Summary:

- Micron is expected to see high FY25 growth driven by advanced memory products, despite potential short-term downside from current market conditions and AI capex concerns.

- Competitive pressures from Samsung and SK Hynix in the DRAM and HBM markets could affect MU’s pricing power, increasing market volatility and risk of overvaluation.

- MU is forecasted to reach a market cap of $153.3B within 12 months, supported by favorable long-term AI growth, but cyclical downturns could impact performance, especially post-FY25.

Martin Barraud/OJO Images via Getty Images

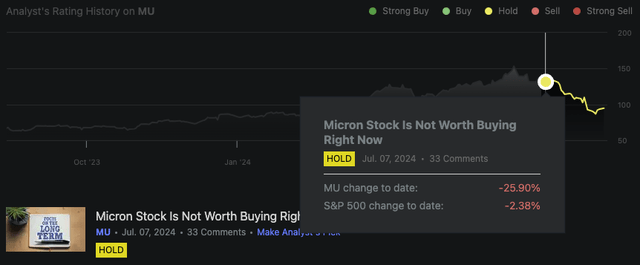

I last covered Micron (NASDAQ:MU) in July, and since then, the stock has declined around 25% in price, following my Hold rating at the time. My analysis was titled “Micron Stock Is Not Worth Buying Right Now”. Now, I consider the stock still richly valued, but also worth a Buy rating due to the high fundamental growth still likely in FY25. I believe that the recent 25% contraction is a result of lower growth in FY25 compared to FY24, which the market has priced into the stock early, but most significantly, bearish sentiment that has entered the market around recession fears and AI capex ROI concerns, which could potentially reduce fundamental growth for companies like Micron moving forward. As a result of this, Micron could still have more downward momentum left in it before it reaches support and heads back up to around a market cap of $153.3B in 12 months’ time, or likely earlier, which, I believe, would constitute a conservative fair value for the stock at the time. Despite this, I think that the likelihood of MU becoming overvalued is quite likely or that sentiment is now revised upward from previous levels with higher valuation multiples, providing the possibility for more speculative gains. However, based on my valuation multiple and sentiment analysis, further cyclical downside volatility is probable in FY25 after a peak in price. In addition, there is a risk of further downside now before price growth picks up momentum as FY25 fundamental growth gets priced in after the valuation reaches support.

My thesis here has changed fundamentally related to the broader bearishness that has entered the market related to AI capex concerns, and the uncertainty of the ROI of these initiatives, affecting stocks like Micron. I believe this is what has produced the significant 25% decline as a result of valuation multiples contracting on a sentiment shift, which is worth analyzing as a better-valued entry point has become apparent as future growth related to AI is still likely over the next fiscal year. Despite the growth in FY25 that is estimated, this is still less than in FY24, so some contraction is likely warranted in valuation, but in my opinion, 25% is too steep and opens up a buying opportunity.

FY24 Versus FY25 Growth & FY25/Long-Term Catalysts

So far in FY24, MU has experienced heavy revenue growth, which was primarily the result of rebounding memory prices and improvements in inventory balances. Maintaining the high-growth rate in FY25 is not possible in my opinion, especially as MU is dealing with tight supply conditions, particularly for advanced DRAM and NAND technologies. While the company is ramping up demand, it is facing constraints from the complexity of HBM production, which consumes more resources than traditional memory products.

Furthermore, Micron is investing heavily in its next-gen 300-plus-layer NAND, which is expected to be in high-volume production by FY25. Over the long-term, this is going to be accretive to MU, but the high capex will strain short-term profitability and free cash flow.

There is also the concern of bearishness in the AI market at the moment, which is dampening investors’ sentiment. Some have raised concerns that capex related to AI will now begin to plateau on fears of spending not giving a worthy ROI in the medium term. The result of this is plummeting AI stock prices, with Micron as no exception. This slowdown is indicated in both the forward fundamental growth rates of MU but also of Nvidia (NVDA), which is the most important revenue generator in the AI arms race. Therefore, now is both a good time to invest in MU due to a more favorable valuation and also a time to have moderated growth predictions due to the slowdown in aggression in AI capex, which will directly affect Micron in the medium term.

That being said, over the long term, MU will still be a beneficiary of the continued growth in AI capex, which some reports estimate will grow at a CAGR of 24% by 2028. In fact, one of the big driving forces of Wall Street’s bullish outlook on MU (with an average analyst price target of $174 in 12 months, indicating an 87% upside) is growth-driven by AI demand.

High growth in FY25 is continuing to be driven by HBM products, which are crucial for AI applications. This is being driven by the increasing need for HPM memory solutions in AI servers and data centers. There are also benefits accruing from the tight supply and high demand of both DRAM and NAND, which should be margin accretive for MU due to pricing power. Furthermore, to support a long-term holding thesis, MU is making ambitious capex investments to increase its production capacity for advanced memory technologies—this positions MU well for FY25 and beyond; that being said, I think long-term holders of MU buying in at the present valuation should be prepared for cyclicality from MU stock, which is common, but presents a highly volatile long-term holding thesis which might work better as a 12-month allocation depending on how the company’s FY26 and FY27 fundamental analyst growth estimates and management guidance evolves.

Valuation Analysis, Sentiment Considerations, & 1Y Price Target

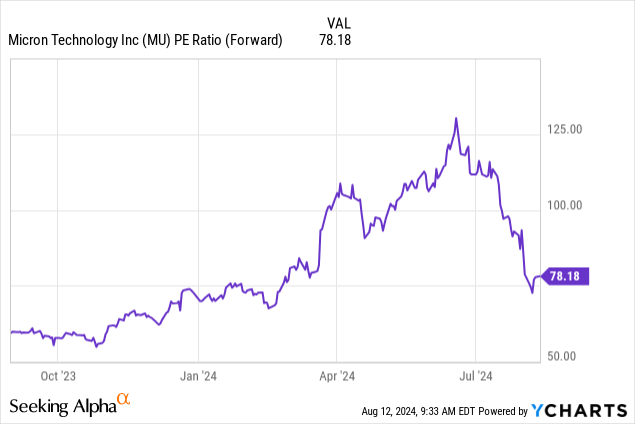

To start with, on a standard forward price-to-earnings basis, MU is now much better valued than my last analysis in July. This is further evidenced by the still strong forward earnings growth expected in FY25. MU only recently recorded positive EPS in Q2 and Q3 2024, but as I mentioned in my previous thesis on the company, the market priced the coming FY25 positive EPS into the stock very early; the stock price climbed as the positive EPS neared.

Seeking Alpha

Considering that there are growing concerns right now of a recession, as well as momentary AI bearishness related to slowing growth rates, I think this is an opportune time to capitalize on this as a contrarian value approach to investing in AI. I believe that there is still downward momentum to be experienced in some of the major AI stocks, but I believe the fundamental growth for MU and other stocks like Nvidia means the long-term growth trajectory remains intact.

MU currently has a forward PS ratio of around 4.1, which is around 50% higher than its 5Y average. This is arguably warranted due to the exponential, although cyclical, nature of MU’s revenue growth. However, I still believe it presents a note of caution as MU is likely to still be fairly valued at best or even slightly overvalued. On understanding this, and the fact that the market can be inherently irrational, MU has a high risk of falling further in price to become undervalued. This is especially true during this moment of recession fear and the broader market discussion on AI capex utility, which I mentioned in my operational analysis above.

Based on this sentiment and valuation analysis, I estimate a PS ratio of around 4 would constitute fair value for MU stock. Therefore, based on the current analyst estimates and guidance, with a total revenue of $38.33B estimated for full-year Fiscal 2025, I believe MU could reach a fair value market cap of $153.3B in 12 months’ time, or earlier if the market prices this into the stock ahead of time, which I find likely. There is, therefore, a lot of short-term upside potential here, despite the potential for further downside before price growth picks up momentum.

SK Hynix/Samsung Competition & AI Market Growth Slowdown

As of Q3 2023, based on the most recent data from Statista I could find, Samsung (OTCPK:SSNLF) held the largest market share in DRAM, with 38.9%, followed by SK hynix (OTCPK:HXSCF) at 34.3%. SK hynix is notable for its HBM market leadership, which is crucial to AI applications, and is aggressively expanding its production capacity. Samsung plans to mass-produce LPDDR5X, which is memory based on advanced processes, as well as HBM. These factors all increase the competition in memory significantly for MU. The result of this higher competition is likely to put pricing pressure on MU, which is the smaller of the three competitors based on market share. There is also the potential for aggressive strategies from larger companies in AI to become more acute as the growth starts to taper off from the initial AI infrastructure build-out. The result of this could also be the consolidation of long-term contracts with major clients like Nvidia, which could limit MU’s growth potential in a worst-case scenario. To be clear, I have a positive medium-term to long-term growth outlook on MU related to AI, but I believe that the risk of market consolidation from its two core competitors remains.

In addition, while AI is a top priority for increased technology industry spending, the actual implementation is still in the nascent stages for most companies, as I touched on previously in this analysis. As a result, the ROI is currently unclear; if the adoption rate does not accelerate as expected, this will dampen the demand for MU’s products significantly. I consider this quite a high risk, firstly for the long-term fundamental growth of MU, but perhaps more starkly for the stock price, which I posit could become quite oversold in a cyclical fashion as sentiment expands and wanes as new fundamental growth related to AI spending tapers off for now.

Conclusion

In my opinion, MU has the potential for significant alpha over the next 12 months. This is backed up by the much more appealing valuation compared to 1 month ago when the stock price was around 25% higher. Now, I consider the stock fairly valued at best, if not slightly overvalued. That being said, I believe MU is likely to deliver high growth in FY25, as anticipated. As a result of this, the company could achieve a market cap of ~$155B in less than 12 months. As a result of this analysis, MU is a Buy, despite the volatility risk and high likelihood of a cyclical downturn leading into FY26, and especially FY27, based on my analysis of MU’s fundamental growth rates and market sentiment for the stock historically and estimated for the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.