Summary:

- Micron Technology, Inc. stock surged after reporting strong fiscal Q2 earnings, driven by outsized AI-driven HBM demand and progress in consumer end-market recovery.

- The company has already sold out of its HBM capacity for FY 2024, with much of FY 2025’s volumes also already accounted for.

- While Micron remains well positioned to benefit from incremental memory demand, there are roadblocks to materialization in the near term that could preclude the stock from further multiple expansions.

vzphotos

Micron Technology, Inc. (NASDAQ:MU) surged after reporting strong fiscal Q2 2024 results earlier this week. The company faces an outsized demand recovery, underpinned by continued progress in capitalizing on emerging secular AI tailwinds. Micron is currently supply constrained, with limited idle capacity to drive volume growth. This leaves strong pricing power for the company, as it remains one of few suppliers of next-generation HBM3e memory critical to AI developments.

The current backdrop differs starkly from just several quarters ago, when the memory demand slump was further exacerbated by the Cyberspace Administration of China’s probe into Micron’s local operations. Today, Micron has already sold out of its high bandwidth memory (“HBM”) capacity for fiscal 2024, with much of what is available for fiscal 2025 already accounted for. This is in line with our previous discussion that Micron is well-positioned to benefit from incremental memory demand driven by burgeoning interest in AI developments. In addition to secular AI tailwinds, a gradual cyclical recovery is also underway in the PC, smartphone, auto and industrial end-markets, reinforcing the DRAM and NAND demand outlook for Micron.

However, we believe much of Micron’s forward optimism has already been priced into the stock at current levels. Further multiple expansion would likely depend on whether Micron can bring forward additional production capacity for HBM in the near term to address pent-up demand and preserve recent market share gains against competition.

The Spotlight on Accretive AI Opportunities

The fiscal second quarter was a strong quarter. Micron grew revenue by 58% y/y and 23% q/q to $5.8 billion, beating consensus expectations of $5.4 billion and management’s upper range guidance. More importantly, the company reported that it has sold out of its capacity for HBM this year, with much of next year’s availability also already accounted for. With sales remaining a function of supply availability, Micron has maintained superior pricing power in recent quarters. This is corroborated by outsized strength in both NAND and DRAM revenue growth in F2Q, despite slight drops in bit shipments. Robust average selling price (“ASP”) expansion has also been accretive to margins, as highlighted by the $0.66 beat in F2Q non-GAAP EPS.

And Micron’s demand outlook is expected to remain strong within the foreseeable future. As discussed in our previous coverage on the stock, Micron is a key beneficiary of emerging AI interest.

However, Micron remains well-positioned to benefit from longer-term secular tailwinds, which we believe have not yet been adequately reflected in the stock’s value at current market levels. Specifically, Micron remains largely entangled in the narrative over impending recessionary pressures on consumer-centric verticals, with markets overlooking its longer-term prospects in HPC applications stemming from burgeoning interest in generative AI developments.

Source: “Micron Technology: When It Rains, It Pours.”

And the latest results show that these tailwinds have been materializing at an accelerating rate. Specifically, DRAM, which acts as temporary storage for data within chips, plays a significant role in unlocking the full potential of accelerated computing power critical for processing data-hungry AI workloads. DRAM allows the powerful AI processors to crunch data in billion- to trillion-parameter models quickly by bringing that data closer to the chip itself. This prevents the chip from having to harness data directly from the hard drive, which is “slow and inefficient” – and a waste of the processing power of AI accelerators.

Industry expects up to 1 terabyte of additional DRAM demand for every server AI processor, or 30x more than what is required in a high-end PC workstation. For instance, Nvidia’s (NVDA) latest Blackwell B200 GPUs requires 33% more HBM3e content than its predecessor. The AI chip leader’s next-generation H200 Tensor Core GPUs, as well as contender Advanced Micro Devices’ (AMD) latest Instinct MI300X/MI300A accelerators will also incorporate HBM3e.

Specifically, HBM3e refers to the latest HBM processor, which is capable of more than doubling inference speeds in GPUs relative to its predecessors. And this is becoming especially important, as recent generative AI developments go to market, thus transitioning the driver of compute demand from training workloads to inferencing workloads. Specifically, inferencing activity – or the process of generating output from foundational models, such as ChatGPT responses – and related compute spending is expected to become double of training’s by 2025. Micron is currently one of few memory makers, primarily South Korea’s SK Hynix, that supply HBM3e, highlighting its competitive advantage.

A similar extent of increase in memory content requirements is expected for consumer applications in the AI-first era. The emergence of AI PCs is expected to require as much as 80% more DRAM content than what is found in the traditional PC. Meanwhile, AI-enabled smartphones will likely double the DRAM content required in its non-AI counterparts available today. In autos, increasing adoption of next-generation autonomous mobility technologies will also further drive memory content requirements per vehicle. This accordingly highlights increasing memory content per GPU required to optimize performance for HPC and AI workloads, creating a robust demand backdrop for Micron.

Growth Acceleration Remains a Function of Supply Availability

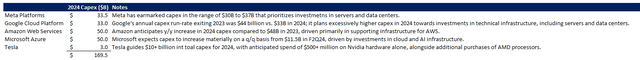

Despite the robust demand environment, Micron’s recent earnings show that the company is already operating close to, or at capacity. Micron’s HBM capacity for FY 2024 is already sold out, with the bulk of FY 2025’s already accounted for as well. This is corroborated by HBM3e integration in both Nvidia and AMD’s next-generation AI processors as earlier discussed, which are in high demand. Micron is likely well positioned for incremental HBM3e demand from other chipmakers – including internal developments at hyperscalers – as well, given heightened capex prioritization in AI infrastructure developments in the near-term. Specifically, big tech alone has pledged about $170 billion in calendar 2024 capex towards AI undertakings, including data center and other supporting technical infrastructure builds.

Yet this strong demand backdrop faces a reduced capex cycle in recent years at Micron, given the preceding cyclical downturn. While management is currently prioritizing HBM output over non-HBM output, with intentions to reduce days inventory outstanding further, it remains a difficult feat to manage.

Due to the downturn that the industry experienced last year, CapEx cuts were made, utilization cuts were made, structural shift from traditional older nodes to newer nodes of equipment was made in order to support the leading-edge nodes. And that resulted in a structural reduction in wafer capacity in the industry as well.

Source: Micron F2Q24 Earnings Transcript.

Specifically, bringing online additional production capacity takes time, given the complexity of memory nodes. While Micron has been engaged in a greenfield development in New York since late October, related DRAM capacity is unlikely to contribute materially until later in the decade. In addition, the complexity of next-generation memory products such as HBM3e also has a 3x higher trade ratio than its predecessors. The trade ratio is expected to increase further for the next-generation HBM4, which is expected to further exacerbate already constrained wafer supply. This leaves limited respite to Micron’s persistent capacity constraints, and risks market share loss to competition.

As a result, forward revenue growth at Micron will likely be restricted to ASP expansion rather than volume expansion. Further wafer supply availability, capacity expansion, and/or production efficiencies will be needed to match volume growth with the current pace of ASP expansion in order to optimize Micron’s share of AI-driven total addressable market (“TAM”) expansion and, inadvertently, revenue outlook.

Fundamental Considerations

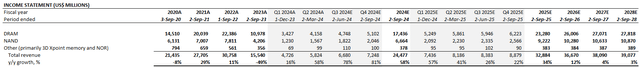

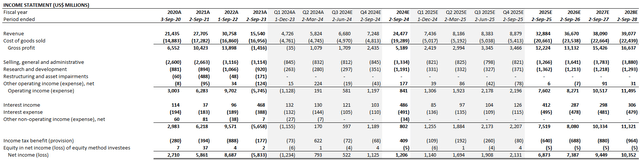

Updating our previous forecast for considerations in the foregoing analysis, as well as Micron’s F2Q results and F3Q guidance, we expect revenue growth of 58% y/y to $24.5 billion in FY 2024.

Specifically, we expect both DRAM and NAND revenue growth to accelerate further in F2H24, before decelerating as ASP expansion tailwinds start to normalize. Demand momentum is likely to last through FY 2025, nonetheless, which is in line with management’s expectations for record revenue and improved profitability over that timeline. Our forecast also considers volume production and shipments on next-generation 1-gamma DRAM and second generation 232-layer NAND nodes in 2025. The new products should command improved ASP and reinforce revenue growth at elevated levels to alleviate the impact from capacity constraints.

Price Considerations

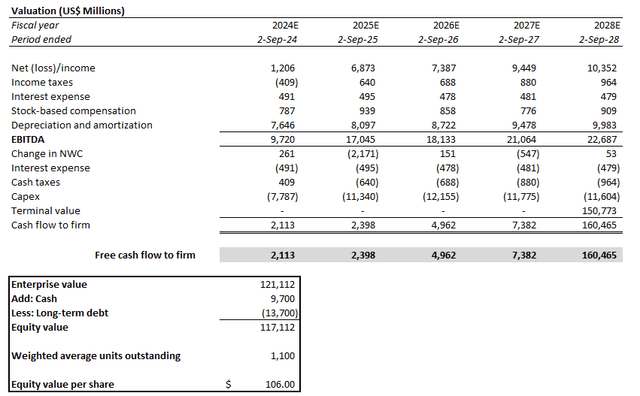

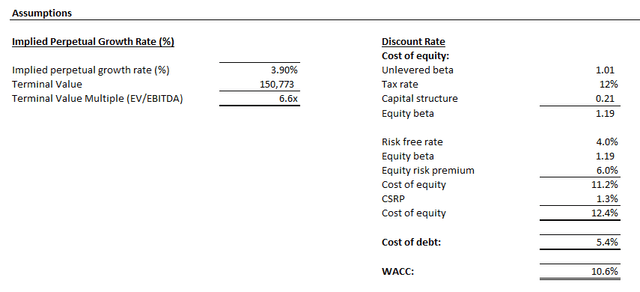

Our price target for Micron is $106, which is compares to the current post-earnings market price of $113 apiece (March 21). The price is derived from a discounted cash flow, or DCF, analysis. The cash flow projections are taken in conjunction with the fundamental forecast above, and considers elevated capex spend through FY 2025 and the remainder of the decade to facilitate ongoing greenfield expansion projects undertaken by Micron across New York and Idaho. Specifically, management has guided higher capex at Micron through FY 2025 compared to levels expected in the current year. Micron is also earmarking 35% of revenue towards capex through the remainder of the decade to support greenfield expansion cycle.

The analysis assumes a 3.9% implied perpetual growth rate on FY 2028E EBITDA, which we believe is an adequate premium to reflect Micron’s expanded TAM prospects in the AI-first era. The perpetual growth rate applied is equivalent to 3% on projected FY 2033 EBITDA when Micron’s growth profile is expected to normalize. This is in line with the higher-range pace of estimated economic expansion observed across Micron’s core operating regions and end-market demand environment. The analysis also considers a 10.6% WACC, which is in line with Micron’s risk profile and capital structure.

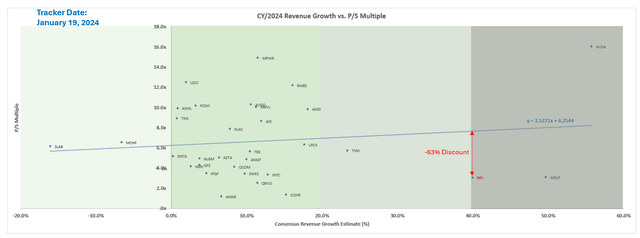

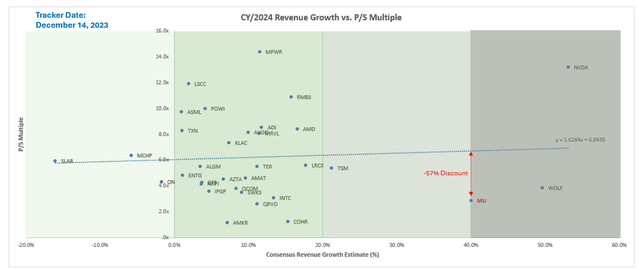

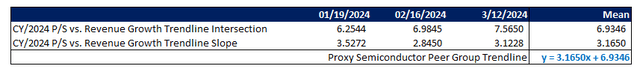

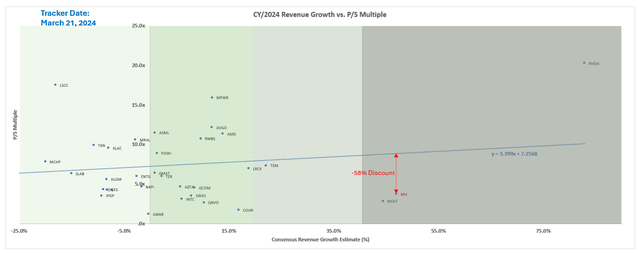

Our price target of $106 is also largely consistent with where we believe Micron should reasonably trade on a relative basis to its semiconductor peers with a similar growth profile. Based on a tracker of growth estimate and valuation multiple changes observed across constituents within the Philadelphia Semiconductor Index (SOX) in recent months, Micron has consistently underperformed the normalized sector trendline by about -63%.

Data compiled and tracked by author Data compiled and tracked by author Data compiled and tracked by author

An exception was observed in early December, when Micron traded at a lesser discount of -57% to where its forward growth estimate is valued based on the normalized sector valuation trendline.

Data compiled and tracked by author

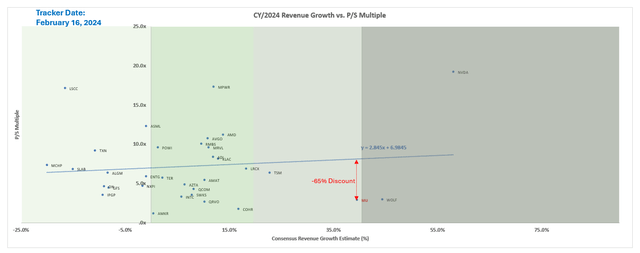

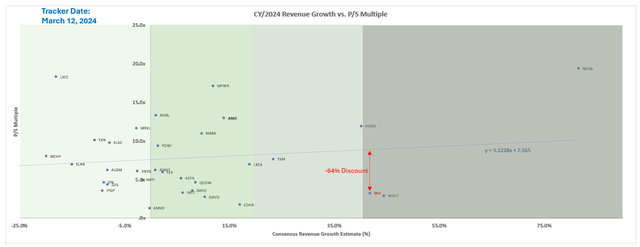

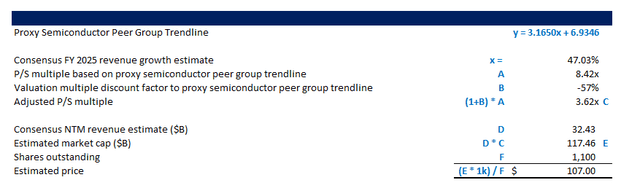

The anomaly likely reflected market’s outsized optimism for its emerging participation in AI momentum at the time. This is similar to current confidence in Micron’s outlook, reinforced by its blockbuster F2Q outperformance. In order to gauge Micron’s valuation prospects on a relative basis to peers, we have taken the average of preceding months’ sector valuation trends to create a proxy baseline. And by applying the reduced -57% valuation multiple discount to the proxy baseline to account for improved confidence in Micron’s underlying fundamental outlook, the stock should trade at about $107 apiece. This is also consistent with the stock’s market open price of about $109 this this morning, which reflects a valuation for Micron that is trading at a reduced -58% discount to the normalized sector trendline.

Author Author Data compiled and tracked by author

Conclusion

The latest Micron Technology, Inc. earnings results continue to underscore how emerging AI tailwinds are materializing strongly for Micron. However, constrained supply capacity remains a significant limitation, and accordingly a downside risk, for Micron in optimizing its capture of AI-driven TAM expansion in the memory demand environment.

We believe the near-term upside potential attributable to Micron’s currently full capacity utilization and robust product pricing outlook has already been reflected in the stock at current levels. Meanwhile, over the longer term, Micron remains inherently sensitive to the cyclical nature of its business. This could coincide unfavorably with significant capacity expansion coming online from its greenfield projects later in the decade. As a result, we see a net neutral setup for Micron at current levels, with much of its reasonably realizable AI prospects over the near and medium term already priced in.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly, exclusive research content and ideas, and tools designed for growth investing, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to research coverage, exclusive ideas and complementary financial models

- Monitored and regularly updated price alerts for our coverage

- A compilation of complementary tools such as growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!