Summary:

- Micron, a semiconductor company, is experiencing a downturn in its share price due to the cyclical nature of the memory market and the post-pandemic downturn in the semiconductor industry.

- The top three memory producers, Micron, SK Hynix, and Samsung, are working to improve the supply-demand imbalance by cutting production which could lead to a recovery in memory prices and Micron’s valuation.

- Despite the risks of a prolonged recovery, Micron’s current valuation offers a favorable risk/reward opportunity, with the company trading close to its tangible book value and having a strong position in the growing data-intensive market.

hapabapa

Investment Thesis

Micron Technology, Inc. (NASDAQ:MU) is a semiconductor company that manufactures storage devices used for a diverse set of end markets.

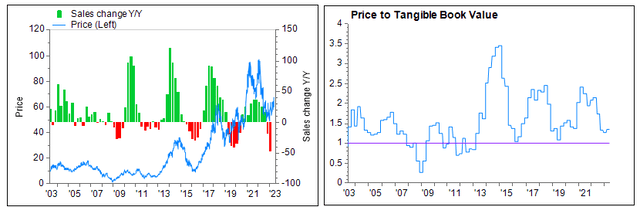

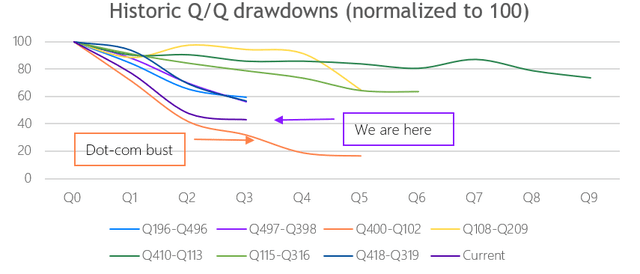

Its two main products are Dynamic Random-Access Memory (DRAM) and Non-volatile, re-writeable semiconductor storage devices memory (NAND). The long-term thesis is that there is a secular growth in data demand, benefiting the industry. However, memory is commodity-like and thus driven by supply and demand. After the boom during the pandemic which most semiconductor companies benefited from, the semiconductor cycle at large has turned downwards, affecting the memory producers the most. This post-pandemic downturn has pressured Micron’s share price down c46% in 2022. After Micron’s FQ223 (Mar 28, 2023), it has now had three consecutive quarters with negative growth. The consensus is that revenue will decelerate in FQ323, and the decline will bottom in FQ423. The semiconductor cycle tends to last about 4–6 quarters, and Micron’s share price tends to bottom once its quarterly revenue growth turns negative or its quarterly revenue decline decelerates. At the current valuation, Micron trades close to tangible book value (1.3x). Apart from the financial crisis, when Micron’s stock bottomed out at 0.2x, the Company tended to bottom at roughly 1x tangible book value throughout the previous 20 years. Micron’s share price has stopped reacting to negative news, increasing my confidence that the bottom is close. For example, in FQ223, gross margins came in negative 31% versus the consensus estimate of positive 8%. Yet despite the weak results and guidance, the shares were up 7%.

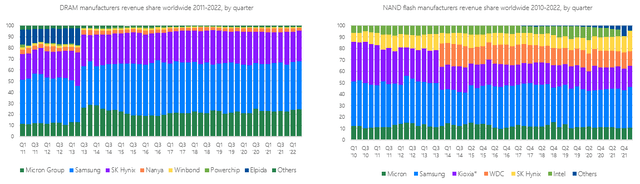

Micron has exposure to the cyclical semiconductor memory market, with about 70% of revenue derived from DRAM and about 20% derived from NAND. DRAM prices fell by c40% last year, and the consensus is that prices will fall by c12% in FQ323 and thereafter stabilize. NAND prices fell by a similar amount in 2022 and are expected to fall by 17% in FQ323 and stabilize in FQ423/FQ124. DRAM and NAND prices are driven by supply and demand. Three leading players control the industry: Micron, SK Hynix, and Samsung (OTCPK:SSNLF). Collectively, these have over 90% market share in DRAM and over 60% in NAND. Micron and SK Hynix, which collectively control c50% of the DRAM market and c30% of the NAND market, have signaled aggressive capex cuts in the 40-50% range, and are reducing wafer starts and slowing technology migrations to improve the supply and demand imbalance. Samsung long held the stance of matching supply with mid-term demand. However, on April 7, 2023, Samsung announced it would lower chip production by a “meaningful level”. With 90% of the DRAM market and 60% of the NAND market cooperating to improve the supply-demand imbalance, I am confident that memory prices will start to improve, with Micron’s valuation to follow.

FactSet

Since consolidation in 2013, Micron has earned an average ROIC of 17% and EBIT margin of 26%. Since the industry is cyclical, I estimate a sustainable EBIT-margin of 26% by using the average margin achieved since the industry consolidation in 2013. Applying this margin, on the average five years sales and 2022 years’ sales, I find that Micron is currently trading at 8 and 10 times these estimated earnings (EV/EBIT), respectively. Moreover, Micron trades close to its tangible book value at only 1.3x. Micron operates in a viable industry with long-term secular growth trends. It has also managed to earn superior returns since industry consolidation in 2013. As such, I find the current valuation unjustified and view the risk/reward as favorable. In my view, Micron offers the best risk/reward of the three players as SK Hynix has 40% of DRAM and 25% of NAND production in China, and it only has a one-year exemption from US export bans, while Samsung earns only one-third of its revenue from memory.

Company Description

Micron manufactures storage devices used for a diverse set of end markets. The two main products are DRAM and NAND. Both are high-volume commodities that are combined in systems such as computers, smartphones, and servers. According to Garner, these end markets comprise about 80% of total DRAM and NAND demand, split between about 33% on servers, 33% on mobile-related devices, 19% on PC, and the remainder on miscellaneous end markets. In 2021, DRAM and NAND markets were worth a combined USD165bn, making up about 25% of the total semiconductor market. While demand and prices fluctuate wildly, DRAM and NAND are expected to show long-term secular growth as the world becomes more data-intensive. For example, worldwide data has increased 80x since 2010 and is expected to reach 175 zettabytes by 2025, representing a 61% CAGR (2018–2025).

Micron’s primary type of memory is DRAM, which represents 70% of its revenue. Micron commands a stable c20% market share in DRAM memory. NAND is the second-highest product category forming c25% of Micron’s revenue. Micron’s market share in NAND is stable at 10%. The DRAM market has become highly consolidated, with the top three manufacturers (Samsung, Micron, and SK Hynix) controlling about 95% of the entire market. In 2008, the same three companies held about 60% of the total DRAM market. The NAND market is also consolidated, while less so than DRAM’s, with Samsung, SK Hynix, and Micron controlling about 64% of the NAND total market.

Statista

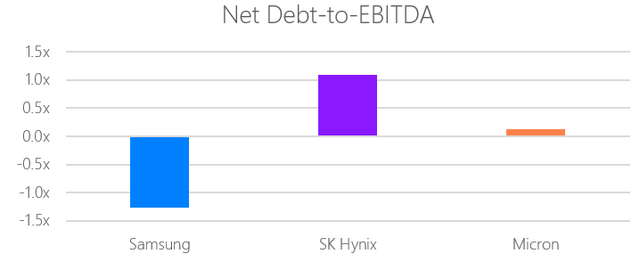

The main industry players have a solid debt structure, and it is unlikely that any of the three firms would go out of business even in a severe downturn. Micron has a net debt-to-EBITDA of 0.1x.

FactSet

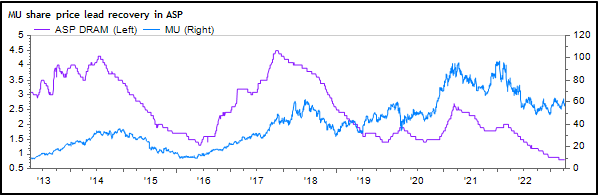

The semiconductor Cycle

Semiconductor memory is commodity-like, thus price is primarily driven by supply and demand. The imbalance tends to be reflected in Micron’s share price which tends to increase when memory prices increase and vice versa. However, Micron’s share price tends to lead the recovery in DRAM prices. Accordingly, DRAM price improvements will boost my confidence that Micron’s share price has bottomed.

FactSet

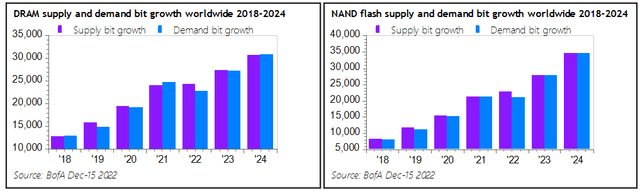

Before delving into the supply and demand outlook, bit growth is one essential term to understand. Bit growth refers to the growth of bits, which are information units used to measure the growth in the memory market. This term is usually used when discussing supply and demand. Supply bit growth can be achieved in several ways: increased production (i.e., more machines or facilities producing memory chips) or node transitions (i.e., tech migrations to smaller nodes which result in higher capacity per chip, thus more bits per chip). Importantly, bit demand tends to grow despite decreasing units sold as memory density increases. The long-term trend for DRAM bit growth is in the high-teens percent, while NAND’s is expected to be in the high-twenties percent.

Demand

The demand environment remains highly elusive from the pandemic-high and uncertain macroeconomic environment. However, industry guidance points to stabilization and a cautiously optimistic H223.

Micron’s overall outlook for 2023 is that DRAM bit demand will grow by c5%, while NAND growth will be in the low-teens percentage range. This is built on mid-single-digit percentage decline in PC unit volume for 2023, reverting to 2019 levels, an increase in smartphone bit shipments in H2FY compared to H1FY, and data center demand bottoming in Q2FY, with sequential growth in Q3FY. As such, Micron expects the industry bit supply to fall short of demand growth which should contribute to price stabilization.

SK Hynix anticipates a more aggressive demand outlook, with low-teens percentage bit growth in DRAM and low-twenties percentage bit growth in NAND. The Company expects a decline in PC units but a greater than 10% growth in DRAM content and a low-twenties percentage growth in client SSD NAND. Smartphone demand continues to be heterogenous, with high-end devices experiencing increased memory density while low-to-mid-range models exhibit slower content growth. On the server side, SK Hynix forecasts high-teens percentage bit growth in DRAM and high thirties percentage bit growth in enterprise SSD NAND. While SK Hynix observes decreasing demand due to restricted IT investments, this is partly offset by higher server specifications from new CPU launches expected in H2CY and increased memory density due to lower prices.

Samsung’s demand forecast is the most cautionary. It sees smartphones and PCs as weak due to macroeconomic factors. However, densification trends and new CPU launches in H2CY add upside potential. On the server side, Samsung expects server inventory adjustments to persist while fundamentals remain favorable, driven by AI and machine learning. In particular, Samsung sees growth in H2 for DDR5 (the most recent DRAM generation), driven by densification trends and new CPU launches on the server side.

Overall, the three firms are cautious about PC and smartphone markets but more optimistic about data centers. However, while units might decline for the former two categories, the lower price drives memory densification, which helps bit demand for both DRAM and NAND. New CPU launches for PCs and data centers could add upside potential.

Supply

The supply side is more straightforward to track, with the top three firms making up more than 90% and 60% of DRAM and NAND market shares, respectively. Micron and SK Hynix have taken several steps to decrease supply, while Samsung has recently said it will lower chip production by a “meaningful level”. Before that, Samsung said it was investing to meet mid-term demand. I interpret mid-term to mean 2024.

Micron and SK Hynix together make up slightly more than 50% of the DRAM market and marginally less than 30% of the NAND market. Both companies have cut their capex guide by >40%. Micron has cut its wafer fabrication equipment (WFE) starts by >50%, and SK Hynix similarly cut WFE albeit by an unspecified amount. To further reduce supply bit growth, the two firms have slowed their tech migrations which will help stabilize supply. Micron expects its actions to result in meaningfully negative DRAM bit growth and a year-on-year reduction in NAND supply bit growth. As such, Micron expects the industry bit supply growth for DRAM and NAND in 2023CY to be below demand growth. SK Hynix expects its actions to result in it achieving negative supply bit growth for DRAM in 2023 and a limited increase in supply bit growth for NAND.

Samsung on the other hand has the most cautious demand outlook and aggressive supply plans. The main risk to my thesis has been that Samsung would not act rationally. The argument for Samsung not cutting supply has been as follows: it would allow Samsung to close the gap in technology with Micron while enabling it to gain a low single-digit market share. This aligns with Samsung’s strategy of investing in downturns to gain market share. The argument for Samsung cutting its capex and slowing its technology migrations, like the rest of the industry, is that it would help stabilize prices. This would be rational from an industry standpoint and would help Samsung stabilize its financial results. For example, estimates for Samsung’s EBIT for Q123 point to a 90% decline year-over-year.

While Samsung has a solid financial profile and can afford to overinvest to gain market share, it seems that financial stability is starting to weigh on Samsung. In April 2023, Samsung said it would lower chip production by “a meaningful level”. While Samsung did not specify by how much it is cutting its output, this is shifting the narrative from Samsung being willing to destroy short-term profitability for market share gains to that of a rational industry.

As discussed before, how much Samsung is cutting production is unknown. However, its earlier communication has stated that most of its 2023 capital expenditure is allocated to infrastructure, such as clean rooms, which does not directly increase bit supply but allows for incremental supply expansion as demand rises. Moreover, converting Samsung’s capex plans to USD allows us to anticipate a 9% decrease year-over-year. Samsung did not give an update on its technology migration plans and thus seems dedicated to advancing its technology migration. However, per Samsung’s earlier communication, extended equipment lead times and increased complexity in migrations are expected to limit bit growth in the short term.

Strictly looking at the estimated capex spend for the top five memory producers, assuming 90% of Samsung’s capex is related to memory, I estimate that capex spending increased by 17% in 2022 and is expected to fall by 27% in 2023. Both SK Hynix and Micron have indicated over 50% and over 40% capex cuts, respectively. Estimates for Samsung point to a 9% decrease year-over-year in USD terms.

Collectively, Micron and SK Hynix control about 50% of the DRAM market and 30% of the NAND market. Both have taken decisive action to curtail supply. With Samsung, which has about 44% and 35% market share in DRAM and NAND, respectively, joining in cutting supply, the supply-demand imbalance would move in the right direction. Bank of America’s December 15, 2022 forecast predicts the supply-demand imbalance for DRAM and NAND to close in 2023 and increase towards undersupply in 2024. With Samsung’s latest announcement, I expect the imbalance to close sometime in 2023. Hence, I see a good risk/reward in investing in Micron at the current valuation.

BofA

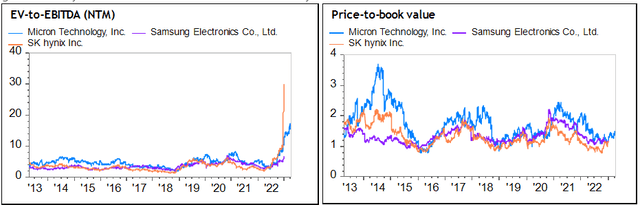

Counterpoints

Of the three companies, Micron trades at a premium on the price-to-book value and sits in the middle of the group’s NTM EV/EBITDA at 16.1x vs. 26.0x and 6.9x for SK Hynix and Samsung, respectively. While Samsung is cheaper, has a higher market share, and has better financial strength than Micron, I still find Micron more attractive. This is because Micron is considered to be ahead in technology and fully leveraged towards the memory cycle, while Samsung generates only about one-third of its revenue from memory.

FactSet

SK Hynix and Micron are equally leveraged towards memory. However, SK Hynix is considered slightly behind Micron on its technology and has significant exposure to China, with more of its production in the country. For example, SK Hynix has about 40% of DRAM and 25% of NAND production capacity in China. And even though it has managed to get a one-year exemption from the US export ban, it remains vulnerable to geopolitical risks. Micron derives only about 11% of its revenue from China and has less than 1% of its assets in China (cUSD440m).

My view on memory recovery being underway is the consensus view. Hence, it could be priced in. While the three companies’ guidance and analysts estimate gradual improvement, I do not think it is “priced in” as each firm is trading close to bottom valuations while they are in a viable industry set to grow long-term. However, the projections from analysts and guidance from the industry have continued to be revised downwards, and there is a risk of a prolonged recovery. I am aware this is a risk, and trying to time a recovery is incredibly hard. However, I think the main result of a prolonged recovery is that it will take longer for the thesis to work; it would not be a “permanent loss of capital” event.

The semiconductor cycle generally lasts 12-18 months. Micron’s management claims the current cycle has manifested the most severe imbalance between supply and demand in DRAM and NAND in the last 13 years. Plotting Micron’s revenue drawdowns in past cycles, the current down cycle is on track to be as bad as the dot-com bust.

FactSet

The pandemic was a synchronized and unprecedented boom in the memory end markets. Many were forced to replace their PCs and smartphones while data center investments boomed to sustain the new work-from-home environment. Thus, a valid argument is that this downturn will be worse than over the last ten years and valuation trends seen over that period are not reflective of this downturn. I believe this is a fair point. However, the market dynamics since the dot-com bust have shifted significantly. I have been unable to locate any statistics on the market share back in the dot-com bust, but only since 2008, the DRAM market has consolidated to the three largest players having more than 90% market share, up from 60%. Nevertheless, the thesis must be reassessed if the supply-demand imbalance worsens.

While the industry is cyclical, since the consolidation in 2013, the industry participants have acted relatively rationally. This has resulted in Micron earning an average ROIC of 17% and EBIT margin of 26% since consolidation. Given my estimated sustainable EBIT level, Micron trades 8-10 times EV/EBIT and only 1.3x tangible book value. So even though my view is the sell-side consensus view, Micron seems to trade on the next quarter instead of factoring in a gradual improvement during 2023. Micron’s share price has stopped reacting to negative news, and thus I think the current valuation is a good entry point before the short-termism disappears and the share starts to reflect the upcoming recovery. All considered, I find the current valuation of Micron unjustified and view the risk/reward as favorable.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.