Summary:

- Micron’s stock has dropped nearly 50% from its June highs, despite no negative news and improving fundamentals driven by AI demand.

- The current valuation of Micron does not reflect its strong fundamentals, presenting a potential buying opportunity with a solid margin of safety. This is supported by the DCF analysis.

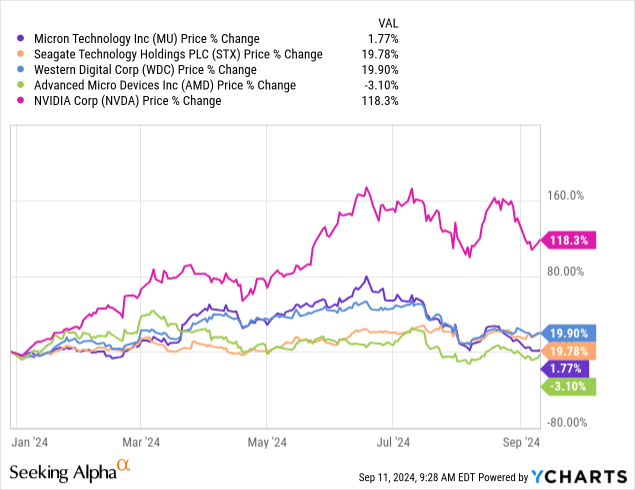

- The recent sell-off appears overdone, especially when compared to peers.

- Despite certain risks associated with the upcoming earnings report, now might be a perfect opportunity to buy the stock.

vzphotos

Micron (NASDAQ:MU) stock has experienced elevated volatility lately along with other chip-making companies like Nvidia (NVDA), AMD (AMD), and Intel (INTC). From its June highs, MU is now down almost 50% without any particular news surrounding the company. Meanwhile, Micron’s prospects remain increasingly positive in light of continuing AI-driven demand, and the falling stock price seems to diverge from the improving fundamentals. Therefore, as MU is scheduled to report its earnings in the coming weeks, now might be a rare opportunity to buy the stock with a solid margin of safety.

AI-driven demand is not likely to ease any time soon

While some people might be skeptical about the actual monetization of AI products and services, there is no doubt AI is here to stay. All the major companies like Google (GOOG)(GOOGL) with its Gemini AI, Microsoft (MSFT) with its Copilot, and Apple (AAPL) with Apple Intelligence are integrating AI solutions into consumer products with billions of users, which inevitably pushes the need for more infrastructure to process and store data. Hence, the global AI infrastructure market is forecasted to reach at least $323 billion by 2032, growing at a hefty 27% CAGR during the forecast period. And seeing the current trend of how increasingly more complex AI models are becoming available for more users, I believe the actual numbers might surpass the forecast.

This growing infrastructure requires significant memory, especially high-bandwidth memory (HBM), and storage capacities to handle the increasing volumes of data, which means Micron is pretty much set to benefit from this trend. During the latest earnings call, Micron CEO Sanjay Mehrotra mentioned the company sees a multi-year AI demand cycle ahead of it.

We are in the early innings of a multi-year race to enable artificial general intelligence, or AGI, which will revolutionize all aspects of life…These trends will drive significant growth in the demand for DRAM and NAND, and we believe that Micron will be one of the biggest beneficiaries in the semiconductor industry of the multi-year growth opportunity driven by AI.

This upcycle seems to be unprecedented and is likely to sustain positive pressure on memory pricing as well. As an indicator, South Korea-based SK Hynix is already hiking their DRAM pricing by 15% to 20%, and Micron and Samsung (OTCPK:SSNLF) are reported to follow suit.

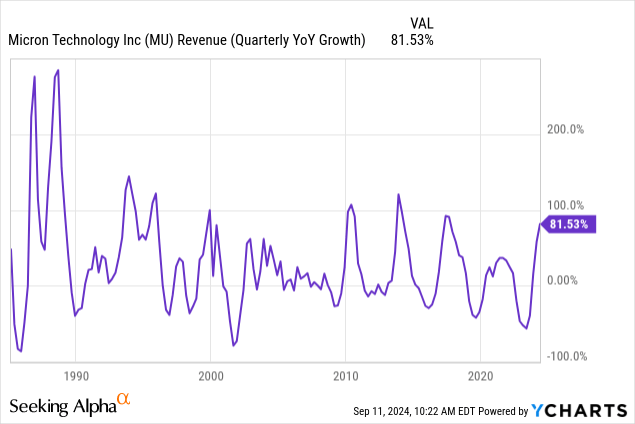

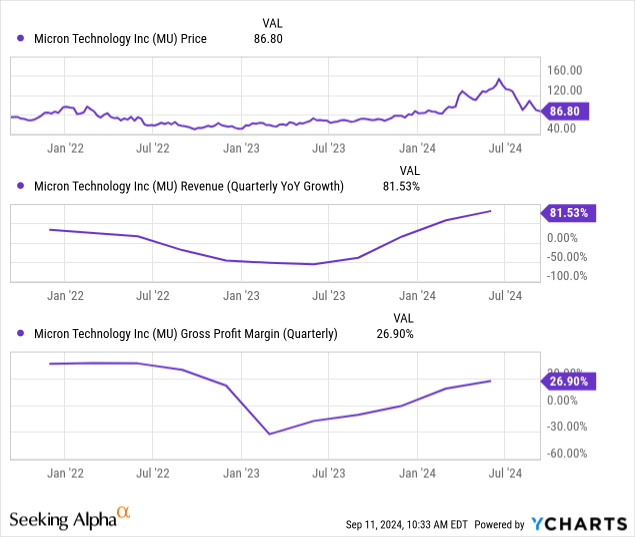

As a refresher for some readers, the memory market is highly cyclical in terms of demand and pricing, which directly affects companies like Micron, especially when it comes to revenue growth and profitability. And looking at the YoY revenue growth chart, Micron seems to be at the beginning of an unprecedented upcycle that started with a substantial 81.5% revenue growth in FQ3 2024.

Micron’s current valuation does not reflect stellar fundamentals

Historically, Micron’s stock has followed a cyclical pattern, rising and falling in line with the volatility of memory prices. As memory prices increased, Micron’s revenue and stock price typically surged, and vice versa during downturns.

However, this year so far, we have seen an unusual divergence from this historical trend. Despite a significant increase in revenue growth, driven by growing demand, Micron’s stock has dropped nearly 45% from its highs and remained flat year-to-date. This disconnect between fundamentals and stock performance suggests that the market is not fully pricing in the opportunities in the AI infrastructure and general memory markets that will inevitably drive future growth.

The potential for margin expansion is particularly notable, as the company’s HBM offerings are set to see increasing adoption in AI-driven data centers. (You can read more about HBM’s impact on margins in another Seeking Alpha article here) During the recent earnings call, the management mentioned Micron’s HBM memory is already “sold out” for the next year:

We expect to generate several hundred million dollars of revenue from HBM in fiscal 2024 and multiple billions of dollars in revenue from HBM in fiscal 2025.

Our HBM is sold out for calendar 2024 and 2025, with pricing already contracted for the overwhelming majority of our 2025 supply. We are making significant strides toward expanding our HBM customer base in calendar 2025, as we design-in our industry-leading HBM technology with major HBM customers.

Therefore, the current undervaluation creates a compelling opportunity for investors. Micron appears to be at the beginning of a multi-year upcycle, with strong revenue and profitability drivers ahead, yet the stock remains significantly discounted.

DCF analysis shows the stock is significantly undervalued

To better understand the stock’s valuation and growth potential, we can use DCF analysis.

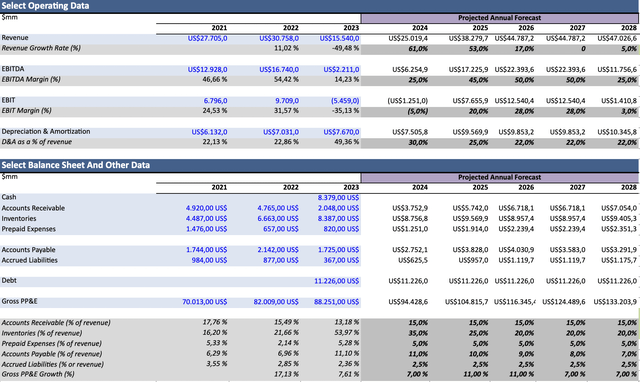

My analysis is based on the following key assumptions:

1. The average annual revenue growth over the horizon period of five years is estimated to be around 27%, with a 53% increase in FY2025, 17% growth in FY2026, 0% growth in FY2027, and a 5% increase in FY2028. This is based on analysts’ earnings estimates and adding a fraction of potential AI-driven growth in 2027.

2. EBITDA margin will remain on the level of 25-50% throughout FY2028, in line with the historical fluctuations.

3. Then goes the WACC.

The after-tax cost of debt is 4.6% (using a 13% tax rate), based on the latest 10-Q filing. The cost of equity capital (13.6%) is calculated using CAPM, with 1.18 beta, a 3% risk-free rate, which is about 50 basis points lower than the current U.S. 10-year bond yield to reflect future rate cuts, and a 9% market premium. The WACC is, therefore, estimated to be around 12.8%.

Here is the operating and balance sheet data used in the modeling:

As a result of these calculations, MU’s fair price range is approximately $113-128, which is about 30% higher than the current stock price. This price range assumes that MU will return to its average EV/EBITDA ratio of 14 by the end of the horizon period. Currently, the stock trades at around 18 EV/EBITDA.

As a result, the current low valuation presents a rare chance to enter Micron’s high-growth phase with a margin of safety, especially considering that memory demand is set to rise as AI and advanced computing continue to scale.

The selling seems to be overdone compared to peers

Analyzing MU’s performance versus its peers, the stock looks oversold as well. Year-to-date, Micron’s direct competitors in the storage market, Western Digital (WDC) and Seagate (STX), are up around 20%, and the main AI hardware player Nvidia is in another league with a 118% growth year-to-date. Meanwhile, MU trades flat on a YTD basis despite demonstrating about 2 times higher revenue growth than STX or WDC. While some degree of conservatism around the AI hype might be understandable, Micron deserves a more significant stock appreciation based on the company’s strong performance this year.

Upcoming earnings and risks

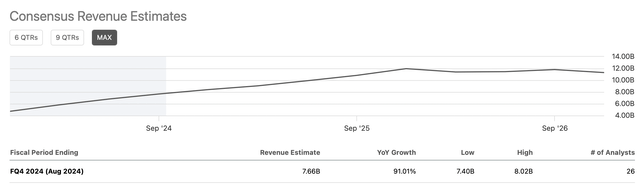

Micron is set to report its FQ4 earnings on September 25. Analysts project $7.66 billion in revenue, which would represent a 91% increase year-over-year, and $1.11 in EPS, almost 2 times higher than in the previous quarter. It is likely Micron will exceed these expectations, based on the recent history—the company beat on EPS and earnings in the last 5 quarters in a row.

However, the recent earnings season has shown that the market’s expectations for AI-related companies are increasingly high, which means just beating analysts’ estimates is not enough anymore. The examples are Nvidia, AMD, Snowflake (SNOW), Alphabet, and Amazon (AMZN), whose stocks went down significantly after earnings despite double beats and solid revenue growth numbers. (Amazon did miss on revenue, according to Seeking Alpha data, but showed a more significant beat on EPS) Therefore, even if Micron exceeds the market’s expectations, it does not mean that the stock will immediately return to its recent highs.

From there, much will depend on Micron’s guidance. Currently, the consensus revenue estimate for FQ1 2025 (November quarter) is $8.41 billion, which would reflect a 78% year-over-year increase. EPS is estimated to be $1.66 for the first quarter of the next fiscal year. For the full fiscal 2025, the market expects $38.24 billion in revenue, a 53% increase YoY, and a $9.38 EPS, or a 670% increase from projected 2024 numbers. If the company guides for lower numbers there, MU might continue its drop even despite its generally impressive fundamental performance and the stock’s undervaluation.

Another development to watch for is Micron’s commentary regarding DRAM and NAND output for PC and smartphone customers. During the Q3 earnings call, the management mentioned these customers had built additional inventories in anticipation of tighter supply, which might create negative pressure on demand in the mid term. The key indicators here are inventories, which amounted to $8.5 billion in the recent quarter, and margins—Micron’s gross margin was 28% in Q3, and the company’s projection for Q4 is 34.5%.

Additionally, investors should keep an eye on Micron’s balance sheet dynamics, specifically the cash/debt ratio. In the latest quarter, the company had $11.2 billion in long-term debt and $8.38 billion in cash and equivalents, which is a relatively safe ratio. Meanwhile, the company expects CapEx in fiscal 2025 to be “meaningfully above” the levels of 2024 to support HBM assembly and construction of new US-based fab and backend facilities. Even though a large share of the investments needed for these facilities is offset by the state incentives and the CHIPS grants, Micron will still require substantial investments next year. This might potentially create a need for additional borrowing, which could deteriorate Micron’s financial profile.

Key takeaways

Micron stock has experienced significant volatility this year, falling nearly 50% from its June highs despite no major negative news, which contrasts with improving fundamentals. The company should benefit significantly from the surging demand for AI- and data-focused infrastructure, which is expected to grow rapidly over the coming years. Therefore, Micron seems to be in the early stages of a multi-year upcycle driven by AI, and demand for high-bandwidth memory should significantly boost revenues and margins in the coming years.

Despite the strong fundamentals and the ongoing memory upcycle, MU’s price has remained under pressure, which creates a rare opportunity to buy the stock with a solid margin of safety. This is supported by the DCF analysis, which shows MU is at about 30% undervalued at the moment. Even though there are certain risks associated with the upcoming earnings report, now might be a perfect opportunity to buy the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU, NVDA, AMD, GOOG, AMZN, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.