Summary:

- Micron stock has outperformed my expectations, driven by Nvidia’s incredibly robust AI upcycle.

- Micron is keen to gain market share in HBM memory chips.

- Samsung is also expected to increase production significantly, subsequently increasing potential risks of oversupply.

- Near-term earnings visibility is expected to remain robust. The potential for oversupply from 2026 could emerge.

- I argue why MU’s medium-term upside seems limited, but the price action is signaling caution may be warranted.

JHVEPhoto

Micron: I Was Too Cautious Previously

I must admit that Micron Technology’s (NASDAQ:MU) stock has outperformed even my most optimistic projections. Therefore, my previous Hold rating on MU seems too cautious as MU continues its upward trajectory. Although I assessed higher potential oversupply risks, I’m not bearish on MU. However, my concerns have not panned out as Nvidia’s (NVDA) AI upcycle has been more sustainable than anticipated.

Micron has capitalized effectively on the surge in HBM demand. Given the sustainable underlying demand attributed to the Generative AI surge, the market has likely reassessed Micron’s typical cyclicality.

Semiconductor investors should be aware of cyclical challenges that hampered Micron and its leading memory peers. Coupled with the more commoditized nature of memory chips compared to its logic peers, Micron suffered supply glut issues linked to overproduction.

Micron: AI Surge Underpin HBM Memory Chips Demand

The third fiscal-quarter earnings release underscores the tight demand/supply dynamics underpinning Micron’s bullish thesis. However, concerns about Micron’s ability to mitigate Samsung’s desire to bolster its HBM production growth shouldn’t be ignored. Accordingly, the memory leader highlighted its plans to increase HBM production by 23.1x of its 2023 base by 2028. In addition, Samsung (OTCPK:SSNLF) intends to secure a firm commitment with AI chip designers based on its more comprehensive product range. Accordingly, Samsung believes “its ability to offer logic, memory, and advanced packaging will help it make rapid progress” in winning more business. Therefore, I encourage investors not to ignore potentially more intense challenges from Samsung moving ahead.

Despite that, there’s no denying that momentum is currently with Micron. In addition, the anticipated CapEx buildout is not expected to result in a supply glut in the near term. Furthermore, Micron’s HBM capacity is sold out through 2025, providing significant visibility on Micron’s earnings and cash flow outlook over the next two years.

Micron: Strong Cash Flow Visibility

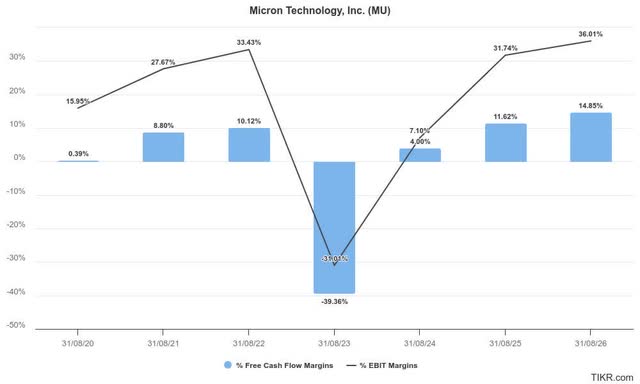

Micron margins estimates % (TIKR)

Analysts have upgraded Micron’s estimates, highlighting Wall Street’s optimism. As seen above, Micron’s upward earnings trajectory is also expected to bolster its free cash flow conversion through FY2026.

As HBM is expected to be accretive to Micron’s earnings growth profile, I assess that Wall Street’s optimism isn’t misplaced. Moreover, Micron is confident in the advantages of its HBM3e solution. Micron highlighted that it can achieve “30% lower power consumption” than its competitors, potentially helping MU gain market share. Accordingly, Micron is assessed to have “set a target to achieve 20% to 25% market share in HBM by 2025.” MU’s optimism is justified, given the constructive underlying demand dynamics relative to its supply constraints.

Furthermore, the AI PC and AI smartphone refresh is also expected to boost Micron’s opportunities. As a result, the coast seems clear as Micron capitalizes on the memory chip upcycle through FY2026.

MU Stock: Valuation Behooves Caution

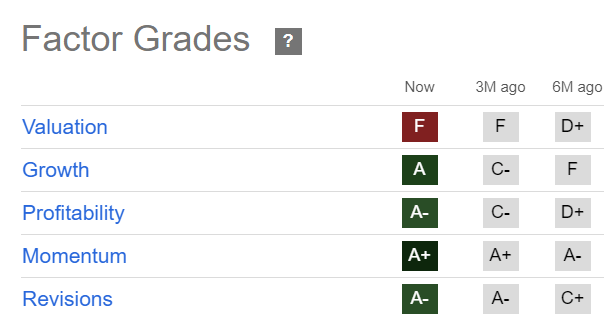

MU Quant Grades (Seeking Alpha)

MU’s “F” valuation grade suggests investors must be careful about being overly-optimistic about the bullish thesis. MU’s initial post-earnings decline highlights the risks of relying too much on AI hype to drive buying momentum higher. Despite that, Micron’s “A” range grades across four other factors suggest a highly robust thesis against further downside bias.

Notwithstanding the market’s optimism, investors must consider what’s next after FY2026. Micron’s Idaho and New York capacity is expected to come online from 2027 onwards, which is anticipated to help the company meet increased production requirements.

However, a potential memory downcycle shouldn’t be ruled out and ignored. Considering that Micron isn’t the only company looking to compete against SK Hynix for market leadership is critical. Samsung’s production plans must be closely monitored, as overcapacity challenges could significantly hamper Micron’s profitability post-2026.

Is MU Stock A Buy, Sell, Or Hold?

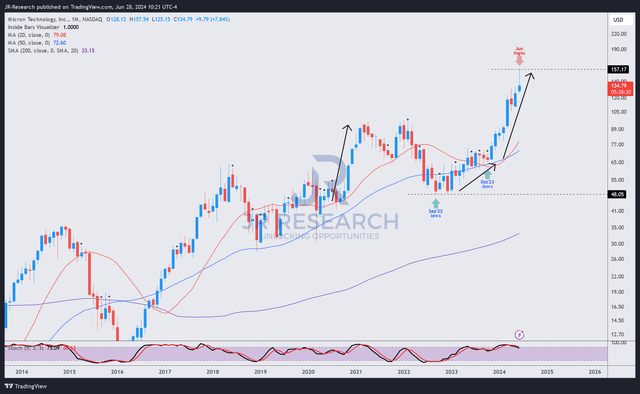

MU price chart (monthly, medium-term, adjusted for dividends) (TradingView)

MU’s price chart corroborates its long-term upward bias. Therefore, MU buyers have demonstrated a remarkable ability to support deep pullbacks over time.

MU’s bottom in September 2022 was highly robust, bottoming above the 50-month moving average (blue line). Buyers have also accumulated constructively before momentum buyers lifted it significantly since October 2023.

Consequently, I assess that Micron is at a critical juncture. While I’ve not determined a sell signal, a bearish reversal price action could finalize in June, behooving caution. Therefore, it’s increasingly likely that we might see further downside volatility to dissipate the recent AI FOMO before a broader consolidation.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!