Summary:

- Micron investors have held their ground firmly above the $95 level, even as the stock has underperformed its semi-peers since peaking in June.

- Micron’s growth prospects in the high bandwidth memory market appear robust.

- Nvidia must depend on its AI memory supply chain to improve its supply constraints, bolstering near-term opportunities for Micron to gain more share.

- MU has also consolidated well recently, as dip-buyers likely accumulated.

- I argue why the buying opportunity in MU is timely and apt, suggesting investors should add more aggressively before its next monster move higher.

vzphotos

Micron: Setback Faces Renewed Optimism

Micron Technology, Inc. (NASDAQ:MU) investors have managed to hold the line above the $95 zone since MU bottomed out in September 2024. Hence, I assess that dip-buying has returned as investors accumulate in anticipation of a more robust production ramp through CY2025. Despite that, the stock has underperformed the S&P 500 (SPX) (SPY) since my previous update. In my last MU article, I highlighted why oversupply fears were overbaked. Moreover, the long-term secular growth drivers in AI infrastructure investments are expected to remain secure. Therefore, I assess that Micron’s past business cyclicalities should matter less as the leading memory chips producer transitions toward higher AI revenue opportunities.

As one of the principal high bandwidth memory suppliers to Nvidia (NVDA), Micron faces intense competition as it seeks to catch up with market leader SK Hynix. Nvidia is expected to face supply constraints, even though management updated its recent earnings conference that they aren’t likely to be structural. Therefore, the demand dynamics have remained robust for Micron, even as it potentially faces the impending entry of Samsung (OTCPK:SSNLF) as the third supplier of AI memory chips for Nvidia.

The most pressing challenges relating to Micron’s business proposition likely relate to its ability to continue gaining market share while fending off Samsung’s entry. Management corroborated its confidence in focusing on improving performance and power efficiencies as the critical value proposition against its peers.

Moreover, Nvidia’s earnings update suggests we are likely still early in the $1T AI infrastructure CapEx ramp as hyperscalers and enterprises level up their adoption and transition to accelerated computing. Therefore, I assess robust valuation support for MU’s thesis as the company undergoes a generational opportunity to partake in the AI growth thesis.

The market’s negative perception of Samsung’s growth prospects in AI spurred a battering in its stock. Hence, Micron management must provide more clarity and proof points in its HBM ramp and market share gains over the next two quarters to improve underlying buying sentiments. Why?

Micron Stock: Valuation Bifurcation Needs To Be Addressed By Market Share Gains

MU/SMH price chart (weekly, medium-term, adjusted for dividends) (TradingView)

As seen above in the MU/SMH price chart, MU remains in a structural downtrend against its semiconductor peers listed in the VanEck Semiconductor ETF (SMH). Hence, the market’s bias against Micron stock’s assessed undervaluation (“A+” valuation grade) hasn’t worked in its favor. Moreover, MU’s outperformance before peaking in June 2024 gave way to underperformance through its September 2024 lows, although the selling intensity seems to have subsided. As a result, I’ve determined that Micron stock appears to be at an inflection point as the market reassesses its bullish proposition.

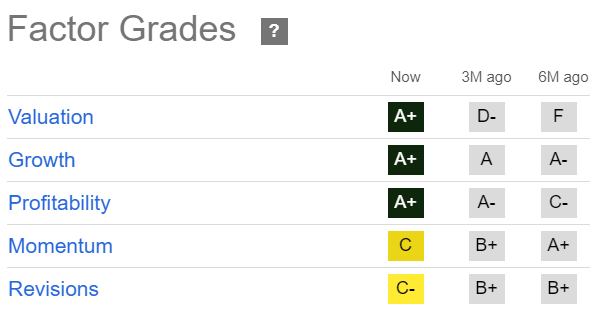

MU Quant Grades (Seeking Alpha)

Wall Street has lowered Micron’s estimates, corroborating the tempered optimism on the stock since June 2024. MU’s “C” momentum grade has also been downgraded from an “A+” grade over the past six months, validating my observation. Despite that, Micron is expected to remain in a growth phase, justified by its opportunity to partake more aggressively in the HBM growth prospects. As a result, I view its best-in-class “A+” growth grade constructively, potentially lending valuation support to MU through CY2026.

Notwithstanding my optimism, Micron management previously highlighted possible inventory challenges. Furthermore, the non-AI segment or legacy units could impede its growth momentum in its partnerships with Nvidia and its AI chips peers. Moreover, it remains to be seen whether Samsung’s anticipated entry could shake up market supply dynamics, possibly elevating execution risks for Micron and SK Hynix. Furthermore, SK Hynix appears to have the nod of Nvidia as its most critical supply chain partner, even as Micron seems confident of ramping up its AI revenue.

Therefore, the uncertainties relating to Micron’s anticipated production ramp and the oversupply risks are expected to hold back against a more aggressive valuation re-rating. Despite that, I believe it’s arguable that Micron’s transition to potentially more profitable business segments (including AI) while shedding less profitable business units should assure investors about its profitability inflection. Therefore, it should provide a higher justification for elevating MU’s valuation bifurcation (“A+” valuation grade relative to its “A+” growth grade) in favor of the bulls.

Is MU Stock A Buy, Sell, Or Hold?

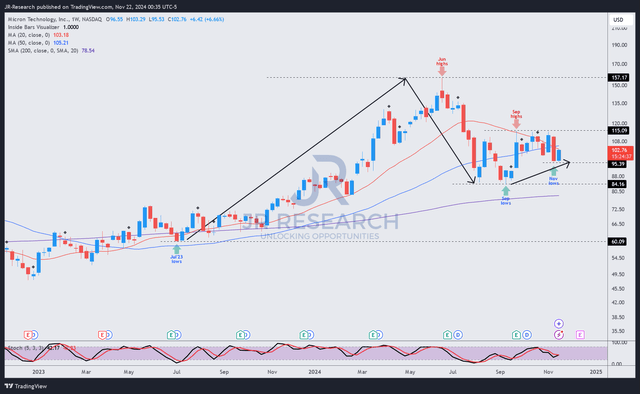

MU price chart (weekly, medium-term, adjusted for dividends) (TradingView)

MU’s price chart has remained constructive for its uptrend continuation thesis. The surge leading to its June 2024 peak seems to have been digested, as buyers held on firmly to its September 2024 bottom. Investors have also managed to lift MU’s momentum close to its 50-week moving average (blue line), bolstering its uptrend bias.

Accordingly, I’ve not assessed a structural reversal in its thesis, which could decisively upend its buying sentiments. Hence, I evaluate that MU’s attractive valuation and opportunities to gain market share in the HBM market align constructively with Nvidia’s determination to reshape the data center investments into accelerated computing opportunities. While possible oversupply and cyclical risks on MU’s bullish thesis cannot be understated, I believe much pessimism is priced in.

Rating: Maintain Buy.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMH, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!