Summary:

- We remain buy-rated on Micron.

- 1Q24 results and outlook confirm our belief that pricing will continue to recover in FY24, pushing top-line growth.

- Management now guides for ~12% QoQ revenue growth next quarter for $5.30 +/- $200M; we see more room for MU to show an upside surprise next quarter.

- We continue to believe top-line growth will be supported by the industry transition from DDR4 to DDR5 and new product cycles.

- We see MU stock outperforming through 1H24.

graphixel

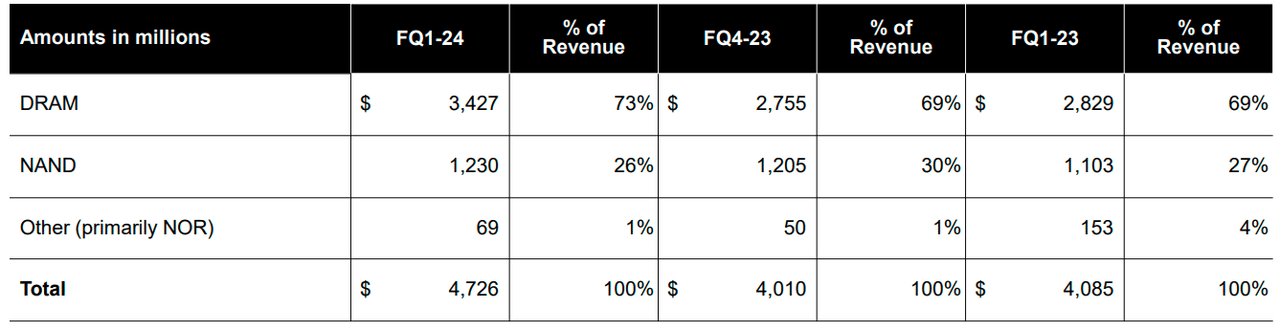

We continue to be buy-rated on Micron (NASDAQ:MU) post-1Q24 earnings. In spite of selling off pre-earnings today, MU stock shot up in after-market trading, up +4% so far, largely driven by higher investor confidence in the memory recovery after MU’s beat and outlook. MU reported revenue up 18% QoQ and 16% Y/Y to $4.726B, outpacing consensus estimates of a loss of $1.01 per share on revenues of $4.63B for the period. 1Q24 results and outlook confirm our expectations that memory bit shipment and pricing are improving post-correction. We expect MU to reaccelerate top-line growth in 2024, supported by a new product cycle and better DRAM and NAND pricing dynamics. This quarter, DRAM sales rebounded 24% QoQ to $3.4B, representing 73% of total sales. This is a notable improvement from last quarter, in which DRAM sales grew slightly by 3% QoQ. We’re seeing our positive thesis about bit shipment rebound being followed by pricing improvement playing out; management noted that they now expect pricing to increase through 2024. We’re particularly optimistic about MU’s DRAM sales due to the industry transition from DDR4 to DDR5, and as the PC and data center, TAM growth accelerates next quarter.

Additionally, the AI/ML market creates new opportunities for the memory/storage space and, by extension, MU. Management emphasized demand tailwinds for its HBM3E and expects continued HBM revenue growth in FY24. The following outlines MU’s revenue by technology.

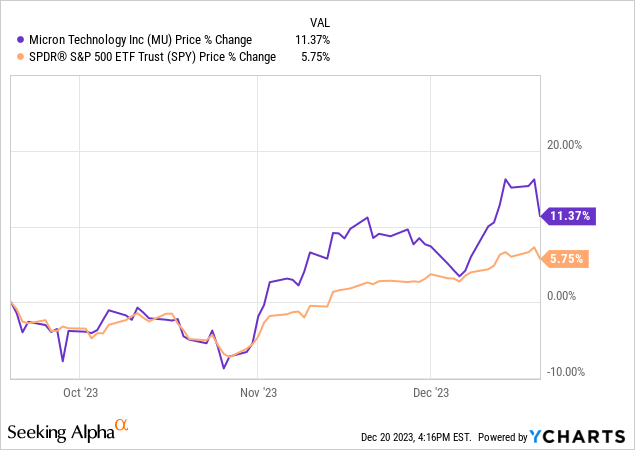

The stock is outperforming the S&P 500 by 5% over the past three months. We think MU is better positioned to see more substantial outperformance in 2024 as the industry demand-supply dynamics improve and distribution levels normalize. Pricing on both the DRAM and NAND front improved this quarter, in the low single-digit and mid-teen percentage, respectively, although NAND shipments declined 18%. Management expects bits to be flat QoQ over the next two quarters while pricing improves, and then expects bit shipment and pricing to improve simultaneously in 4Q24. We think the price increases will offset the lower shipment growth over the next two quarters. We see an increasingly favorable risk-reward profile for the stock in 2024 and recommend investors explore entry points at current levels.

The following outlines MU’s stock performance against the S&P 500 over the past three months.

YCharts

Still, MU is not without risks. We think the company may have to increase capex spend to keep up with EUV tools for higher capacity demand. We’re not too concerned about this, as management noted the expectation of WFE capex to be down Y/Y in FY24. Management’s disciplined capex spending further increases our confidence in MU’s position in FY24.

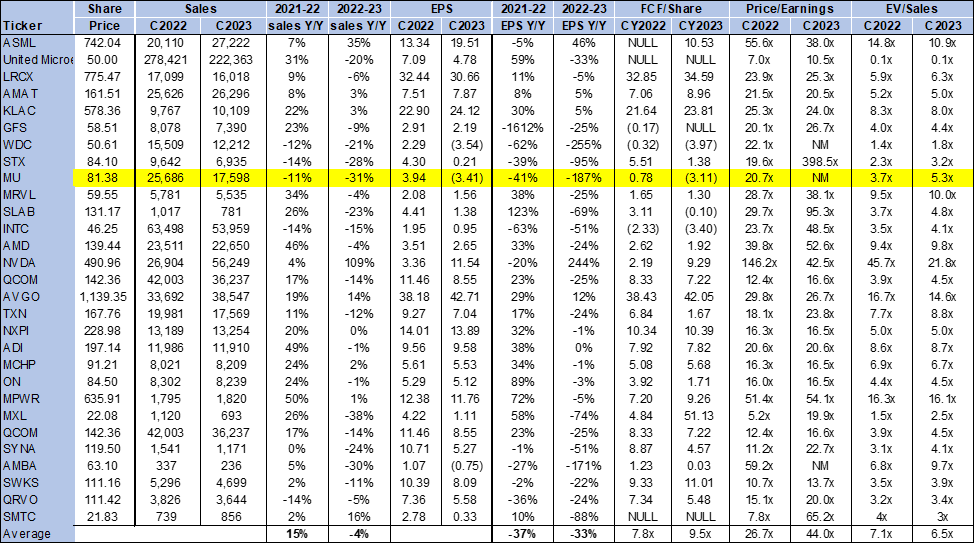

Valuation

MU is relatively cheap, in our opinion. The stock is trading at 5.3x EV/C2023 Sales versus the peer group average of 6.5x. We see attractive entry points at the current level, and more upside potential in 1H24 as memory end demand and pricing improve after a muted 2023. The following chart outlines MU’s valuation against the peer group average.

TSP

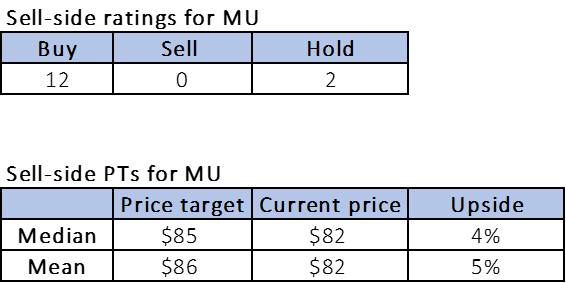

Word on Wall Street

Wall Street shares our bullish sentiment on MU. Of the 14 analysts covering the stock, 12 are buy rated, and the remaining are sell-rated. The stock is trading at $82 per share. The median sell-side price target is $85, while the mean is $86, with an upside potential of 4-5%.

The following charts outline Wall Street’s sentiment on the stock.

TSP

What to do with the stock

We maintain our buy rating on MU. We think wafer start reductions this year have enabled the current recovery; we expect price improvement in 2024 to push top-line growth for MU even if unit volumes remain flat QoQ. We also believe the PC and data center TAM growth in 2024, coupled with the industry transition to higher capacity memory for leading-edge nodes, will support top-line growth next year. We recommend investors buy the stock opportunistically, as we see MU outperforming through 1H24.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.