Summary:

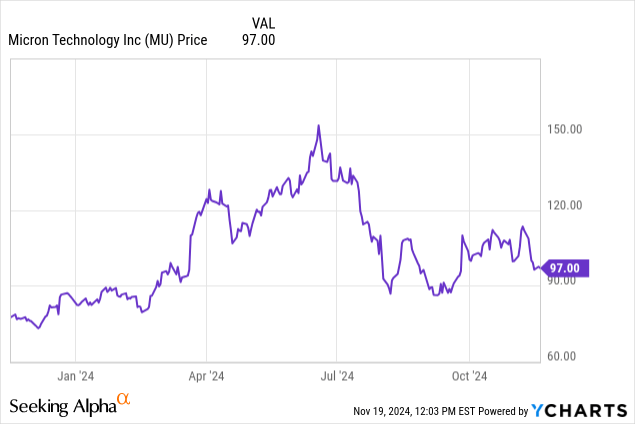

- MU has dropped 15% from recent highs despite strong earnings and an upbeat Q1 2025 forecast.

- Concerns over memory demand and oversupply are looming.

- Micron’s high-margin product offerings will drive growth and offset weakness.

krblokhin

Micron Technology (NASDAQ:MU) shares have been in decline the last couple of weeks as the stock has dropped nearly 15% since 11/7, despite a blowout earnings report and a broad post-election tech stock rally. Even though the company forecasted an upbeat Q1 2025, concerns have again begun to creep in that memory demand will be weaker than expected in 2025. I continue to see a MU as the beneficiary of an ongoing memory upcycle and am re-iterating a Strong Buy.

As you might recall, before Micron’s Q4 earnings release, analysts were concerned over weak consumer memory demand and HBM oversupply. In an article before earnings came out, I argued that these concerns were either overblown (in the case of weak consumer demand) or unlikely to come to fruition (in the case of HBM oversupply). Micron’s forecast for Q1 demonstrated just that, as the revenue and earnings outlook came in above consensus on the ramp for HBM and strength in enterprise SSD sales that offset weak consumer sales. That article can be read here.

Well, just when it seemed like some upward momentum might be building for MU, another wrench has been thrown into the gears to derail and disappoint investors. I’ve seen many folks on Seeking Alpha and elsewhere lamenting that the stock continues to drop despite seemingly executing perfectly and wondering why this is the case. Much like the pre-earnings discourse, fears of oversupply have rung out yet again.

While neither Micron itself or other memory suppliers have sounded an alarm, third parties like Edgewater Research have forecasted a softening demand outlook in 2025 and price trackers like TrendForce have reported that DRAM spot prices haven’t increased as expected and a bit of growth is rising. These factors together have dampened investor optimism regarding prospects for MU in the near-term and have led shares to bleed some value. Are these fears overblown yet again, or might there be a storm brewing?

The first point of discussion that we should cover is the increasing complexity of the memory market. I think part of the disconnect between what Micron is forecasting and what third parties are forecasting is that the speed of product development has ramped up, new technologies have entered the fray, and new suppliers are becoming more of a factor. Take the forecast for increasing DRAM bit shipments as an example: this includes low-margin DDR4, medium-margin DDR5, and high-margin HBM. If the price of DDR4 drops but the price for DDR5 and HBM stays high, this is likely to be a net positive for Micron and other memory makers even if overall DRAM bit shipments are expected to rise. And this is precisely what appears to be happening.

Average selling prices for DDR4 are already facing downward pressure as supply catches up to demand, and Chinese manufacturers ramp up capacity, but this was already expected as Micron acknowledged in its earnings call:

So in terms of China supply, yes, there has been China supply in the market. It’s primarily limited to China-oriented, China-exported customers who are using some of that supply or attempting to use it and generally focused on the product categories that have lower performance associated with them. So, DDR4, LP4 on the DRAM side and some of the lower end products on the NAND side, especially in mobile and consumer SSD type of product categories.

The market has seen a significant jump in the premium of DDR5 over DDR4 as Chinese suppliers have been able to produce the latter in volume while the former still remains the domain of the big 3 — Samsung, SK Hynix, and Micron. In fact, DDR5 spot price is now about 50% higher than DDR4, compared to 37% in March 2024.

While all revenue drivers are relevant, some are more important than others. Micron evidently saw the rising supply of DDR4 and still provided an upbeat outlook to investors, indicating the company has made great strides towards establishing its share of the high-margin markets that will ultimately fuel net income, cash flow, and future growth:

We are gaining share in all of the big high profit portions of the product portfolio of the industry. We have HBM share gains happening, really is robust share in high cap bins, pioneering leaders in LP5 and the data center, data center SSDs at record share levels. So you can see how the portion of the business that’s exposed to those kinds of trends in China are really becoming smaller as a percent of our revenue over time.

This should come as no surprise. With limited wafer supply and capacity, Micron is happy to let China flood the market in lower-end memory offerings to focus on the profit centers. Here’s a further example of how growing DRAM supply doesn’t necessarily translate to pricing pressure for Micron:

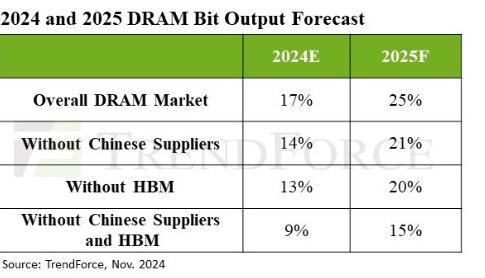

TrendForce

From the chart, overall DRAM bit shipments are expected to increase 25% for 2025, which is quite significant and could be viewed as a bad sign for DRAM pricing in 2025. That is, until we take a closer look at why exactly that number is so high:

1) Bit growth is only 21% without Chinese suppliers (i.e. if you exclude low-margin DDR4).

2) HBM accounts for a significant portion of bit growth, which is good for Micron because HBM is capacity constrained and extremely high-margin.

3) Without Chinese suppliers (DDR4) and HBM, a bit of growth is only 15%, which is historically fairly low.

I am making some educated guesses here, of course, and demand trends could shift any number of ways, but if the market continues as it has been and is expected to, Micron will meet or exceed its Q1 guidance and be well-positioned for even further strength in 2025. The secular trends fueling memory demand remain strong as AI infrastructure build-outs continue to drive enterprise SSD sales, which are offsetting the continued weakness in the consumer market.

Based on a consensus FY2025 EPS estimate of around $9, which is likely a low-ball in my opinion, based on Micron’s typically conservative guidance, MU is trading a bit under 11 times forward earnings. As concerns over memory supply and pricing pressure dissipate, I expect to see MU shares rise in the coming weeks and especially leading up to the Q1 2025 earnings report.

That said, investors should prepare themselves for a major bellwether this week, which could induce some wild price swings. I am, of course, referring to Nvidia’s (NVDA) earnings report, expected to be released after the close Wednesday. As the provider of the literal engines of AI compute, Nvidia has the most insight into upcoming trends and its results will drive stock movements across the AI sector.

Investor Takeaway

Despite concerns of increasing bit shipments and potential downward pricing pressure, I think Micron is well positioned for FY2025 in the high-margin sectors that are most important to the stock’s prospects. While overall DRAM shipments might rise, Chinese suppliers of DDR4 are the ones most at risk from this development, while the demand for higher-performing memory offerings sold by Micron, Samsung, and SK Hynix remains strong.

I don’t currently have a specific expectation for the NVDA earnings report, but investors should prepare themselves for volatility. For those with a low-risk tolerance, it might be best to wait until after the report to make any moves on MU. For everyone else, I think MU remains a Strong Buy for 2025, especially after this most recent sell-off, and if the stock does indeed drop after Nvidia’s earnings, I will highly consider adding to my position.

Thanks for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.