Summary:

- Micron Technology has been struggling due to soft demand in PC and mobile segments, macroeconomic headwinds, and a China ban affecting certain customers.

- The company’s financials show a loss for the last three quarters, but analysts predict a return to profitability in the next 12 months due to expected growth in PC and handheld markets.

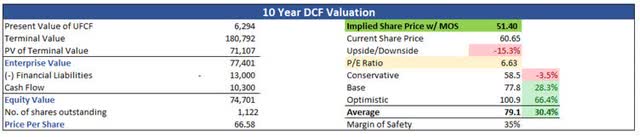

- Despite the current struggles, MU’s intrinsic value is $51.40 a share, implying that the current share price is slightly high for my risk profile.

vzphotos

Investment Thesis

In this article I will cover briefly what is the situation in the NAND and DRAM sector, the China ban on Micron’s (NASDAQ:MU) products for certain customers, and will draw up a DCF analysis where I will assume margins improve overtime to more normalized levels to see what I would be willing to pay for the company. With the mentioned China risks and still quite soft demand in PC and mobile segments, coupled with macroeconomic headwinds, I rate the company as a “hold” until there is more certainty in future revenue potential.

Outlook

The last three quarters were not very good for the company to say the least. Every quarter the company recorded a loss, with Q2 recording the largest loss per share so far this year. Q3 came in at a slightly less loss than Q2, however, it still came in at $-1.73, bringing in a total of $-4.03 a share in the 9 months ended June 1 ’23. Q4 outlook is looking slightly better with only about $-0.53 of loss to be recorded according to analysts. It’s been a tough year for MU. The high levels of inventories and write-downs have affected the company’s performance significantly. The PC and mobile markets have not recovered yet, however, the bottom seems to be coming in as many other companies have pointed to the bottom of the market in the 2nd half of ’23. Let’s hope that is correct for the sake of MU.

According to Gartner, DRAM, and NAND markets are going to finish 2023 on a sour note, dropping 39.4% and 32.9%, respectively. The last few years of the pandemic effect which accelerated sales of PCs, mobiles and other similar electronics led to a build-up of inventories that are hard to sell now for the full price, leading to lower average sale prices overall, dampening revenues. We are seeing some inventories normalize, however, the negative semiconductor sentiment is still around, although not as bad as it was just a couple of months ago. Companies like MU are going to cut production of memory, so the inventory levels come back in line with historical figures and stabilize. Analysts now estimate that FY23 revenues for Micron will decline by almost 50%. Margins were obliterated in the last three quarters, and I do not think that these will normalize for at least another few years.

On the China front, the company is expecting that about half of their Chinese customers will be affected by the ban on their products, meaning the customers in China will have to find substitutes elsewhere, for example, in South Korea. To me, this seems like a short-term pain. The management mentioned that around 25% of their total revenues come from China and they said that they identified 50% of those customers might potentially be affected, then this would translate to around 12%-13% of their total revenues being affected, which is significant, however, not the end of the world. The company will be able to find international customers that are not going to be affected by the ban and diversify in the long run. The less exposure the company has to China, the better it will do overall because the company wouldn’t have to worry about all the US-China tensions.

The company is experiencing tough cyclicality right now and as it happens with these types of companies, they tend to revert to being highly profitable shortly after. The PC and handheld markets are going to return to growth in ’24 in my opinion and that is my conservative outlook of the sector. Some companies and analysts think we are in the trough right now and are about to pop off. With the many different products the company has in store in terms of AI data server products and other high bandwidth models that will support the advancement of AI that are seeing a lot of demand, coupled with the really strong automotive industry, I can see the company becoming profitable once again in the next 12 months.

Financials

One thing to note is all the below graphs will be as of FY22, which ended in September ’22. I will include the latest figures from Q3 ’23 if they are necessary for extra color.

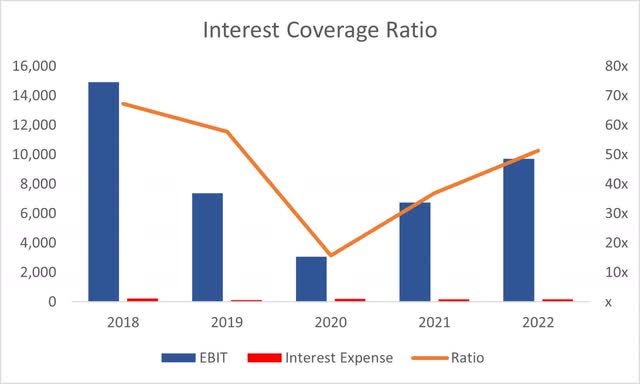

As of Q3 ’23, the company had around $9.3B in cash and $1B in marketable securities, bringing total liquidity to around $10.3B against $13B in long-term debt. I don’t think this is a problem in the long run, especially if MU can manage to pay down the annual interest expense on the outstanding debt. As of Q3 ’23, the interest expense stood at $259m while interest income was $334m, so I don’t think that the amount of leverage the company has on the books is going to cause issues during these rough times. I can see the company rebounding and returning to the interest coverage ratio it had in the past.

Interest Coverage Ratio (Author)

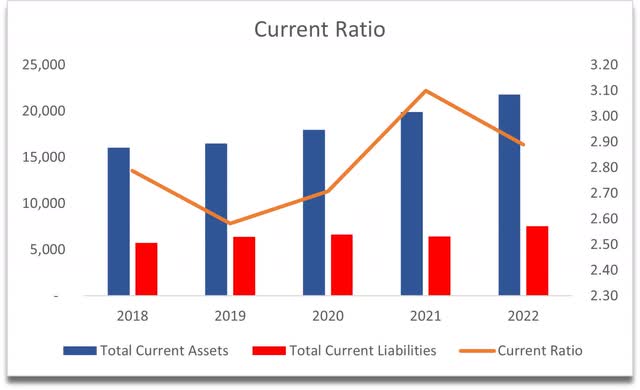

The company’s historical current ratio has been very solid over the last 5 years, which at the end of FY22 stood at 2.9. As of Q3 ’23, that ratio has improved to 4.3, meaning the company can pay off its short-term obligation over 4 times. In my opinion, MU has no liquidity and insolvency issues right now. Even with the tough year or two still ahead, the company will not default on its debt because the interest expense is more than covered by the cash outstanding or even their short-term investments.

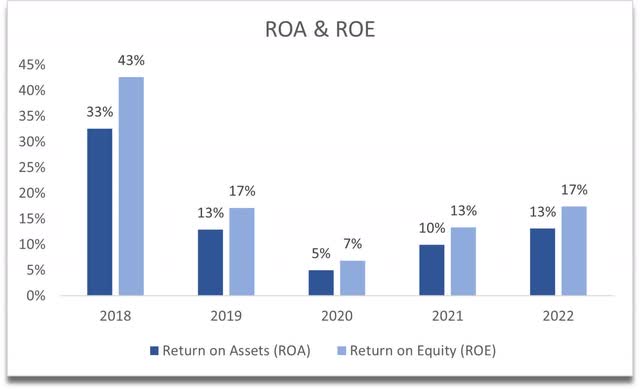

In terms of efficiency and profitability, historically the company was doing well. Even up until FY22, the company’s ROA and ROE have been above my minimums of 5% for ROA and 10% for ROE, however, these will be negative in FY23 and probably in FY24, unless the inventory situation and demand come back for MU’s products. I can also see that the company will get back to similar efficiency and profitability it saw in FY18 by FY25.

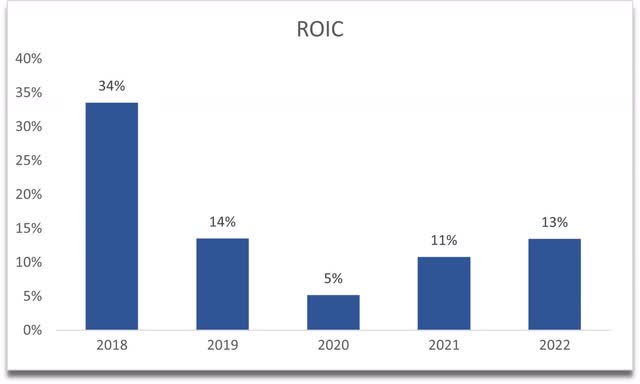

The next very important related metric is the return on invested capital or ROIC. I can see that the company has been losing its competitive edge over the last while starting at the end of FY18 but recovering some of it from the pandemic lows by the looks of it, just like ROA and ROE show. It seems like the strong moat and competitive advantage it saw in FY18 has been lost and we will see these figures go into negative territory when FY23 is announced.

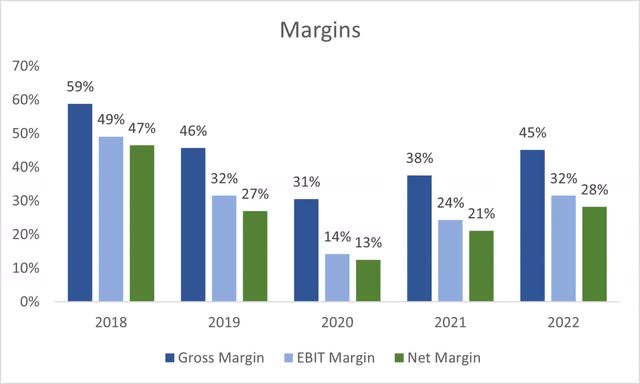

In terms of historical margins, it looks like the company is doing well over the last five years, however, we now know that the last three quarters have not been very pretty, with negative net margins plaguing the company’s operations but as I said earlier these setbacks are temporary because if they weren’t, the company would not last very long.

Overall, historically it looks like the company is doing just fine. FY23 will show a company that has struggled this year with massive inventory build-up and a much lower average sale price to get rid of it, which led to gross margins deteriorating. This will be short-lived, but I don’t think it’s going to go away that quickly and I would expect margins to stay this ugly for at least the next three quarters.

Valuation

I decided to play around with the DCF model and see what kind of potential the company has over the next decade, once all of these obstacles go away and cyclicality turns back positive.

For the base case, I decided to go with what the analysts assume for the next year, which is a -50% revenue decline in FY23 followed by a strong rebound that coincides with the mentioned Gartner report in the outlook section. I went with a 36% rebound, followed by 25% in FY25, which I then linearly grew down to 5% by ’32, giving me around 10.5% CAGR over the next decade. In the last decade, the company managed to grow revenues at around 20% CAGR so I think I’m being reasonable in my assumptions.

For the optimistic case, I went with a 14.4% CAGR and for the conservative case, I went with an 8.6% CAGR over the next decade.

In terms of margins, the company will make a loss of $-5.10 a share in FY23, which is slightly more conservative than analysts’ $-4.56 a share. For the next year, I modeled an EPS loss of $-0.9 a share, which is very close to analysts also. From then on, the company will start to make money once again, and in FY25, the company will have around 7% net margin or around $1.5 per share, which will gradually return to the net margin it saw at the end of FY22 when net margins reached 28%. That seems very reasonable to me.

On top of these assumptions, I will add a 35% margin of safety on the final calculation because of the negative sentiment and awful numbers that will come out shortly, which will bring a lot of volatility. With that said, Micron’s intrinsic value is $51.40 a share, implying that the current share price is a bit high for my risk profile.

The P/E ratio in the picture is taking FY22 results, just so I can have some sort of a measure because we all know the FY23 results will be negative.

Closing Comments

Historically the company performed very well. It does seem to me that the company was one of the semiconductor companies that got hit the most with the softer demand cycle for its products compared to other semis that I’ve covered in the past. As I mentioned before I don’t think that the bad times will last for much longer, however, I won’t be investing at this price. If it comes down closer to my PT, I will certainly take another look at the company and decide if I should start a position. I wouldn’t sell my position right now if I were already an investor. I would add to any meaningful weakness in the near future if you thought that we are at the bottom of cyclicality and that the company will capture meaningful revenue growth in the long run just as it did in the recent past.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.