Summary:

- Micron beat top and bottom line estimates for Q4, but margin guidance is concerning.

- Revenues declined 40% Y/Y due to declining demand, China’s ban, and a deteriorating pricing situation.

- Micron continues to expect a negative gross margin in FQ1’24.

- With an inconclusive EPS picture, investors have no compelling reason to buy.

hapabapa

Micron (NASDAQ:MU) continues to suffer from weak operating fundamentals in the industry and the memory maker unfortunately guided for yet another quarter of negative gross margins. Micron beat top and bottom line estimates for its most recent quarter last week, but I believe the margin guidance is cause for great concern… as is negative momentum in average selling prices for both its core products, DRAM and NAND. Considering that Micron recognized losses in FQ4’23 equal to 30% of revenues, I believe the risk profile remains highly unattractive for investors, and the best way to deal with an unfavorable risk profile is to stay on the sidelines until the business situation of Micron has improved!

Previous coverage

I rated Micron stock as a hold in my last work on the memory maker — Micron: AI To The Rescue — when it faced an unclear short-term outlook with regard to its top line growth and gross margins. Micron’s outlook for FQ1’24 further suggests that Micron is not out of the woods and may continue to struggle in the near term. EPS have increased, but Micron still generates a ton of losses. A hold rating seems justified following the margin outlook for the next fiscal quarter.

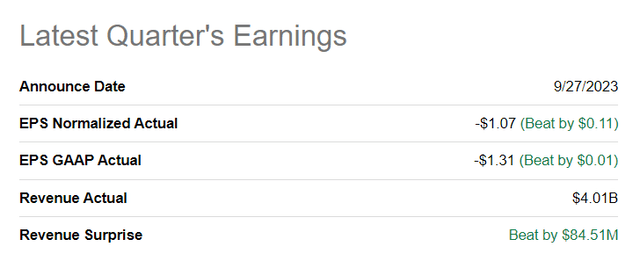

Micron beats estimates again

When it comes to beating top and bottom line estimates, Micron is executing well. The company reported revenues of $4.01B, beating estimates by $85M. At the same time, Micron beat bottom line expectations by $0.11 per share.

Although Micron beat estimates for its fourth fiscal quarter, the firm’s revenues declined 40% year over year due to declining demand for Micron’s products in end-markets, China’s ban on some of Micron’s memory products and a drastically deteriorating pricing situation that has weighed on the firm’s pricing power.

Micron’s revenues in the fourth fiscal quarter totaled $4.01B, showing 7% quarter over quarter growth. This growth occurred chiefly due to rebounding shipment volumes in the NAND product category: NAND revenue growth explained 74% of Micron’s $258M sequential revenue increase.

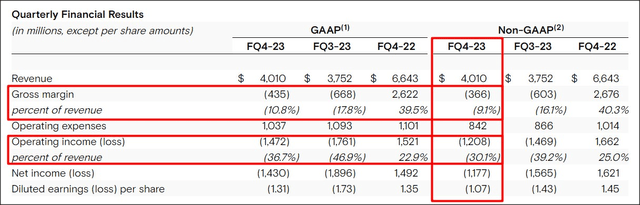

Although revenues ticked up Q/Q, the margin situation remains challenged: gross margins remained widely negative. Gross margins dropped from negative 16.1% to negative 9.1% (showing a 7 PP improvement Q/Q), and Micron continued to generate a scary amount of losses.

In the last quarter alone, the memory maker lost $1.2B (on a non-GAAP basis) which calculates to about 30% of its revenues. In other words, Micron lost $0.30 on every dollar generated in revenues. For the entire fiscal year, Micron reported a stunning non-GAAP loss of $4.9B, representing 31% of full-year revenues… reflecting a massive $14.3B swing in profits compared to FY 2022.

Volume situation improving, pricing situation continues to be pressured

Average selling prices continued to decline in the fourth fiscal quarter, both for Micron’s DRAM as well as NAND products. DRAM average selling prices declined in the high-single digit percentage range while NAND prices decreased in the mid-teens digit percentage range. While the pricing situation remained weak, the company said that it saw volume improvements in both businesses.

The DRAM category, which accounts for approximately 69% of consolidated revenues, saw an increase in the mid-teens percentage while NAND crushed it with a 40%+ increase in average selling prices. In other words, there is evidence that the NAND demand-supply situation is improving and already resulting in a sharp uptick in prices. Micron also updated its outlook and said that it now expected NAND demand growth to accelerate to the high teens percentage range (up from high-single digits) in the 2023 calendar year.

Unfortunately, since NAND only accounts for about one-third of Micron’s revenues (30%), the volume surge had not as strong a top line effect as a similar volume surge in DRAM would have had.

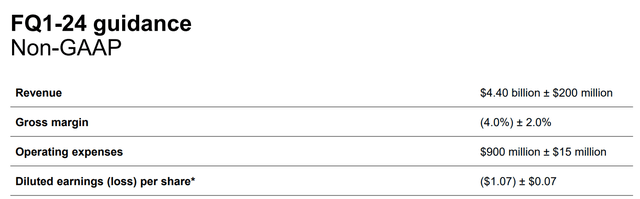

Guidance for FQ1’24

Unfortunately, according to Micron’s internal projections, the pricing and demand situation for DRAM/NAND products will remain weak in FQ1’24: Micron sees a negative non-GAAP gross margin of 4% +/- 2%. While this means that the memory maker could see a sequential gross margin improvement of about 7 PP (in the best-case), investors expected that the memory maker would be able to reverse its margin trend sooner and return to positive territory.

The revenue forecast for FQ1’24 is $4.4B +/- $200M, however, which is positive and implies 15% top line growth quarter over quarter.

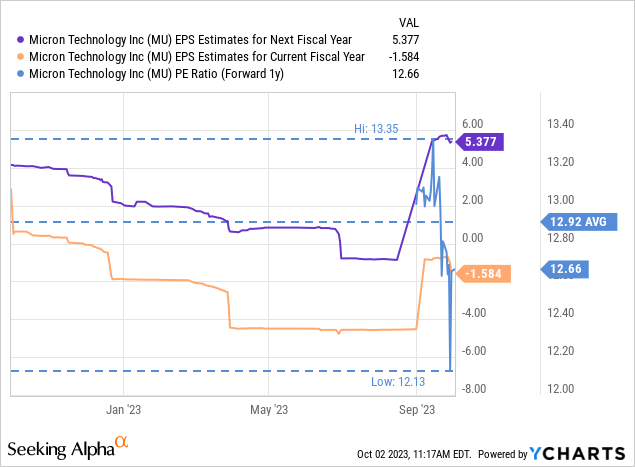

Micron’s valuation

The current EPS picture for Micron is inconclusive and I would say the best solution for investors is to stay on the sidelines for now. Micron has seen a reboot of its revenue growth in the fourth fiscal quarter (NAND revenues grew 19% Q/Q to $1.2B in FQ4’23), which is positive, but margins are under pressure, and average selling prices in both core product categories DRAM and NAND remain weak.

Analysts currently expect Micron to generate $5.38 per-share in earnings next year which implies a P/E ratio of 12.6X. The P/E ratio is only slightly below Micron’s 1-year average P/E ratio of 12.9X. EPS estimates have risen ahead of earnings, in large part because investors expected a return to positive gross margins in FY 2024. Considering that the pricing environment remains weak, I believe there is a good chance that investors will be wrong about this.

Risks with Micron

The Cybersecurity Administration of China recently imposed restrictions on Micron’s chips as part of a broader national security review. Micron has said in its earnings release for FQ4’23 that China’s ban of Micron products resulted in headwinds in its domestic data center and networking business. Going forward, the greatest commercial risk, as I see it, is a further price erosion in the critical DRAM market which generates $7 out of $10 in revenues for Micron. Weaker average selling prices as well as a decline in shipments would likely further weigh on the company’s margin projections.

Final thoughts

Micron’s fourth fiscal quarter highlighted the continual risk of investing in a company that is seeing negative gross margins. Micron’s margin forecast for the next quarter indicates that the firm’s core operating fundamentals are set to remain under pressure, despite a projected sequential top line increase of up to 15%. While I believe that margins have already bottomed, the risk profile still looks not attractive and investors may still be too bullish. As a result, I believe there is nothing wrong with staying on the sidelines until business conditions, especially in DRAM, have improved!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.