is thus enjoying a robust upsurge in sales and profitability, and the company does expect demand for its new HBM products to remain resilient.

In my view, Micron is one of the most compelling and captivating bets on the growth of the artificial intelligence industry at the present moment and with a low profit multiple to boot, I think that investors can still jump on the bandwagon and participate in the company’s HBM3e shipment up-scaling.

My Rating History

My last stock classification for Micron was Buy, predominantly because demand for HBM3E high bandwidth memory was going through the roof. Micron’s fourth quarter earnings, released last week, corroborated this story as the chip company profited from sales that almost doubled YoY.

The up-scaling in high bandwidth memory is only starting and, in my view, Micron Technology is not going to see its sales momentum run out of steam anytime soon.

Micron Technology Is Doing A Bang Up Job

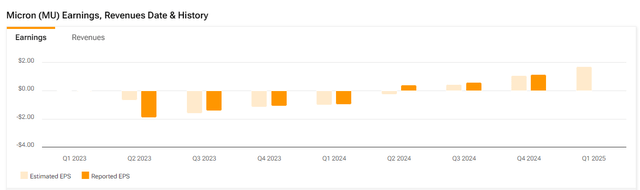

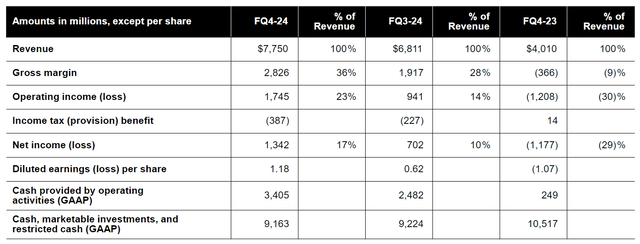

Micron reported profits for the fourth quarter which amounted to $1.18 per share, exceeding the Street estimate of $1.11 per share comfortably. The last quarter, which is Micron’s 4Q24, was the third quarter in a row in which the chip company reported positive income.

Earnings And Revenue (Yahoo Finance)

Micron Technology’s 4Q24 earnings have been stellar lately, as the memory manufacturer is profiting from a substantial up-scaling in the market for high bandwidth memory. High bandwidth memory, or HBM, is needed in data centers to power AI applications. This product is presently so high in demand that Micron has already contracted for its entire HBM supply for 2025.

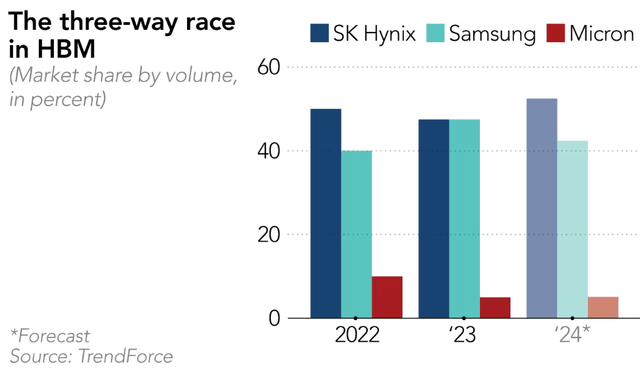

HBM is obviously the hottest thing in the memory market right now and a very solid growth opportunity that has a long runway for Micron Technology: The memory manufacturer presently has an HBM market share of 10%, but anticipates to scale its share up to 25% in the medium term. Shipments of its latest HBM3e product only recently begun, and management drew cheers from investors when it reiterated that it sees HBM contributing multiple billions in revenue by the financial year 2025.

The market for high bandwidth memory is effectively controlled by three companies, including SK Hynix, which dominates the market, Samsung and Micron. Micron Technology started shipping its HBM3e in the second calendar quarter, so obviously the chip company has a number of quarters in which shipments are going to scale up.

Micron Technology also preparing to ramp shipments of next-generation HBM3e 12-high units this quarter (deliveries to industry partners have already begun) which would obviously help the chip company realize its ambitions to grow its HBM market share.

Market Share By Volume (TrendForce)

Due to skyrocketing HBM demand, Micron Technology is enjoying a substantial increase in sales and operating profits. In 4Q24, Micron Technology’s sales totaled $7.75 billion, up 93% YoY. Micron’s DRAM and NAND segments profited from 14% and 15% QoQ sales growth. Most importantly, the chip company’s growth is profitable with operating income trickling in at $1.75 billion, reflecting a whopping 23% operating income margin.

Compared against the prior quarter, Micron benefited from a 9 percentage point jump in margins, underscoring that its HBM growth is highly profitable.

Operating Profits (Micron Technology, Inc.)

Micron Is An Outrageous Bargain

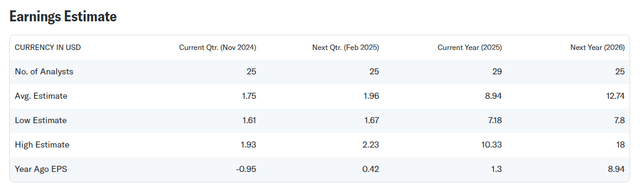

The market models $12.74 per share in profits for Micron next year (the company’s 2026 financial year) which reflects back to us profit growth of 42% YoY and estimates are poised to rise, in my view.

This year, Micron is anticipated to see a 588% rise in its profits to $8.94. The chip company’s stock is presently selling for $103.71 which leads us to a leading profit multiple of 11.6x. With HBM up-scaling just in the first innings, I think there is a case to be made for Micron Technology’s stock to rerate substantially higher: Taking into account that Micron’s profits are skyrocketing, thanks to leaping HBM shipments, I think the chip company could sell for 18-20x leading (2025) profits which leads us to an intrinsic value range of $161 to $179.

Obviously, key to the investment thesis is a steady up-scaling of HBM shipments. If evidence were to emerge that demand for HBM is not that great, Micron’s stock would most certainly see a painful multiple compression.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis Might Prove To Be Faulty

Micron is a highly volatile stock that is known for being susceptible to wild price swings. This volatility is related to often rapid changes in the underlying profit estimates.

With that said, though, the growth of Micron is highly profitable, as we have seen with the chip company’s surging operating income margins in the last quarter.

Obviously, drastically resetting profit estimates to the downside and lower operating margins would be a hint for investors to anticipate another cyclical profit contraction. Whether Micron’s profits rise or fall, investors should anticipate the stock to remain highly volatile in any case.

My Conclusion

As far as I am concerned, Micron Technology is one of the most compelling and captivating growth stories in the AI market.

Profit estimates are getting revised higher after Micron’s fourth quarter earnings last week, which suggests, obviously, that a cyclical profit contraction is not anticipated to play out in the next year or so. As such, I think Micron’s stock has a lot of potential to keep running higher.

In conclusion, I think that high bandwidth memory and the associated margin gains paint a compelling growth picture for Micron and though the stock has been catapulted higher by the company’s 4Q24 earnings, I see a very positively skewed risk/reward relationship for investors that have a 2-3 year investment horizon. Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.