Summary:

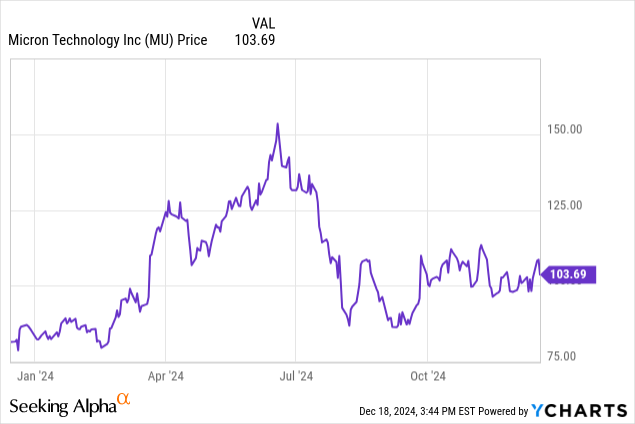

- Micron Technology, Inc. stock is selling off after-hours, down more than 13%.

- Weak consumer demand and lower-than-expected NAND bit demand led to reduced guidance and CapEx cuts, despite strong HBM and enterprise SSD sales.

- Micron expects to return to growth in 2H2025, driven by AI accelerator demand and data center growth, and I think shares represent a buying opportunity.

gorodenkoff

Micron Technology, Inc. (NASDAQ:MU) reported fiscal Q1 earnings after the close on Wednesday amidst fears that both DRAM and NAND might be approaching oversupply territory despite strong growth in AI applications and a nascent memory upcycle. These fears appear to have been founded as the stock is plummeting after hours, currently down over 10% as I write this. In this article, I’ll look at the results, why shares might be dropping, and where investors should go from here.

At the time of my most recent article on MU at the end of November, the stock had dipped back below $100 and investors were left scratching their collective heads wondering why. The company had provided upbeat Q1 2025 guidance and demand for high-bandwidth memory (“HBM”), used in AI accelerators like Nvidia’s (NVDA) newly launched Blackwell, was skyrocketing, but shares just kept dropping. I concluded that fears about DRAM oversupply were likely the root cause. Those fears were probably unfounded since supply of DDR5 and HBM, the actual profit centers of the memory market, remained tight while supply of low-margin DDR4 from Chinese suppliers ballooned.

At the end of the piece, I stated:

Based on a consensus FY2025 EPS estimate of around $9, which is likely a low-ball in my opinion considering Micron’s typically conservative guidance, MU is trading a bit under 11 times forward earnings. As concerns over memory supply and pricing pressure dissipate, I expect to see MU shares rise in the coming weeks and especially leading up to the Q1 2025 earnings report.

The last part ended up coming to pass, as MU rose 10%+ in the month leading up to the Q1 report. That article can be read here.

Well, now we finally have an answer, at least for now. MU initially rose this week before being caught up in a broader market sell-off on Wednesday following the Fed cutting interest rates, and then declined steeply after hours on disappointing Q1 results.

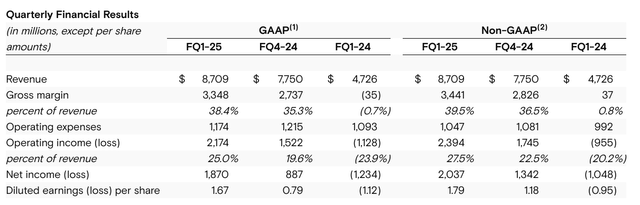

Let’s start with a recap of Micron’s earnings results:

Much of what we expected has come to pass here, specifically revenue growth was extremely strong at 85% YoY and +12.3% QoQ and gross margin expanded from the down cycle lows in Q1 2024 and from the previous quarter by 300 bps. EPS also saw an impressive boost to $1.79 (non-GAAP) as the DRAM and NAND recovery continued to improve bit shipment volume and pricing.

However, that’s about where the good news ends. On the cash flow side there was a major drop-off. The company reported $3.2 billion in operating cash flow, well below the $4.1 billion estimate, and nearly $3 billion in capital expenditures to barely eke out $100 million in FCF for the quarter.

But it gets worse: guidance was well below consensus estimates. Micron expects adjusted earnings to be between $1.33 and $1.53 per share, well below the $1.92 per share estimate. Sales are forecast to be between $7.7B and $8.18B, with the midpoint well below the $8.99B estimate. Gross margin is also expected to be significantly lower than previous expectations.

CEO Sanjay Malhotra attributed some of this weakness to consumer demand, which appears to be working its way up the supply chain and leading OEMs to scale back production in the short-term while inventories adjust. Specifically, Micron says that bit demand growth for NAND has been weaker than expected and, as such, the company is scaling back NAND CapEx in 2025 to match. How pricing responds in this situation will depend on the actions of Samsung and SK Hynix. However, both will likely scale back as well since the recent downcycle ostensibly just ended and neither company wants a repeat of the margin devastation.

As expected, HBM demand continues to soar and enterprise SSD sales in general are showing strength despite the consumer weakness. As for DRAM in general, Micron sees bit demand growth for 2025 in the mid-teens. This is in-line with previous expectations and represents a modest decline from 2024, indicating this market will remain a positive for the company going forward despite the uncertainty on the consumer side.

On the CapEx side in general, I think Micron should (and will) continue to ramp up to accommodate increased HBM demand, even if this means hurting free cash flow in the short term. Capturing and consolidating market share in this high-margin domain is critical to the company’s long-term success, and near-term headwinds should not derail those plans.

Going forward, I think we will continue to see strong margins and revenue growth from the rollout of HBM as Micron races to bring additional capacity online to take valuable market share while the iron is hot. With the ramp of Nvidia’s B100 and B200 (and expected second half ramp of the GB200), Advanced Micro Devices, Inc.’s (AMD) MI325X and upcoming MI355X, and the multitude of other custom AI accelerators from hyperscalers, the HBM market will remain hot for the foreseeable future. Further, I don’t think the usual memory cycle economics apply to HBM yet, so it’s likely we’ll see growth in this space buoy operating results when the typical memory downcycles occur and supercharge those results during an upcycle.

Investor Takeaway

So where do MU investors go from here? Micron said it expects to return to growth in 2H2025 after this short-term hiccup, which is encouraging, but uncertainties remain. As I’ve written in numerous MU articles, but particularly in this one here from September, I continue to see Micron at the early stages of a multi-year upcycle. Based on that previous analysis of this memory cycle, I continue to see at least a couple of years of upcycle for Micron and its peers, driven by HBM and data center demand. This quarter was an obvious setback as perhaps weak consumer demand was underestimated in the revenue mix as AI grabbed all the headlines.

Despite the ongoing selloff, I think Micron shares currently represent an extremely valuable risk-reward profile and as such, I am re-iterating a Strong Buy on MU going into 2025. For the more risk-tolerant investors out there, I think long-dated call options (8-12 month expiry) could be an interesting-leveraged play on this potential upside. Personally, I will be doubling down (or close to it) at open tomorrow with stock and options.

Best of luck, and thanks for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.