Summary:

- Micron Technology stock dropped nearly 50%, making it a strong buy at $80-100 due to its low valuation and solid earnings.

- Micron’s leadership in memory chips and AI demand, especially from data centers, positions it for substantial future growth.

- Micron’s recent earnings beat expectations, with robust guidance and a potential forward P/E ratio of around seven, indicating undervaluation.

- Despite risks like competition and economic volatility, Micron’s bullish Wall Street ratings and AI-driven growth suggest significant upside potential.

Georgijevic

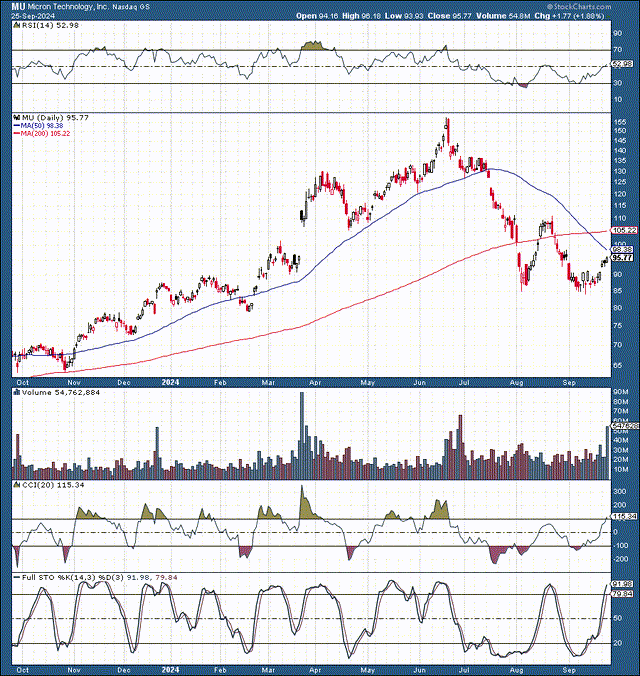

We discussed purchasing Micron Technology, Inc. (NASDAQ:MU) stock during the recent meltdown, as the stock dropped into the $85-95 range. Micron had a monster run-up in late 2023 and the first half of 2024. Its stock climbed to $157, becoming considerably overbought. For a while, Micron even became the poster child for an overvalued and overhyped AI stock.

However, its share price collapsed by approximately 45% in the correction process, making Micron a strong buy in the $80-100 range as its valuation cratered to below ten times forward earnings estimates. Micron recently reported a better-than-expected fiscal fourth quarter, providing better-than-anticipated sales and better-than-forecasted profitability.

Therefore, Micron remains in an advantageous market position with considerable growth ahead, implying that its stock could go substantially higher in future years.

Micron — Potential Long-Term Bottom

Micron experienced a spectacular drop of nearly 50% as the AI hype premium got sucked out of the stock recently. The monstrous correction lowered Micron’s stock to the $85-84 support range. Additionally, Micron successfully retested the support range before rebounding and moving higher more recently. We also saw the RSI make a higher low during the recent retest, implying potential seller exhaustion and a possible shift toward a more positive momentum soon. Now, Micron is set to move back toward the $130-150 price target range.

Micron: Under The Radar AI Play

Micron is a leader in the memory chip space, and it’s experiencing increased demand because of the broad AI expansion process. “Demand from data center customers continues to be strong, and customer inventory levels are healthy,” Micron CEO Sanjay Mehrotra said on a conference call with analysts.

Just to get an idea for the memory AI demand, in June Micron’s HBM chips, used in the AI processors designed by Nvidia (NVDA) were sold out for the 2024 and 2025 calendar years with pricing already determined. Due to the continued AI demand, Micron forecasted fiscal Q1 sales of $8.7B vs. the estimate for about $8.2B. Moreover, the company forecasts a gross margin for about 39.5% vs. the estimate for just 37.7%, illustrating the increased profitability due to AI at Micron.

Micron remains at the cutting edge of memory and AI. Micron’s memory and storage solutions enable generative AI training experiences, from real-time natural language processing (“NLP”) data to personal assistants and AI artwork. In addition to benefiting from the AI-related revenue, Micron should benefit from the AI-related efficiencies Micron moves forward with its smart manufacturing agenda as we move on.

Some of Micron’s top AI products include HBM3E, DDR5, LPDDR memory solutions, and the 6,000, 7,000, and 9,000 DDS storage products. Micron’s leading technologies allow the latest generation of faster and more intelligent global infrastructures. Therefore, Micron remains a crucial component in making AI model training, machine learning training, and generative AI solutions possible.

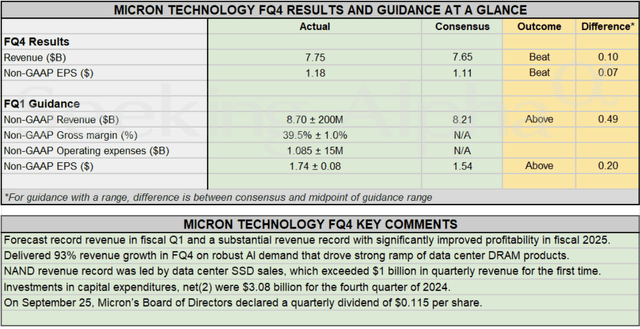

Micron’s Solid Earnings Announcement

There were many “questionable” earnings announcements during the recent earnings season. Moreover, there was a theme of many AI-related companies providing underwhelming results, guidance, or both. However, Micron did not fall into this questionable earnings category. Instead, Micron provided an excellent earnings report with robust guidance.

Micron earnings (seekingalpha.com )

Micron delivered EPS of $1.18, a seven-cent beat. Revenue was $7.75B in the quarter, a $100M beat, a93.3% YoY increase. While Micron’s fiscal Q4 results were solid, its fiscal Q1 2025 guidance was excellent. Micron guided to $8.7B in revenues, approximately $490M over the consensus estimate. It also guided to $1.74 in EPS, 20 cents higher than the consensus estimate. Micron’s results were solid and illustrated the potential for more growth as we advance.

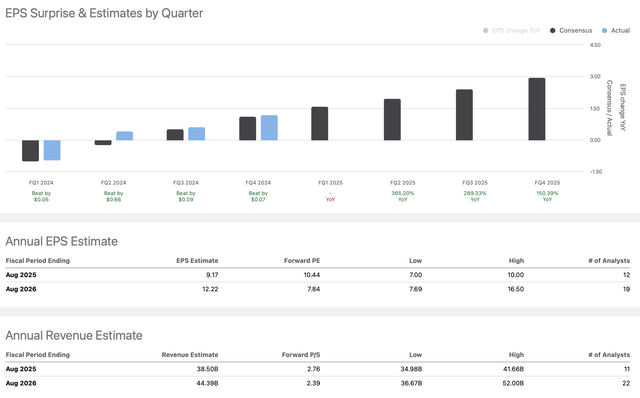

Micron Likely To Outperform

EPS vs. estimates (seekingalpha.com )

Micron has outperformed the estimates recently, and the positive trend could continue as we advance. The consensus TTM EPS estimate was just 39 cents, yet Micron delivered $1.27 instead, an outperformance rate of 225%. We see that the forward (2026) consensus EPS estimate is around $12.20, putting its forward P/E ratio around 8-10, which is relatively low for a company in Micron’s market-leading position with considerable growth ahead. Moreover, if Micron outperforms mildly by just 15-20%, it could earn about $15 next year, implying its stock could be trading at a forward P/E ratio of around seven right now.

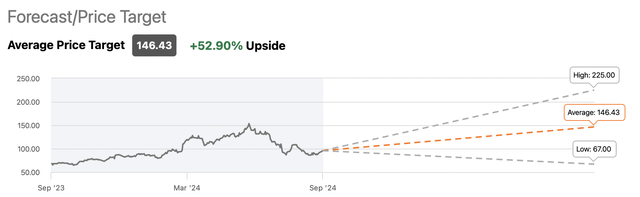

Bullish Wall Street Ratings

Price targets (seekingalpha.com )

Despite Micron’s 45% slide, its price targets have not budged much since peaking. The average price target slipped from a high of about $162 to around $147 more recently. This represents only about a 9% reduction in price target estimate adjustments vs. the enormous decline in its stock price. This dynamic implies that the selloff was likely overdone, and Micron may be undervalued here. Furthermore, the average 12-month price target is around $147, about 35% above Micron’s current price (roughly $110). We may also see more price target increases after the bullish earnings, suggesting that Micron’s stock could have a substantial upside from here.

Where Micron’s stock could be in the coming years:

| Year (fiscal) | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $40 | $48 | $55 | $62 | $67 | $73 |

| Revenue growth | 60% | 20% | 15% | 12% | 9% | 8% |

| EPS | $9.50 | $14 | $17 | $19 | $22 | $25 |

| EPS growth | 630% | 47% | 20% | 15% | 14% | 12% |

| Forward P/E | 11 | 12 | 13 | 13 | 13 | 12 |

| Stock price | $154 | $204 | $247 | $286 | $325 | $355 |

Source: The Financial Prophet.

Micron’s sales should continue increasing as the AI revolution progresses, and demand for its chips continues to grow in the coming years. Furthermore, we see Micron becoming more profitable, a constructive trend that could lead to multiple expansions and a much higher stock price in future years.

Risks to Micron

Despite my bullish assessment, Micron faces risks. While it enjoys a solid market position, Micron has competition. Furthermore, geopolitical risks and other variables should be considered. Moreover, Micron could encounter more volatility if the economy slows more significantly or interest rates remain high for longer than expected. Parts of Micron’s business are also cyclical, and its products can experience price drops due to oversupply and other unfavorable market dynamics.

In a more bearish case scenario, Micron may not achieve the high growth my estimates illustrate, and its profitability metrics may not expand as expected. Micron can also experience multiple contractions during down cycles, leading to a lower P/E ratio and a depressed stock price. Investors should consider these and other risks before investing in Micron.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!