Summary:

- Micron’s stock price surged by over 16% since March 2024, driven by strong growth in memory and storage, particularly in AI and HBM3.

- Micron reported 50% sequential data center revenue growth in Q3, driven by AI demand, and anticipates HBM3E revenue to reach multiple billions in FY25.

- Micron is well-positioned to benefit from the CHIPS and Science Act, with plans for manufacturing expansion and potential revenue growth to exceed $30 billion in FY25.

JHVEPhoto

I presented my ‘Buy’ thesis on Micron’s (NASDAQ:MU) in my previous coverage published in March 2024. Since then, the stock price has already surged by more than 16%. I highlighted Micron’s strong growth in memory and storage driven by AI and HBM3. The company released its Q3 FY24 result on June 26th, reporting AI demand drove 50% sequential data center revenue growth in the quarter. I believe that Micron’s growth in AI business has just started, and the company could sustain a high growth for several years. I reiterate the ‘Buy’ rating with a fair value of $160 per share.

HBM3E Shipment Ramping Up

My biggest takeaway from the quarter is the strong demand and positive market feedback for Micron’s HBM3E products. As communicated over the earnings call, the company started to ramp up HBM3E shipment from Q3, generating $100 million in HBM3E revenue for the quarter. The management anticipates HBM3E revenue to reach multiple billions in FY25. As discussed in my previous coverage, Micron’s HBM has already been sold out for calendar year 2024 and 2025, reflecting strong demands driven by AI workloads.

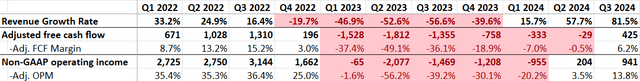

In Q3, Micron delivered 81.5% revenue growth with 13.8% adjusted operating income, as detailed in the table below. It is indeed a very strong quarter. The stock price went down after the earnings as many short-term investors took profits.

Another important development is that Micron signed a nonbinding preliminary memorandum of terms with the U.S. government for $6.1 billion in grants under the CHIPS and Science Act, as communicated over the earnings call. The grant is going to be used for manufacturing expansion in Idaho and New York. I view Micron as one of the best-positioned players to benefit from the CHIPS and Science Act. There are only three main players manufacturing DRAM products, with Samsung (OTCPK:SSNLF) and SK Hynix, both South Korean companies, leading the competition. While Micron is relatively smaller compared to Samsung and SK Hynix, it is the only U.S.-based company. Micron’s CEO has made significant efforts to boost U.S. production footprint and secure government grants from the CHIPS and Science Act. I anticipate Micron will continue to benefit from the government grants in the future.

FY25 Outlook

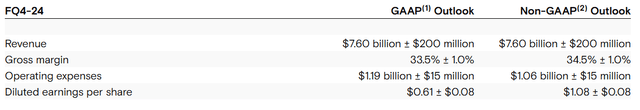

As Micron has already delivered phenomenal revenue growth over the past three quarters, Micron is on track to deliver $25 billion+ in revenue in FY24, as the company guided below.

It is more important to think about Micron’s growth in FY25. My thinking process is as follows:

- As disclosed over the earnings call, Micron’s supply growth in FY24 remains below the demand growth for both DRAM and NAND. The company is expected to deliver 7.6 billion in revenue in Q3 according to the company’s guidance. Assuming there is no growth in supplies, I estimate that Micron will deliver above $30 billion in revenue in FY25.

- Micron plans to allocate $8 billion in CAPEX in FY25, representing 4.2% year-over-year growth. The growing supply could contribute additional $1.1 billion to revenue in FY25, as per my estimates.

As such, I calculate the total revenue will reach $31.1 billion in FY25, including both existing supply and new manufacturing capacities.

Valuation

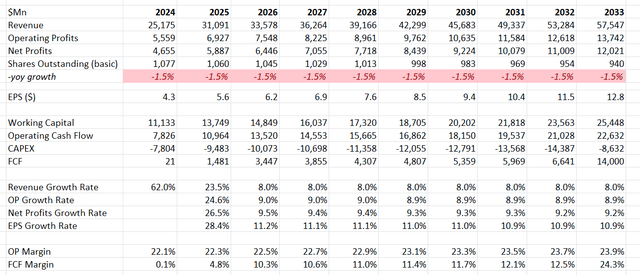

As analyzed above, the revenue growth is estimated to be 23.5% in FY25 in the DCF model. IMARC forecasts that the global memory market will grow at a CAGR of 14.1% from 2024 to 2032, driven by demands for consumer electrics and AI workloads. I expect the end-market growth will be faster in the early years, as more enterprise customers invest heavily in AI training and inference; then the market will start to moderate in the later years. As such, I anticipate Micron will deliver 8% revenue growth from FY26 onward.

Micron has allocated more than $4 billion towards shares repurchase over the past three years. I assume the company will spend 8% of total revenue on shares buyback, leading to a 1.5% reduction in total shares outstanding.

In addition, I assume the company is going to generate 20bp operating leverage from gross profits, driven by new HBM3E technology. As indicated over the earnings call, HBM3E carries higher margin than the group level. Therefore, a higher revenue mix towards HBM3E could drive the gross margin expansion.

The DCF summary can be founded in the below table:

Micron DCF – Author’s Calculations

The WACC is calculated to be 11.9% assuming risk-free rate 4.26% ((US 10Y Treasury)); Beta 1.34 ((Seeking Alpha); Equity market premium 7%; cost of debt 7%; debt $13.3 billion; equity $44 billion; Tax rate 10%.

Discounting all the free cash flow, the fair value of Micron’s stock price is estimated to be $160 per share.

Key Risks

Although Micron is experiencing strong revenue growth in the AI era, the company hasn’t generated meaningful free cash flow due to high CAPEX spending. As discussed previously, the company plans to spend $8 billion in CAPEX in FY24 and anticipates mid-30s capital intensity in the near future. Having said that, the high capital expenditure is quite necessary to capture the rapid growth in demands.

In addition, investors need to understand Micron is a highly volatile semiconductor company, with revenue growth moving along with industry cycles. Therefore, Micron’s earnings are likely to be quite volatile in the future.

Conclusion

I view Micron as a key beneficiary of rapid AI growth, leading HBM3E growth in data centers. The supply of memory market is still short of end-market demands, resulting in strong revenue growth for Micron in the near future. I reiterate the ‘Buy’ rating with a fair value of $160 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.