Summary:

- Adding another AI associated stock to my buy call portfolio with Seeking Alpha, A very bullish structure is in Play for Micron Technologies.

- With earnings due next week, numbers that the market likes, or a big surprise could trigger Micron to accelerate quickly to my outlined target of $200.

- Price targets have been upgraded by heavyweight banks recently too, we look into their pricing upgrades for this equity before analyzing the charts according to my analysis.

style-photography

There are periods in this job where there is not a lot to write about, for example, markets going sideways or, in particular, taking their time to get to an outlined target.

2024 is not one of those periods, the equity markets are extremely bullish with the S&P500 setting record highs as this summer gets under way.

This whole market is being lifted by the AI evolution for the most part, and of course there is a strong labor market, along with anticipation of rate cuts as inflation slows. Primarily the catalyst has been the AI associated equities cementing the phase, “A rising tide lifts all boats”.

I have a portfolio of buy calls that can be found exclusively with Seeking Alpha for the AI sphere that in short include, Apple (AAPL) at $160, Meta (META) at $127, Nvidia (NVDA) at $187 and Crowdstrike (CRWD) at $390. Ever on the lookout for a hot AI breakout equity, Micron Technologies (NASDAQ:MU) fits that picture too.

Micron Technologies stock has been extremely bullish of late, as this equity has now initiated a third wave towards the $200 region according to my analysis.

In this article, we will look into the company in more detail, cover recent earnings results and see if upcoming earnings can launch Micron Technologies further north towards my target.

Both UBS and Bank of America have recently raised their price targets for MU with $155 and $170 targets respectively. I encounter this regularly in the markets that I cover as readers who follow my analysis will know, a major financial institution issuing a more conservative target or upgrading as the picture becomes clearer where I have issued my guidance in some cases, months in advance. In this case, it is certainly supportive to have confluence with other analysts that Micron is looking to go higher, with my price target quite further north for this stock.

Micron technologies was founded in 1978 and are based in Boise, Idaho. A semiconductor and computer chip manufacturing company that developers memory and storage solutions that are used in automobiles, consumer electronics, servers and computers.

Primed in an area where there is currently high demand for its products, especially with the AI evolution, MU is well positioned to serve this demand with its semiconductors for AI applications as the pace of this market accelerates, and so have Micron’s earnings as of late.

The share price is up 85% this year and up just under 350% in the past five years. Microns earnings have had modest EPS beats in three of the last four quarters, being roughly +6% but its more recent release earlier this year saw a 273% beat and one wonders if there is a nice surprise for investors this time around too. Revenue for this period was between +1-2% for the first three quarters, with +8.85% in the last one.

The Zacks estimate for EPS in the upcoming June the 26th earnings release is for $0.48 with revenue expected at $6.6 billion which is a considerable increase on the EPS of -$1.43 and revenue at $3.75 billion for the same period last year.

Now we can move over to the weekly and monthly charts to examine where this breakout started, where it is looking to go next and how it may get there.

In order for a financial market to both climb over time and give probability to its potential future price, it must make three wave patterns that consist of bullish buying candles and bearish selling candles, in this case MU has a set of significant buying vs selling candles printed in this structure and is appearing very bullish.

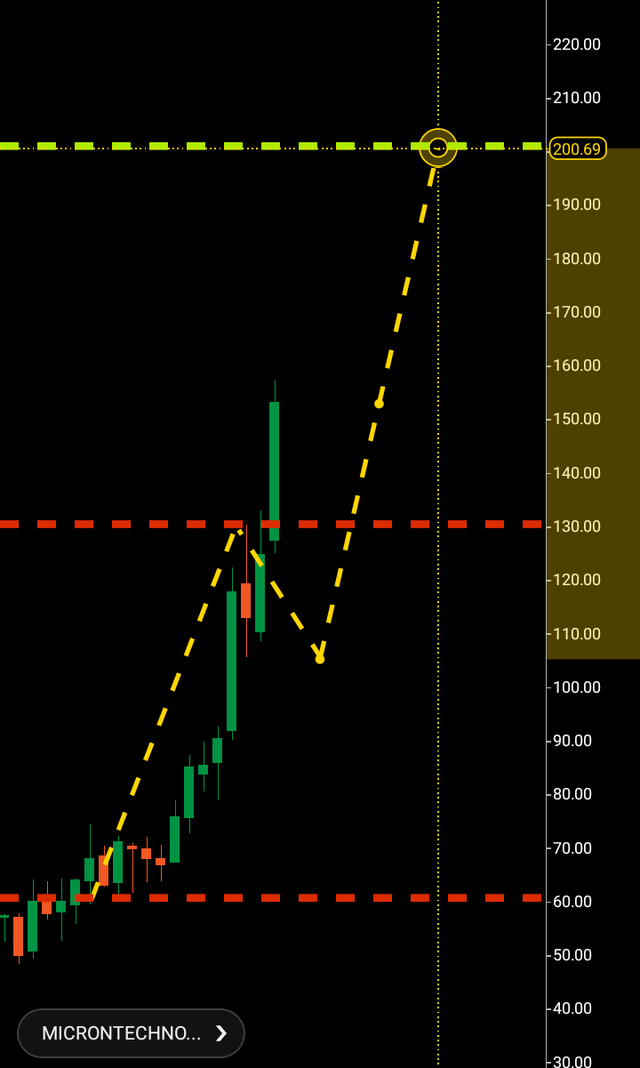

If we examine the monthly chart below, we can see the indecision period circa the $60 area a number of months ago before a wave of buying took place off that low. This qualifies as the wave one $60-$130.

Micron Technologies Monthly Chart (C trader)

Since that move higher there has been only one bearish candle printed off the $130 rejection area which technically acts as the wave two $130-$105.

The bullish appetite that matches this picture is confirmed by the third wave breaking above resistance at $130 and onto a new price range towards the $200 area which would be the third wave completion as a third wave can be gauged by measuring the length of the wave one before it found rejection and adding that numerical figure as a target once the third wave breaks above one and two.

Bearish case :

As in my recent article for Crowdstrike: Is Wall Streets New Darling The Next AI Gold Train, there isn’t anything immediately bearish in this picture. Technically, as long as MU stays above $60 it remains in its structure to $200. It could be of course an earnings surprise to the negative that acts as a catalyst of selling but in this environment with this demand during this period in particular, nothing is bearish about this equity.

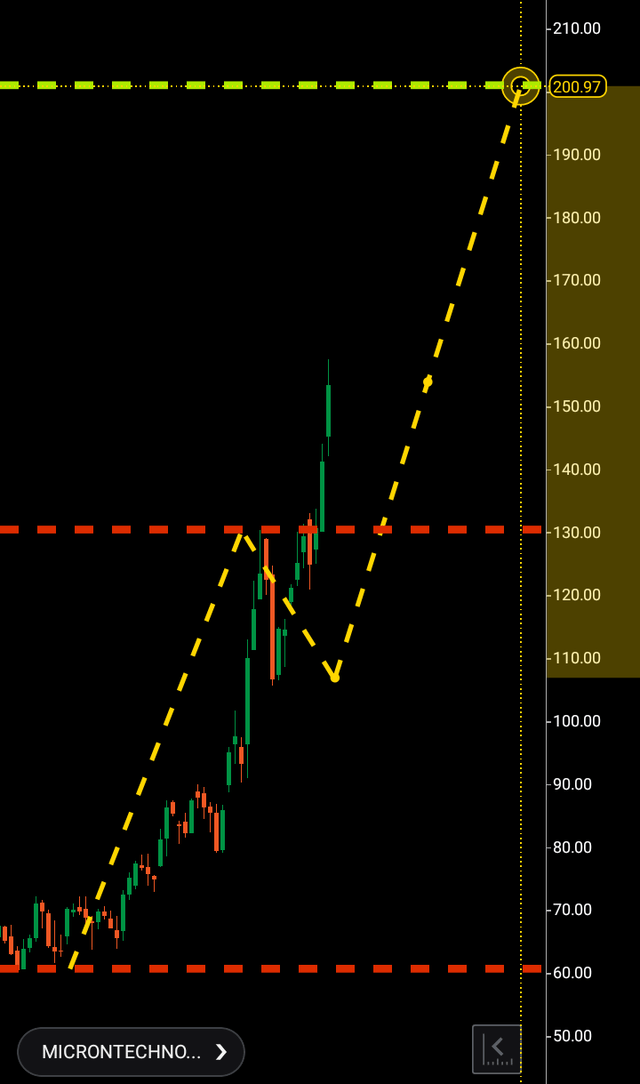

It will have to pause at some stage to create some selling candles particularly on the weekly chart as we can see below, the monthly could technically achieve $200 from here but the weekly I would imagine will need to see a bearish week on the chart soon which is technically interesting timing with earnings around the corner…

Micron Technologies Weeky Chart (C trader)

To finalize:

I expect Micron to go higher and arrive at $200 from here between the next 60 to 230 days and am issuing a buy signal for this equity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.